Novo Resources Business Review

VANCOUVER, British Columbia, Feb. 08, 2024 (GLOBE NEWSWIRE) --

HIGHLIGHTS

- Strong exploration progress and results delivered across Western Australian gold portfolio, led by work completed at the Becher and Nunyerry North Projects.

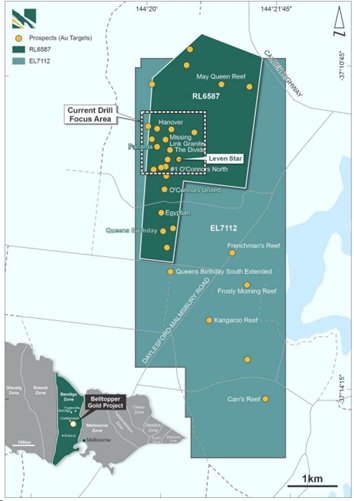

- ~2,300 m diamond drill program progressing as planned at the Belltopper Gold Project, located in Victoria. Assay results expected in Q1 2024.

- De Grey completed a total of 7,536 m of AC drilling targeting the Heckmair, Irvine and Bonatti prospects, and 4,154 m of RC drilling on the Heckmair, Irvine and Lowe prospects as part of its planned 39,000 m drill program at the Becher project under the Egina earn-in/joint venture. Final assays from the current drill programs are anticipated in Q1 2024.

- Transformative Battery Metals Joint-Venture Agreement with SQM. Novo received A

$10 million (C$8.8 million ) for a75% interest in five prospective Li-Ni tenements in the West Pilbara of Western Australia, forming the Harding Battery Metals Joint Venture (HBMJV). - Liatam Mining exceeded the required spend of A

$1.75 million (C$1.55 million ) to form the 80/20 Quartz Hill Joint Venture (JV), located in the East Pilbara of Western Australia. Liatam also increased their shareholding in Novo from ~3% to ~6% , through completion of an A$1.8 million (C$1.59 million ) investment at A$0.20 (C$0.18) per share. - The Nullagine Gold Project located in the East Pilbara of Western Australia, was sold to Calidus Resources Limited, who assumed all claims and responsibilities relating to the Project, including rehabilitation liability of approximately A

$45 million (C$40 million ). Novo received A$250,000 (C$221,000) (in CAI shares) as consideration for the divestment and has a right to receive a further A$5 million (C$4.42 million ) in deferred consideration. - Novo is in a strong financial position to continue its aggressive exploration focus in Western Australia. and Victoria, with no debt and a cash balance (as at 31 January 2024) of A

$21 million (C$18.6 million ) and investments of A$30 million (C$26.51 million ).

SUSTAINABILITY

- Novo completed 2023 with only one Lost Time Injury/Serious Potential Incident.

- 2023 Sustainability Report released and available on the Company’s website.

- Key achievements in FY23 included:

- Contributing more than A

$190,000 (C$168,000) t o community programs. - Awarded the Gold Industry Group Award for Company of the Year 2022, as part of the National Gold Education Program.

- Ongoing focus on working with traditional owners to ensure Novo progresses exploration programs with respect for their cultural and heritage traditions.

- Contributing more than A

WESTERN AUSTRALIAN GOLD PORTFOLIO

Egina Gold Camp

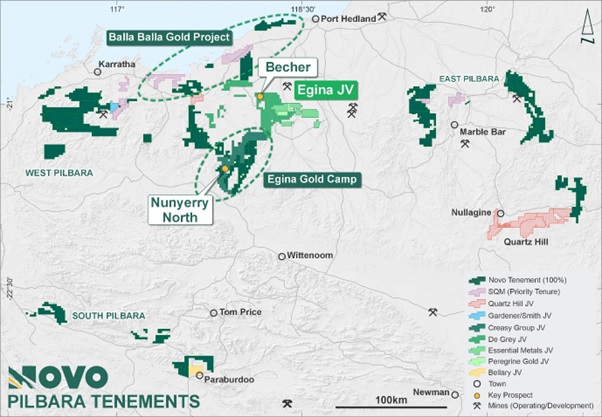

The Egina Gold Camp is Novo Resources Corp’s (Novo of the Company) highly prospective gold belt located in the Pilbara, which includes the priority Becher and Nunyerry North projects (Figure 1).

This belt comprises a series of structurally complex, gold fertile corridors, hosted by rocks of the Mallina Basin in the north and mafic / ultramafic sequences further south.

These corridors trend towards +A

Figure 1: Novo Pilbara tenure showing main projects and significant prospect.

