De Grey Reaches A$7M Minimum Spend at Egina Gold Project and Continues Investment

Rhea-AI Summary

De Grey Mining has satisfied its initial A$7 million minimum expenditure commitment on exploration at the Egina Gold Project, a joint venture with Novo Resources Corp. The project, located near De Grey's 12.7 Moz Hemi Gold Project, is considered highly prospective for significant intrusion-related gold deposits. De Grey has completed 34,180 m of AC drilling and 9,129 m of RC drilling across four main prospects, as well as a drone magnetic survey.

Anomalous gold results include 6m @ 1.2g/t Au at Heckmair, 4m @ 2.1g/t Au at Irvine, and 8m @ 4.7g/t Au at Lowe. De Grey now has the right to earn a 50% joint venture interest by spending an additional A$18 million through June 30, 2027. The combined Egina Gold Project and De Grey's tenure forms a strategically significant land position covering approximately 2,500 sq km in the Mallina Basin.

Positive

- De Grey Mining has satisfied the A$7 million minimum expenditure commitment for the Egina Gold Project

- Significant drilling completed: 34,180 m of AC drilling and 9,129 m of RC drilling

- Anomalous gold results reported, including 8m @ 4.7g/t Au at Lowe prospect

- De Grey has the option to earn a 50% joint venture interest with additional A$18 million investment

- The project is located near De Grey's 12.7 Moz Hemi Gold Project, suggesting high prospectivity

Negative

- No significant negative aspects reported in the press release

News Market Reaction

On the day this news was published, NSRPF gained 10.18%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

HIGHLIGHTS

- At the Egina Gold Project, De Grey Mining (ASX: DEG) has continued an aggressive exploration program at the Becher Project, with drilling at Heckmair, Irvine, Lowe and Whillans Prospects. Egina is located southwest of, and in close proximity to, De Grey’s 12.7 Moz Hemi Gold Project.1

- Novo’s Egina tenements are considered by De Grey and Novo to be highly prospective for significant intrusion-related gold deposits and share similar attributes to the Hemi deposit.

- In addition to Novo’s approx. 60,000 m AC and RC drilling completed in 2023, De Grey has completed 34,180 m of AC drilling and 9,129 m of RC drilling to date across the four main prospects, testing prospective intrusions and regional structures, as well as a drone magnetic survey.

- Anomalous gold results2 during the initial expenditure period include:

- 6m @ 1.2g/t Au in MSRC0068 at Heckmair;

- 4m @ 2.1g/t Au in MSAC0989 at Irvine;

- 8m @ 4.7g/t Au in MSRC0031 at Lowe.3

- De Grey has now satisfied its initial A

$7 million minimum expenditure commitment over a 15-month period on exploration at the Egina Gold Project.

- De Grey now has the right to earn a

50% joint venture interest in the Egina tenements by spending an additional A$18 million through to June 30, 2027, at which time a Joint Venture will be formed with customary funding and dilution rights applied to both De Grey and Novo.

- The combined Egina Gold Project and De Grey’s tenure forms a strategically significant land position in the Mallina Basin covering approximately 2,500 sq km.

- Forward programs by De Grey in 2024 will include follow-up targeted RC and diamond drilling.

_________________

1 Refer to De Grey’s ASX Announcement, Hemi Gold Project Resource Update, dated 21 November 2023. No assurance can be given that a similar (or any) commercially viable mineral deposit will be determined at Novo’s Becher Project.

