New Pacific Intersects 183 Meters Grading 92 Grams Per Tonne Silver in Step-out Drilling at the Carangas Project, Bolivia

HIGHLIGHTS OF DRILL RESULTS (ALL INTERVALS ARE CORE LENGTHS)

Hole DCAr0184 intersected 92 g/t Ag,

Hole DCAr0175 intersected 55 g/t Ag,

Hole DCAr0182 intersected 72 g/t Ag,

Hole DCAr0173 intersected 51 g/t Ag,

Hole DCAr0189 intersected 90 g/t Ag,

The assay results of these final holes continue to demonstrate a significant shallow horizon of silver mineralization that has been extended to the southwest of the previously drilled area. Drill results from the step-out hole to the northeast in the Central Valley demonstrate a broad shallow silver zone stacked over broad gold mineralization, and gold remains open to the northeast.

PROGRESS OF INAUGURAL MINERAL RESOURCE ESTIMATE

The Company is working closely with RPMGlobal to complete a technical report on the mineral resource estimate of the Carangas Project in accordance with the National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101"). The technical work is progressing well and on schedule with the outcome of the mineral resource estimate expected by August 2023.

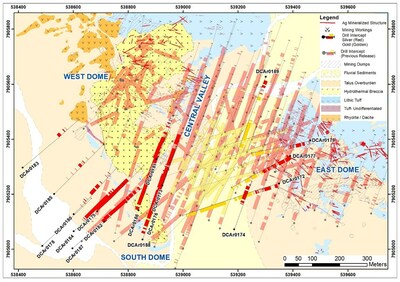

Figure 1 Simplified geology and drill plan map of the Carangas Project

Table 1 Summary of drill intercepts | ||||||||||

Hole_ID | Depth_from | Depth_to | Interval_m | Ag_g/t | Au_g/t | Pb_% | Zn_% | Cu_% | AgEq_g/t | |

