Nova Minerals Announces Drilling to Commence at the Estelle Gold Project, Alaska, and Company Update

Nova Minerals (NASDAQ: NVA) has announced the commencement of resource definition drilling and exploration field programs at its Estelle Gold Project in Alaska. The company is focusing on Feasibility Study (FS) stage drilling at the high-grade RPM deposit to increase and prove-up resources. With a total defined 5.2 Moz Au in-pit constrained S-K 1300 compliant resource across 4 deposits, Nova is considering two strategies for production:

1. Establishing an initial low capex smaller scale operation at RPM for early cashflow.

2. Developing a higher capex larger mining operation for increased gold production.

The company's 2024 work plan includes resource drilling, mineral resource estimate updates, LIDAR surveys, heap leach metallurgical test work, geotechnical studies, and ore sorting test work. Nova is also exploring the potential of critical elements like antimony as by-product credits.

Nova Minerals (NASDAQ: NVA) ha annunciato l'inizio della perforazione per la definizione delle risorse e dei programmi di esplorazione presso il suo Estelle Gold Project in Alaska. L'azienda si sta concentrando sulla perforazione in fase di studio di fattibilità (FS) presso il deposito ad alto grado RPM per aumentare e confermare le risorse. Con un totale definito di 5,2 Moz Au in risorse conformi S-K 1300 distribuite su 4 depositi, Nova sta considerando due strategie per la produzione:

1. Stabilire un'operazione iniziale a bassa spesa per capitale di dimensioni ridotte presso RPM per ottenere flussi di cassa anticipati.

2. Sviluppare un'operazione mineraria di dimensioni maggiori e con un investimento superiore per aumentare la produzione di oro.

Il piano di lavoro dell'azienda per il 2024 include perforazioni per le risorse, aggiornamenti della stima delle risorse minerali, rilievi LIDAR, test metallurgici di heap leach, studi geotecnici e test di separazione dei minerali. Nova sta anche esplorando il potenziale di elementi critici come l'antimonio come crediti di sottoprodotto.

Nova Minerals (NASDAQ: NVA) ha anunciado el inicio de la perforación para la definición de recursos y programas de campo de exploración en su Proyecto Estelle Gold en Alaska. La empresa se está centrando en la perforación en la etapa de Estudio de Factibilidad (FS) en el depósito de alta ley RPM para aumentar y confirmar los recursos. Con un total definido de 5,2 Moz Au en recursos conformes S-K 1300 en 4 depósitos, Nova está considerando dos estrategias para la producción:

1. Establecer una operación inicial de bajo capex a menor escala en RPM para obtener flujo de caja anticipado.

2. Desarrollar una operación minera de mayor capex y a mayor escala para aumentar la producción de oro.

El plan de trabajo de la empresa para 2024 incluye perforaciones de recursos, actualizaciones de estimación de recursos minerales, encuestas LIDAR, pruebas metalúrgicas de lixiviación en pilas, estudios geotécnicos y pruebas de clasificación de mineral. Nova también está explorando el potencial de elementos críticos como el antimonio como créditos de subproducto.

노바 미네랄스(NASDAQ: NVA)가 알래스카의 에스텔 금 프로젝트에서 자원 정의 드릴링 및 탐사 필드 프로그램을 시작한다고 발표했습니다. 이 회사는 고급 RPM 자 deposit에서의 타당성 조사(FS) 단계 드릴링에 집중하여 자원을 증가시키고 확인할 계획입니다. 4개의 자 deposit에서 S-K 1300 기준을 준수하여 정의된 총 5.2 Moz Au의 자원이 있는 노바는 생산을 위한 두 가지 전략을 고려하고 있습니다:

1. 초기 저비용 소규모 운영을 RPM에서 설정하여 조기 현금 흐름을 얻는 것.

2. 금 생산을 늘리기 위해 더 높은 자본 지출의 대규모 채굴 작업을 개발하는 것.

회사의 2024 작업 계획에는 자원 드릴링, 광물 자원 추정 업데이트, LIDAR 조사, 적재 리치 금속 테스트, 지반 공학 연구 및 광석 분류 테스트가 포함됩니다. 노바는 또한 항쟁과 같은 중요한 요소의 잠재력을 부가 생산물 크레딧으로 탐색하고 있습니다.

