New Afton Achieves Significant Milestone with Completion of the First Draw Bell at C-Zone on Time and C-Zone Commercial Production On-Track for Second Half of 2024

- Completion of first draw bell and commissioning of final dewatering wells

- Expected increase in annual production by 60% for gold and copper

- Significant decrease in all-in sustaining costs

- None.

Insights

Analyzing...

"These are important milestones for New Gold and the New Afton team," stated Patrick Godin, President & CEO. "Completing the first draw bell from C-Zone is a positive step in significantly increasing our production profile at New Afton over the coming years and final commissioning of all 29 dewatering wells at the NATSF marks the completion of major activities for the tailings stabilization project. The C-Zone project remains on track and on budget and we will build on the momentum from these milestones and continue to advance C-Zone towards commercial production expected in the second half of 2024."

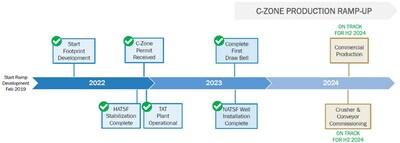

C-Zone is the fourth block cave at New Afton, after completion of Lift 1 in 2022 and the currently producing B3 cave. With current C-Zone mineral reserves of 486 million pounds of copper and 653,000 ounces of gold, the C-Zone production period of 2024 to 2030 is expected to increase average annual production at New Afton to approximately 90,000 ounces of gold and approximately 70 million pounds of copper, both

Development of the dual ramps from B3 to C-Zone commenced in the first quarter of 2019, reaching the cave footprint in the second quarter of 2022. The footprint includes an undercut level, for initiating the cave, and the extraction level from which ore will be mucked from drawpoints for the life of the cave. Two drawpoints make up one draw bell and C-Zone is designed with 91 draw bells arranged in a herringbone layout. Block caving requires upfront capital investment in development and footprint construction, followed by a production period with minimal capex and the lowest unit mining costs of all the underground mining methods. Construction of the first draw bell is significant because it is the transition point at which the block cave gradually ramps up ore production.

From now until the second half of 2024, additional draw bells will continue to be constructed until the cave reaches hydraulic radius to achieve steady state self-cave propagation (considered commercial production for C-Zone), after which the extraction rate can be accelerated. Relative to other block caves, New Afton ore caves well, with Lift 1 and B3 achieving hydraulic radius as expected without any pre-conditioning required. C-Zone is expected to achieve hydraulic radius in the second half of 2024. Operating costs at C-Zone are expected to be significantly lower than current B3 unit mining costs because the extraction and processing rate will increase from approximately 8,500 tpd currently to 16,000 tpd, spreading the fixed costs over a greater tonnage.

A second gyratory crusher will be installed and connected by conveyors to the existing Lift 1 conveyor system to surface, eliminating the cost of truck haulage. Of the three additional main conveyor legs, two are already installed and operational. Excavation of the crusher chamber is complete and has been handed over to the construction crew with commissioning expected in the second half of 2024 to align with the increased extraction rate.

The C-Zone project also includes three major activities related to tailings management, including the thickened and amended tailings (TAT) plant, the stabilization of the Historical Afton Tailings Storage Facility (HATSF), and the stabilization of NATSF. Surface subsidence, inherent in block caving, is modelled to progress in the direction of the HATSF, now closed, and the NATSF. Therefore, a new TAT plant was constructed and non-flowable, thickened tailings is diverted into the Historic Afton Pit. The TAT project was successfully completed on time in late 2022 and, to date, performance is exceeding design density and strength targets. In-pit tailings has sufficient capacity to double the remaining mine life with minimal capital or permitting requirements. Stabilization of the HATSF and NATSF is achieved through lowering the phreatic surface, resulting in tailings consolidation and reduced pore water pressure. Tailings stabilization on the HATSF was completed in Q4 2022. Stabilization of the NATSF reached an important milestone in September, with commissioning of the final dewatering wells. With all 29 wells now complete and operating, the piezometer network is showing that dewatering is trending within expectations to the target dewatering rate. Additionally, a total of five evaporators are in operation with an additional seven being commissioned to remove surface water from the NATSF. The overall NATSF stabilization project is on track for completion in the first half of 2026.

New Afton is at a pivotal moment, with expected near-term increasing production to lead to a decline all-in sustaining costs, leading to strong free cash flow for the operation. Coupled with several underground and regional exploration opportunities the Company continues to advance, New Gold believes there remains strategic upside to the operation's future mine life and production.

New Gold is a Canadian-focused intermediate mining company with a portfolio of two core producing assets in