DCAr0172 | 19.48 | 42.10 | 22.62 | 17 | 0.27 | 0.18 | 0.01 | 32 | ||

81.13 | 141.87 | 60.74 | 36 | 0.33 | 0.84 | 74 | ||||

150.87 | 153.43 | 2.56 | 30 | 0.29 | 0.64 | 0.17 | 77 | |||

213.05 | 228.50 | 15.45 | 20 | 0.12 | 0.48 | 1.09 | 0.01 | 80 | ||

245.00 | 252.00 | 7.00 | 26 | 0.25 | 1.07 | 1.31 | 0.03 | 122 | ||

264.00 | 387.25 | 123.25 | 4 | 0.15 | 0.36 | 0.78 | 0.01 | 53 | ||

401.70 | 420.70 | 19.00 | 11 | 0.46 | 0.44 | 0.68 | 0.06 | 85 | ||

492.63 | 709.20 | 216.57 | 5 | 0.12 | 0.37 | 1.05 | 0.01 | 61 | ||

DCAr0173 | 29.00 | 101.70 | 72.70 | 51 | 0.57 | 1.37 | 0.02 | 115 | ||

112.64 | 207.18 | 94.54 | 10 | 0.34 | 0.90 | 0.03 | 53 | |||

DCAr0174 | 206.30 | 210.45 | 4.15 | 7 | 0.66 | 1.19 | 0.01 | 67 | ||

217.55 | 233.00 | 15.45 | 8 | 0.41 | 1.00 | 0.02 | 55 | |||

247.30 | 318.00 | 70.70 | 4 | 0.37 | 0.90 | 46 | ||||

329.36 | 355.32 | 25.96 | 7 | 0.24 | 0.95 | 0.04 | 50 | |||

DCAr0175 | 5.50 | 303.54 | 298.04 | 55 | 0.26 | 0.47 | 0.01 | 79 | ||

incl. | 94.60 | 136.26 | 41.66 | 235 | 0.65 | 1.30 | 0.02 | 300 | ||

DCAr0176 | 10.00 | 252.00 | 242.00 | 14 | 0.26 | 0.75 | 0.03 | 49 | ||

DCAr0177 | 6.00 | 70.60 | 64.60 | 24 | 0.39 | 0.78 | 0.01 | 62 | ||

86.67 | 162.40 | 75.73 | 13 | 0.33 | 1.28 | 0.02 | 67 | |||

196.10 | 213.60 | 17.50 | 15 | 0.36 | 0.70 | 0.01 | 55 | |||

DCAr0178 | 235.23 | 236.43 | 1.20 | 54 | 0.17 | 0.34 | 70 | |||

328.49 | 329.70 | 1.21 | 29 | 0.24 | 0.42 | 0.06 | 56 | |||

DCAr0179 | 13.90 | 23.35 | 9.45 | 39 | 0.18 | 0.18 | 50 | |||

30.45 | 35.62 | 5.17 | 53 | 0.04 | 0.87 | 83 | ||||

95.44 | 132.13 | 36.69 | 25 | 0.17 | 0.51 | 47 | ||||

152.00 | 229.75 | 77.75 | 16 | 0.02 | 0.29 | 0.51 | 0.01 | 43 | ||

423.70 | 425.10 | 1.40 | 11 | 1.93 | 0.01 | 0.21 | 155 | |||

510.70 | 523.70 | 13.00 | 3 | 1.41 | 0.03 | 0.16 | 0.02 | 109 | ||

530.80 | 537.20 | 6.40 | 14 | 0.81 | 0.09 | 0.13 | 0.15 | 79 | ||

592.30 | 606.20 | 13.90 | 26 | 0.47 | 0.06 | 0.03 | 0.15 | 62 | ||

669.20 | 802.50 | 133.30 | 5 | 0.77 | 0.08 | 0.22 | 0.06 | 69 | ||

DCAr0180 | 113.62 | 118.90 | 5.28 | 59 | 0.08 | 0.10 | 0.01 | 66 | ||

130.48 | 131.70 | 1.22 | 83 | 0.08 | 0.14 | 90 | ||||

170.38 | 212.25 | 41.87 | 26 | 0.20 | 0.40 | 0.01 | 46 | |||

222.20 | 247.73 | 25.53 | 20 | 0.43 | 0.83 | 0.01 | 61 | |||

266.85 | 270.90 | 4.05 | 31 | 0.19 | 0.45 | 0.03 | 54 | |||

344.17 | 346.80 | 2.63 | 19 | 0.70 | 1.05 | 0.03 | 77 | |||

DCAr0181 | 1.54 | 119.00 | 117.46 | 31 | 0.34 | 0.59 | 0.01 | 61 | ||

incl. | 12.00 | 36.80 | 24.80 | 83 | 0.88 | 1.13 | 0.02 | 148 | ||

142.42 | 151.00 | 8.58 | 30 | 0.12 | 0.34 | 45 | ||||

180.90 | 185.40 | 4.50 | 21 | 0.23 | 0.61 | 0.01 | 49 | |||

201.50 | 206.00 | 4.50 | 62 | 0.11 | 0.29 | 0.01 | 77 | |||

217.80 | 220.50 | 2.70 | 65 | 0.44 | 1.31 | 0.01 | 123 | |||