Nova Minerals (NASDAQ: NVA) a annoncé le début des forages de définition des ressources et des programmes d'exploration sur le Projet Estelle Gold en Alaska. L'entreprise se concentre sur les forages de l'étape d'étude de faisabilité (FS) au sein du gisement à haute teneur RPM pour augmenter et prouver les ressources. Avec un total défini de 5,2 Moz Au en ressources conformes S-K 1300 réparties sur 4 gisements, Nova envisage deux stratégies pour la production :

1. Établir une opération initiale à faible investissement en capital de petite échelle au RPM pour un flux de trésorerie anticipé.

2. Développer une opération minière plus importante avec un investissement plus élevé pour augmenter la production d'or.

Le plan de travail de l'entreprise pour 2024 comprend des forages de ressources, des mises à jour des estimations de ressources minérales, des enquêtes LIDAR, des travaux de test métallurgiques par lixiviation en tas, des études géotechniques et des tests de tri de minerai. Nova explore également le potentiel d'éléments critiques tels que l'antimoine en tant que crédits de sous-produit.

Nova Minerals (NASDAQ: NVA) hat den Beginn von Ressourcendefinitionsbohrungen und Erkundungsfeldprogrammen in ihrem Estelle Gold Projekt in Alaska bekannt gegeben. Das Unternehmen konzentriert sich auf Bohrungen in der Machbarkeitsstudien- (FS) Phase im hochgradigen RPM-Vorkommen, um Ressourcen zu erhöhen und zu bestätigen. Mit insgesamt definierten 5,2 Moz Au in S-K 1300-konformen Ressourcen über 4 Vorkommen zieht Nova zwei Strategien für die Produktion in Betracht:

1. Aufbau eines anfänglichen, kapitalärmeren, kleineren Betriebs bei RPM für frühe Cashflows.

2. Entwicklung eines größeren Bergbauunternehmens mit höheren Investitionen für eine gesteigerte Goldproduktion.

Der Arbeitsplan des Unternehmens für 2024 umfasst Ressourcenbohrungen, Aktualisierungen der Schätzung der mineralischen Ressourcen, LIDAR-Umfragen, metallurgische Testarbeiten zur Heap-Leaching-Technik, geotechnische Studien und Tests zur Erzsortierung. Nova erkundet auch das Potenzial kritischer Elemente wie Antimon als Nebenproduktgutschriften.

- Total defined 5.2 Moz Au in-pit constrained S-K 1300 compliant resource across 4 deposits

- Feasibility Study stage drilling at high-grade RPM deposit to increase and prove-up resources

- Potential for low capex, high margin, scalable start-up operation

- Exploration of critical elements like antimony as potential by-product credits

- Company-owned drill rig for cost-efficient resource definition drilling

- Project still in feasibility study stage, not yet in production

- Higher capex option for larger mining operation may require strategic partners

Insights

Nova Minerals' announcement about commencing drilling at the Estelle Gold Project in Alaska is impactful for investors, but requires careful analysis. The company's focus on a Feasibility Study (FS) for the high-grade RPM deposit indicates progress towards potential production, which is positive. However, several factors warrant consideration:

- The 5.2 Moz Au resource across four deposits is significant, but the quality and economic viability of these resources need further evaluation.

- The company's dual strategy of considering both a low-capex smaller operation and a higher-capex larger operation shows flexibility but also uncertainty about the optimal development path.

- The ongoing metallurgical work, including heap leach and ore sorting studies, could significantly impact project economics if successful.

- The discovery of critical elements like Antimony could provide valuable by-product credits, but their economic impact remains speculative at this stage.

While the project shows promise, investors should be cautious about the company's ability to execute its plans effectively, especially given the early stage of development and the inherent risks in mining projects.

From a financial perspective, Nova Minerals' update presents a mixed picture. The company's strategy to potentially start with a smaller, low-capex operation at RPM could be prudent in the current market environment, potentially reducing initial capital requirements and financial risk. However, several financial considerations stand out:

- The company's cash position and ability to fund the ongoing Feasibility Study and potential development are important factors not addressed in this update.

- The mention of potential strategic partners for the larger development scenario suggests the company may need external funding or expertise to fully realize the project's potential.

- The focus on cost-efficient drilling using company-owned equipment is positive for managing exploration expenses.

- The potential for by-product credits from critical elements could enhance project economics, but the market demand and pricing for these elements need careful assessment.