Cautionary Note Regarding Forward-Looking Statements

Certain information contained in this news release, including any information relating to New Gold's future financial or operating performance are "forward-looking". All statements in this news release, other than statements of historical fact, which address events, results, outcomes or developments that New Gold expects to occur are "forward-looking statements". Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the use of forward-looking terminology such as "plans", "expects", "is expected", "budget", "scheduled", "targeted", "estimates", "forecasts", "intends", "anticipates", "projects", "potential", "believes" or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "should", "might" or "will be taken", "occur" or "be achieved" or the negative connotation of such terms. Forward-looking statements in this news release include, among others, statements with respect to: projections about advancing the C-Zone, transitioning to the production ramp-up phase and being on track and on budget for commercial production in the second half of 2024 from the C-Zone; expectations around significantly increasing the production profile at New Afton over the coming years; the Company's estimates and expectations regarding mineral reserves and mineral resources and associated timing; production expectations for New Afton; projections around processing at New Afton's existing mill; the Company's expectations regarding production, costs, capital and exploration investments and expenses, and the timing and factors contributing to those expected results; anticipated decrease in all-in sustaining costs and significant free cash flow resulting therefrom at New Afton; planned activities, undertakings and areas of focus at the New Afton Mine and expectations of timing and costs associated therewith; the continued construction of additional draw bells; expectations around achieving hydraulic radius in the second half of 2024; the anticipated increase in the extraction and processing rate; the installation of a second gyratory crusher and the elimination of the cost of truck haulage resulting therefrom; projected commissioning of the crusher chamber and conveyor in the second half of 2024; anticipated completion of the overall NATSF stabilization project in the first half of 2026; planned completion of commissioning of seven additional evaporators and the expected effectiveness thereof to remove surface water from the NATSF; and the strategic upside projected for New Afton's future mine life and production, and the factors contributing thereto .

All forward-looking statements in this news release are based on the opinions and estimates of management that, while considered reasonable as at the date of this press release in light of management's experience and perception of current conditions and expected developments, are inherently subject to important risk factors and uncertainties, many of which are beyond New Gold's ability to control or predict. Certain material assumptions regarding such forward-looking statements are discussed in this news release, New Gold's latest annual MD&A, its most recent annual information form and technical reports on the Rainy River Mine and New Afton Mine filed on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. In addition to, and subject to, such assumptions discussed in more detail elsewhere, the forward-looking statements in this news release are also subject to the following assumptions: (1) there being no significant disruptions affecting New Gold's operations other than as set out herein; (2) political and legal developments in jurisdictions where New Gold operates, or may in the future operate, being consistent with New Gold's current expectations; (3) the accuracy of New Gold's current mineral reserve and mineral resource estimates and the grade of gold, silver and copper expected to be mined and the grade of gold, copper and silver expected to be mined; (4) the exchange rate between the Canadian dollar and

Forward-looking statements are necessarily based on estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors that may cause actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking statements. Such factors include, without limitation: price volatility in the spot and forward markets for metals and other commodities; discrepancies between actual and estimated production, between actual and estimated costs, between actual and estimated Mineral Reserves and Mineral Resources and between actual and estimated metallurgical recoveries; equipment malfunction, failure or unavailability; accidents; risks related to early production at the Rainy River Mine, including failure of equipment, machinery, the process circuit or other processes to perform as designed or intended; the speculative nature of mineral exploration and development, including the risks of obtaining and maintaining the validity and enforceability of the necessary licenses and permits and complying with the permitting requirements of each jurisdiction in which New Gold operates, including, but not limited to: uncertainties and unanticipated delays associated with obtaining and maintaining necessary licenses, permits and authorizations and complying with permitting requirements; changes in project parameters as plans continue to be refined; changing costs, timelines and development schedules as it relates to construction; the Company not being able to complete its construction projects at the Rainy River Mine or the New Afton Mine on the anticipated timeline or at all; volatility in the market price of the Company's securities; changes in national and local government legislation in the countries in which New Gold does or may in the future carry on business; compliance with public company disclosure obligations; controls, regulations and political or economic developments in the countries in which New Gold does or may in the future carry on business; the Company's dependence on the Rainy River Mine and New Afton Mine; the Company not being able to complete its exploration drilling programs on the anticipated timeline or at all; inadequate water management and stewardship; disruptions to the Company's workforce at either the Rainy River Mine or the New Afton Mine, or both, due to cases of COVID-19 or otherwise; the responses of the relevant governments to any disease, epidemic or pandemic outbreak, including the COVID-19 outbreak, not being sufficient to contain the impact of such outbreak; disruptions to the Company's supply chain and workforce due to any disease, epidemic or pandemic outbreak, including the COVID-19 outbreak; an economic recession or downturn as a result of any disease, epidemic or pandemic outbreak, including the COVID-19 outbreak, that materially adversely affects the Company's operations or liquidity position; there being further shutdowns at the Rainy River Mine or New Afton Mine; significant capital requirements and the availability and management of capital resources; additional funding requirements; diminishing quantities or grades of Mineral Reserves and Mineral Resources; actual results of current exploration or reclamation activities; uncertainties inherent to mining economic studies including the Technical Reports for the Rainy River Mine and New Afton Mine; impairment; unexpected delays and costs inherent to consulting and accommodating rights of First Nations and other Indigenous groups; climate change, environmental risks and hazards and the Company's response thereto; tailings dam and structure failures; ability to obtain and maintain sufficient insurance; actual results of current exploration or reclamation activities; fluctuations in the international currency markets and in the rates of exchange of the currencies of

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/new-afton-achieves-significant-milestone-with-completion-of-the-first-draw-bell-at-c-zone-on-time-and-c-zone-commercial-production-on-track-for-second-half-of-2024-301943880.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/new-afton-achieves-significant-milestone-with-completion-of-the-first-draw-bell-at-c-zone-on-time-and-c-zone-commercial-production-on-track-for-second-half-of-2024-301943880.html

SOURCE New Gold Inc.