Novo’s tenure forms a contiguous package of approx. 80 km strike length directly along this trend and has been one of the main focus areas for the Company’s exploration and joint venture programs over the last eighteen months, culminating in the Egina earn-in/JV with De Grey and delineation of the Nunyerry North orogenic gold prospect.

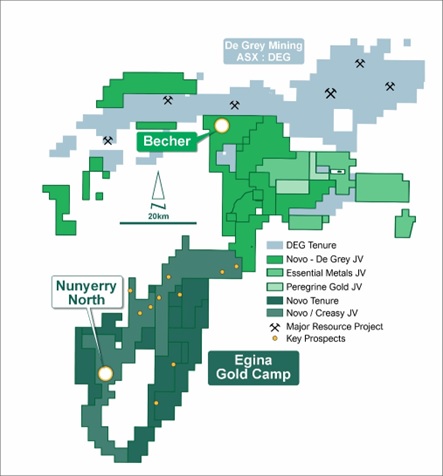

In addition, several other priority gold targets are also being progressed along the main structural corridors within the Egina Gold Camp (Figure 2). These prospects form part of Novo’s regional reconnaissance program in 2024.

_______________

1 No assurance can be given that a similar (or any) commercially viable mineral deposit will be determined at Novo’s Egina Gold Camp.

Egina Earn-in/JV (De Grey earning a

De Grey commenced aircore (AC) drilling at the Becher project within the Egina area in October 2023, as part of their planned 39,000 m program of AC, reverse circulation (RC) and diamond drilling.

In Q4 2023, a total of 271 infill AC holes were completed for 7,536 m. Drilling targeted the Heckmair, Irvine and Bonatti prospects. In addition, RC drilling commenced, with the first 29 drill holes for 4,154 m completed, focusing on the Heckmair, Irvine and Lowe prospects.

Final assays from the current drill programs are anticipated in Q1 2024.

Becher provides significant potential for the discovery of large scale, intrusion-related gold deposits similar to Hemi, as well as shear-hosted orogenic deposits similar to Withnell and Mallina deposits.

Figure 2: Egina Gold Camp prospectivity highlighting the Egina JV with De Grey and the Nunyerry North target, in addition to newly delineated structural targets for further exploration.

Nunyerry North (

Novo completed its maiden drill program of 30 RC holes for 2,424 m in November, with excellent results generated.

The program tested high grade surficial gold anomalism across a strike length of ~ 500 m and immediately defined several zones of mineralised quartz veining, some of which appear blind at surface.

Key results2 from the program included:

- 11 m @ 1.98 g/t Au, including 7 m @ 2.92 g/t Au (NC014)

- 4 m @ 4.15 g/t Au, including 2 m @ 7.42 g/t (NC015)

- 8 m @ 1.31 g/t Au (NC024) and

- 4 m @ 3.56 g/t Au, including 2 m @ 6.06 g/t Au (NC027)

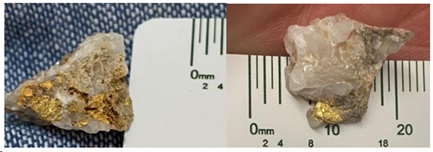

Image 1: Nunyerry North coarse gold in white translucent quartz veins from surface.

Mineralisation is hosted in arrays of white quartz veins, with minor sulphides including pyrite, pyrrhotite and chalcopyrite. The vein arrays trend between two north dipping shear zones, the Freyda and Skadi Shear Zones and are hosted in a 60 m wide zone of fine to medium grained mafic to high MgO basalt within an ultramafic dominant package.

It is important to note that the maiden drill program only tested a small area of the overall Nunyerry North prospect. It is recognized from surface work that Nunyerry North has significant visible gold or coarse nuggety gold, which provides challenges to obtain accurate assay results (Image 1). Novo is conducting trials on the best methodology and sample size to allow accurate reporting of the gold assays.

Based on the highly encouraging results from the maiden drill program, further work at Nunyerry North will include:

- 3D targeting and detailed geological and structural modelling

- Additional RC and diamond drilling to test extensions to the known mineralisation and the southern and western soil anomalies in H1 2024

- Generation of high-resolution aerial photography and digital elevation model (DEM) for the entire target area

- Detailed mapping and rock chip sampling in areas outside of the current limit of mapping

- Petrological studies to define host rock composition, alteration and sulphide mineralogy

_______________

2 See ASX Announcement, Successful RC Drill Program Completed Nunyerry North, RC Drilling Commenced at Becher, dated 15 November 2023.

