Nova Minerals Limited Engages Whittle Consulting for Estelle Optimization

Nova Minerals (NASDAQ: NVA) has engaged Whittle Consulting for optimization of its upcoming project-wide economic studies and focused RPM starter mine Feasibility Study within its Estelle Gold Project in Alaska. Whittle has agreed to take ~18% of their consulting fees in Nova ordinary shares. The optimization aims to establish the potential for an early small-scale operation at Estelle to produce revenue from near-surface high-grade areas with minimum capital cost and time to permit.

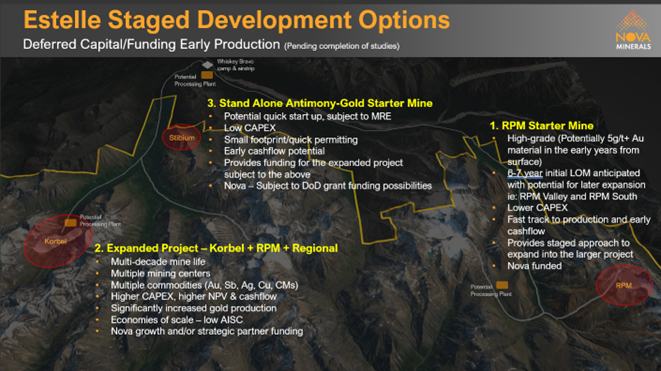

The company is considering a strategy to achieve production with a scalable operation by: 1) Establishing an initial lower capex smaller scale operation at the high-grade RPM deposit, 2) Developing a higher capex larger mining operation, and 3) Advancing the Stibium Antimony-Gold Prospect as an additional small-scale, stand-alone, quick startup cash flow opportunity. Nova is targeting to publish an optimized economic study and Feasibility Study in 2025.

Nova Minerals (NASDAQ: NVA) ha incaricato Whittle Consulting per l'ottimizzazione dei suoi prossimi studi economici a livello di progetto e per lo studio di fattibilità del sito minerario RPM all'interno del suo Estelle Gold Project in Alaska. Whittle ha accettato di ricevere circa il 18% delle proprie spese di consulenza in azioni ordinarie di Nova. L'ottimizzazione ha l'obiettivo di stabilire il potenziale per un funzionamento iniziale in piccola scala a Estelle, per generare entrate da aree ad alta gradezza prossime alla superficie, con un costo di capitale e tempi di autorizzazione minimi.

L'azienda sta considerando una strategia per raggiungere la produzione mediante un'operazione scalabile attraverso: 1) Stabilire un'operazione iniziale a basso capex di dimensioni ridotte nel deposito ad alta gradezza RPM, 2) Sviluppare un'operazione mineraria di maggiori dimensioni e capex, e 3) Sviluppare il progetto Stibium Antimonio-Oro come un'ulteriore opportunità di flusso di cassa immediato, autonoma e su piccola scala. Nova punta a pubblicare uno studio economico ottimizzato e uno studio di fattibilità nel 2025.

Nova Minerals (NASDAQ: NVA) ha contratado a Whittle Consulting para la optimización de sus próximos estudios económicos a nivel de proyecto y el estudio de viabilidad del inicio de la mina RPM dentro de su Estelle Gold Project en Alaska. Whittle ha acordado recibir aproximadamente el 18% de sus honorarios de consultoría en acciones ordinarias de Nova. La optimización tiene como objetivo establecer el potencial para una operación temprana a pequeña escala en Estelle, para generar ingresos de áreas de alta ley cercanas a la superficie, con un costo de capital y un tiempo de permiso mínimos.

La compañía está considerando una estrategia para lograr producción con una operación escalable mediante: 1) Establecer una operación inicial a menor capex y menor escala en el depósito de alta ley RPM, 2) Desarrollar una operación minera de mayor capex y mayor tamaño, y 3) Avanzar en el Prospecto de Antimonio-Oro Stibium como una oportunidad de flujo de efectivo adicional, autónoma y de inicio rápido. Nova tiene como objetivo publicar un estudio económico optimizado y un estudio de viabilidad en 2025.