2 See Appendix: Tables 1 and 2 for detailed assay results and hole locations

3 Refer to Novo’s ASX Announcement, Significant Drill Results at Becher (corrected), dated 14 February 2024.

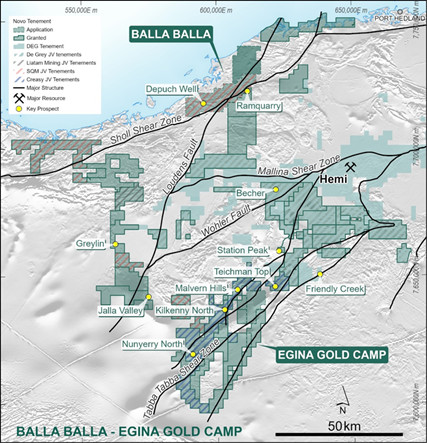

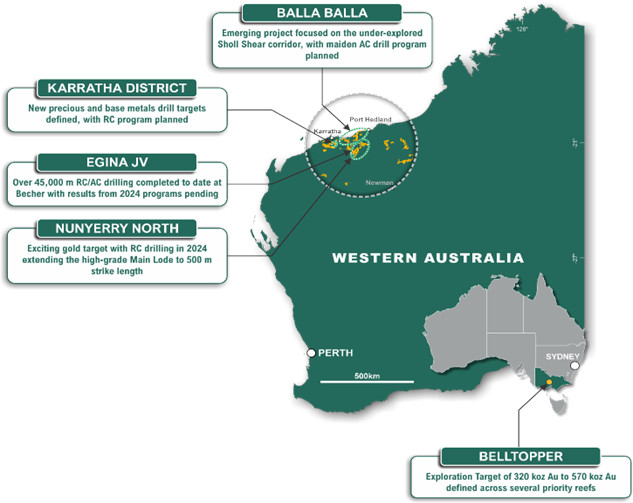

VANCOUVER, British Columbia, Oct. 09, 2024 (GLOBE NEWSWIRE) -- Novo Resources Corp. (Novo or the Company) (ASX: NVO) (TSX: NVO) (OTCQX: NSRPF) is pleased to provide a progress update on exploration activities at the Egina Gold Project (Figure 1) with De Grey Mining Ltd (De Grey) (ASX:DEG).

Novo Executive Co-Chairman and Acting CEO Mike Spreadborough said: “We are delighted that De Grey shares our enthusiasm for the Egina Gold Project. We’ve been exploring the Mallina Basin since 2017, attracted by its gold prospectivity. To be able to partner with a group like De Grey, with its nearby Hemi deposit, provides the best opportunity for us to drive value for our shareholders at Egina, through any potential new discoveries and future exploration success.”

“Importantly, De Grey is just starting to explore at Egina, with several highly prospective areas yet to be systematically tested, providing multiple new targets to explore and build upon the platform set by De Grey over the past 12 months.”

“Meanwhile, we remain focussed on progressing our prospects in the Pilbara and Victoria, as well as assessing project generation opportunities.”

De Grey General Manager Exploration, Phil Tornatora, commented: “The Egina Project is an important part of De Grey’s strategy to grow a large regional scale resource base around the planned Hemi processing plant. The Egina tenements are approximately 1,000 sq km and significantly grows the land position De Grey has exposure to around Hemi. Egina contains major structures and geological units which extend from Hemi and is prospective for both large intrusion-hosted deposits like Hemi and orogenic gold deposits. Large prospective areas of the Egina Project have not been explored so we believe the area still has exciting potential.

“During the September quarter, De Grey satisfied its minimum expenditure commitment by spending A

Figure 1: Novo Tenure in the Central Pilbara showing the Egina Gold Camp and Balla Balla Gold Project

In June 2023, Novo entered into an earn-in and joint venture agreement with De Grey for the Company’s Becher Project and adjacent tenements within the Egina Gold Camp (Figure 1), with the resultant joint venture to be known as the Egina JV.

De Grey is earning into the Egina JV and has advised Novo that it has now satisfied the initial minimum expenditure requirement of A

De Grey assumed management control of the Novo area (under the earn-in arrangements) from 1 July 2023 and rapidly advanced key exploration efforts through targeted AC and RC drill programs and geophysical surveys.

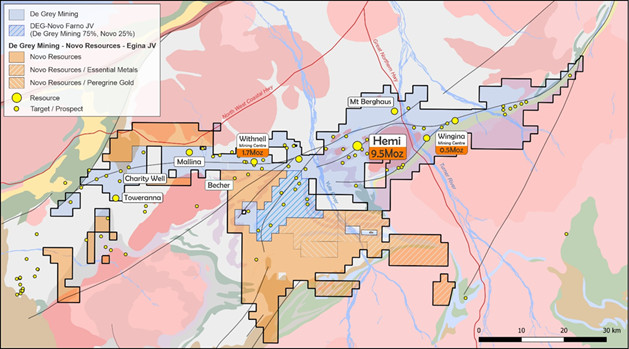

The Egina JV tenure comprises a large 1,034 sq km tenement package adjacent to De Grey’s existing Hemi Gold Project (‘Hemi’) and is located immediately south of Withnell and southwest of the Hemi deposits (see Figure 2).

Figure 2 Hemi and Egina Gold Project areas.4

_________________

4 Refer to De Grey’s ASX Announcement, Hemi Gold Project Resource Update, dated 21 November 2023.

Egina Gold Project Prospectivity

Egina contains similar geology and structures to those found within Hemi, in some cases directly along strike from De Grey’s current exploration areas. Consolidating exploration of the Egina tenements with Hemi is an important step in De Grey’s strategy to discover and grow a large resource base centred around the future Hemi processing plant.