Investors should closely monitor Nova's ability to advance the project through the Feasibility Study stage and secure necessary funding for development. The company's financial health and access to capital will be critical in determining its ability to transition from exploration to production.

The geological aspects of Nova Minerals' Estelle Gold Project present both opportunities and challenges. Key points to consider include:

- The high-grade zones at RPM, with grades ranging from 1 g/t Au to >5 g/t Au, are particularly promising and could support a viable mining operation if sufficiently extensive.

- The project's location in the Tintina Gold Belt, a prolific gold-producing region, enhances its geological potential.

- The planned LIDAR survey will provide valuable data for infrastructure design and mineral reserve classification, potentially improving the accuracy of resource estimates.

- Ongoing geotechnical studies could lead to steeper pit slopes, which would positively impact project economics by reducing strip ratios.

- The presence of critical elements like Antimony adds geological complexity but also potential value.

However, it's important to note that only 1.4 Mt of the resource is currently in the Measured category, with the majority in Indicated and Inferred categories. This highlights the need for additional drilling to increase confidence in the resource estimate. The success of the 2024 drilling program in upgrading and expanding the resource will be important for the project's advancement.

Anchorage, Alaska, July 31, 2024 (GLOBE NEWSWIRE) -- Nova Minerals Limited (“Nova” or the “Company”) (NASDAQ: NVA, NVAWW) (ASX: NVA) (OTC: NVAAF) (FSE: QM3) is pleased to announce the commencement of resource definition drilling and exploration field programs on its over 200mi2 flagship Estelle Gold Project, located in the prolific Tintina Gold Belt in Alaska.

The Company is focused on Feasibility Study (FS) stage drilling at the high-grade RPM deposit to continue to increase and prove-up resources to the higher confidence Measured and Indicated categories. With a total defined 5.2 Moz Au in-pit constrained S-K 1300 compliant resource (Table 1) across 4 deposits, the Estelle Gold Project has development optionality in terms of initial project size and scale, which is subject to market conditions and strategic partners to meet our objective of ultimately growing the Estelle Gold Project into a tier 1 gold producer. The Feasibility Study currently underway is considering a strategy to achieve production with a scalable operation, by:

| 1. | Establishing an initial low capex smaller scale operation at the high-grade RPM deposit requiring less infrastructure for expected early cashflow and high margins to potentially self-fund expansion plans; and/or |

| 2. | Develop the higher capex larger mining operation for increased gold production, cash flow, and mine life that potential future large gold company strategic partners have expressed an interest. |

Work Plan and PFS Highlights:

