Nerdy Announces First Quarter 2023 Financial Results

Learning Memberships Evolution and Application of AI Drive Return to Growth & Profitability

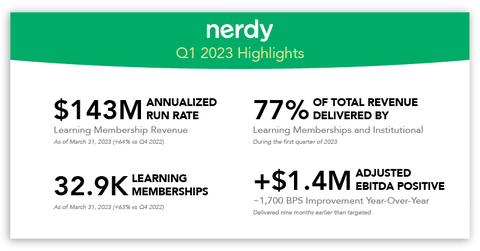

(Graphic: Business Wire)

“One year ago, we unveiled an ambitious plan to evolve our products and revenue model toward long-term recurring ‘always-on’ relationships with our customers. I am pleased to share that in the first quarter, we executed at a high level and returned to growth, having substantially evolved our business model,” said Chuck Cohn, Founder, Chairman and Chief Executive Officer of Nerdy Inc. ”Our evolution to Learning Memberships and the application of AI for HI®, or Artificial Intelligence for Human Interaction, drove continued growth and improvement in customer lifetime values and was a key contributor to our strong operating results including the delivery of positive Adj. EBITDA more than nine months ahead of our target. AI for HI® also allowed us to achieve a major milestone by surpassing 10 million hours of live face-to-face tutoring delivered on our Live Learning Platform since launch.”

Please visit the Nerdy investor relations website https://www.nerdy.com/investors to view the Nerdy Q1 Shareholder Letter on the Quarterly Results Page.

Financial and Operating Highlights

-

Revenue Outperforms Guidance – In the first quarter, Nerdy delivered revenue of

$49.2 million $45 -47 million5% from$46.9 million

-

Learning Memberships Deliver Strong Results – Revenue recognized in the first quarter from Learning Memberships grew to

$29.7 million 60% of total revenue, up from50% of total company revenue recognized in the fourth quarter of 2022. Learning Membership revenue grew to an annualized run rate of$143 million $87 million $0

-

Institutional Business Continues to Scale – In the first quarter, Varsity Tutors for Schools executed a record 97 contracts, yielding

$6.3 million $8.5 million 32% year-over-year and represented17% of total revenue in the first quarter. Our diversified product portfolio is resonating with school district partners setting us up for continued growth.

-

Positive Non-GAAP Adjusted Net Earnings and Adjusted EBITDA Achieved – Net loss was

$32.2 million $31.7 million $0.5 million $8.2 million $1.4 million $3.0 million $6.6 million

-

Free Cash Flow and Liquidity – Cash provided by operating activities was positive

$6.8 million $0.9 million $5.8 million $96.5 million

- Raising Full Year Guidance – For the second quarter and full year, we expect revenue growth will be driven by the continued evolution towards recurring revenue streams, the corresponding build in the number of Learning Membership subscribers, and higher Institutional revenues. Our positive momentum provides us with increased visibility into and confidence in our expectation that we will deliver sequential year-over-year revenue growth each quarter as we move throughout 2023.

- Revenue Guidance: For the second quarter of 2023, we expect revenue in a range of

- Adjusted EBITDA Guidance: For the second quarter of 2023, we expect an adjusted EBITDA loss in a range of

Webcast and Earnings Conference Call

Nerdy’s management will host a conference call and webcast today, May 9, 2023 at 5:00 p.m. Eastern Time. Interested parties in the

About Nerdy Inc.

Nerdy (NYSE: NRDY) is a leading platform for live online learning, with a mission to transform the way people learn through technology. The Company’s purpose-built proprietary platform leverages technology, including AI, to connect learners of all ages to experts, delivering superior value on both sides of the network. Nerdy’s comprehensive learning destination provides learning experiences across 3,000+ subjects and multiple formats—including Learning Memberships, one-on-one instruction, small group classes, large format group classes, and adaptive self-study. Nerdy’s flagship business, Varsity Tutors, is one of the nation’s largest platforms for live online tutoring and classes. Its solutions are available directly to students and consumers, as well as through schools and other institutions. Learn more about Nerdy at https://www.nerdy.com.

Forward-looking Statements

The information included herein and in any oral statements made in connection herewith may include “forward looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions, or strategies regarding the future, including our expectations with respect to: the guidance with respect to our financial performance; continued improvements in sales and marketing leverage; the growth of our Institutional business; simplifying our operations model while growing our business; and the sufficiency of our cash to fund future operations. Additionally, any statements that refer to projections, forecasts, or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,” “approximately,” “believes,” “contemplates,” “continues,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “outlook,” “plans,” “possible,” “potential,” “predicts,” “projects,” “should,” “seeks,” “will,” “would,” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements made herein relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of this press release or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements.

There are a significant number of factors that could cause actual results to differ materially from statements made herein or in connection herewith, including but not limited to, our limited operating history, which makes it difficult to predict our future financial and operating results; our history of net losses; risks associated with our shift to the Learning Membership model; risks associated with scaling up our Institutional business, risks associated with our intellectual property, including claims that we infringe on a third party’s intellectual property rights; risks associated with our classification of some individuals and entities we contract with as independent contractors; risks associated with the liquidity and trading of our securities; risks associated with payments that we may be required to make under the tax receivable agreement; risks associated with the terms of our warrants; litigation, regulatory and reputational risks arising from the fact that many of our Learners are minors; changes in applicable law or regulation; the possibility of cyber-related incidents and their related impacts on our business and results of operations; the possibility that we may be adversely affected by other economic, business, and/or competitive factors; and risks associated with managing our rapid growth. Our actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to, risks detailed in our filings with the SEC, including our Annual Report on Form 10-K filed on February 28, 2023, as well as other filings that we may make from time to time with the SEC.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230509005996/en/

Jason Pello

Investor Relations

investors@nerdy.com

Source: Nerdy Inc.