노바 미네랄스(NASDAQ: NVA)는 알래스카의 에스텔 골드 프로젝트 내에서 다가오는 프로젝트 전반의 경제 연구와 RPM 스타터 광산의 타당성 조사를 최적화하기 위해 휘틀 컨설팅을 계약했습니다. 휘틀은 자신들의 컨설팅 비용의 약 18%를 노바의 보통주로 받기로 합의했습니다. 최적화의 목표는 최소한의 자본 비용과 허가 시간으로 표면 근처의 고등급 지역에서 수익을 창출하기 위해 에스텔에서 초기 소규모 운영의 가능성을 설정하는 것입니다.

회사는 다음과 같은 방법으로 확장 가능한 운영을 통해 생산을 달성할 수 있는 전략을 고려하고 있습니다: 1) 고등급 RPM 광산에서 초기 저개발 규모 운영을 확립하고, 2) 더 높은 내역가를 가진 대규모 광산 운영을 개발하고, 3) 스티비움 안티모니-금 탐사를 추가로 소규모, 독립적이고 신속한 스타트업 현금 흐름 기회로 발전시키는 것입니다. 노바는 2025년에 최적화된 경제 연구와 타당성 조사를 발표할 예정이다.

Nova Minerals (NASDAQ: NVA) a engagé Whittle Consulting pour l'optimisation de ses prochaines études économiques à l'échelle du projet et de l'étude de faisabilité de la mine RPM au sein de son Estelle Gold Project en Alaska. Whittle a accepté de recevoir environ 18% de ses honoraires de conseil en actions ordinaires de Nova. L'optimisation vise à établir le potentiel d'une exploitation précoce à petite échelle à Estelle pour générer des revenus à partir de zones de haute teneur proches de la surface, avec un coût en capital et un délais d'autorisation minimum.

L'entreprise envisage une stratégie pour atteindre la production avec une opération évolutive en : 1) Établissant une première opération à petite échelle et à faible capex sur le gisement à haute teneur RPM, 2) Développant une opération minière à plus fort capex et plus grande échelle, et 3) Avançant le projet Stibium Antimoine-Or comme une opportunité de flux de trésorerie autonome, rapide et à petite échelle. Nova vise à publier une étude économique optimisée et une étude de faisabilité en 2025.

Nova Minerals (NASDAQ: NVA) hat Whittle Consulting mit der Optimierung seiner bevorstehenden projektweiten wirtschaftlichen Studien und der Machbarkeitsstudie für die RPM-Startermine im Estelle Gold-Projekt in Alaska beauftragt. Whittle hat zugestimmt, etwa 18% ihrer Beratungsgebühren in Nova-Stammaktien zu erhalten. Die Optimierung zielt darauf ab, das Potenzial für einen frühen Kleinbetrieb in Estelle zu ermitteln, um Einnahmen aus hochgradigen, nahenflächen Bereichen mit minimalen Investitionskosten und genehmigungszeiten zu generieren.

Das Unternehmen erwägt eine Strategie zur Erreichung einer Produktion mit einem skalierbaren Betrieb durch: 1) die Etablierung eines anfänglichen Kleinbetriebs mit niedrigem Capex im hochgradigen RPM-Vorkommen, 2) die Entwicklung eines größeren Bergbaubetriebs mit höherem Capex und 3) die Weiterentwicklung des Stibium-Antimon-Gold-Prospekts als zusätzliche Möglichkeit für einen kleinen, eigenständigen und schnellen Cashflow. Nova plant, ein optimiertes wirtschaftliches Studium und eine Machbarkeitsstudie im Jahr 2025 zu veröffentlichen.

- Engagement of Whittle Consulting for project optimization, potentially improving project economics

- Whittle agreeing to take ~18% of consulting fees in Nova shares, aligning interests

- Consideration of a scalable operation strategy with multiple development options

- Potential for early revenue from near-surface high-grade areas with minimum capital cost

- Advancement of Stibium Antimony-Gold Prospect as a potential quick startup cash flow opportunity

- Target to publish optimized economic study and Feasibility Study in 2025

- Feasibility Study and economic optimization results not expected until late 2024/2025

- Project development and production timeline still uncertain

- Potential dilution of existing shareholders through share issuance to Whittle Consulting

Insights

The engagement of Whittle Consulting for project optimization is a strategic move for Nova Minerals. This partnership aims to enhance the economic viability of the Estelle Gold Project, particularly focusing on a potential small-scale, high-grade operation to generate early revenue. Key points to consider:

- Whittle's agreement to accept

$50,000 in Nova shares demonstrates confidence in the project's potential. - The optimization study could significantly improve project economics by increasing early cash flows and optimizing life-of-mine metal production.