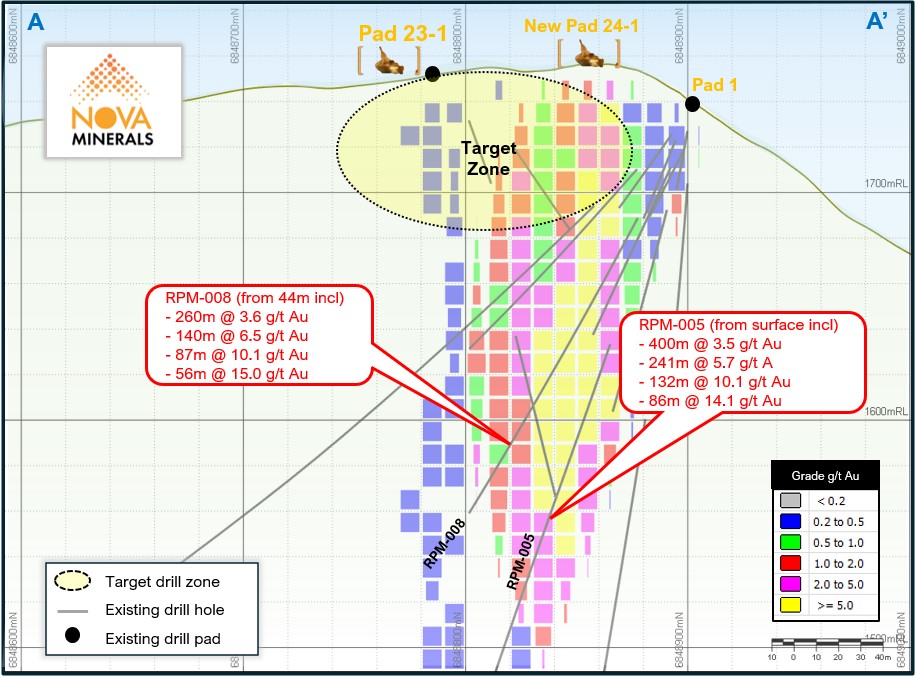

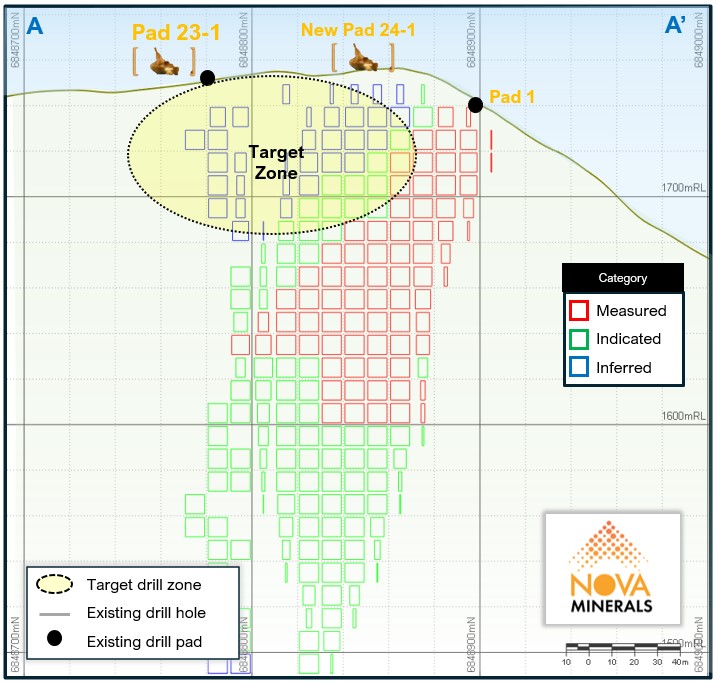

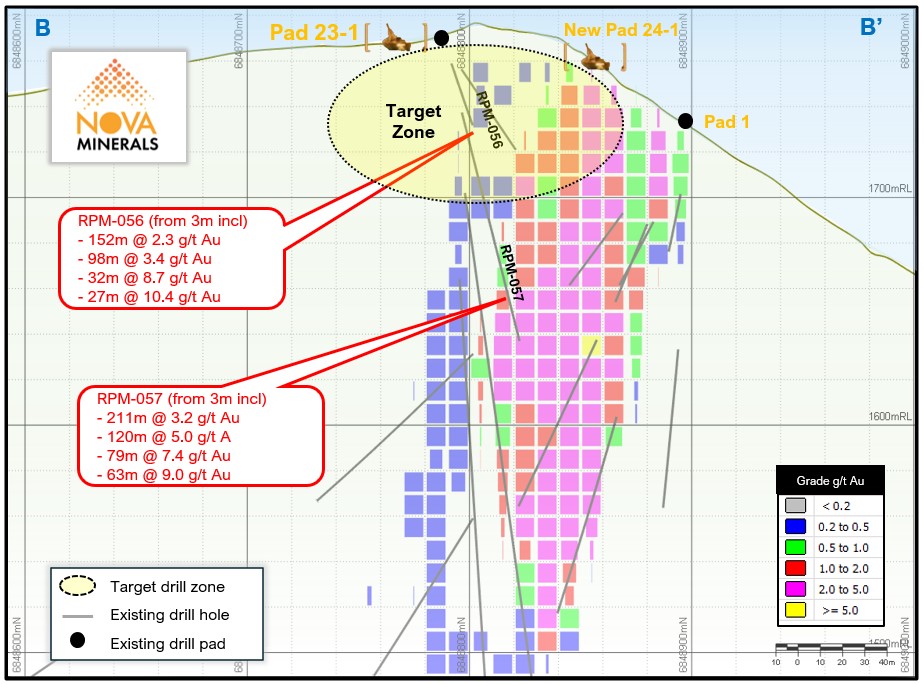

| ● | Resource Drilling. Program focused at RPM to increase and prove-up resources as part of the Feasibility Study utilizing the company owned drill rig to achieve a cost efficient program (Figures 1 to 5). |

| ● | Mineral Resource Estimate (MRE). Update to include the 2023 and 2024 drilling data and to incorporate the higher gold price for an updated resource. |