Previous exploration by De Grey within the existing Farno Joint Venture (De Grey

The additional tenure in the west of Egina also contains strike extensions of the structural corridor that hosts the Mallina deposit and opportunities to discover new intrusions similar to Toweranna and Charity Well.

As part of the A

Most of the remaining areas throughout Egina have received very little modern systematic exploration, providing scope for new discoveries.

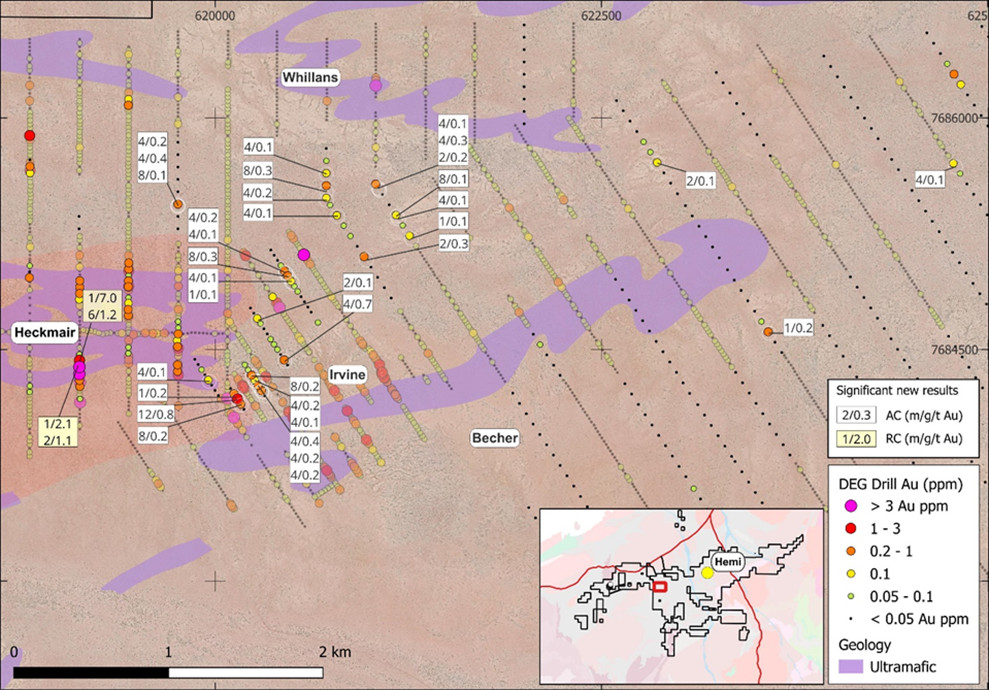

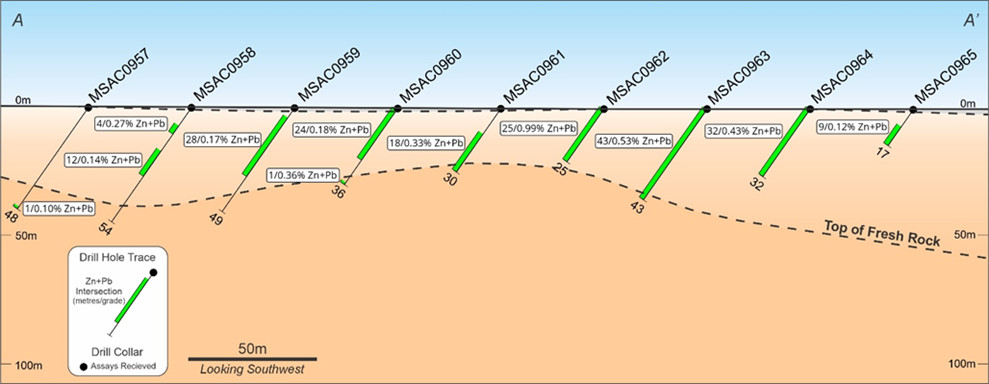

Figure 3 Egina anomalous gold intercepts and drilling (see Appendix: Tables 1 and 2).

Previous results from De Grey’s work on the Egina Project were provided by De Grey in an ASX release on 13 February 2024 (Greater Hemi and Regional Exploration Update), and by Novo in its ASX release on 14 February 2024 (Significant Drill Results at Becher corrected), which included a best intercept of 8m @ 4.7 g/t Au from 97 m in MSRC0031 at the Lowe prospect, with mineralisation associated with a deformed intrusive sill.