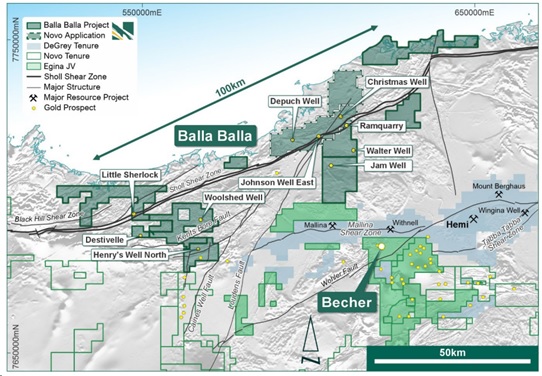

Balla Balla Gold Project

Balla Balla is an emerging exploration project covering an area over 1,200 sq km. The Project is focused on the Sholl Shear and associated potentially fertile structural corridors undercover and is considered prospective for intrusion-related gold mineralisation, in addition to structurally hosted gold.

Geophysical interpretation and research of historical data completed in 2023 has advanced the Company’s understanding of prospectivity in the project area and further delineated targets for follow-up work in 2024.

Tenement E47/4923 was granted and overall discussions with Native Title partners are progressing, which is expected to further enable access for exploration programs in 2024.

Figure 3: Location and tenure of the Balla Balla Gold Project, with preliminary structural interpretation and key prospects.

BELLTOPPER GOLD PROJECT

Diamond drilling of multiple high-grade targets continued at the Belltopper Gold Project in Victoria, with the first two deep diamond holes completed.

To date 917.7 m of drilling, from a planned 6-hole, 2,300 m programme has been completed, testing structural and intrusion hosted/related gold targets, including high tenor induced polarization geophysical anomalies.

Diamond drilling has recommenced, with the Company focused on completing the remaining four planned drill holes.

Assays from the program are expected in Q1 2024.

Figure 4: Belltopper Gold Project location map with focus area for current drilling program.

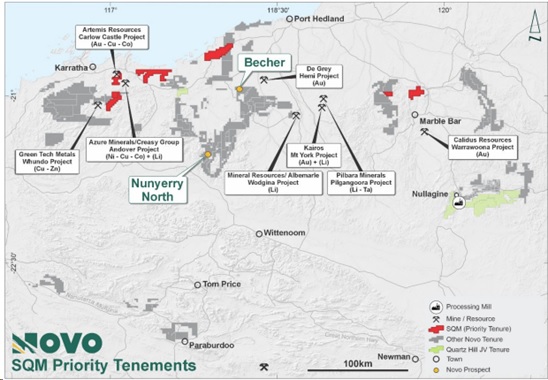

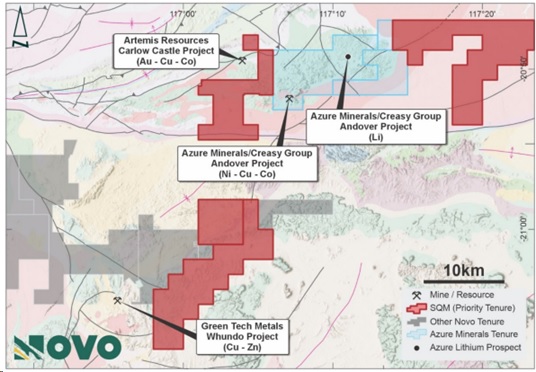

HARDING BATTERY METALS JOINT VENTURE (HBMJV)

Novo entered into a tenement sale agreement, joint venture agreement, and coordination agreement with SQM Australia Pty Ltd (SQM), a wholly owned subsidiary of Sociedad Química y Minera de Chile S.A., in relation to five of Novo’s prospective lithium and nickel exploration tenements (Priority Tenements) in the West Pilbara.

SQM has paid Novo A

Any tenements over which the option is exercised will be held by the HBMJV in the same proportions as the existing HBMJV tenements (

Novo’s

Novo will also be entitled to a contingent success payment based on the lithium contained in a JORC compliant ore reserve upon completion of a feasibility study. SQM is the manager of the HBMJV.

The HBMJV with SQM is a significant milestone for Novo, providing leverage to battery metals discoveries across a package of tenements adjacent to or in the vicinity of Azure Minerals’ Andover Lithium - Nickel Project and Artemis Resources’ Carlow Castle Gold – Copper – Cobalt Project.

Figure 5: Harding Battery Metals JV Priority Tenements.

Figure 6: Location of Priority Tenement adjacent to Azure Minerals’ Andover Lithium – Nickel Project.

QUARTZ HILL JOINT VENTURE WITH LIATAM MINING

Liatam Mining Pty Ltd (Liatam) exceeded the required spend of A

Liatam will sole fund and free carry all of Novo’s required exploration costs in relation to the joint venture structure, until earlier of:

- Liatam having completed a Feasibility Study in respect of at least one deposit of Relevant Minerals; and

- Liatam has completed and funded exploration to the cap of A

$20 million (C$17.67 million ).

