Northern Superior Announces ONGold's Agreements to Acquire Monument Bay and Domain Gold Projects in Manitoba

Northern Superior Resources announces that its 72%-owned subsidiary ONGold Resources has entered agreements to acquire 100% ownership of the Monument Bay Gold Project and Domain Project in Manitoba from Agnico Eagle Mines and Capella Minerals. The deal involves initial consideration of $250,000 in cash and 8.7 million ONGold shares valued at approximately $4.2 million, plus up to $22 million in milestone-based payments.

Monument Bay is an advanced-stage exploration asset with over 232,000 meters drilled in more than 800 diamond core holes. The project's most recent historical resource estimate (2017) identified 2.3 million Au oz at 1.24 g/t in Measured & Indicated categories and 720,000 Au oz at 0.92 g/t in Inferred category. Upon closing, Agnico Eagle will own 15% of ONGold, while Northern Superior's stake will be 62%.

Northern Superior Resources annuncia che la sua controllata al 72% ONGold Resources ha stipulato accordi per acquisire il 100% della proprietà Monument Bay Gold Project e del Domain Project in Manitoba da Agnico Eagle Mines e Capella Minerals. L'accordo prevede una considerazione iniziale di 250.000 dollari in contanti e 8,7 milioni di azioni ONGold valutate a circa 4,2 milioni di dollari, più fino a 22 milioni di dollari in pagamenti basati su obiettivi.

Monument Bay è un asset di esplorazione in fase avanzata con oltre 232.000 metri di perforazioni in più di 800 fori di carotaggio a diamante. La stima delle risorse storiche più recente del progetto (2017) ha identificato 2,3 milioni di once d'oro (Au) a 1,24 g/t nelle categorie Misurato e Indicato e 720.000 once d'oro (Au) a 0,92 g/t nella categoria Inferita. Al termine dell'operazione, Agnico Eagle possiederà il 15% di ONGold, mentre la quota di Northern Superior sarà del 62%.

Northern Superior Resources anuncia que su subsidiaria ONGold Resources, de la que posee el 72%, ha firmado acuerdos para adquirir el 100% de la propiedad Monument Bay Gold Project y el Domain Project en Manitoba de Agnico Eagle Mines y Capella Minerals. El acuerdo implica una consideración inicial de 250,000 dólares en efectivo y 8.7 millones de acciones de ONGold valoradas en aproximadamente 4.2 millones de dólares, más hasta 22 millones de dólares en pagos basados en hitos.

Monument Bay es un activo de exploración en fase avanzada, con más de 232,000 metros perforados en más de 800 pozos de perforación de diamante. La estimación de recursos histórica más reciente del proyecto (2017) identificó 2.3 millones de onzas de Au a 1.24 g/t en las categorías Medidas e Indicadas y 720,000 onzas de Au a 0.92 g/t en la categoría Inferida. Tras el cierre, Agnico Eagle poseerá el 15% de ONGold, mientras que la participación de Northern Superior será del 62%.

Northern Superior Resources는 자회사 ONGold Resources가 Agnico Eagle Mines 및 Capella Minerals로부터 매니토바의 Monument Bay Gold Project와 Domain Project의 100% 소유권을 인수하는 계약을 체결했다고 발표했습니다. 이 거래는 현금 250,000달러와 약 420만 달러에 해당하는 870만 ONGold 주식으로 구성된 초기 대가와 최대 2200만 달러의 이정표 기반 지급금을 포함합니다.

Monument Bay는 800개 이상의 다이아몬드 코어 홀에서 23만 미터 이상의 시굴이 진행된 고급 단계의 탐사 자산입니다. 프로젝트의 가장 최근 역사적 자원 추정치(2017)는 측정 및 지표 범주에서 2.3백만 온스의 Au를 1.24 g/t으로, 추정 범주에서 72만 온스의 Au를 0.92 g/t으로 확인했습니다. 거래가 완료되면 Agnico Eagle은 ONGold의 15%를, Northern Superior는 62%의 지분을 보유하게 됩니다.

Northern Superior Resources annonce que sa filiale à 72% ONGold Resources a signé des accords pour acquérir 100% de la propriété Monument Bay Gold Project et du Domain Project au Manitoba auprès d'Agnico Eagle Mines et de Capella Minerals. L'accord implique une contrepartie initiale de 250 000 dollars en espèces et de 8,7 millions d'actions ONGold d'une valeur d'environ 4,2 millions de dollars, plus jusqu'à 22 millions de dollars en paiements basés sur des jalons.