DCA0182 | 15.71 | 60.50 | 44.79 | 30 | 0.05 | 0.12 | 0.01 | 36 | ||

66.50 | 248.50 | 182.00 | 72 | 0.30 | 0.59 | 0.01 | 101 | |||

incl. | 116.50 | 181.00 | 64.50 | 132 | 0.49 | 0.93 | 0.01 | 179 | ||

254.50 | 278.75 | 24.25 | 10 | 0.50 | 0.88 | 0.01 | 55 | |||

DCAr0183 | 259.25 | 276.60 | 17.35 | 36 | 0.15 | 0.40 | 0.01 | 54 | ||

300.25 | 304.55 | 4.30 | 20 | 0.07 | 0.03 | 0.08 | 31 | |||

316.40 | 317.57 | 1.17 | 401 | 0.30 | 0.61 | 0.03 | 433 | |||

DCAr0184 | 86.00 | 87.30 | 1.30 | 332 | 0.16 | 0.29 | 0.01 | 347 | ||

96.30 | 99.30 | 3.00 | 95 | 0.10 | 0.20 | 0.01 | 104 | |||

106.80 | 290.00 | 183.20 | 92 | 0.25 | 0.46 | 0.01 | 117 | |||

incl. | 123.50 | 138.00 | 14.50 | 272 | 0.50 | 0.89 | 0.03 | 320 | ||

incl. | 149.45 | 168.10 | 18.65 | 173 | 0.33 | 0.43 | 0.02 | 198 | ||

301.20 | 311.50 | 10.30 | 40 | 0.30 | 0.54 | 0.01 | 68 | |||

332.50 | 338.30 | 5.80 | 27 | 0.32 | 0.89 | 0.08 | 75 | |||

DCAr0185 | 115.88 | 116.94 | 1.06 | 32 | 0.16 | 0.43 | 0.01 | 51 | ||

154.85 | 156.35 | 1.50 | 57 | 0.05 | 0.10 | 0.01 | 63 | |||

186.25 | 187.75 | 1.50 | 56 | 0.08 | 0.16 | 0.00 | 64 | |||

212.38 | 228.36 | 15.98 | 51 | 0.11 | 0.24 | 0.01 | 64 | |||

237.00 | 238.30 | 1.30 | 187 | 0.38 | 0.67 | 0.06 | 226 | |||

245.40 | 249.60 | 4.20 | 40 | 0.02 | 0.07 | 0.06 | 49 | |||

275.20 | 276.70 | 1.50 | 33 | 0.07 | 0.13 | 0.01 | 41 | |||

327.30 | 328.60 | 1.30 | 41 | 0.33 | 0.47 | 0.09 | 76 | |||

DCAr0186 | 0.00 | 17.00 | 17.00 | 36 | 0.34 | 0.03 | 0.01 | 48 | ||

29.00 | 311.80 | 282.80 | 34 | 0.47 | 0.99 | 0.01 | 83 | |||

355.38 | 360.50 | 5.12 | 13 | 0.71 | 1.76 | 0.01 | 94 | |||

DCAr0187 | 184.55 | 186.03 | 1.48 | 84 | 0.28 | 0.55 | 0.01 | 111 | ||

202.30 | 205.20 | 2.90 | 26 | 0.02 | 0.03 | 0.09 | 36 | |||

257.73 | 259.12 | 1.39 | 49 | 0.04 | 0.03 | 0.03 | 54 | |||

323.40 | 324.70 | 1.30 | 15 | 0.43 | 0.95 | 0.01 | 61 | |||

DCAr0188 | 35.00 | 48.23 | 13.23 | 45 | 0.12 | 0.21 | 0.00 | 56 | ||

61.90 | 69.10 | 7.20 | 32 | 0.10 | 0.23 | 0.00 | 43 | |||

130.80 | 310.15 | 179.35 | 24 | 0.24 | 0.49 | 0.01 | 49 | |||

DCAr0189 | 42.26 | 88.07 | 45.81 | 90 | 1.14 | 1.22 | 0.03 | 167 | ||

105.24 | 130.90 | 25.66 | 71 | 0.32 | 0.75 | 0.05 | 110 | |||

153.20 | 156.00 | 2.80 | 66 | 0.12 | 0.09 | 73 | ||||

165.00 | 169.80 | 4.80 | 48 | 0.29 | 0.28 | 0.02 | 68 | |||

176.92 | 178.07 | 1.15 | 112 | 0.27 | 0.19 | 126 | ||||

202.90 | 212.39 | 9.49 | 205 | 0.25 | 0.33 | 0.47 | 248 | |||

459.30 | 460.66 | 1.36 | 4 | 3.36 | 0.03 | 0.14 | 0.06 | 254 | ||

532.00 | 716.50 | 184.50 | 9 | 0.95 | 0.03 | 0.04 | 0.02 | 81 | ||

incl. | 651.50 | 659.00 | 7.50 | 94 | 11.21 | 0.17 | 910 | |||

755.50 | 797.50 | 42.00 | 4 | 0.95 | 0.10 | 0.02 | 76 | |||

874.60 | 876.10 | 1.50 | 1 | 1.65 | 0.08 | 0.05 | 122 | |||

