Nerdy Announces First Quarter 2024 Financial Results

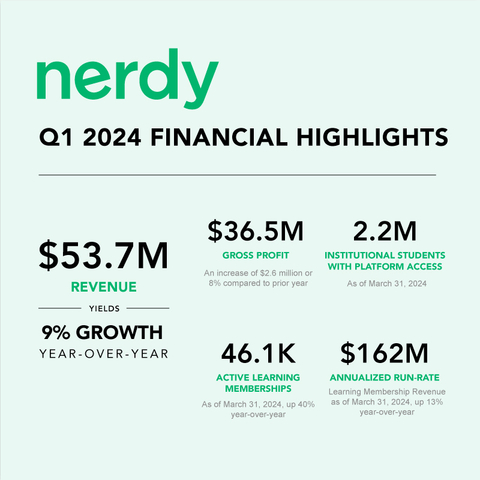

Nerdy Inc. (NYSE: NRDY) reported revenue of $53.7 million in Q1 2024, exceeding guidance, with a positive operating cash flow. The company expanded freemium efforts, with 2.2 million students on the Varsity Tutor platform. Active Members and Institutional business revenue saw significant growth. Gross profit increased by 8%, and non-GAAP adjusted EBITDA improved. Second-quarter revenue guidance is $50-$52 million, reaffirming a full-year guidance of $232-$246 million.

Revenue of $53.7 million in Q1 2024 exceeded guidance expectations, driven by Consumer and Institutional growth.

Active Members increased by 40% year-over-year, reflecting strong growth in Learning Memberships.

Institutional business revenue rose by 39% to $11.9 million, with a record number of contracts executed.

Gross profit increased by 8% to $36.5 million, with a gross margin of 68.0%.

Non-GAAP adjusted EBITDA improved to positive $24 thousand, exceeding the top end of guidance.

Net loss was $12.0 million in Q1, compared to $32.2 million in the same period in 2023.

Non-GAAP adjusted net loss was ($0.9) million, lower than non-GAAP adjusted net earnings of $0.5 million in Q1 2023.

Operational cash flow decreased to $4.4 million from $6.8 million in Q1 2023.

Non-GAAP adjusted EBITDA and margin were lower due to investments in go-to-market efforts and product development.

Insights

Examining the reported financials, Nerdy Inc.'s revenue growth of

The transformation to an access-based subscription model is evidently yielding operational efficiencies with positive operating cash flow, although it has seen a slight decrease from the previous year. The positive non-GAAP adjusted EBITDA, albeit a modest

Nerdy Inc.'s strategic expansion in the educational tech market, specifically within the institutional sphere where a

For investors, the focus on sales headcount and the timing of these hiring practices in relation to the educational cycle is a nuanced detail that could impact future revenue streams and should be monitored as an indicator of successful market capture and sustained growth within the educational technology sector.

The balance sheet strength, with

While the net loss figures might raise concerns, the transition to a more efficient business model and the expected positive operating cash flow for 2024 are strategic highlights that investors should weigh alongside the reported net losses. The Q1 performance in light of the strategic decisions, particularly the investments in go-to-market strategies and product developments, should be viewed as foundational steps towards future profitability and market share expansion in a competitive EdTech landscape.

Nerdy delivers revenue of

Nerdy reaffirms previously provided full year 2024 revenue and non-GAAP adjusted EBITDA guidance

Nerdy Q1 2024 Financial Highlights (Graphic: Business Wire)

“In the first quarter, the convergence of subscription business models and access-based products across Consumer and Institutional is allowing us to simplify our business and focus our efforts and resulted in revenue and non-GAAP adjusted EBITDA exceeding our guidance range, as well as positive operating cash flow. We had meaningful progress on expanding our freemium efforts with more than 475 school districts and 2.2 million Institutional students enabled with access to the Varsity Tutor platform as of quarter-end. Additionally, Institutional Learnings Sessions on the platform of 772K were up

Please visit the Nerdy investor relations website https://www.nerdy.com/investors to view the Nerdy Q1 Shareholder Letter on the Quarterly Results Page.