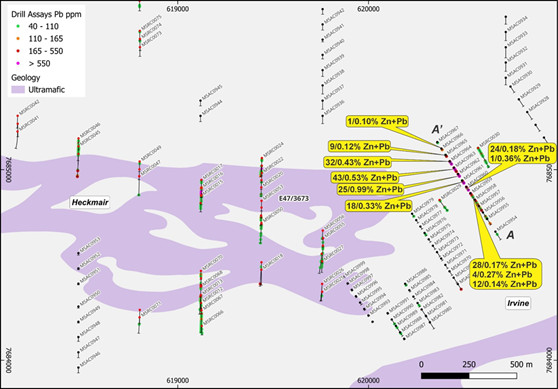

Other highlights included a large WNW-trending 1.5km brittle fault zone in the Heckmair intrusion with broad intervals of anomalous base metals and low-level gold mineralisation. A follow-up RC program comprising 19 holes (2,368 m) returned strong base metal values including 10 m @ 0.1g/t Au, 29.7 g/t Ag,

Prospect locations in the Becher area are shown in Figure 3, with significant intercepts given in Appendix: Tables 1-3.

Exploration since De Grey’s Greater Hemi and Regional Exploration Update on 13 February 2024 includes AC and RC drilling, in addition to the drone aeromagnetic survey, which was flown to enable more detailed structural and geological interpretation of bedrock.

Whillans Prospect

Multiple thin anomalous gold intercepts were returned at the Whillans prospect from drillholes MSRC0074, and MSRC0076, associated with minor quartz veining and weak sericite alteration of metasedimentary arkosic sandstone and siltstone.

Heckmair Prospect

Multiple thin intercepts were returned at the southern edge of the Heckmair sanukitoid intrusion from drillholes MSRC0012, MSRC0013, MSRC0068, MSRC0069, including 6 m @ 1.2g/t Au in MSRC0068, Novo ASX release on 14 February 2024 (Significant Drill Results at Becher corrected). All intercepts were associated with minor quartz veining and weak sericite alteration and hosted within a dioritic intrusion.

Irvine and Heckmair East Prospects

Aircore drilling at Irvine, extending to the eastern side of the Heckmair Intrusion has identified broad zones of Zn-Pb-Ag and gold anomalism within the weathered horizon. These are adjacent to the previously reported intercepts of base metal mineralisation within the Heckmair Fault that bisects the Heckmair intrusion (Figures 4 and 5). In the Mallina basin, base metal anomalies can signal enhanced gold prospectivity. Better gold intercepts include 12 m @ 0.8g/t Au (including 4 m @ 2.1g/t Au) in MSAC0989. Gold mineralisation is hosted in quartz veining within metasediments, immediately adjacent to an intrusion. Anomalous base metal intercepts include 25 m @

Four metre composite samples with anomalous base and precious metals assays are currently being re-split and will be submitted for multi-element and fire assay gold analysis, with ongoing interpretation and targeting to follow.

Figure 4 Plan showing anomalous base metal results in AC drilling at Irvine

(see Appendix: Tables 2 and 3)

Figure 5 Section showing anomalous base metal (Zn+Pb) results in AC drilling at Heckmair East (see Appendix: Tables 2 and 3)

Four metre composite samples with anomalous base and precious metals assays are currently being re-split and will be submitted for multi-element and fire assay analysis, with ongoing interpretation and targeting to follow.

Planned work

De Grey is currently awaiting final assay results including aircore re-splits. Work will continue compiling and analysing results from recently completed work programs in addition to generating additional targets and developing follow-up programs.

Negotiations with the Mugarinya Community Association are continuing regarding an access agreement to the Yandeyarra Aboriginal Reserve, which covers some of the Egina tenements. A high-level Aboriginal heritage area avoidance survey was recently completed on tenements within the Yandeyarra Reserve with results pending. Discussions are also underway with the Ngarluma Aboriginal Corporation regarding upcoming heritage surveys.

Once these permits and clearances are in place, De Grey will be well-positioned for exploring areas that have previously seen little to no modern exploration.

On-ground exploration activities will progress from minimum impact, typical early-stage activities including ground gravity surveys, surficial geochemical surveys, geological mapping including remote sensing methods. De Grey advises that it intends to then progress to AC drilling for target generation and sub-surface geological mapping. Follow up target testing drilling would then generally involve follow-up AC, RC and DD drilling.

Key terms of the Egina HOA between De Grey and Novo include:

- De Grey has the right to earn a

50% joint venture interest in the Novo tenements by spending a total of A$25 million within four years from June 2023 (including the A$7 million already spent); - De Grey has full program management and sole rights to explore the tenements during the earn-in phase;

- Upon De Grey earning a

50% interest, a joint venture (“Egina JV”) will be formed; - De Grey will remain the manager of the Egina JV while it holds a minimum

50% interest; and - Each party will be responsible for funding its share of joint venture costs or have its share of the joint venture subject to dilution at a rate of

1% per A$1 million of non-expenditure contribution.

