Northern Superior Details Philibert Exploration Strategy Including Connecting Mineralization 1.5 KM Southeast of Current Resource

Northern Superior announced its 9-month exploration strategy for the Philibert gold property in Quebec, Canada, targeting expansion and connecting mineralization. The plan includes 20,000 meters of drilling in various directions, aiming to explore an additional 4 km of mineralization. Significant historical drill results include 1.55 g/t Au over 26.0 meters and 2.17 g/t Au over 17.9 meters. The project has a transformational Mineral Resource Estimate of 48.46 million tonnes inferred at 1.10 g/t Au, totaling 1,708,800 ounces, and 7.88 million tonnes indicated at 1.10 g/t Au, totaling 278,920 ounces. Recent $8 million equity financing will fund the program. The company also plans metallurgical testing and has outlined potential underground resources. Additionally, 2,250,000 stock options and 50,000 RSUs have been granted under the 2022 Equity Incentive Plan.

- 20,000 meters of expansion drilling planned for the next 9 months.

- Historical drilling results show significant mineralization: 1.55 g/t Au over 26.0 meters, 2.17 g/t Au over 17.9 meters.

- Transformational MRE: 48.46 million tonnes inferred at 1.10 g/t Au (1,708,800 ounces) and 7.88 million tonnes indicated at 1.10 g/t Au (278,920 ounces).

- $8 million equity financing secured, sufficient to fund the exploration program.

- Potential underground resources: 239,000 ounces at 5.68 g/t gold not included in the 2023 MRE.

- Initial metallurgical recovery results show up to 95.6% flotation concentrate recovery.

- Exploration results are primarily historical and require further sampling to confirm.

- Significant capital allocation to exploration with no immediate revenue generation.

- Stock option grants (2,250,000 options) and RSUs (50,000 units), potentially diluting existing shares.

TORONTO, ON / ACCESSWIRE / June 13, 2024 / Northern Superior Resources Inc. ("Northern Superior" or the "Company") (TSXV:SUP)(OTCQX:NSUPF) is pleased to unveil its exploration plan for the next 9 months on the Philibert gold property, located 60 kilometres southwest of Chibougamau, Québec, Canada (the "Philibert Project"; Northern Superior:

In 2023, the Company filed a transformational Mineral Resource Estimate ("MRE") for the Philibert deposit of 48.46 million tonnes of inferred mineral resource averaging 1.10 grams of gold per tonne for 1,708,800 ounces of gold, and 7.88 million tonnes of indicated mineral resource averaging 1.10 grams of gold per tonne for 278,920 ounces of gold. The Philibert Project is located only 9 km away from IAMGOLD Corporation ("IAMGOLD")'s Nelligan project. IAMGOLD recently shared an operational update on its activities in the Chibougamau Gold Camp (see IAMGOLD's MD&A filed on Sedar on May 9, 2024, page 18).

The Company will continue to advance its assets in the Chibougamau Gold Camp with an immediate focus on the Philibert Project. The recent

Program Highlights:

- Impactful Program: Over 20,000 metres of expansion drilling planned for next 9 months, i) along strike to the east and west and, ii) along the hanging wall trend north and down dip of the open pit resource and defined pit;

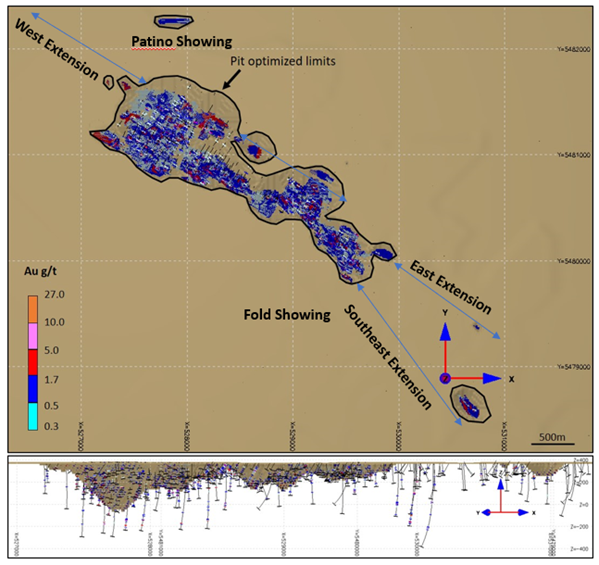

- Great Potential: Work conducted to date on the Philibert Project is based on 3 km of mineralization while geophysics is indicative of an additional 4 km of mineralization spreading east and west of the resource (see Figure 1);