| ● | LIDAR. Detailed survey across the property to enable detailed infrastructure design, mineral reserve classification, exploration, etc. |

| ● | Heap Leach. Metallurgical test work is currently underway with METS Engineering to include a low-cost gold recovery method option in the flow sheet for processing lower grade ores to potentially substantially reduce capex and increase the gold production profile. |

| ● | Geotechnical. Detailed studies are underway to potentially increase pit slope angles further. Early indications show very competent geology, with the study results expected to have a significant positive impact on the project economics. |

| ● | Ore Sorting. FS level test work to commence to investigate the additional benefit of using Steinart multiple sensor technologies and further improve on previous exceptional results from utilizing XRT density sorting. Ore sorting results to date have shown the potential to significantly improve resource extraction providing processing optionality, which is expected to reduce overall processing costs, increase total gold production, and increase the life of mine. In addition, planning is underway to complete a future 200kt bulk pit pilot test program to further de-risk ore sorting and optimize material handling and flow. The expected benefits of ore sorting to improve project economics include: |

| ○ | Pre-concentration of mill feed by separating it into high-grade, low-grade and waste fractions | |

| ○ | Selective high grading of lower grade ores and existing waste dumps | |

| ○ | Reduction of environmental risks and costs – smaller tailings dam footprint | |

| ○ | Optimization of multiple process streams, for example, sending appropriate ore to the mill and heap leach | |

| ○ | Pre-concentration of ore in order to reduce transportation costs | |

| ○ | Lowering operating costs | |

| ○ | Improving ore grade |

| ● | Critical Elements. In addition to copper and silver, highly elevated concentrations of Antimony and other critical elements have been discovered at numerous prospects across the Estelle Project. These elements have the potential to provide significant by-product credits to the project. The Company continues to include multi-element analysis for all samples to define these resources for potential future extraction from the gold processing waste stream, and/or as a stand-alone small-scale operation for near term cash flow, i.e. for antimony production which is found in prospects outside of the existing gold deposits. The Company continues to pursue this opportunity as well as federal and state grants for critical minerals development studies and extraction/refining plant capital requirements. The US Government is engaged in providing grant funding and support through the Defense Production Act (DPA) and other legislation to establish and fully secure US domestic critical minerals supply chains which are currently controlled by foreign adversaries. The Estelle Gold Project with its potential of contained critical mineral resources and other key project aspects could contribute to achieving these US national security objectives. |

Nova CEO, Mr Christopher Gerteisen commented: “In less than 5 years we have taken the project from green fields to a total 5.2 Moz Au in-pit constrained S-K 1300 compliant resource with a FS now in progress. We have focused defining high confidence resources for conversion to reserves at 2 deposits, RPM and Korbel, from the over 20 prospects across the Estelle Gold Project on our path towards production. Now in the FS stage, the asset is progressing towards development with our strategy reflecting the flexibility of the project to current market conditions and our commitment to balance sheet management, with a low-capex, expected high margin, scalable start-up operation with potential self-funded expansion and/or a strategic partner to advance the full-scale production scenario to ultimately realize our goal of becoming a tier 1 gold producer with the Estelle Gold Project.”

This strategy provides a defined path to production designed to provide free cashflow, while potentially allowing us to continue to unlock the district organically and to deliver on our prior track record of resource growth, new discoveries, at a low-cost per discovery ounce.”

