Idaho Strategic Drilling Extends Klondike Zone with High Grade Intercepts - Highlighted by 793 g/t Au Over 0.1m

Idaho Strategic Resources, Inc. (OTCQB:NJMC) announced new exploration results from its 2021 drill program at the Golden Chest mine. Key highlights include:

- GC 21-208: 20.66 g/t gold over 1.3 meters and 29.64 g/t gold over 2.7 meters, featuring a peak of 793 g/t Au over 0.1 meters.

- GC 21-209: 1.06 g/t gold over 50 meters, with higher-grade intervals including 4.79 g/t over 7.3 meters.

The company plans further drilling to expand resource estimates and production options, building on the successful 2021 program.

- High-grade gold intercepts reported, including 793 g/t Au over 0.1m.

- Expansion of mineralization with 100 meters of strike and dip.

- Plans for additional drilling in 2022 to enhance resource estimates.

- None.

Insights

Analyzing...

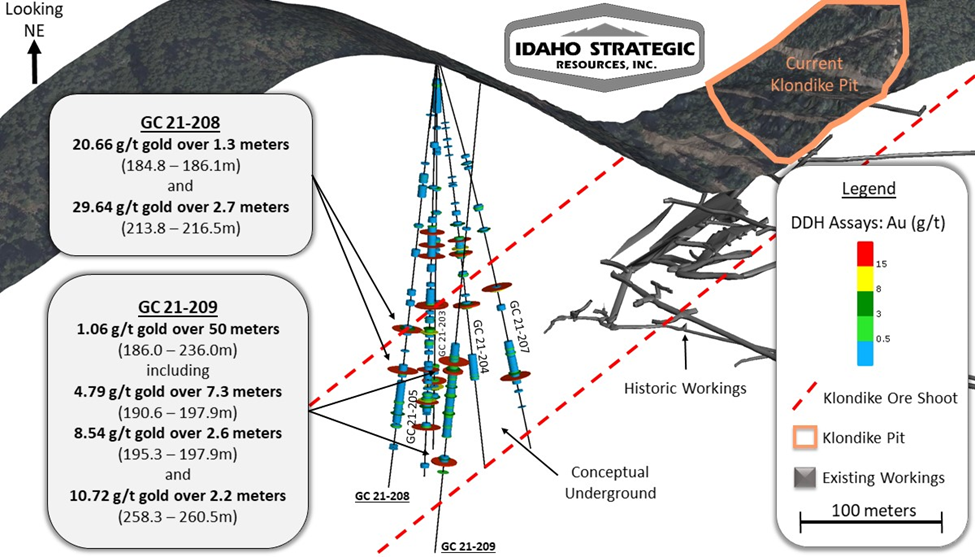

COEUR D'ALENE, ID / ACCESSWIRE / January 5, 2022 / Idaho Strategic Resources, Inc. (OTCQB:NJMC) ("IDR", "Idaho Strategic" or the "Company") is pleased to provide the latest exploration results from the Company's 2021 drill program at the Golden Chest mine. These recent results come from drill holes GC 21-208 and GC 21-209 in the Klondike area, located north of current underground operations in the Skookum.

These latest intercept highlights below are reported in grams of gold per tonne (g/t) and in drilled thickness, as vein orientations have yet to be determined.

GC 21-208

- 20.66 g/t gold over 1.3 meters from 184.8 to 186.1 m

- 29.64 g/t gold over 2.7 meters from 213.8 to 216.5 m

- Includes 793 g/t Au (2nd highest grade drill intercept at GC) sample over 0.1m

GC 21-209

- 1.06 g/t gold over 50 meters from 186.0 to 236 m including the following higher-grade intervals:

- Includes 4.79 g/t gold over 7.3 meters from 190.6 to 197.9 m

- Includes 8.54 g/t gold over 2.6 meters from 195.3 to197.9 m

- 10.72 g/t gold over 2.2 meters from 258.3 to 260.5 m

Drillhole GC 21-208 is the last hole drilled from the first pad in the Klondike area, whereas GC 21-209 is located on a separate pad approximately 50 meters south of this previous drilling. The high-grade intervals are anchored by widespread sections of low-grade gold mineralization (Figure 1). The high-grade intervals are highlighted by the 793 g/t Au sample over 0.1 m in hole GC 21-208, as shown by the easily visible gold contained in quartz veinlets (Photo 1). In contrast, gold mineralization is more widespread and continuous in drillhole GC 21-209 which exposed 1.06 g/t Au over 50 meters. These areas of widespread gold mineralization are associated with strong silicification and hornfels alteration.

The IDR drillers have kept the company-owned core drill turning in the Klondike area through fall and early winter due to these superlative drill results. To date, drillholes completed in the Klondike area are GC 21-203 (273m), GC 21-204 (276m), GC 21-205 (281m), GC 21-206 (lost at 49m), GC 21-207 (271m), GC 21-208 (294m) and GC 21-209 (323m). Thus far, this drilling has delineated a mineralized body with 100 meters of strike and 100 meters of dip with varying thicknesses - and it continues to expand with each additional drill hole.