- Expansion Drilling with Demonstrated Mineralization: Notable historic drill holes over 300 metres east of the current resource returned 2.17 g/t Au over 17.9 metres, and 1.66 g/t Au over 8.27 metres with both requiring further sampling (see Figure 1,2 and 3);

- Plan to Connect Mineralization: Historic drilling located over 1,500 metres southeast of the current resource (see Figure 1,2 and 3) returned 1.55 g/t Au over 26.0 metres starting at 72.5 metres, and 1.09 g/t Au over 13.7 metres with both drill holes requiring further sampling above and below the intersections;

- Great potential to the west: Approximately 300 metres west of the defined pit along the hanging wall trend returned 1.76 g/t Au over 7.0 metres, including 10.8 g/t Au over 1.0 metre starting at 162.5 metres from historical drilling. Other anomalous gold values were returned but requiring further sampling above and below the intersection. The western trend is defined by a linear magnetic anomaly interpreted to correspond to the gabbro host of Philibert extending on the property for over 2 km. The Company is planning some geochemical and geophysical surveys to help define the targeted zone (see Figure 1,2 and 3);

- Strike extensions: Expansion drilling southeast of the Corsac Fox zone part of the interpreted hanging wall with an additional potential of 700 metres of strike extension (see Figure 1,2 and 3);

- Building on great metallurgy: Further metallurgical testing is being planned for the eastern end of the pit to build on initial testing with flotation concentrate returning recoveries up to

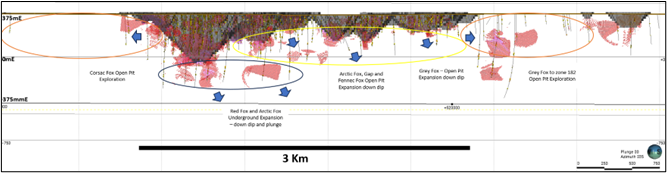

95.6% (see press release dated July 6, 2023); and, - Underground Potential: While the MRE published in 2023 did not include any of the underground potential, a previous study of the economic potential of the Philibert Project,2 focused exclusively on underground resources from the western domains, with approximately 239,000 ounces at 5.68 g/t gold (see Figure 2). Such underground potential will be further explored, evaluated, and potentially included in a subsequent mineral resource estimate (see Figure 3).

"The Philibert Project has already demonstrated significant potential with its initial NI 43-101 resource estimate published in 2023, showcasing a relatively high-grade profile for a bulk tonnage operation. Additionally, the project benefits from a low nugget effect, minimal overburden cover, and promising initial metallurgical recovery results. These attributes firmly position the Philibert Project as a cornerstone of the Chibougamau Gold Camp, which is rapidly gaining recognition as it nears the 10-million-ounce mark, with key deposits located within 10 km of one another. We are very excited to continue developing this cornerstone asset," commented Simon Marcotte, President and Chief Executive Officer of Northern Superior.

The current pit is defined along a 3 km strike and up to a vertical depth of 450 metres in the west and up to 150 metres in the south. In the western end, the hanging wall zone widens the mineralization corridor up to 500 metres compared to 200 metres near the middle of the pit. The Company plans to complete drilling along the 700-metre corridor to define the hanging wall mineralization aimed at widening the pit northward. This work will also define mineralization down dip and plunge in the eastern end of the pit from Fennec Fox to Grey Fox.