- The focus on a lower capex, smaller-scale operation at the RPM deposit could lead to near-term cash flow, potentially self-funding future expansion.

- The inclusion of antimony in the project scope, especially with China's export restrictions, could open up strategic opportunities, possibly with US Department of Defense support.

While the full impact remains to be seen, this optimization effort could be a game-changer for Nova Minerals, potentially accelerating their path to production and improving overall project economics.

Nova Minerals' engagement of Whittle Consulting is a significant step towards optimizing the Estelle Gold Project. Several aspects of this development are noteworthy:

- The focus on establishing a small-scale operation from near-surface, high-grade areas could significantly reduce initial capital requirements and time to permit.

- Whittle's Integrated Strategic Planning methodology has a track record of substantially improving project economics across over 180 mining projects worldwide.

- The optimization will cover important aspects such as pit phasing, mine scheduling, cut-off grade optimization and variable grind-size analysis, which can all contribute to improved project economics.

- The inclusion of carbon modeling and reduction options aligns with increasing industry focus on sustainability.

This comprehensive approach to project optimization, combined with Nova's multi-deposit resource base, positions the company well for potential near-term production and long-term growth. The engagement of Whittle could be a pivotal move in realizing the full potential of the Estelle Project.

Caufield, Australia, Oct. 02, 2024 (GLOBE NEWSWIRE) -- Nova Minerals Limited (“Nova” and the “Company”) (NASDAQ: NVA) (ASX: NVA) (FRA: QM3), a gold and critical minerals exploration stage company focused on advancing the Estelle Gold Project in Alaska, U.S.A., is pleased to announce the engagement of mine optimization experts, Whittle Consulting (“Whittle”, more on Whittle here) for optimization of its upcoming project wide economic studies and focused RPM starter mine Feasibility Study, within its over 500km2 flagship Estelle Gold Project, located in the Tintina Gold Belt in Alaska. In support of the project, Whittle have agreed to take ~

2024 RPM drill results and antimony surface sample assays expected back in the coming weeks.

Project Optimization

The advancement of the Estelle gold and critical minerals project provides significant leverage to gold and antimony at a time when both commodities are currently at record high prices. The Company has commenced its activities with Whittle for the purposes of advancing the project optimization with the primary objective being to establish the potential scope and scale of an early small-scale operation at Estelle to produce revenue from near-surface high-grade areas at minimum capital cost and time to permit. While the study will focus on the early small-scale operation, it will also dovetail with the plan for realizing the value of the complete resource across the project area in the longer term, and in particular will direct future activities for engineering, test work, and drilling whilst moving towards a Feasibility Study (“FS”) in 2025.

To watch a short video where Nova CEO, Christopher Gerteisen, and Whittle CEO, Gerald Whittle, talk about optimization of the Estelle Gold Project

please click here

With an already defined multi-million ounce gold resource across 4 deposits, the Estelle Project has development optionality in terms of initial project size and scale. The FS currently underway is considering a strategy to achieve production with a scalable operation, subject to market conditions and strategic partners, by;

1. Establishing an initial lower capex smaller scale operation at the high-grade RPM deposit for potential near term cashflow at high margins to self-fund expansion plans.

2. Develop the higher capex larger mining operation with increased gold production, cash flow, and mine life, which is of interest to potential future large gold company strategic partners.

3. With China announcing export restrictions on antimony, the Stibium Antimony-Gold Prospect is being advanced and investigated as an additional small scale, stand-alone, quick start up cash flow opportunity, with potential US Dept. of Defense (DoD) support.

The review so far by Whittle has indicated an opportunity for their Integrated Strategic Planning methodology to substantially improve project economics by increasing cash flows in the early years of production and optimizing life-of-mine metal production. The optimization will include identifying initial high-value pit phases, mine schedule, cut-off and stockpiling to optimize plant feed grade, variable grind-size analysis to optimize production throughput versus recovery, project staging and scaling options, and inclusion of mineral resources from recent drilling. Carbon modelling and reduction options will also be considered.