ANALYTICAL METHODOLOGY – AC DRILLING

AC drilling is utilised as a first pass technique testing for gold mineralisation and anomalous pathfinder geochemistry in basement rocks under cover. The drilling methodology is rapid and low cost, with a low impact footprint, enabling large systematic programs to be completed in a cost effective and timely manner.

One metre AC drill samples are collected from the drill rig through a cyclone and placed on the ground in piles for geological quantitative and qualitative logging. These piles are then speared as four-meter composites.

All AC chip samples were sent to ALS in Perth, Western Australia and each sample was dried, split, crushed and pulverised to

QAQC procedures for the program include insertion of certified coarse blanks (minimum rate

ANALYTICAL METHODOLOGY – RC DRILLING

RC drilling allows for deeper testing of anomalies delineated by aircore drilling, and other geological direct targeting methods such as surface mapping and sampling, where bedrock is exposed at surface.

RC sampling utilized a cone splitter on the rig cyclone and drill cuttings were sampled on 1m intervals. All RC chip samples were sent to ALS in Perth, Western Australia and each sample was dried, split, crushed and pulverised to

QAQC procedures for the program include insertion of certified coarse blanks (minimum rate

There were no limitations to the verification process and all relevant data was verified by a qualified person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) by reviewing analytical procedures undertaken by ALS.

Authorised for release by the Board of Directors.

CONTACT

| Investors: Mike Spreadborough +61 8 6400 6100 info@novoresources.com | North American Queries: Leo Karabelas +1 416 543 3120 leo@novoresources.com | Media: Cameron Gilenko +61 466 984 953 cameron.gilenko@sodali.com | |

QP STATEMENT

Ms. Karen (Kas) De Luca (MAIG), is the qualified person, as defined under National Instrument 43-101 Standards of Disclosure for Mineral Projects, responsible for, and having reviewed and approved, the technical information contained in this news release. Ms De Luca is Novo’s General Manager Exploration.

JORC COMPLIANCE STATEMENT

The information in this news release that relates to new exploration results at Novo’s Becher Project is based on information compiled by Ms De Luca, who is a full-time employee of Novo Resources Corp. Ms De Luca is a Competent Person who is a member of the Australian Institute of Geoscientists. Ms De Luca has sufficient experience that is relevant to the style of mineralisation and the type of deposits under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves'. Ms De Luca consents to the inclusion in the report of the matters based on her information in the form and context in which it appears.

The information in this news release that relates to previously reported exploration results at Novo’s Becher Project is extracted from Novo's announcement titled Significant Drill Results at Becher (corrected) released to ASX on 14 February 2024 which is available to view at www.asx.com.au. The Company confirms that it is not aware of any new information that materially affects the information included in the original market announcement and that all material assumptions and technical parameters underpinning the estimates in the relevant market announcement continue to apply and have not materially changed. The Company confirms that the form and context in which the Competent Person’s findings are presented have not been materially modified from the original market announcement.

FORWARD-LOOKING STATEMENTS

Some statements in this news release may contain “forward-looking statements” within the meaning of Canadian and Australian securities law and regulations. In this news release, such statements include but are not limited to planned exploration activities and the timing of such. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, without limitation, customary risks of the resource industry and the risk factors identified in Novo’s annual information form for the year ended December 31, 2023 (which is available under Novo’s profile on SEDAR+ at www.sedarplus.ca and at www.asx.com.au) in the Company’s prospectus dated 2 August 2023 which is available at www.asx.com.au. Statements as to De Grey’s planned exploration activities are based solely on De Grey’s statements to Novo. Forward-looking statements speak only as of the date those statements are made. Except as required by applicable law, Novo assumes no obligation to update or to publicly announce the results of any change to any forward-looking statement contained or incorporated by reference herein to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements. If Novo updates any forward-looking statement(s), no inference should be drawn that the Company will make additional updates with respect to those or other forward-looking statements.