Drilling will also focus on expansion to the east, southeast and west following the additional 4 km linear magnetic trend interpreted to define the Obatogamau formation fractionated gabbro, host to the Philibert deposit. In the southeast area, two separate trends are identified from limited historic drilling with significant mineralization intersected including 1.55 g/t Au over 26.0 metres, 2.17 g/t Au over 17.9 metres, and 1.96 g/t Au over 10.0 metres. All mineralization is recorded as being associated with disseminated pyrite mineralization within a quartz rich gabbro host.

Less drilling has been completed along the western trend, but the host gabbro is interpreted to coincide to a well-defined northwest trending linear magnetic anomaly. One drill hole completed 300 metres west of the defined pit returned 1.76 g/t Au over 7.0 metres, including 10.8 g/t Au over 1.0 metre.

A number of high priority exploration targets are planned to be tested including the magnetic fold feature to the south of the east end of the defined pit with a historic hole returning 0.73 g/t Au over 15.1 metres, including 1.52 g/t Au over 6.2 metres starting at 43.6 metres.

The Patino showing is located to the northwest of the defined pit constrained resources includes historic intersections of 0.66 g/t Au over 5.18 metres, 1.45 g/t Au over 2.8 metres and 0.94 g/t Au over 3.05 metres. Mineralization is recorded as hosted within a graphitic sediment horizon with quartz-carbonate veins and semi-massive to massive pyrite, chalcopyrite, sphalerite and pyrrhotite. The Patino showing is associated with an additional structure that appears to be oriented in a more east-west direction.

Other groundwork is being planned to follow up on historic mapping and channel sampling which identified mineralization within a similar looking gabbro host to Philibert but located between 1 km and 1.2 km north of the resource.

The Company is also planning to complete 10,000 metres of sampling from selectively sampled historic core within and outside the currently defined pit in order to improve the ore to waste ratio in pit and help define mineralized trends outside the current resource.

Corporate Matters

Furthermore, the Company wishes to announce the granting of 2,250,000 incentive stock options under its 2022 Equity Incentive Plan (the "Plan"), including 1,630,000 options which were granted to certain directors and senior officers of the Company. Each option is exercisable at a price of

About Northern Superior Resources Inc.

Northern Superior is a gold exploration company focused on the Chibougamau Camp in Québec, Canada. The Company has consolidated the largest land package in the region, with total land holdings currently exceeding 62,000 hectares. The main properties include Philibert, Lac Surprise, Chevrier and Croteau. Northern Superior also owns

The Philibert Project is located 9 km from IAMGOLD Corporation's Nelligan Gold project which was awarded the "Discovery of the Year" by the Québec Mineral Exploration Association (AEMQ) in 2019. Philibert hosts a new maiden 43-101 inferred resource of 1,708,800 ounces Au and an indicated resource of 278,900 ounces of Au.3 Northern Superior holds a majority stake of

Northern Superior is a reporting issuer in British Columbia, Alberta, Ontario and Québec, and trades on the TSX-V under the symbol SUP and the OTCQB Venture Market under the symbol NSUPF. For further information, please refer to the Company's website at www.nsuperior.com or the Company's profile on SEDAR+ at www.sedarplus.ca.

About SOQUEM

SOQUEM, a subsidiary of Investissement Québec, is dedicated to promoting the exploration, discovery, and development of mining properties in Québec. SOQUEM also contributes to maintaining strong local economies. Proud partner and ambassador for the development of Québec's mineral wealth, SOQUEM relies on innovation, research, and strategic minerals to be well-positioned for the future.

Qualified Person

The technical content and scientific aspects of this press release have been prepared by Ms. DeLazzer Vice-President Exploration of Northern Superior.