Monument Bay est un actif d'exploration en phase avancée avec plus de 232 000 mètres de forage réalisés dans plus de 800 trous de forage à diamant. La dernière estimation historique des ressources du projet (2017) a identifié 2,3 millions d'onces d'Au à 1,24 g/t dans les catégories Mesuré et Indiqué et 720 000 onces d'Au à 0,92 g/t dans la catégorie Inférée. À la clôture, Agnico Eagle possédera 15% de ONGold, tandis que Northern Superior détiendra 62%.

Northern Superior Resources gibt bekannt, dass ihre zu 72% im Besitz befindliche Tochtergesellschaft ONGold Resources Vereinbarungen zur Übernahme von 100% der Monument Bay Gold Project und Domain Project in Manitoba von Agnico Eagle Mines und Capella Minerals geschlossen hat. Der Deal umfasst eine anfängliche Gegenleistung von 250.000 US-Dollar in bar und 8,7 Millionen ONGold-Aktien im Wert von ca. 4,2 Millionen US-Dollar, sowie bis zu 22 Millionen US-Dollar in leistungsabhängigen Zahlungen.

Monument Bay ist ein fortgeschrittener Erkundungsfonds mit über 232.000 Metern, die in mehr als 800 Diamantkernbohrlöchern gebohrt wurden. Die letzte historische Ressourcenschätzung des Projekts (2017) identifizierte 2,3 Millionen Au-Unzen bei 1,24 g/t in den gemessenen und angezeigten Kategorien und 720.000 Au-Unzen bei 0,92 g/t in der abgeleiteten Kategorie. Nach Abschluss wird Agnico Eagle 15% von ONGold besitzen, während Northern Superior 62% halten wird.

- None.

- None.

TORONTO, ON / ACCESSWIRE / November 25, 2024 / Northern Superior Resources Inc. ("Northern Superior") (TSXV:SUP)(OTCQX:NSUPF)(GR:D9M1) is pleased to announce that ONGold Resources Ltd. ("ONGold" or the "Company") (TSXV:ONAU)(OTCQB:ONGRF), in which Northern Superior currently holds a

