Namibia Critical Metals Inc. Closes Private Placement of $750,000

Namibia Critical Metals has successfully closed a $750,000 non-brokered private placement, increasing from an initial target of $500,000 due to strong investor interest. A total of 3,750,000 units were issued at $0.20 per unit, each consisting of one common share and one warrant exercisable at $0.35 until March 31, 2024. Proceeds will be primarily used for gold exploration and corporate purposes. The company currently holds advanced projects in Namibia, including the Lofdal dysprosium-terbium project.

- Successfully raised $750,000 through private placement, exceeding initial target of $500,000.

- Issuance of 3,750,000 units, each with a warrant exercisable at $0.35 until March 31, 2024.

- Funds will support gold exploration and corporate activities.

- None.

Insights

Analyzing...

HALIFAX, NS / ACCESSWIRE / March 31, 2022 / Namibia Critical Metals Inc. ("Namibia Critical Metals" or the "Company" or "NMI") (TSXV:NMI OTCQ:NMREF) today announced it has closed the non-brokered private placement announced on February 23, 2022 the amount of which was increased from

The proceeds of the Private Placement will be used primarily to fund gold exploration and general corporate purposes. The common shares and warrants of the Company issued pursuant to the Private Placement are subject to a four-month hold period expiring August 1, 2022. Finder's fees of

About Namibia Critical Metals Inc.

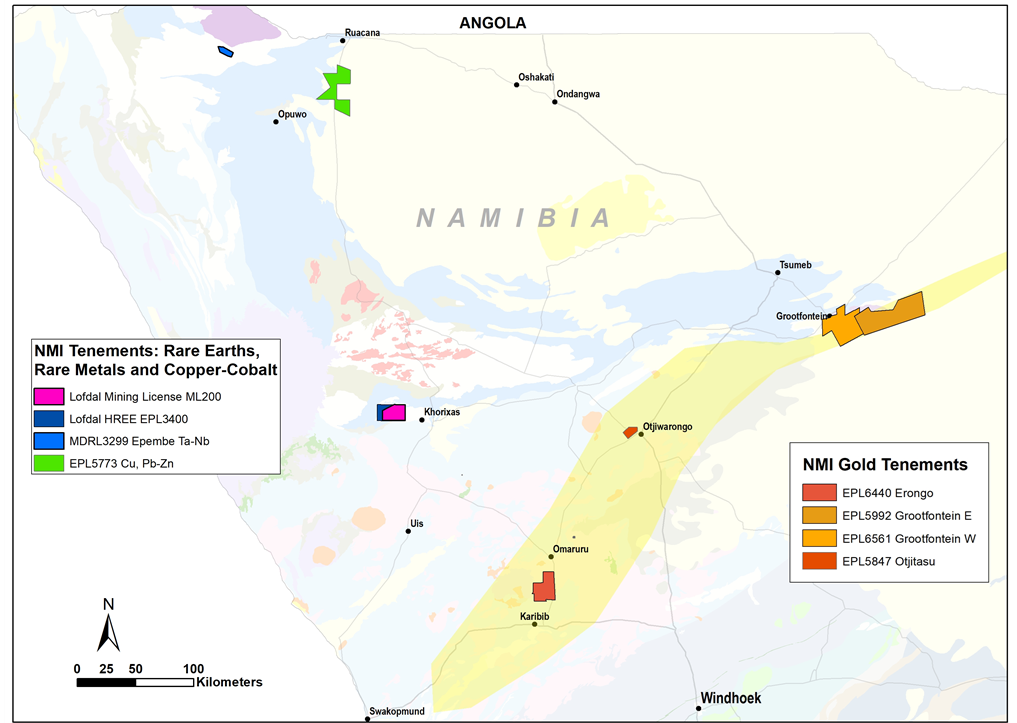

Namibia Critical Metals Inc. holds a diversified portfolio of exploration and advanced stage projects in Namibia focused on the development of sustainable and ethical sources of metals for the battery, electric vehicle and associated industries. The most advanced stage project in the portfolio is Lofdal. The Company also holds significant land positions in areas favourable for gold mineralization.

Figure 5: Location of Namibia Critical Metals' projects

Heavy Rare Earths: The Lofdal Dysprosium-Terbium Project is the Company's most advanced project being fully permitted with a Mining Licence (ML 200) issued in 2021. The project is being developed in joint venture with Japan Oil, Gas and Metals National Corporation ("JOGMEC").

About Japan Oil, Gas and Metals National Corporation (JOGMEC) and the JV

JOGMEC is a Japanese government independent administrative agency which among other things seeks to secure stable resource supplies for Japan. JOGMEC has a strong reputation as a long term, strategic partner in mineral projects globally. The mandated areas of responsibilities within JOGMEC relate to oil and natural gas, metals, coal and geothermal energy. JOGMEC facilitates opportunities with Japanese private companies to secure supplies of natural resources for the benefit of the country's economic development.

Rare earths are of critical importance to Japanese industrial interests and JOGMEC has extensive experience with all aspects of the sector. JOGMEC provided Lynas with US

Namibia Critical Metals currently owns a

Gold: The Company's Exclusive Prospecting Licenses ("EPLs") prospective for gold are located in the Central Namibian Gold Belt which hosts a number of significant orogenic gold deposits including the Navachab Gold Mine, the Otjikoto Gold Mine and more recently the discovery of the Twin Hills deposit. At the Erongo Gold Project, stratigraphic equivalents to the meta-sediments hosting the recent Osino gold discovery at Twin Hills have been identified and exploration is progressing over this highly prospective area. The Grootfontein Base Metal and Gold Project has potential for magmatic copper-nickel mineralization, Mississippi Valley-type zinc-lead-vanadium mineralization and Otjikoto-style gold mineralization. Interpretation of geophysical data and regional geochemical soil sampling have identified first gold targets.

Tantalum-Niobium: The Epembe Tantalum-Niobium-Uranium Project is at an advanced stage with a well-defined, 10 km long carbonatite dyke that has been delineated by detailed mapping and radiometric surveys and over 11,000 meters of drilling. Preliminary mineralogical and metallurgical studies including sorting tests (XRT), indicate the potential for significant physical upgrading. Further work will be undertaken to advance the project to a preliminary economic assessment stage.

The common shares of Namibia Critical Metals Inc. trade on the TSX Venture Exchange under the symbol "NMI" and the OTCQ under "NMREF".

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For more information please contact

Namibia Critical Metals Inc.

Darrin Campbell, President

Tel: +01 (902) 835-8760

Fax: +01 (902) 835-8761

Email: Info@NamibiaCMI.com

Web site: www.NamibiaCriticalMetals.com

The foregoing information may contain forward-looking information relating to the future performance of Namibia Rare Earths Inc. Forward-looking information, specifically, that concerning future performance, is subject to certain risks and uncertainties, and actual results may differ materially. These risks and uncertainties are detailed from time to time in the Company's filings with the appropriate securities commissions.

SOURCE: Namibia Critical Metals Inc.

View source version on accesswire.com:

https://www.accesswire.com/695561/Namibia-Critical-Metals-Inc-Closes-Private-Placement-of-750000