Nova Minerals Provides an Update on its Estelle Gold-Antimony Project, in Alaska

Rhea-AI Summary

Nova Minerals (NASDAQ: NVA) has provided an update on its Estelle Gold-Antimony Project in Alaska. The company is progressing with its Feasibility Study (FS), considering two development options: a smaller-scale operation at the high-grade RPM deposit for potential near-term cashflow, and a larger mining operation for increased gold production. Nova is also exploring the possibility to fast-track the Stibium gold-antimony prospect with potential US Department of Defense support, following China's export restrictions on antimony.

At RPM, 11 drill holes have been completed to date, targeting near-surface high-grade inferred material. The Stibium prospect continues to impress, with extensive surface sampling underway and several tons of bulk samples being collected for metallurgical testing. Nova has also staked approximately 1km² of additional claims at Stibium.

Positive

- Feasibility Study considering two development options for potential production and cashflow

- 11 drill holes completed at RPM targeting high-grade inferred material

- Extensive surface sampling at Stibium prospect showing promising gold and antimony results

- Potential fast-track development of Stibium with US Department of Defense support

- Additional 1km² of claims staked at Stibium prospect

Negative

- None.

News Market Reaction

On the day this news was published, NVA gained 0.61%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Anchorage, Alaska, Aug. 21, 2024 (GLOBE NEWSWIRE) -- Nova Minerals Limited (“Nova” or the “Company”) (NASDAQ: NVA) (ASX: NVA) (FSE: QM3) is pleased to provide an update on its 2024 drilling and exploration field programs on its over 500km2 flagship Estelle Gold Project, located in the prolific Tintina Gold Belt in Alaska, where RPM drilling for the completion of its Feasibility Study (FS) is progressing, and surface sampling for gold-antimony at its Stibium prospect continues to impress.

Highlights

- Development Optionality:

The Feasibility Study (FS) currently underway is considering a strategy to achieve production as soon as possible with a scalable operation, subject to market conditions and strategic partners, by;

- Establishing an initial lower capex smaller scale operation at the high-grade RPM deposit for potential near term cashflow at high margins to self-fund expansion plans; and/or

- Develop the higher capex larger mining operation with increased gold production, cash flow, and mine life, which is of interest to potential future large gold company strategic partners.

- With China announcing export restrictions on antimony, the Company is now also investigating the possibility to fast track the Stibium gold-antimony prospect development option with potential US Dept. of Defense (DoD) support.

- Environmental studies progressing and Lidar survey completed for detailed technical studies, infrastructure, and access road design.

- RPM:

- Resource definition drilling is progressing with 11 holes completed to date targeting near surface high grade inferred material to increase and prove up resources for the FS (Figures 1 and 2)

- Extensive surface exploration sampling program underway around the wider RPM area to extend existing and delineate additional high-grade mineralized zones

- Stibium:

- Extensive surface exploration sampling program also underway at Stibium, to follow up a 2m wide surface vein containing stibnite (Antimony) over 30m in strike length previously discovered with results including 12.7 g/t Au and

60.5% Sb (Antimony) (ASX Announcement: 10 October 2023) (Figures 3 and 4) - Several tons of bulk sample on antimony rich material is being collected at Stibium for metallurgical test work at laboratories in Alaska and Australia

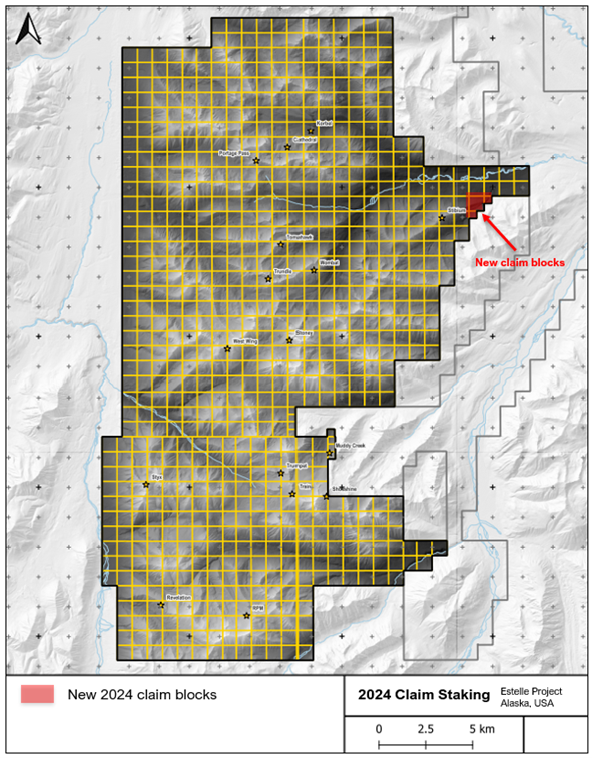

- Approximately 1km2 of prospective additional claims have been staked at Stibium (Figure 5)

- Extensive surface exploration sampling program also underway at Stibium, to follow up a 2m wide surface vein containing stibnite (Antimony) over 30m in strike length previously discovered with results including 12.7 g/t Au and

Nova Head of Exploration, Mr Hans Hoffman commented: “After our successful listing on the NASDAQ, our dedicated field crews mobilized and drilling is now well underway. We built a new pad at RPM between the original Pad 1 and Pad 23-1 where we are drilling our inferred resource with intent to upgrade to measured and indicated. We believe this should prove successful based on the immense mineralized quartz veins observed on surface above our drill traces. Concurrently, we are hitting the new Stibium prospect with intensity; identifying massive stibnite veins in outcrop and expanding our geochemical coverage to highlight the extent of this impressive gold and antimony occurrence.”