Whittle Consulting is comprised of a group of highly experienced industry experts, who have strong technical backgrounds in a range of disciplines including geology, mining engineering, metallurgy, research, mathematics and computing, finance, operational, financial modeling and analysis and a thorough appreciation of practical, organizational, and contextual reality. Whittle Consulting is comfortable with complexity, not being bound by conventional thinking, and by being willing to challenge existing paradigms and conventional wisdom which can conceal the real potential of mining businesses.

Whittle Consulting has demonstrated significant improvements in estimated economics for over 180 mining projects/operations worldwide with their "Whittle Integrated Strategic Planning" approach, even when several conventional optimization approaches have already been applied. Spanish Mountain, Cardinal Resources, Gold Fields, Asanko, Amarillo, Rainy River, Newcrest Lihir, Iamgold Rosebel, Condor Gold, and others are included in the list of gold open pit mining companies Whittle Consulting has worked with.

While results from this optimization study are expected in late 2024, Nova is targeting to publish an optimized economic study and Feasibility Study, to both Australian JORC and US S-K 1300 standards, which is to be jointly prepared by RoughStock Mining, Mets Engineering, and Whittle Consulting, in 2025.

Partial Payment in Shares

Subject to shareholder approval at the upcoming Annual General Meeting, Whittle has agreed to take US

Nova Minerals CEO, Mr Christopher Gerteisen commented: “Nova consists of a small team working on the very large Estelle Project and I am pleased with what we have been able to accomplish to date. Now is the time take the next step by engaging high caliber consultants like Whittle Consulting to accelerate the FS which will be initially focused on RPM as a scale-able low capex/high margin project with future expansion plans achieved through cashflow as soon as possible. We believe completion of a FS will put us in a position to submit our permit applications, a major step in the path to project development. In parallel, we are also focused on the commercial aspects including financing and/or strategic partners which early discussions indicate may yield significant reductions in capital and operating costs. We look forward to updating on these fronts as we continue to progress.

Estelle is a major mineralized trend, hosting gold, antimony, silver, copper, and other critical elements and we are working to begin production as early as possible and operate for decades supplying the minerals the world needs.

In addition, we are very aware of the value of a domestically sourced critical mineral antimony, and we are looking at these discoveries from many angles with multiple parties to potentially establish and fully secure the US supply chain. We are excited to keep you updated on this as the year progresses.

To date, we have achieved our goals and are on a path to commercial production while minimizing dilution to our existing shareholders. We will keep our shareholders updated as relevant studies are ongoing and completed.”

Whittle Consulting CEO, Mr Gerald Whittle commented: “We like Nova Mineral’s open minded approach and agility. The Estelle project presents near surface high-grade ore which lends itself to a highly profitable small-scale selective-mining approach to get into production and cash flow early, to contribute to a large expansion later to exploit the full potential of the ore body.”

About Nova Minerals Limited

Nova Minerals Limited is a Gold, Antimony and Critical Minerals exploration and development company focused on advancing the Estelle Project, comprised of 514 km2 of State of Alaska mining claims, which contains multiple mining complexes across a 35 km long mineralized corridor of over 20 advanced Gold and Antimony prospects, including two already defined multi-million ounce resources, and several drill ready Antimony prospects with massive outcropping stibnite vein systems observed at surface. The

Further discussion and analysis of the Estelle Gold Project is available through the interactive Vrify 3D animations presentations and videos all available on the Company’s website.

www.novaminerals.com.au

Forward-Looking Statements

This press release contains “forward-looking statements” that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements. Forward-looking statements contained in this press release may be identified by the use of words such as “anticipate,” “believe,” “contemplate,” “could,” “estimate,” “expect,” “intend,” “seek,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “target,” “aim,” “should,” "will” “would,” or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements are based on Nova Minerals Limited’s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. These and other risks and uncertainties are described more fully in the section titled “Risk Factors” contained in our Registration Statement on Form F-1 as filed with the Securities and Exchange Commission. Forward-looking statements contained in this announcement are made as of this date, and Nova Minerals Limited undertakes no duty to update such information except as required under applicable law..

For Additional Information Please Contact

Craig Bentley

Director of Finance & Compliance & Investor Relations

E: craig@novaminerals.com.au

M: +61 414 714 196

Attachments