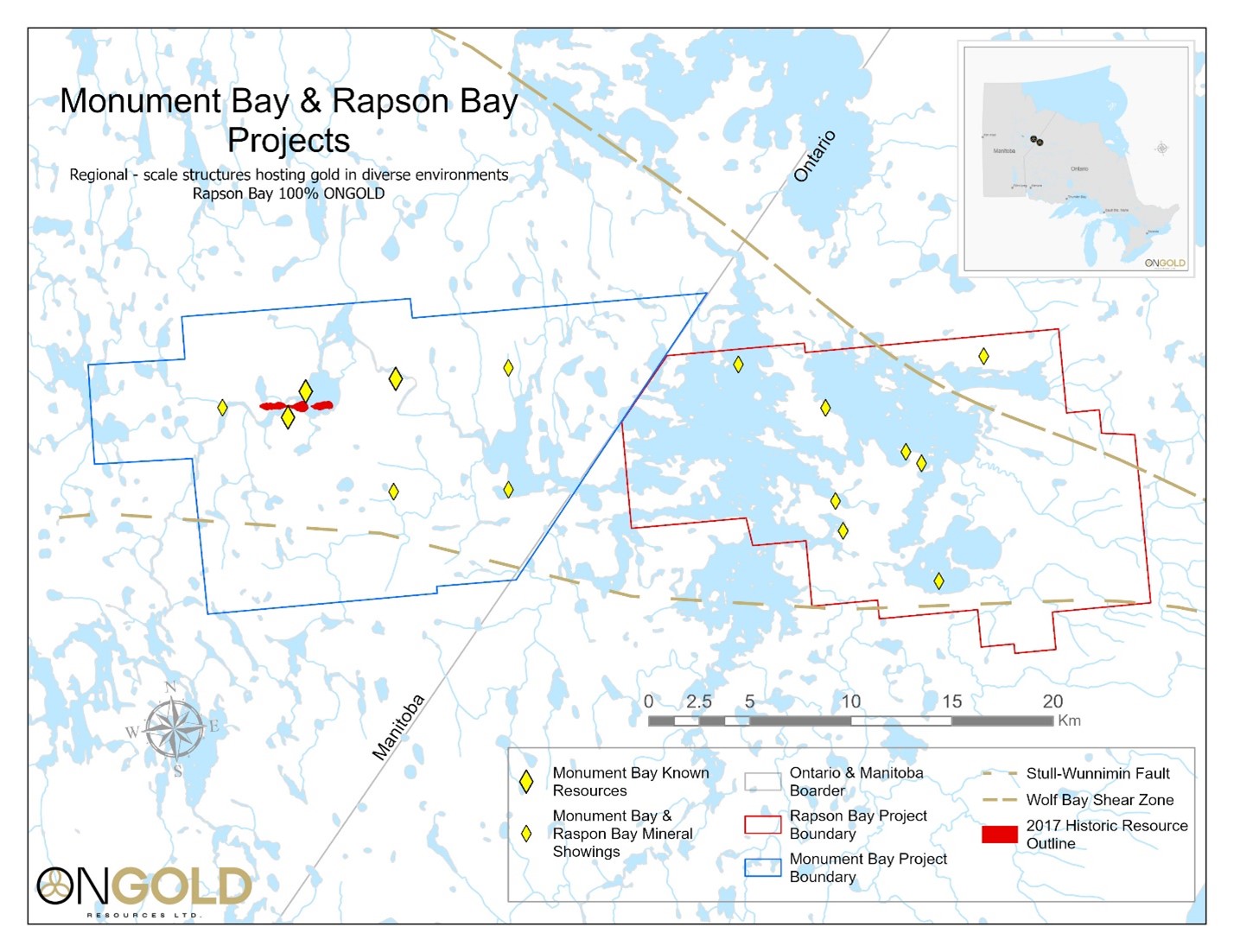

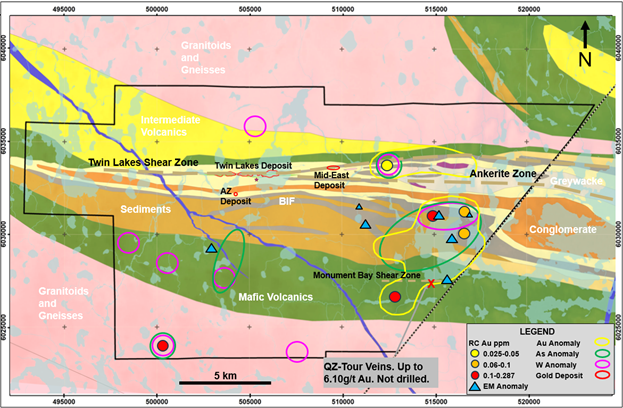

Monument Bay is located in northeastern Manitoba, near the Ontario-Manitoba border, and represents a district-scale exploration opportunity with significant gold and tungsten mineralization over a 40 km strike length. Monument Bay is an advanced stage exploration asset with over 232,000 metres drilled in more than 800 diamond core holes, while still having substantial exploration upside both within the known deposits and along underexplored satellite zones. Monument Bay has had numerous mineral resources estimates completed by various Qualified Persons on behalf of various operators, which are no longer current under National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") but will be used by ONGold to focus exploration efforts and form the basis of future resource estimates to be prepared in accordance with NI 43-101. The proposed acquisition of Monument Bay will strengthen ONGold's portfolio, provide a camp to explore ONGold's nearby Rapson Bay Properties and complement the Company's broader exploration footprint in Northern Ontario.

