Nova Minerals Limited Provides an Update on the RPM Feasibility Study and Variation to the Nebari Convertible Facility

Nova Minerals (NASDAQ: NVA) has executed a variation agreement with Nebari Gold Fund 1, LP, its largest institutional shareholder and convertible note holder. The agreement reduces the month-end cash covenant from US$2m to A$1m and offers an option to extend the convertible facility by 12 months to November 29, 2026. This frees up approximately A$2m, allowing Nova to accelerate the RPM early start-up option to a Feasibility Study (FS) for delivery in 2025.

The company is exploring routes to develop the RPM gold deposit, aiming for a lower capex, high-margin, scalable project to generate early cash flow. Nova is also in advanced discussions with the US Department of Defense regarding a potential starter antimony operation at Stibium. The variation agreement amends the conversion price from A$0.53 to A$0.25, subject to shareholder approval.

Nova Minerals (NASDAQ: NVA) ha stipulato un accordo di variazione con Nebari Gold Fund 1, LP, il suo maggiore azionista istituzionale e detentore di note convertibili. L'accordo riduce il vincolo di liquidità di fine mese da 2 milioni di dollari statunitensi a 1 milione di dollari australiani e offre un'opzione per estendere la struttura convertibile di 12 mesi fino al 29 novembre 2026. Questo libera circa 2 milioni di dollari australiani, consentendo a Nova di accelerare l'opzione di avvio anticipato dell'RPM verso uno Studio di Fattibilità (FS) da consegnare nel 2025.

L'azienda sta esplorando vie per sviluppare il giacimento aurifero RPM, puntando a un progetto a basso capex, ad alto margine e scalabile per generare flussi di cassa precoci. Nova è anche in fase avanzata di discussioni con il Dipartimento della Difesa degli Stati Uniti riguardo a una potenziale operazione iniziale di antimoniato a Stibium. L'accordo di variazione modifica il prezzo di conversione da 0,53 dollari australiani a 0,25 dollari australiani, soggetto all'approvazione degli azionisti.

Nova Minerals (NASDAQ: NVA) ha ejecutado un acuerdo de variación con Nebari Gold Fund 1, LP, su mayor accionista institucional y tenedor de notas convertibles. El acuerdo reduce el convenio de efectivo de fin de mes de 2 millones de dólares estadounidenses a 1 millón de dólares australianos y ofrece una opción para extender la instalación convertible por 12 meses hasta el 29 de noviembre de 2026. Esto libera aproximadamente 2 millones de dólares australianos, lo que permite a Nova acelerar la opción de inicio anticipado de RPM hacia un Estudio de Viabilidad (FS) para entregar en 2025.

La empresa está explorando rutas para desarrollar el depósito de oro de RPM, con el objetivo de crear un proyecto con menor capex, alto margen y escalable para generar flujo de caja temprano. Nova también se encuentra en conversaciones avanzadas con el Departamento de Defensa de los EE. UU. sobre una posible operación inicial de antimonio en Stibium. El acuerdo de variación modifica el precio de conversión de 0,53 dólares australianos a 0,25 dólares australianos, sujeto a la aprobación de los accionistas.

노바 미네랄스(NASDAQ: NVA)는 최대 기관 주주이자 전환 사채 보유자인 네바리 골드 펀드 1, LP와 변동 계약을 체결했습니다. 이 계약은 월말 현금 규제를 미화 200만 달러에서 호주 달러 100만 달러로 줄이고, 전환 가능 시설을 12개월 연장할 옵션을 제공합니다. 이를 통해 약 호주 달러 200만이 해제되어, 노바는 RPM 조기 시작 옵션을 타당성 조사(FS)로 가속화하여 2025년에 제공할 수 있게 됩니다.

이 회사는 RPM 금 매장지를 개발하기 위한 경로를 탐색하고 있으며, 초기 현금 흐름을 창출하기 위해 낮은 자본 지출(capex)과 높은 마진을 가진 확장 가능한 프로젝트를 목표로 하고 있습니다. 노바는 또한 스티비움(Stibium)에서 초기 항안마이슨(antimony) 운영에 대한 미국 국방부와의 고급 논의 중에 있습니다. 변동 계약은 전환 가격을 호주 달러 0.53에서 호주 달러 0.25로 수정하며, 주주 승인을 받아야 합니다.