Discovering this new zone of mineralization in the Klondike area is only one of the highlights of our very successful 2021 Golden Chest drill program. We are currently finishing Klondike hole (GC 21-210) and additional holes are planned in this area. The focus of our drilling remains mineral resource expansion in concert with planning production options to access, develop and extract this new gold resource area. Our 2022 Golden Chest exploration drill program includes more step-out drill holes in order to build from the impressive drilling and exploration accomplishments of 2021.

NJMC's Vice President of Exploration, Rob Morgan commented, "It feels like are walking into something big and may be on the cusp of a great discovery. Our drilling has demonstrated that the gold is there, and the intercepts seem to get better with each new hole. Even for a high-grade orogenic deposit like ours, to see assays exceeding 100 g/t gold are remarkable and to have grades of 793 g/t, or almost 25 ounces per ton, is amazing. We need to add drill holes on the east (up dip), west (down dip) and to the south along strike, however the results to date are impressive. Of course, there remains much more drilling to do to further refine this mineralized body, but I see that as a good problem to have."

Qualified Person

NJMC's Vice President of Exploration, Robert John Morgan, PG, PLS is a qualified person as such term is defined in National Instrument 43-101 and has reviewed and approved the technical information and data included in this press release.

QA/QC

Core samples are delivered by the driller to a secure facility prior to logging by Company geologists. Core is then logged and samples for assay are obtained by sawing the core in half longitudinally while trying to ensure a representative sample is submitted to the laboratory for analysis. All the samples were analyzed by American Analytical of Osburn, Idaho, an ISO certified laboratory. Samples were analyzed using lead collection fire assay with a gravimetric finish. A series of known assay standards are submitted with each drill hole as part of the quality assurance-quality compliance program. Assay results are utilized in decision making related to exploration, resource modeling, stope and mine development and other tasks related to mine production and milling.

Figure 1.

Photo 1.

About Idaho Strategic Resources, Inc.

Domiciled in Idaho and headquartered in the Panhandle of northern Idaho, Idaho Strategic Resources (IDR) is one of the few resource-based companies (public or private) possessing the combination of officially recognized U.S. domestic rare earth element properties (in Idaho) and Idaho-based gold production located in an established mining community.

Idaho Strategic Resources produces gold at the Golden Chest Mine located in the Murray Gold Belt (MGB) area of the world-class Coeur d'Alene Mining District, north of the prolific Silver Valley. With over 5,000 acres of patented and un-patented land, the Company has the largest private land position in the area following its consolidation of the Murray Gold Belt for the first time in over 100-years.

In addition to gold and gold production, the Company maintains an important strategic presence in the U.S. Critical Minerals sector, specifically focused on the more "at-risk" Rare Earth Elements (REE's). The Company's Diamond Creek and Roberts REE properties are included the U.S. national REE inventory as listed in USGS, IGS and DOE publications. Both projects are located in central Idaho and participating in the USGS Earth MRI program.

With an impressive mix of experience and dedication, the folks at IDR maintain a long-standing "We Live Here" approach to corporate culture, land management, and historic preservation. Furthermore, it is our belief that successful operations begin with the heightened responsibility that only local oversight and a community mindset can provide. Its "everyone goes home at night" policy would not be possible without the multi-generational base of local exploration, drilling, mining, milling, and business professionals that reside in and near the communities of the Silver Valley and North Idaho.

For more information on Idaho Strategic Resources go to www.idahostrategic.com or call:

Monique Hayes, Corporate Secretary/Investor Relations

Email: monique@idahostrategic.com

(208) 625-9001

Forward Looking Statements

This release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended that are intended to be covered by the safe harbor created by such sections. Such statements are based on good faith assumptions that Idaho Strategic Resources believes are reasonable, but which are subject to a wide range of uncertainties and business risks that could cause actual resultsto differ materially from future resultsexpressed, projected, or implied by such forward-looking statements. Such factors include, among others: the risk that results of current exploration activities will further define an economic viable resource at the Golden Chest Mine, the impact of supply chain risks and expanding needs of operations as inventory increases; an increased risk associated with production activities occurring without completion of a feasibility study of mineral reserves demonstrating economic and technical viability; environmental hazards, industrial accidents, weather or geologically related conditions; changes in the marketprices of gold and silverand the potential impact on revenues from changes in the market price of gold and cash costs; a sustained lower price environment; risks relating to widespread epidemics or pandemic outbreaks including the COVID-19 pandemic; the potential impact of COVID-19 on our workforce, suppliers and other essential resources, including our ability to access goods and supplies, the ability to transport our products and maintain employee productivity; the risks in connection with the operations, cash flow and results of the Company relating to the unknown duration and impact of the COVID-19 pandemic; as well as other uncertainties and risk factors. Actual results,developments and timetables could vary significantly from the estimates presented.

Readers are cautioned not to put undue reliance on forward-looking statements. Idaho Strategic Resources disclaims any intent or obligation to update publicly such forward-looking statements, whether a result of new information, future events or otherwise.

SOURCE: Idaho Strategic Resources, Inc.

View source version on accesswire.com:

https://www.accesswire.com/681041/Idaho-Strategic-Drilling-Extends-Klondike-Zone-with-High-Grade-Intercepts--Highlighted-by-793-gt-Au-Over-01m