APPENDIX

Table 1: Significant new RC results (>2 gram x m Au) - Intercepts - 0.5 g/t Au lower cut, 4 m maximum internal waste

| Hole ID | Zone | Depth From (m) | Depth To (m) | Down hole Width (m) | Au (g/t) | Collar East (GDA94) | Collar North (GDA94) | Collar RL (GDA94) | Dip (deg) | Azi (GDA94) | Hole Depth (m) | Hole Type |

| MSRC0068 | Heckmair | 9 | 15 | 6 | 1.18 | 619121 | 7684387 | 63 | -56 | 181 | 263 | RC |

| MSRC0068 | Heckmair | 82 | 83 | 1 | 6.99 | 619121 | 7684387 | 63 | -56 | 181 | 263 | RC |

| MSRC0069 | Heckmair | 23 | 24 | 1 | 2.02 | 619122 | 7684430 | 63 | -55 | 180 | 83 | RC |

| MSRC0069 | Heckmair | 45 | 47 | 2 | 1.06 | 619122 | 7684430 | 63 | -55 | 180 | 83 | RC |

Table 2: Significant new AC results - Intercepts - 0.1g/t Au lower cut, 10m maximum internal waste.

| Hole ID | Zone | Depth From (m) | Depth To (m) | Down hole Width (m) | Au (g/t) | Collar East (GDA94) | Collar North (GDA94) | Collar RL (GDA94) | Dip (deg) | Azimuth (GDA94) | Hole Depth (m) | Hole Type |

| MSAC0429 | Whillans East | 21 | 22 | 1 | 0.22 | 623578 | 7684615 | 65 | -60 | 147 | 65 | AC |

| MSAC0445 | Unnamed | 12 | 14 | 2 | 0.12 | 622860 | 7685711 | 65 | -60 | 147 | 51 | AC |

| MSAC0803 | Unnamed | 52 | 56 | 4 | 0.14 | 624776 | 7685706 | 64 | -60 | 147 | 72 | AC |

| MSAC0915 | Whillans South | 44 | 45 | 1 | 0.10 | 621258 | 7685237 | 63 | -60 | 147 | 45 | AC |

| MSAC0917 | Whillans South | 12 | 20 | 8 | 0.12 | 621170 | 7685371 | 63 | -60 | 147 | 85 | AC |

| MSAC0917 | Whillans South | 56 | 60 | 4 | 0.11 | 621170 | 7685371 | 63 | -60 | 147 | 85 | AC |

| MSAC0920 | Whillans South | 60 | 64 | 4 | 0.14 | 621038 | 7685571 | 62 | -60 | 147 | 103 | AC |

| MSAC0920 | Whillans South | 80 | 84 | 4 | 0.34 | 621038 | 7685571 | 62 | -60 | 147 | 103 | AC |

| MSAC0920 | Whillans South | 100 | 102 | 2 | 0.20 | 621038 | 7685571 | 62 | -60 | 147 | 103 | AC |

| MSAC0925 | Whillans South | 52 | 54 | 2 | 0.31 | 620963 | 7685101 | 61 | -60 | 147 | 54 | AC |

| MSAC0929 | Whillans South | 12 | 16 | 4 | 0.13 | 620788 | 7685369 | 62 | -60 | 147 | 87 | AC |

| MSAC0931 | Whillans South | 28 | 32 | 4 | 0.16 | 620719 | 7685482 | 62 | -60 | 180 | 75 | AC |

| MSAC0932 | Whillans South | 76 | 84 | 8 | 0.28 | 620719 | 7685562 | 63 | -60 | 180 | 93 | AC |

| MSAC0933 | Whillans South | 8 | 12 | 4 | 0.13 | 620719 | 7685642 | 62 | -60 | 180 | 111 | AC |

| MSAC0938 | Heckmair North | 12 | 16 | 4 | 0.19 | 619759 | 7685442 | 59 | -60 | 180 | 90 | AC |

| MSAC0938 | Heckmair North | 20 | 24 | 4 | 0.36 | 619759 | 7685442 | 59 | -60 | 180 | 90 | AC |

| MSAC0938 | Heckmair North | 28 | 36 | 8 | 0.12 | 619759 | 7685442 | 59 | -60 | 180 | 90 | AC |

| MSAC0961 | Heckmair East | 4 | 8 | 4 | 0.14 | 620490 | 7684943 | 63 | -55 | 147 | 30 | AC |

| MSAC0961 | Heckmair East | 28 | 29 | 1 | 0.14 | 620490 | 7684943 | 63 | -55 | 147 | 30 | AC |

| MSAC0962 | Heckmair East | 8 | 16 | 8 | 0.30 | 620469 | 7684977 | 63 | -55 | 147 | 25 | AC |

| MSAC0963 | Heckmair East | 24 | 28 | 4 | 0.24 | 620447 | 7685010 | 63 | -55 | 147 | 43 | AC |

| MSAC0963 | Heckmair East | 32 | 36 | 4 | 0.10 | 620447 | 7685010 | 63 | -55 | 147 | 43 | AC |