Notes: | |

1. | Drill location, altitude, azimuth, and dip of drill holes are provided in Table 2 |

2. | Drill intercept is core length, and grade is length weighted. True width of mineralization is unknown due to early stage of exploration without adequate drill data. |

3. | Calculation of silver equivalent ("AgEq") is based on the long-term median of the August 2021 Street Consensus Commodity Price Forecasts, which are |

4. | A cut-off of 20 g/t AgEq is applied to calculate the length-weighted intercept. At times, samples lower than 20 g/t AgEq may be included in the calculation of consolidation of mineralized intercepts. |

Table 2 Summary of drill hole details | |||||||

Hole_id | Easting | Northing | Altitude | Depth_m | Azimuth (°) | Dip (°) | Target |

DCAr0172 | 539349.02 | 7905238.86 | 3929.60 | 850.00 | 253 | -66 | ED |

DCAr0173 | 538924.50 | 7905230.73 | 3905.50 | 302.00 | 20 | -45 | WD |

DCAr0174 | 539186.31 | 7905072.00 | 3906.83 | 401.00 | 20 | -62 | CV |

DCAr0175 | 538687.16 | 7905137.40 | 3906.07 | 452.00 | 46 | -57 | SW |

DCAr0176 | 538899.47 | 7905162.68 | 3905.34 | 252.00 | 20 | -55 | SD |

DCAr0177 | 539389.94 | 7905338.18 | 3928.27 | 801.00 | 244 | -72 | ED |

DCAr0178 | 538487.32 | 7905011.21 | 3906.36 | 401.00 | 45 | -50 | SW |

DCAr0179 | 539463.00 | 7905396.00 | 3945.00 | 851.00 | 255 | -76 | ED |

DCAr0180 | 538604.00 | 7905129.00 | 3900.00 | 401.00 | 44 | -57 | SW |

DCAr0181 | 538906.00 | 7905327.00 | 3923.00 | 251.00 | 20 | -45 | WD |

DCAr0182 | 538714.00 | 7905100.00 | 3906.00 | 401.00 | 48 | -63 | SW |

DCAr0183 | 538414.00 | 7905294.00 | 3906.00 | 401.00 | 50 | -50 | SW |

DCAr0184 | 538600.00 | 7905062.00 | 3906.00 | 401.00 | 47 | -55 | SW |

DCAr0185 | 538532.00 | 7905197.00 | 3906.00 | 401.00 | 45 | -50 | SW |

DCAr0186 | 538838.00 | 7905141.00 | 3922.00 | 431.00 | 20 | -45 | SD |

DCAr0187 | 538599.00 | 7905002.00 | 3905.00 | 431.00 | 48 | -68 | SW |

DCAr0188 | 538852.00 | 7905033.00 | 3911.00 | 450.00 | 20 | -52 | SD |

DCAr0189 | 539302.00 | 7905627.00 | 3908.00 | 930.00 | 203 | -73 | CV |

Note: | 1. Drill collar coordinate system is WGS1984 UTM Zone 19S | ||||||

2. Coordinate of drill collar is picked with Real Time Kinematics (RTK) GPS | |||||||

3. CV - Central Valley; WD - West Dome; ED - East Dome; SW - Southwest step-out | |||||||

The Company maintains tight sample security and quality assurance and quality control for all aspects of its exploration program at the Carangas Project. Drill core is logged, photographed and split on-site by the company and stored under secure conditions until being shipped in security-sealed bags by New Pacific staff in Company vehicles, directly from the project to ALS Global in