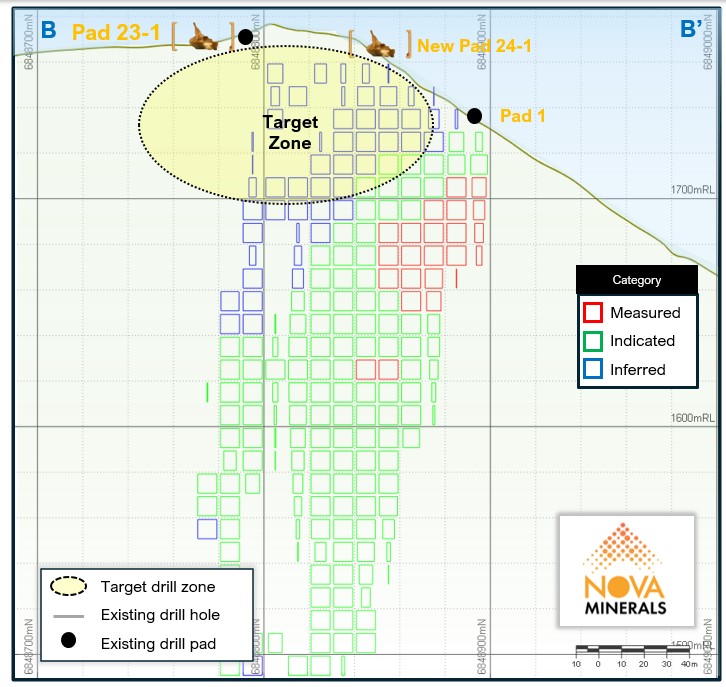

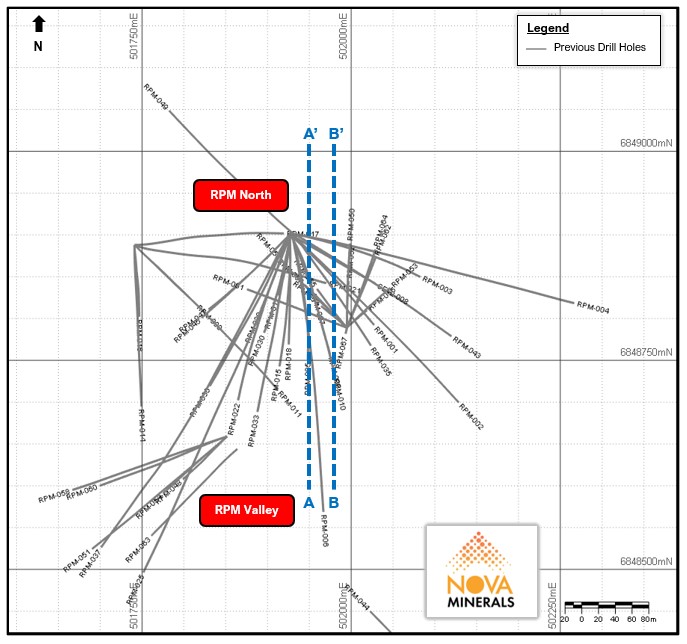

2024 RPM Drill Plan

Highly targeted and strategic drilling at the RPM deposit continues, with the Company owned Reverse Circulation (RC) rig working to upgrade and expand the current resource. Of the drilling planned for 2024, the majority will be allocated to advance the RPM high grade starter pit area and to further delineate the at-surface, high-grade (1 g/t Au to > 5 g/t Au) zone encountered there during 2022-2023 drilling, while upgrading inferred resources and testing for potential near surface extensions of the high-grade gold system to the south and west (Figures 1 to 5). Drilling at RPM will be complemented by ongoing metallurgical work and environmental surveys as outlined in this announcement along with studies as necessary to inform economic assessment of the discovery to gain a head start for a potential initial low capex smaller scale operation at the high-grade RPM deposit requiring less infrastructure for early cashflow and high margins to self-fund expansion plans.

Due to the speed, efficiency and lower costs of running the Company owned RC rig on labor hire only, when compared to diamond drilling, this drill program is designed to be conducted at a lower cost, while providing the necessary data density to meet our objectives of expanding and proving up a significant amount of the existing RPM resource into the Measured and Indicated categories to allow conversion into economic reserves for the upcoming FS.

The Company looks forward to announcing the assay results from the drill campaign as they come in to assess the significance of the observations in Figures 1-4.

|  | |

| Figure 1. RPM North Section A-A’ 1950mE looking West showing existing drill traces and selected results, and the 2024 drill target zone – Block model (Au Grade) | Figure 2. RPM North Section A-A’ 1950mE looking West showing the 2024 drill target zone – Block model (Resource classification) |

|  | |

| Figure 3. RPM North Section B-B’ 1975mE looking West showing existing drill traces and selected results, and the 2024 drill target zone – Block model (Au Grade) | Figure 4. RPM North Section B-B’ 1975mE looking West showing the 2024 drill target zone – Block model (Resource classification) |

Figure 5. RPM North and RPM Valley plan view, with all drill holes to date

Table 1. Estelle Gold Project in-pit constrained S-K 1300 compliant Mineral Resource Estimate (MRE) – January 31, 2024. ~ 6,600m of drilling performed in late 2023 is not included in this MRE.