Nova Minerals (NASDAQ: NVA) a signé un accord de variation avec Nebari Gold Fund 1, LP, son plus grand actionnaire institutionnel et détenteur de billets convertibles. L'accord réduit le covenant de liquidité de fin de mois de 2 millions de dollars américains à 1 million de dollars australiens et propose une option pour prolonger la facilité convertible de 12 mois jusqu'au 29 novembre 2026. Cela libère environ 2 millions de dollars australiens, permettant à Nova d'accélérer l'option de démarrage anticipé de l'RPM vers une Étude de Faisabilité (FS) à livrer en 2025.

La société explore des voies pour développer le gisement d'or RPM, visant un projet à faible capex, à marge élevée et évolutif pour générer des flux de trésorerie précoces. Nova est également en discussions avancées avec le ministère de la Défense des États-Unis concernant une opération initiale potentielle d'antimoine à Stibium. L'accord de variation modifie le prix de conversion de 0,53 AUD à 0,25 AUD, sous réserve de l'approbation des actionnaires.

Nova Minerals (NASDAQ: NVA) hat eine Änderungsvereinbarung mit dem Nebari Gold Fund 1, LP, seinem größten institutionellen Aktionär und Inhaber von wandelbaren Anleihen, abgeschlossen. Die Vereinbarung reduziert die Cash-Klausel zum Monatsende von 2 Millionen US-Dollar auf 1 Million AUD und bietet die Möglichkeit, die Wandelanleihe um 12 Monate bis zum 29. November 2026 zu verlängern. Dies schafft etwa 2 Millionen AUD, sodass Nova die vorzeitige Startoption für RPM zu einer Machbarkeitsstudie (FS) für die Lieferung im Jahr 2025 beschleunigen kann.

Das Unternehmen erkundet Möglichkeiten zur Entwicklung des RPM-Goldvorkommens mit dem Ziel, ein kapitalarmen, margenstarkes und skalierbares Projekt zu schaffen, das frühe Cashflows generiert. Nova führt auch fortgeschrittene Gespräche mit dem US-Verteidigungsministerium über einen möglichen Starterbetrieb für Antimon in Stibium. Die Änderungsvereinbarung ändert den Umwandlungspreis von 0,53 AUD auf 0,25 AUD, vorbehaltlich der Genehmigung der Aktionäre.

- Reduction of month-end cash covenant from US$2m to A$1m, freeing up ~A$2m for project acceleration

- Option to extend convertible facility for 12 months to November 29, 2026

- Acceleration of RPM Feasibility Study for delivery in 2025

- Potential for early cash flow generation from RPM gold deposit development

- Advanced discussions with US Department of Defense for potential antimony operation at Stibium

- Conversion price of Nebari's convertible note amended from A$0.53 to A$0.25, potentially leading to more dilution for existing shareholders

Insights

Analyzing...

Caufield, Australia, Sept. 20, 2024 (GLOBE NEWSWIRE) -- Nova Minerals Limited (“Nova” and the “Company”) (NASDAQ: NVA) (ASX: NVA) (FRA: QM3), a gold and critical minerals exploration stage company focused on advancing the Estelle Gold Project in Alaska, U.S.A., is pleased to advise the Company has executed a variation agreement with its largest institutional shareholder and convertible note holder Nebari Gold Fund 1, LP (Nebari) to reduce the month end cash covenant required under the previously announced loan agreement dated 21 November 2022 from US

Further details in respect to the variations of the Nebari convertible facility agreement are set out below.

Nova CEO, Mr Christopher Gerteisen commented: “It is a pleasure to work with Nebari, our largest institutional shareholder and note holder, who have shown strong support and indicated an unwavering commitment towards advancing the project through to production. We are certainly both aligned with the current fast track RPM FS completion strategy aimed at achieving production as soon as possible. Working together we have now freed up more than US

Nebari Senior Managing Director, Mr Roderik van Losenoord adds: “We are very pleased to be supporting Nova and its Estelle Project, as the company explores routes to develop RPM. Support and partnership is what the Nebari-lending relationship with our borrowers is all about.”