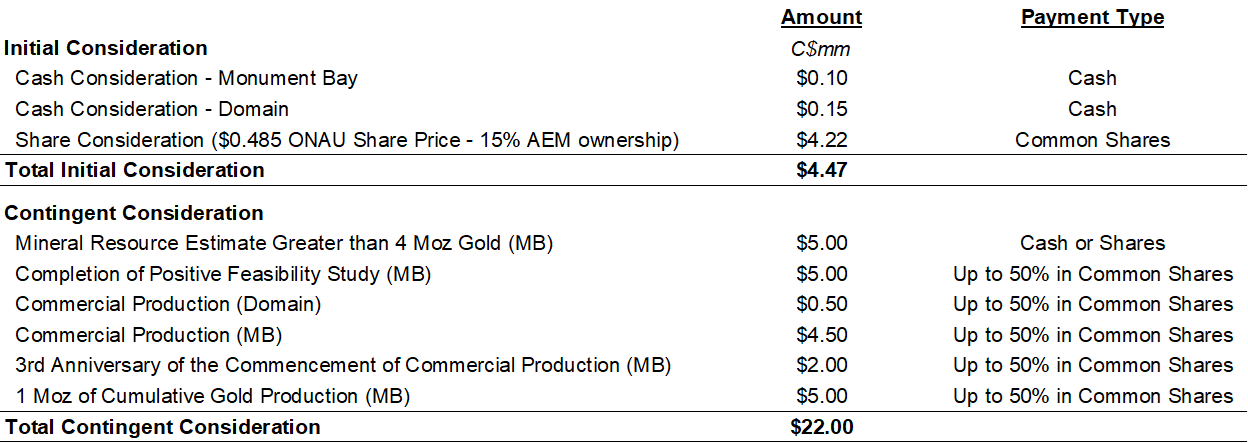

ONGold entered into separate asset purchase agreements for Monument Bay (the "MB Agreement") and Domain (the "Domain Agreement", together with the MB Agreement, the "Agreements") on November 25, 2024. Under the terms of the Agreements, ONGold will acquire the Monument Bay and Domain Projects for initial aggregate consideration consisting of

The transactions are an important step in advancing ONGold's strategy of becoming a leading junior explorer in the prolific Stull Lake Greenstone belt of Northern Canada. With its extensive technical expertise, strong commitment to social acceptability, mindful Indigenous engagement and partnerships, in addition to a proven track record of responsible exploration, ONGold's team is uniquely positioned to unlock the full potential of Monument Bay and Domain.

Kyle Stanfield, CEO of ONGold, commented: "We are thrilled to have reached this agreement with Agnico Eagle, a leader in the gold mining industry, and proud that ONGold is the new owner of these high-quality assets. With an experienced management team and advisory board, including leaders with deep expertise in technical exploration, capital markets, and Indigenous relations, ONGold is well-equipped to responsibly unlock the full potential of these assets. We believe the under-explored Monument Bay regional area holds great potential to create substantial value for our shareholders as well as the local community."

Transaction Highlights

Attractive Acquisition Price

Initial Consideration of

$250,000 in cash and 8.7 million ONGold common shares valued at approximately$4.2 million at a$0.48 5 ONAU share price for the Projects.Contingent consideration with respect to the Projects is payable at significant project milestones.

Addition of Advanced Stage Exploration Project with Historic Resources

Monument Bay has been the subject of several historic resource estimates completed by various operators which are no longer current under NI 43-101. See discussion of, and cautionary disclosure related to, historic resource estimates below.

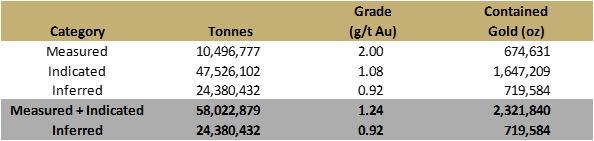

The most recent Technical Report (2017) identified 2.3 million Au oz at an average grade of 1.24 g/t in the Measured & Indicated Mineral Resources categories and 720,000 Au oz at an average grade of 0.92 g/t in the Inferred Mineral Resources category. The mineral resources referenced above are historic and no longer current under NI 43-101. See discussion of, and cautionary disclosure related to, historic resource estimates below.

Excellent Near Deposit Exploration Opportunities

Significant potential to expand mineralization at the Twin Lakes Deposit, AZ, and Mid-East Zones through near-mine exploration.

Untested shear zones and geophysical anomalies provide high-priority drill targets for mineral resource expansion.

Exciting Regional Exploration Play

Monument Bay's district-scale land package along the prolific Stull-Wunnummin Fault Zone is highly prospective and under-explored.

Geological features similar to significant mines like Newmont's Musselwhite gold mine suggest potential for high-grade, iron formation-hosted gold deposits within the Monument Bay property.

Synergistic and Complementary Acquisition

The acquisition will complement ONGold's Northern Ontario properties, allowing the team to leverage deep regional expertise and operational efficiencies to accelerate exploration success across a broader portfolio.

Substantial opportunities for resource sharing and streamlined exploration, positioning ONGold as a leading junior gold explorer in the Northern Ontario and Manitoba regions.

Diversifying across multiple assets with significant exploration potential creates multiple pathways for future growth and discovery.

Significant camp infrastructure at Monument Bay could be used to support future exploration at Rapson Bay.