| Measured | Indicated | Inferred | Total | |||||||||||||||||||||||

| Deposit | Cut-off Grade | Tonnes Mt | Grade Au g/t | Au Moz | Tonnes Mt | Grade Au g/t | Au Moz | Tonnes Mt | Grade Au g/t | Au Moz | Tonnes Mt | Grade Au g/t | Au Moz | |||||||||||||

| RPM North | 0.20 | 1.4 | 4.1 | 0.18 | 3.0 | 1.6 | 0.15 | 23 | 0.60 | 0.45 | 28 | 0.88 | 0.78 | |||||||||||||

| RPM South | 0.20 | - | - | - | - | - | - | 23 | 0.47 | 0.35 | 23 | 0.47 | 0.35 | |||||||||||||

| Total RPM | 1.4 | 4.1 | 0.18 | 3.0 | 1.6 | 0.15 | 46 | 0.54 | 0.80 | 51 | 0.70 | 1.13 | ||||||||||||||

| Korbel Main | 0.15 | - | - | - | 240 | 0.31 | 2.39 | 35 | 0.27 | 0.30 | 275 | 0.30 | 2.70 | |||||||||||||

| Cathedral | 0.15 | - | - | - | - | - | - | 150 | 0.28 | 1.35 | 150 | 0.28 | 1.35 | |||||||||||||

| Total Korbel | - | - | - | 240 | 0.31 | 2.39 | 185 | 0.28 | 1.65 | 425 | 0.30 | 4.05 | ||||||||||||||

| Total Estelle Gold Project | 1.4 | 4.1 | 0.18 | 243 | 0.33 | 2.54 | 231 | 0.33 | 2.45 | 476 | 0.3 | 5.17 | ||||||||||||||

Notes to Table 1

| 1. | A Mineral Resource is defined as a concentration or occurrence of material of economic interest in or on the Earth’s crust in such form, grade or quality, and quantity, that there are reasonable prospects for economic extraction. |

| 2. | The mineral resource applies a reasonable prospect of economic extraction with the following assumptions: |

| ● | Resources are constrained within optimized pit shells that reflect a conventional large-scale truck and shovel open pit operation with cost and revenue parameters as follows: |

| ○ | Gold price of US | |

| ○ | ||

| ○ | Pit slope angles of 50o | |

| ○ | Mining cost of US | |

| ○ | Processing cost for RPM US | |

| ○ | Combined processing recoveries of | |

| ○ | General and Administrative Cost of US | |

| ○ | Tonnages and grades are rounded to two significant figures. Ounces are rounded to 1000 ounces. Rounding errors are apparent. | |

Please refer to the “S-K 1300 Technical Report Summary Initial Assessment for the Estelle Gold Project, Alaska, USA” with an effective date of January 31, 2024, available under the Company’s website at www.novaminerals.com.au

Christopher Gerteisen, P.Geo., Chief Executive Officer of Nova Minerals, has supervised the preparation of this news release and has reviewed and approved the scientific and technical information contained herein. Mr. Gerteisen is a “qualified person” for the purposes of SEC Regulation S-K 1300.

About Nova Minerals Limited

Nova Minerals Limited is a gold and critical minerals exploration and development company focused on advancing the Estelle Gold Project, comprised of 513 km2 of State of Alaska mining claims, which contains multiple mining complexes across a 35 km long mineralized corridor of over 20 identified gold prospects, including two already defined multi-million ounce resources across four deposits. The

Further discussion and analysis of the Estelle Gold Project is available through the interactive Vrify 3D animations, presentations, and videos, all available on the Company’s website. www.novaminerals.com.au

Forward Looking Statements

This press release contains “forward-looking statements” that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements. Forward-looking statements contained in this press release may be identified by the use of words such as “anticipate,” “believe,” “contemplate,” “could,” “estimate,” “expect,” “intend,” “seek,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “target,” “aim,” “should,” “will” “would,” or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements are based on Nova Minerals Limited’s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. These and other risks and uncertainties are described more fully in the section titled “Risk Factors” in the final prospectus related to the public offering filed with the Securities and Exchange Commission. Forward-looking statements contained in this announcement are made as of this date, and Nova Minerals Limited undertakes no duty to update such information except as required under applicable law.

For Additional Information Please Contact

Craig Bentley

Director of Finance & Compliance & Investor Relations

E: craig@novaminerals.com.au

M: +61 414 714 19