The content of the disclosure has been reviewed and approved by Mr. Claude Duplessis, P. Eng. of the Order of Engineers of Quebec, an independent Qualified Person as defined by the National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

Northern Superior Resources Inc. on Behalf of the Board of Directors

Simon Marcotte, CFA, President and Chief Executive Officer

Contact Information

Simon Marcotte, CFA

President and Chief Executive Officer

Tel: (647) 801-7273

info@nsuperior.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This Press Release contains forward-looking information and statements (collectively, "Forward-Looking Statements") that involve risks and uncertainties, which may cause actual results to differ materially from the statements made herein. When used in this document, the words "may", "would", "could", "will", "intend", "plan", "anticipate", "believe", "estimate", "expect" and similar expressions are intended to identify Forward-Looking Statements. Such statements herein include, but are not limited to, statements regarding the Company's ability to convert inferred resources into measured and indicated resources; parameters and methods used to estimate the mineral resource estimate (the "MRE") at the Philibert Project; the prospects, if any, of the Philibert Project and its other projects in the area; and the significance of historic exploration activities and results. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include the results of exploration activities, the Company's financial position and general economic conditions, the ability of exploration activities to accurately predict mineralization; the accuracy of geological modelling; the ability of the Company to complete further exploration activities; the legitimacy of title and property interests in the Philibert Project and its other projects in the area; the accuracy of key assumptions, parameters or methods used to estimate the MRE; the ability of the Company to obtain required approvals; the evolution of the global economic climate; metal prices; environmental expectations; community and non-governmental actions; the Company's ability to secure required funding; and other risks detailed from time to time in the filings made by the Company with securities regulators available at www.sedarplus.ca.

The Forward-Looking Statements contained in this news release are expressly qualified in their entirety by this cautionary statement. All Forward-Looking Statements in this news release are made as of the date of this news release and the Company does not undertake to update or revise any such statements contained herein to reflect new events or circumstances, except as may be required by applicable securities laws.

Information Concerning Estimates of Mineral Resources

The disclosure in this news release and referred to herein was prepared in accordance with NI 43-101 which differs from the requirements of the U.S. Securities and Exchange Commission (the "SEC"). The terms "measured mineral resource", "indicated mineral resource" and "inferred mineral resource" used in this news release are in reference to the mining terms defined in the Canadian Institute of Mining, Metallurgy and Petroleum Standards (the "CIM Definition Standards"), which definitions have been adopted by NI 43-101.

Investors are cautioned not to assume that any part or all of mineral resources will ever be converted into reserves. Pursuant to CIM Definition Standards, "inferred mineral resources" are that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Such geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and may not be converted to a mineral reserve. However, it is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies. Investors are cautioned not to assume that all or any part of an inferred mineral resource is economically or legally mineable.

Effective February 25, 2019, the SEC adopted new mining disclosure rules under subpart 1300 of Regulation S-K of the United States Securities Act of 1933, as amended (the "SEC Modernization Rules"), with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical property disclosure requirements included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources". Information regarding mineral resources contained or referenced in this news release may not be comparable to similar information made public by companies that report according to U.S. standards. While the SEC Modernization Rules are purported to be "substantially similar" to the CIM Definition Standards, readers are cautioned that there are differences between the SEC Modernization Rules and the CIM Definitions Standards.

1 Northern Superior has the option to acquire from Soquem the remaining

2 Historical information : Roche Ltée., (1991) Économique, Propriété Philibert. Projet: 11044-001.

3 Northern Superior announces 1,708,809 gold ounces in inferred category and 278,921 gold ounces in indicated category at 1.10 g/t in maiden NI 43-101 pit constrained resource estimate at Philibert; Northern Superior's press release dated August 08, 2023.

4 NI 43-101 Technical Report Mineral Resource Estimation for the Chevrier Main Deposit, Chevrier Project Chibougamau, Quebec, Canada, October 20, 2021, Prepared in accordance with NI 43-101 by Lions Gate Geological Consulting Inc. IOS Services Géoscientifiques Inc. for Northern Superior.

5 Chalice Gold Mines Limited and Northern Superior Resources Inc. Technical Report on the Croteau Est Gold Project, Québec, September 2015, Prepared in accordance with NI 43-101 by Optiro Pty Ltd ("Optiro") to Chalice Gold Mines Limited and Northern Superior.

SOURCE: Northern Superior Resources Inc.

View the original press release on accesswire.com