Agnico Eagle as a Strategic Shareholder

Agnico Eagle to receive 8.7 million ONGold common shares as part of the Initial Consideration, resulting in a

15% equity stake in ONGold.

Strategic Benefits to ONGold:

District-Scale Exploration Potential: Monument Bay and Domain offer significant blue-sky potential with expansive, underexplored land packages along the prolific Stull-Wunnummin Fault Zone, providing opportunities for large-scale gold and critical metals discoveries.

Addition of Advanced Stage Exploration Project: Monument Bay adds an advanced-stage exploration asset with extensive drilling (more than 800 holes over 232,000 metres) and a historical mineral resource estimate which identified 2,300,000 Au oz at an average grade of 1.24 g/t in the Measured & Indicated Mineral Resources categories, and 720,000 Au oz at an average grade of 0.92 g/t in the Inferred Mineral Resources category. While this estimate is historical and not currently compliant under NI 43-101, it provides a foundation for ONGold to advance exploration and potentially establish a current mineral resource estimate. See discussion of, and cautionary disclosure related to, historic resource estimates below.

Critical Minerals Potential: Monument Bay offers exploration potential for critical minerals, including copper, nickel and tungsten.

De-risking the Portfolio: This acquisition of the Projects diversifies and de-risks ONGold's exposure, expanding its project scale and bolstering its portfolio of highly prospective gold assets in Canada and the Northern Ontario region.

Complementary Geography: Monument Bay's proximity to ONGold's Rapson Bay Property and TPK Project presents significant opportunities for operational synergies that will optimize resource sharing and streamline exploration activities.

Figure 1: Map of Monument Bay & Rapson Bay

Historic Mineral Resource Estimate

Monument Bay has been subject to several mineral resource estimates that contemplate both open pit and underground mining on the property since the initial resource estimate in 1991. All resource estimates are no longer current under NI 43-101 and should be treated as historic in nature.

Recently, a series of internal historical mineral resource estimates for Monument Bay were completed by WSP Canada Inc. ("WSP") on behalf of Agnico Eagle's subsidiary, Yamana Gold Ontario Inc. ("Yamana"). The most recent technical report, titled "Monument Bay 2017 Resource Update, Twin Lakes Deposit," dated July 2017 and authored by WSP, evaluated the pit-constrained Twin Lakes deposit but did not evaluate potential underground mineral resources at Twin Lakes or other deposits, including the AZ and Mid-East zones, is described below.

Figure 2: Monument Bay Historic Mineral Resource Estimate

Note: Pit constrained resources at 0.3 g/t Au cut off grade.

The historical mineral resource estimate for Monument Bay is derived from an unpublished report prepared for Yamana by WSP dated July 2017. The resource estimate was calculated using cut-off grades of 0.3 grams per tonne (g/t) gold for open-pit resources. The 2015 pit shell was used to constrain the resource. The Mid-East and AZ Zones are not included in this estimate. This resource only considers open-pit resources and is pit-constrained. Subsequent resource modelling has indicated there is a high degree of variability in tonnage, metal grades, and contained metal as a result of different estimation methodologies and geological models.

This estimate, prepared prior to ONGold's execution of the MB Agreement, is considered historical in nature. It is no longer current and should not be relied upon. The 2015 pit shell used to constrain the resource is outdated and would need to be updated to reflect current economic conditions and technical parameters. A qualified person has not done sufficient work to classify the historical estimates in this news release as current mineral resources or mineral reserves, and ONGold is not treating the historical estimates as current mineral resources or current mineral reserves. ONGold does not have any more recent estimates or data available with respect to these historical estimates and has not conducted sufficient work to establish the relevance and reliability of the historical resource estimates.

To verify and update this historical estimate to current NI 43-101 standards, additional work is required. This includes further drilling, a review of the geological model, and validation of previous findings under the oversight of a qualified person. Until such work is completed, investors are cautioned that the historical estimate does not meet current NI 43-101 standards, and any economic analysis or decisions based on this estimate should be avoided.