| MSAC0969 | Heckmair | 16 | 20 | 4 | 0.68 | 620446 | 7684433 | 65 | -55 | 147 | 54 | AC |

| MSAC0977 | Heckmair | 24 | 26 | 2 | 0.14 | 620272 | 7684702 | 63 | -55 | 147 | 27 | AC |

| MSAC0981 | Heckmair | 4 | 8 | 4 | 0.14 | 620300 | 7684233 | 65 | -55 | 147 | 66 | AC |

| MSAC0981 | Heckmair | 16 | 20 | 4 | 0.24 | 620300 | 7684233 | 65 | -55 | 147 | 66 | AC |

| MSAC0981 | Heckmair | 65 | 66 | 1 | 0.36 | 620300 | 7684233 | 65 | -55 | 147 | 66 | AC |

| MSAC0982 | Heckmair | 4 | 8 | 4 | 0.43 | 620278 | 7684267 | 65 | -55 | 147 | 81 | AC |

| MSAC0982 | Heckmair | 36 | 40 | 4 | 0.18 | 620278 | 7684267 | 65 | -55 | 147 | 81 | AC |

| MSAC0982 | Heckmair | 72 | 76 | 4 | 0.16 | 620278 | 7684267 | 65 | -55 | 147 | 81 | AC |

| MSAC0983 | Heckmair | 0 | 4 | 4 | 0.19 | 620257 | 7684300 | 64 | -55 | 147 | 40 | AC |

| MSAC0983 | Heckmair | 8 | 12 | 4 | 0.10 | 620256 | 7684300 | 64 | -55 | 147 | 40 | AC |

| MSAC0984 | Heckmair | 8 | 16 | 8 | 0.23 | 620235 | 7684334 | 64 | -55 | 147 | 25 | AC |

| MSAC0988 | Heckmair | 8 | 16 | 8 | 0.22 | 620165 | 7684147 | 63 | -55 | 147 | 41 | AC |

| MSAC0989 | Heckmair | 8 | 20 | 12 | 0.83 | 620143 | 7684180 | 63 | -55 | 147 | 69 | AC |

| including | 12 | 16 | 4 | 2.12 | 620143 | 7684180 | 63 | -55 | 147 | 69 | AC | |

| MSAC0990 | Heckmair | 47 | 48 | 1 | 0.21 | 620121 | 7684214 | 63 | -55 | 147 | 48 | AC |

| MSAC0995 | Heckmair | 16 | 20 | 4 | 0.12 | 619955 | 7684303 | 62 | -55 | 147 | 22 | AC |

Table 3: Significant new AC results - Intercepts - 500 ppm Zn+Pb lower cut.

| Hole ID | Zone | Depth From (m) | Depth To (m) | Down hole Width (m) | Zn+Pb (ppm) | Zn+Pb (%) | Collar East (GDA94) | Collar North (GDA94) | Collar RL (GDA94) | Dip (deg) | Azimuth (GDA94) | Hole Depth (m) | Hole Type |

| MSAC0957 | Irvine | 47.00 | 48.00 | 1 | 1020 | 0.10 | 620578 | 7684809 | 64 | -55 | 147 | 48.00 | AC |

| MSAC0958 | Irvine | 8.00 | 12.00 | 4 | 2716 | 0.27 | 620556 | 7684843 | 64 | -55 | 147 | 54.00 | AC |

| MSAC0958 | Irvine | 20.00 | 32.00 | 12 | 1414 | 0.14 | 620556 | 7684843 | 64 | -55 | 147 | 54.00 | AC |

| MSAC0959 | Irvine | 4.00 | 32.00 | 28 | 1723 | 0.17 | 620534 | 7684876 | 63 | -55 | 147 | 49.00 | AC |

| MSAC0960 | Irvine | 0.00 | 24.00 | 24 | 1834 | 0.18 | 620512 | 7684910 | 63 | -55 | 147 | 36.00 | AC |

| MSAC0960 | Irvine | 35.00 | 36.00 | 1 | 3605 | 0.36 | 620512 | 7684910 | 63 | -55 | 147 | 36.00 | AC |

| MSAC0961 | Irvine | 12.00 | 30.00 | 18 | 3287 | 0.33 | 620490 | 7684943 | 63 | -55 | 147 | 30.00 | AC |

| MSAC0962 | Irvine | 0.00 | 25.00 | 25 | 9877 | 0.99 | 620469 | 7684977 | 63 | -55 | 147 | 25.00 | AC |

| MSAC0963 | Irvine | 0.00 | 43.00 | 43 | 5277 | 0.53 | 620447 | 7685010 | 63 | -55 | 147 | 43.00 | AC |

| MSAC0964 | Irvine | 0.00 | 32.00 | 32 | 4288 | 0.43 | 620425 | 7685044 | 63 | -55 | 147 | 32.00 | AC |

| MSAC0965 | Irvine | 8.00 | 17.00 | 9 | 1171 | 0.12 | 620403 | 7685077 | 62 | -55 | 147 | 17.00 | AC |

| MSAC0966 | Irvine | 14.00 | 15.00 | 1 | 1012 | 0.10 | 620381 | 7685111 | 64 | -55 | 147 | 15.00 | AC |