Nova CEO, Mr Christopher Gerteisen commented: “We have only scratched the surface at the high-grade RPM deposit with targeted drilling this year aimed to prove up resources in support of our efforts of an initial lower capex, smaller scale operation at RPM, to achieve production and cashflow as soon as possible. Drilling to date has confirmed the holes are hitting the target with mineralization remaining wide open.

At the Stibium prospect our field crews are continuing to find near surface, massive stibnite veining and gold-antimony zones, which present opportunities to assess the stand-alone potential of a quick start antimony operation, particularly with the China export restrictions. We will update the market as we progress.

Nova has a long list of near term catalysts. Drill results from RPM, exploration test work at the Stibium gold-antimony prospect, and a forthcoming resource update, at gold prices now trading at record highs of over US

RPM

Field activities at Estelle commenced on July 28th with the mobilization of our company owned reverse-circulation (RC) drill rig to RPM (Figure 1). This year’s drill program is designed to target the near surface high-grade inferred zones to prove them up into the higher measured and indicated categories for feasibility studies. The drill crews started on the southern end of the high-grade intrusion at Pad 23-1 and completed holes towards the south and east to test the hornfels-granodiorite contact. The rig was then moved to a new pad along the ridge to the northeast to conduct infill drilling between the original Pad 1 and last year’s Pad 23-1 (Figure 2). 11 holes have been drilled since the program kicked off with core from 4 of the holes sent to the ALS laboratory for analysis, and the remainder currently being processed at camp.

A surface sampling program is underway in the wider RPM area with a focus on delineating geochemical anomalies. Detailed soil grids have been constructed, and crews are actively sampling soils and rock chips, as well as recording geologic observations, and following-up anomalies identified from years past. Rock and soil samples collected will be sent to the ALS laboratory for analysis, and results will be reported when they come in.

Figure 1. Drilling at RPM well underway

Figure 2. Building Pad 24-1, with the RPM North Pad 1 at the top of the picture

Stibium

Stibium has been of particular interest this year due to its antimony abundance and China’s recent limit of exports on the commodity (see news link here). Field crews have conducted numerous traverses across the prospect area and a topographic contour grid was designed at sample intervals ranging from 50m to 100m to test the extent of gold and antimony mineralization. An approximately 2,500 kilogram bulk sample of a >2m wide quartz breccia vein is also actively being collected at Stibium where sample E408569 from 2023 returned 12.7 g/t Au and

Figure 3. Massive stibnite (Antimony) rock sample from Stibium

Figure 4. Massive stibnite (Antimony) veining at Stibium

Nova staked an additional 3 State of Alaska mining claims, totaling approximately 1km2, adjacent to the Stibium prospect. The claims were staked to capture more prospective ground. Details of the new claims can be found in Table 1 and Figure 5 below.

Table 1. Nova’s tenement holdings with the new claim block highlighted below

| Tenement/Claim/ADL Number | Location | Beneficial % Held | |

| 725940 - 725966 | Alaska, USA | 85 | % |

| 726071 - 726216 | Alaska, USA | 85 | % |

| 727286 - 727289 | Alaska, USA | 85 | % |

| 728676 - 728684 | Alaska, USA | 85 | % |

| 730362 - 730521 | Alaska, USA | 85 | % |

| 737162 - 737357 | Alaska, USA | 85 | % |

| 740524 - 740621 | Alaska, USA | 85 | % |

| 733438 - 733598 | Alaska, USA | 85 | % |

| 741364 - 741366 | Alaska, USA | 85 | % |

Figure 5. Map of the Estelle claim block highlighting the new claims staked at Stibium

Other

Lidar topography analysis has now been completed for detailed technical studies and design, with results expected shortly. This should give additional information to more accurately target prospects with walk up drill targets and commence a diamond drilling program soon after.

Nova CEO Christopher Gerteisen has been invited to another Dept. of Defense (DoD) related conference in September to discuss Estelle’s antimony potential and illustrate how Nova could potentially help the US shore up its supply of this critical mineral.

Christopher Gerteisen, P.Geo., Chief Executive Officer of Nova Minerals, has supervised the preparation of this news release and has reviewed and approved the scientific and technical information contained herein. Mr. Gerteisen is a "qualified person" for the purposes of SEC Regulation S-K 1300.

About Nova Minerals Limited

Nova Minerals Limited is a gold and critical minerals exploration and development company focused on advancing the Estelle Gold Project, comprised of 513 km2 of State of Alaska mining claims, which contains multiple mining complexes across a 35 km long mineralized corridor of over 20 identified gold prospects, including two already defined multi-million ounce resources across four deposits. The

Further discussion and analysis of the Estelle Gold Project is available through the interactive Vrify 3D animations (which will be updated shortly with all the new drill results), presentations and videos all available on the Company’s website.

www.novaminerals.com.au

Forward Looking Statements

This press release contains “forward-looking statements” that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements. Forward-looking statements contained in this press release may be identified by the use of words such as “anticipate,” “believe,” “contemplate,” “could,” “estimate,” “expect,” “intend,” “seek,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “target,” “aim,” “should,” "will” “would,” or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements are based on Nova Minerals Limited’s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. These and other risks and uncertainties are described more fully in the section titled “Risk Factors” in the final prospectus related to the public offering filed with the Securities and Exchange Commission. Forward-looking statements contained in this announcement are made as of this date, and Nova Minerals Limited undertakes no duty to update such information except as required under applicable law.

For Additional Information Please Contact

Craig Bentley

Director of Finance & Compliance & Investor Relations

M: +61 414 714 196