Monument Bay - Exploration Potential

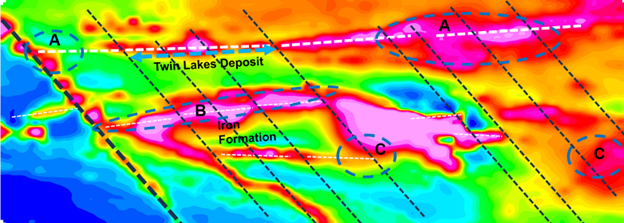

In addition to deposits at Twin Lakes and the AZ and Mid-East Zones, the large Monument Bay property holds many untested targets and offers significant potential for new discoveries. Areas to the east of the Mid-East Zone have similar magnetic signatures as the mafic volcanic unit in the hanging wall of the Twin Lakes Deposit. This area is generally poorly tested by diamond drilling.

The shear structures at Monument Bayhave been known since the 1980s but have never been drilled. The shear has been traced for a length of at least 1.5 km and aeromagnetic surveys suggest it may extend several kilometres further. Previous work has exposed a series of quartz-tourmaline veins at surface spatially associated with a shear zone in mafic volcanic rocks. Assays up to 6.10 g/t Au have been obtained from these veins.

Northwest trending features seen in aeromagnetic data appear to control high-grade mineralization in the Twin Lakes Deposit. These same features, interpreted to be faults, cut iron formation units to the southeast, where a decrease in magnetic intensity suggests magnetite-destructive alteration (sulphidization) may be present. Similar magnetic signatures are characteristic of iron formation hosted gold deposits such as the Musselwhite Mine in Northern Ontario operated by Newmont Corporation.

In addition, recently analyzed airborne electromagnetic (EM) surveys found several zones of high conductivity. These represent standalone targets, which may be prospective for critical metals. Again, these targets are untested by drilling.

Figure 3: Total Magnetic Intensity and Exploration Targets

Legend:

A) Potential Twin Lakes analogues along strike

B) Conductive sulphidic zones in iron formation

C) Standalone high conductance zones; possible base metals targets

Exploration Plans

These multiple exploration targets require follow-up with ground surveys prior to drilling. On completion of desktop compilation and analysis, the exploration program is anticipated to focus on refining the geological model and identifying new target areas. Key activities include integrating geology and geophysics through desktop studies, re-analyzing stored samples for gold grains, and conducting a drone magnetometer survey over 50-meter spaced lines to gather detailed geophysical data. Additionally, a 45-day field program involving geological mapping and structural analysis will target poorly drilled satellite zones to the east and south of the Twin Lakes Deposit.

Further analysis, including magnetic inversion studies, will enhance the understanding of subsurface structures and guide future exploration efforts. This groundwork is anticipated to set the stage for more intensive exploration campaigns, focusing on drilling exploration targets and refining targets for deposit discovery and resource expansion.

Proximity to Rapson Bay Project

The Monument Bay Property is contiguous to ONGold's Rapson Bay Project in Ontario, which consists of 1,528 cell units covering over 286 km2. This property covers approximately 23 km of the Wolf Bay Shear Zone, a splay from the regional Stull-Wunnummin Fault Zone ("SWFZ"). This shear separates the basalt-dominated Hayes River Group and Oxford Lake Group, which consists mainly of intermediate to felsic volcanics and derived sedimentary rocks. The Gilleran Lake Intrusive is a differentiated mafic intrusion within the Hayes River Group. Several gold, copper and zinc showings are known on the property. Rapson Bay is located approximately 30 km from the camp at Monument Bay, allowing ONGold to utilize the existing camp infrastructure to conduct and expand exploration activities at Rapson Bay.

A multi-phase work program in 2010-2011 by Northern Superior Resources Inc. consisted of prospecting, mapping, airborne magnetometer, selected induced polarization (IP) and ground magnetometer surveys and surficial till sampling. This culminated with the drilling of 9 diamond core holes totalling 2,548.7 m. Several intersections of gold mineralization were obtained from this drilling, highlighted by WB-11-008C, which cut 0.83 g/t Au, 3.07 g/t Ag, 0.55 % Cu and 0.028 % Mo over a core length of 52.5 m from 57.9 m downhole, including 1.83 g/t Au, 6.65 g/t Ag,

Summary of the Transaction

ONGold will acquire the Projects for an Initial Consideration of approximately

Upon completion of the acquisition of the Projects, Agnico Eagle will hold a

Figure 4: Summary of Consideration

In connection with the acquisition of the Projects, a non-arm's length party to ONGold (as such term is defined in the policies of the TSX Venture Exchange) will be paid finder's fees in the amount of

Technical Report

In accordance with the rules of the TSX Venture Exchange, the Company will file a technical report relating to Monument Bay, prepared in compliance with NI 43-101, within 90 days of the closing of the acquisition of Monument Bay.