JORC Code, 2012 Edition – Table 1

Section 1 Sampling Techniques and Data

(Criteria in this section apply to all succeeding sections.)

| Criteria | JORC Code explanation | Commentary |

| Sampling techniques |

|

|

| Drilling techniques |

|

|

| Drill sample recovery |

|

|

| Logging |

|

|

| Sub-sampling techniques and sample preparation |

|

|

| Quality of assay data and laboratory tests |

|

|

| Verification of sampling and assaying |

|

|

| Location of data points |

|

|

| Data spacing and distribution |

|

|

| Orientation of data in relation to geological structure |

|

|

| Sample security |

|

|

| Audits or reviews |

|

|

Section 2 Reporting of Exploration Results

(Criteria listed in the preceding section also apply to this section.)

| Criteria | JORC Code explanation | Commentary |

| Mineral tenement and land tenure status |

|

|

| Exploration done by other parties |

|

|

| Geology |

|

|

| Drill hole Information |

|

|

| Data aggregation methods |

|

|

| Relationship between mineralisation widths and intercept lengths |

|

|

| Diagrams |

|

|

| Balanced reporting |

|

|

| Other substantive exploration data |

|

|

| Further work |

|

|

ABOUT NOVO

Novo is an Australian based gold explorer listed on the ASX and the TSX focused on discovering standalone gold projects with > 1 Moz development potential. Novo is an innovative gold explorer with a significant land package covering approximately 6,700 square kilometres in the Pilbara region of Western Australia, along with the 22 square kilometre Belltopper project in the Bendigo Tectonic Zone of Victoria, Australia.

Novo’s key project area is the Egina Gold Camp, where De Grey Mining (ASX: DEG) is farming-in to form a JV at the Becher Project and surrounding tenements through exploration expenditure of A

Novo has also formed lithium joint ventures with both Liatam and SQM in the Pilbara which provides shareholder exposure to battery metals.

Novo has a significant investment portfolio and a disciplined program in place to identify value accretive opportunities that will build further value for shareholders.

Please refer to Novo’s website for further information including the latest Corporate Presentation.

NB: An Exploration Target as defined in the JORC Code (2012) is a statement or estimate of the exploration potential of a mineral deposit in a defined geological setting where the statement or estimate, quoted as a range of tonnes and a range of grade (or quality), relates to mineralisation for which there has been insufficient exploration to estimate a Mineral Resource. Accordingly, these figures are not Mineral Resource or Ore Reserve estimates as defined in the JORC Code (2012). The potential quantities and grades referred to above are conceptual in nature and there has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource. These figures are based on the interpreted continuity of mineralisation and projection into unexplored ground often around historical workings. The Exploration Target has been prepared in accordance with the JORC Code (2012) as detailed in the Company’s ASX announcement released on 25 September 2024 (available to view at www.asx.com.au). The Company confirms that it is not aware of any new information that materially affects the information included in the original market announcement and that all material assumptions and technical parameters underpinning the estimates in the original market announcement continue to apply and have not materially changed.

Refer to De Grey ASX Announcement, Hemi Gold Project Resource Update, dated 21 November 2023. No assurance can be given that a similar (or any) commercially viable mineral deposit will be determined at Novo’s Becher Project.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/fccc9384-3fce-487f-9830-7efc474b4a74

https://www.globenewswire.com/NewsRoom/AttachmentNg/e057254b-be1f-4ed4-9ae3-ff45bd931c03

https://www.globenewswire.com/NewsRoom/AttachmentNg/e60d55c8-599b-4716-8ef5-9efb1c54a8ea

https://www.globenewswire.com/NewsRoom/AttachmentNg/4b9929c4-1322-4789-b320-a8bfb0d1c327

https://www.globenewswire.com/NewsRoom/AttachmentNg/09ba8abd-7324-4b6d-8912-fa17081d7de0

https://www.globenewswire.com/NewsRoom/AttachmentNg/eafff3ba-91d1-4caa-8b28-35d2d23779e8