Financial and Operating Highlights

-

Revenue Beats Expectations – In the first quarter, Nerdy delivered revenue of

$53.7 million 9% year-over-year from$49.2 million -

Memberships Continue to Scale – Revenue recognized in the first quarter from Learning Memberships was

$39.9 million 34% from Q1 2023) and represented74% of total Company revenue. Active Members of 46.1K as of March 31, 2024 were up40% year-over-year. -

Institutional Business Delivers Record Quarterly Revenue – In the first quarter, Institutional delivered revenue of

$11.9 million 39% year-over-year, and represented22% of total revenue. Varsity Tutors for Schools executed 83 contracts, yielding$4.4 million -

Strong Quarterly Gross Profit – Gross profit of

$36.5 million 8% year-over-year. Gross margin was68.0% for the three months ended March 31, 2024, compared to a gross margin of68.9% during the comparable period in 2023. The increase in gross profit was primarily driven by the continued scaling of our Consumer and Institutional businesses. The decrease in gross margin was primarily due to higher utilization of tutoring sessions across our new access-based products within our Institutional business in a seasonally high period in the school year. -

More Efficient Business Model Yields Positive Adjusted EBITDA – Net loss was

$12.0 million $32.2 million ( for the first quarter of 2024 compared to non-GAAP adjusted net earnings of$0.9) million $0.5 million $24 thousand $3.0 million $1.4 million -

Operating Cash Flow and Liquidity – Positive operating cash flow was

$4.4 million $6.8 million $77.0 million -

Second Quarter and Full Year 2024 Outlook – Today, we are introducing guidance for the second quarter of the year, and reaffirming previously provided full year revenue and adjusted EBITDA guidance.

-

Revenue Guidance: For the second quarter of 2024, we expect revenue in a range of

$50 $52 million $232 $246 million 24% at the midpoint vs. our 2023 revenue of$193 million -

Non-GAAP Adjusted EBITDA Guidance: For the second quarter of 2024, we expect adjusted EBITDA in a range of negative

$4 million $2 million $5 $15 million

-

Revenue Guidance: For the second quarter of 2024, we expect revenue in a range of

Webcast and Earnings Conference Call

Nerdy’s management will host a conference call and webcast today, May 7, 2024 at 5:00 p.m. Eastern Time. Interested parties in the

About Nerdy Inc.

Nerdy (NYSE: NRDY) is a leading platform for live online learning, with a mission to transform the way people learn through technology. The Company’s purpose-built proprietary platform leverages technology, including AI, to connect learners of all ages to experts, delivering superior value on both sides of the network. Nerdy’s comprehensive learning destination provides learning experiences across thousands of subjects and multiple formats—including Learning Memberships, one-on-one instruction, small group tutoring, large format classes, and adaptive assessments. Nerdy’s flagship business, Varsity Tutors, is one of the nation’s largest platforms for live online tutoring and classes. Its solutions are available directly to students and consumers, as well as through schools and other institutions. Learn more about Nerdy at https://www.nerdy.com.

Forward-looking Statements

All statements contained herein that do not relate to matters of historical fact should be considered forward-looking statements, including, without limitation, statements regarding our strategic priorities, including those related to enhancing the Learning Membership experience and on our expansion of freemium strategies; and our anticipated second quarter and full year 2024 outlook; as well as statements that include the words “expect,” “plan,” “believe,” “project,” and “may,” and similar statements of a future or forward-looking nature.

The information included herein and in any oral statements made in connection herewith may include “forward looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions, or strategies regarding the future, including our expectations with respect to: the guidance with respect to our financial performance; continued improvements in sales and marketing leverage; the growth of our Institutional business; simplifying our operations model while growing our business; and the sufficiency of our cash to fund future operations. Additionally, any statements that refer to projections, forecasts, or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,” “approximately,” “believes,” “contemplates,” “continues,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “outlook,” “plans,” “possible,” “potential,” “predicts,” “projects,” “should,” “seeks,” “will,” “would,” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements made herein relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of this press release or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements.

There are a significant number of factors that could cause actual results to differ materially from statements made herein or in connection herewith, including but not limited to, our limited operating history, which makes it difficult to predict our future financial and operating results; our history of net losses; risks associated with our ability to acquire and retain customers in our Consumer business; risks associated with scaling up our Institutional business; risks associated with our intellectual property, including claims that we infringe on a third-party’s intellectual property rights; risks associated with our classification of some individuals and entities we contract with as independent contractors; risks associated with the liquidity and trading of our securities; risks associated with payments that we may be required to make under the tax receivable agreement; litigation, regulatory and reputational risks arising from the fact that many of our Learners are minors; changes in applicable law or regulation; the possibility of cyber-related incidents and their related impacts on our business and results of operations; the possibility that we may be adversely affected by other economic, business, and/or competitive factors; and risks associated with managing our rapid growth. Our actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to, risks detailed in our filings with the SEC, including our Annual Report on Form 10-K filed on February 27, 2024, as well as other filings that we may make from time to time with the SEC.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240507294775/en/

Investor Relations

investors@nerdy.com

Source: Nerdy Inc.