Monument Bay Description

Monument Bay is located in northeastern Manitoba, close to the Ontario-Manitoba border, approximately 590 km from Winnipeg and 52 km northeast of Red Sucker Lake First Nation. The site is accessible year-round by aircraft, with winter road access available during freeze-up conditions. The project consists of 136 contiguous mining claims covering 31,250 hectares. ONGold plans to maintain the existing exploration camp at Twin Lakes with access via a 5,000-foot ice runway in the winter, and float planes for summer operations. A high-voltage power line extends to Red Sucker Lake.

The geological setting of Monument Bay is situated within the Oxford-Stull Domain, part of the Western Superior Province. This region is a granite-greenstone terrane characterized by volcanic-sedimentary assemblages and significant plutonic activity, formed through the subduction and collision of major continental terranes.

The gold and tungsten mineralization at Monument Bay is hosted within the Twin Lakes and AZ Shear Zones, which are splays of the regional SWFZ. These mylonitic shear zones deform the volcanic and sedimentary rocks of the Stull Lake Greenstone Belt, creating favorable conditions for mineralization. The Twin Lakes deposit, the primary focus of historic exploration, is hosted within the Twin Lakes Shear Zone and exhibits many characteristics typical of Archean orogenic gold systems, including stockwork veins, quartz-carbonate shear veins, and hydrothermal breccias. Gold and tungsten mineralization are associated with porphyry intrusions, with visible gold, pyrite, arsenopyrite, and scheelite present in the deposit. The Mid-East and AZ Zones, located along parallel shear zones, represent additional exploration targets with the potential to supplement the Twin Lakes Deposit.

Figure 5: Monument Bay Geological Overview

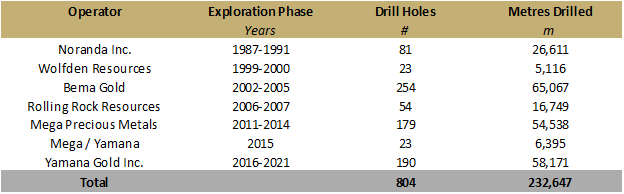

Project History

Monument Bay has a rich exploration history spanning several decades, with multiple operators contributing to its development and the understanding of its geological potential. Since the late 1980s, extensive exploration activities-including drilling, geophysical surveys, and resource estimations-have been conducted by various companies. Information regarding these operators and their exploration tenures is summarized in the table below.

Figure 6: Exploration History by Operators

Note: The drilling data presented above are based on internal reports provided by previous operators, including Yamana Gold Inc. ONGold has not yet fully reviewed or verified this historical drilling information.

More recently, from 2011 to 2015, Mega Precious Metals held the property and drilled 179 diamond drill holes, focusing on expanding known mineralization and identifying new targets within the project area. In June 2015, Mega Precious Metals was acquired by Yamana Gold Inc. Yamana advanced the project by generating several in-house resource estimates with WSP, and conducted additional drilling, including almost 60,000 metres of drilling in 190 holes, significantly enhancing the project's drilling database.

In March 2023, Agnico Eagle acquired Yamana's Canadian assets, including Monument Bay and Domain. Overall, Monument Bay now hosts a comprehensive database of over 800 diamond drill holes representing over 232,000 meters of drilling, providing a solid foundation for ONGold to advance future exploration and development efforts.

Technical Information

The scientific and technical content of this press release (except the technical information pertaining to the "About Northern Superior Resources Inc." section) has been reviewed and approved by Rodney Barber, P. Geo. for ONGold, who is a "Qualified Person" as defined by NI 43-101. Mr. Barber is the President of ONGold and is not considered independent.

All technical data contained in this press release related to Monument Bay is considered historical in nature. Please see the disclaimer in the section of this press release titled "Historic Mineral Resource Estimate" for further details.

About ONGold Resources Ltd.

ONGold holds significant exploration assets in Northern Ontario, highlighted by the district-scale TPK Project and October Gold Project. These projects represent a strategic footprint in one of Canada's most prolific gold-producing regions.

The TPK Project, known for its extensive gold mineralization, covers 47,976 of hectares in a highly favourable geological setting, and has shown promising exploration results from historical drilling and recent surveys. The project area is situated in a region known for its mineral potential.