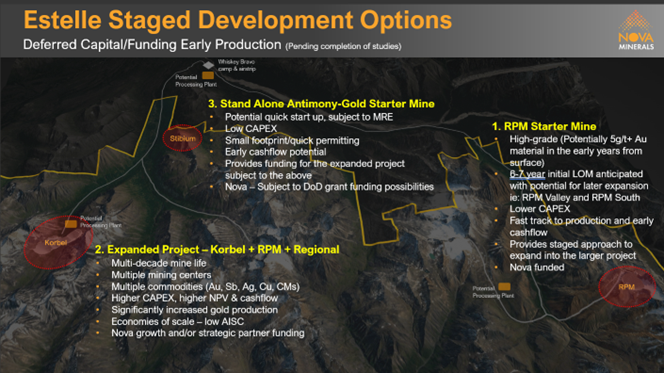

With an already defined multi-million ounce gold resource across 4 deposits, the Estelle Project has development optionality in terms of initial project size and scale. The PFS currently underway is considering a strategy to achieve production with a scalable operation, subject to market conditions and strategic partners, by;

1. Establishing an initial lower capex smaller scale operation at the high-grade RPM deposit for potential near term cashflow at high margins to self-fund expansion plans; and/or

2. Develop the higher capex larger mining operation with increased gold production, cash flow, and mine life, which is of interest to potential future large gold company strategic partners.

3. With China announcing export restrictions on antimony, the Stibium Antimony-Gold Prospect is being advanced and investigated as an additional small scale, stand-alone, quick start up cash flow opportunity, with potential US Dept. of Defense (DoD) support.

Nebari Convertible Note Variation

1. Nebari Gold Fund 1, LP continues to hold all its equity and remains a top 20 supporting shareholder. Nebari also continues to be a potential future funding partner for the lower capex, higher margin RPM project development currently going through PFS.

2. The variation agreement allows Nova an additional ~A

3. The variation agreement allows Nova to extend the term of the convertible facility by written notification prior to 29 November 2024, by an additional 12 months to 29 November 2026, at its option, subject to shareholder approval.

4. In return for Nebari’s support in reducing the month end cash covenant and providing Nova with the option to extend the convertible facility for an additional 12 months, Nova has agreed to amend the conversion price from A

About Nova Minerals Limited

Nova Minerals Limited is a Gold, Antimony and Critical Minerals exploration and development company focused on advancing the Estelle Project, comprised of 514 km2 of State of Alaska mining claims, which contains multiple mining complexes across a 35 km long mineralized corridor of over 20 advanced Gold and Antimony prospects, including two already defined multi-million ounce resources, and several drill ready Antimony prospects with massive outcropping stibnite vein systems observed at surface. The

Further discussion and analysis of the Estelle Gold Project is available through the interactive Vrify 3D animations presentations and videos all available on the Company’s website.

www.novaminerals.com.au

Forward-Looking Statements

Certain statements made in this announcement are forward-looking statements including with respect to the creation of a trading market for ADSs representing the Ordinary Shares in the United States. These forward-looking statements are not historical facts but rather are based on the Company’s current expectations, estimates, and projections about its industry; its beliefs; and assumptions. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties, and other factors, some of which are beyond the Company’s control, are difficult to predict, and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements, including if the Company’s registration statement is not declared effective by the SEC. The Company cautions security holders and prospective security holders not to place undue reliance on these forward-looking statements, which reflect the view of the Company only as of the date of this announcement. The forward-looking statements made in this announcement relate only to events as of the date on which the statements are made. The Company will not undertake any obligation to release publicly any revisions or updates to these forward-looking statements to reflect events, circumstances, or unanticipated events occurring after the date of this announcement except as required by law or by any appropriate regulatory authority.

For Additional Information Please Contact

Craig Bentley

Director of Finance & Compliance & Investor Relations

E: craig@novaminerals.com.au

M: +61 414 714 196

Attachment