Following an initial 12-month period of exploration, Liatam made an offer of A

Novo retained its

In addition to the formation of the JV, Liatam completed an additional A

SALE OF NULLAGINE GOLD PROJECT

Novo sold its Nullagine Gold Project (NGP) to Calidus Resources following the conclusion of a strategic review.

The sale occurred pursuant to a share sale agreement under which Calidus agreed to acquire all issued shares in Millennium Minerals Pty Ltd (Millennium) and an asset sale agreement under which Calidus agreed to acquire additional tenements and assets in the broader Mosquito Creek Basin (from Novo subsidiaries Beatons Creek Gold Pty Ltd, Nullagine Gold Pty Ltd and Rocklea Gold Pty Ltd).

Both agreements were inter-conditional and collectively provided for the acquisition of the NGP by Calidus.

As consideration for the sale, Novo received A

Novo completed the revision of the terms of its deferred consideration deed with IMC Holdings (originally entered into upon the acquisition of Millennium Minerals Ltd in 2020) to restructure the obligation to pay the balance of the amount owing under that arrangement over a possible 3-year period.

CORPORATE

Relinquishment of Tenure

The Company’s exploration programs across key Pilbara areas were successful in identifying priority targets for exploration follow-up in 2024, along with identifying tenure that provides little further exploration value or follow-up.

As a result, a planned relinquishment program was completed to reduce land tenure holding costs. The combined relinquishment program, transfer of some tenure in accordance with the HBMJV and the divestment of NGP has reduced the Pilbara tenure area held or managed by the Company to an estimated ~7.500 sq km and reduced annual holding costs.

The Company’s annual general meeting was held on 31 October, with all resolutions passed.

ABOUT NOVO

Novo explores and develops its prospective land package covering approximately 7,500 square kilometres in the Pilbara region of Western Australia, along with the 22 square kilometre Belltopper project in the Bendigo Tectonic Zone of Victoria, Australia. In addition to the Company’s primary focus, Novo seeks to leverage its internal geological expertise to deliver value-accretive opportunities to its shareholders.

CONTACT

| Investors: Mike Spreadborough +61 8 6400 6100 info@novoresources.com | North American Queries: Leo Karabelas +1 416 543 3120 leo@novoresources.com | Media: Cameron Gilenko +61 466 984 953 cgilenko@citadelmagnus.com |

Authorised for release by Board of Directors.

DISCLAIMER

This Business Review constitutes a voluntary disclosure by the Company and is not a Quarterly Activities Report for the purposes of ASX Listing Rules 5.3 and 5.5 for which Novo has an exemption, as a foreign entity with its primary listing on an overseas exchange with a particular obligation imposed by the home exchange that is comparable to the ASX Listing Rule obligation.

FORWARD-LOOKING INFORMATION

Some statements in this news release contain forward-looking statements, including, without limitation, planned exploration and the expected timing of receipt of assay results. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, without limitation, customary risks of the resource industry and the risk factors identified in Novo’s annual information form for the year ended December 31, 2022, which is available under Novo’s profile on SEDAR+ at www.sedarplus.ca and in the Company’s prospectus dated 2 August 2023 which is available at www.asx.com.au. Forward-looking statements speak only as of the date those statements are made. Except as required by applicable law, Novo assumes no obligation to update or to publicly announce the results of any change to any forward-looking statement contained or incorporated by reference herein to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements. If Novo updates any forward-looking statement(s), no inference should be drawn that the Company will make additional updates with respect to those or other forward-looking statements.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/2ec517b8-8960-4e0e-b1ba-0f806204db3b

https://www.globenewswire.com/NewsRoom/AttachmentNg/f028fd19-0be9-4679-a878-a774a4610642

https://www.globenewswire.com/NewsRoom/AttachmentNg/fc7b4ded-070e-467a-bb30-b77906349da5

https://www.globenewswire.com/NewsRoom/AttachmentNg/848c65e8-63f1-4563-9e79-e01f8e810d87

https://www.globenewswire.com/NewsRoom/AttachmentNg/5c0f7d69-2e6a-4fea-b4a8-eb3ad9e6b6fa

https://www.globenewswire.com/NewsRoom/AttachmentNg/b4b7075e-fd19-4d9d-8edd-544eecde5ab7

https://www.globenewswire.com/NewsRoom/AttachmentNg/d2af3003-8fcc-4712-b13c-68ad41f33aed