ONGold also holds the district scale October Gold Project, consisting of 1,308 claims covering an area of 271 km2, which has a favorable geological setting for large-scale gold deposits and is located approximately 35 km along strike from the Cote Lake Mine. Evolution Mining Limited ("Evolution") (ASX: EVN) holds an option to acquire a

ONGold also holds a

ONGold is committed to responsible exploration practices and sustainable development, emphasizing strong partnerships with local communities and stakeholders. By adhering to high standards of environmental stewardship and community engagement, ONGold aims to not only explore and develop its assets but also contribute positively to the regions and Indigenous territories in which it operates.

With a seasoned management team led by industry veterans and a strategic focus on high-potential mining assets, ONGold Resources Ltd. is well-positioned to become a leader in the development of next-generation mines in Canada's prolific mining sectors.

ONGold Resources Ltd. on behalf of the Board of Directors

Kyle Stanfield, Chief Executive Officer & Director

Contact Information

Kyle Stanfield

Chief Executive Officer

Telephone: 1 (855) 525-0992

Email: info@ongoldresources.com

About Northern Superior Resources Inc.

Northern Superior is a gold exploration company focused on the Chibougamau Camp in Québec, Canada. The Company has consolidated the largest land package in the region, with total land holdings currently exceeding 62,000 hectares. The main properties include Philibert, Lac Surprise, Chevrier and Croteau. Northern Superior also owns

The Philibert Project is located 9 km from IAMGOLD Corporation's Nelligan[1] Gold project which was awarded the "Discovery of the Year" by the Québec Mineral Exploration Association (AEMQ) in 2019. Philibert hosts a new maiden 43-101 inferred resource of 1,708,800 ounces Au and an indicated resource of 278,900 ounces of Au.[2]Northern Superior holds a majority stake of

The technical content related to the section "About Northern Superior Resources Inc." has been reviewed and approved by Ms. Melanie Pichon, P.Geo., Senior geologist. Ms. Pichon is a QP under the NI 43-101 and is not considered independent.

Northern Superior is a reporting issuer in British Columbia, Alberta, Ontario and Québec, and trades on the TSXV under the symbol SUP and the OTCQB Venture Market under the symbol NSUPF. For further information, please refer to the Company's website at www.nsuperior.com or the Company's profile on SEDAR+ at www.sedarplus.ca.

Northern Superior Resources Inc. on Behalf of the Board of Directors

Simon Marcotte, CFA, President and Chief Executive Officer

Contact Information

Katrina Damouni

Director - Corporate Development

Tel: +44 7795 128583 (Mobile/WhatsApp)

info@nsuperior.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. The information in this news release about the proposed transaction; plans at the Projects; and any other information herein that is not a historical fact may be "forward-looking information". Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "interpreted", "management's view", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward- looking information and are intended to identify forward-looking information. This forward-looking information is based on reasonable assumptions and estimates of management of the Company, and at the time it was made, involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the companies to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, risks relating to historic mineral resource estimates and the ability to obtain permits; the inability of the Company to close the transactions contemplated by the Agreements and any ancillary matters thereto; and the inability of the Company to obtain approvals of the TSX Venture Exchange. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, the parties cannot assure shareholders and prospective purchasers of securities that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither party nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. Neither party undertakes, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

[1]IAMGOLD reports increase in mineral reserves and resources at existing assets, with increase in resources at Gosselin; IAMGOLD Corporation News Release dated February 15, 2024 and October 23, 2024.

[2]Northern Superior announces 1,708,809 gold ounces in inferred category and 278,921 gold ounces in indicated category at 1.10 g/t in maiden NI 43-101 pit constrained resource estimate at Philibert; Northern Superior's press release dated August 08, 2023.

[3]NI 43-101 Technical Report Mineral Resource Estimation for the Chevrier Main Deposit, Chevrier Project Chibougamau, Quebec, Canada, October 20, 2021, Prepared in accordance with NI 43-101 by Lions Gate Geological Consulting Inc. IOS Services Géoscientifiques Inc. for Northern Superior.

[4] Chalice Gold Mines Limited and Northern Superior Resources Inc. Technical Report on the Croteau Est Gold Project, Québec, September 2015, Prepared in accordance with NI 43-101 by Optiro Pty Ltd ("Optiro") to Chalice Gold Mines Limited and Northern Superior.

SOURCE: Northern Superior Resources Inc.

View the original press release on accesswire.com