The scientific and technical information contained in this news release has been reviewed and approved by Alex Zhang, P. Geo., Vice President of Exploration (the "Qualified Person"), who is a qualified person for the purposes of NI 43-101. The Qualified Person has verified the information disclosed herein using standard verification processes, including the sampling, preparation, security and analytical procedures underlying such information, and is not aware of any significant risks and uncertainties or any limitations on the verification process that could be expected to affect the reliability or confidence in the information discussed herein.

New Pacific is a Canadian exploration and development company with precious metal projects in

For further information, please contact:

Andrew Williams, President

New Pacific Metals Corp.

Phone: (604) 633-1368 Ext. 236

E-mail: invest@newpacificmetals.com

For additional information and to receive company news by e-mail, please register using New Pacific's website at www.newpacificmetals.com.

The PEA study results of the Silver Sand Project are preliminary in nature and are intended to provide an initial assessment of the project's economic potential and development options. The PEA mine schedule and economic assessment includes numerous assumptions and is based on both indicated and inferred mineral resources. Inferred resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the project economic assessments described herein will be achieved or that the PEA results will be realized. The estimate of mineral resources may be materially affected by geology, environmental, permitting, legal, title, socio-political, marketing or other relevant issues. Mineral resources are not mineral reserves and do not have demonstrated economic viability. Additional exploration will be required to potentially upgrade the classification of the inferred mineral resources to be considered in future advanced studies. AMC Mining Consultants (

Certain of the statements and information in this news release constitute "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian provincial securities laws. Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, or future events or performance (often, but not always, using words or phrases such as "expects", "is expected", "anticipates", "believes", "plans", "projects", "estimates", "assumes", "intends", "strategies", "targets", "goals", "forecasts", "objectives", "budgets", "schedules", "potential" or variations thereof or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements or information. Such statements include, but are not limited to statements regarding: anticipated timing for the commencement and outcome of the inaugural mineral resource estimation for the Project; anticipated timing for the mapping program for the Project; anticipated exploration, drilling, development, construction, and other activities or achievements of the Company; timing of receipt of permits and regulatory approvals; estimates of the Company's revenues and capital expenditures; and other future plans, objectives or expectations of the Company.

Forward-looking statements or information are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements or information, including, without limitation, risks relating to: global economic and social impact of COVID-19; fluctuating equity prices, bond prices, commodity prices; calculation of resources, reserves and mineralization, general economic conditions, foreign exchange risks, interest rate risk, foreign investment risk; loss of key personnel; conflicts of interest; dependence on management, uncertainties relating to the availability and costs of financing needed in the future, environmental risks, operations and political conditions, the regulatory environment in

The forward-looking statements are necessarily based on a number of estimates, assumptions, beliefs, expectations and opinions of management as of the date of this news release that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties and contingencies. These estimates, assumptions, beliefs, expectations and options include, but are not limited to, those related to the Company's ability to carry on current and future operations, including: the duration and effects of COVID-19 on our operations and workforce; development and exploration activities; the timing, extent, duration and economic viability of such operations; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the Company's ability to meet or achieve estimates, projections and forecasts; the stabilization of the political climate in

Although the forward-looking statements contained in this news release are based upon what management believes are reasonable assumptions, there can be no assurance that actual results will be consistent with these forward-looking statements. All forward-looking statements in this news release are qualified by these cautionary statements. Accordingly, readers should not place undue reliance on such statements. Other than specifically required by applicable laws, the Company is under no obligation and expressly disclaims any such obligation to update or alter the forward-looking statements whether as a result of new information, future events or otherwise except as may be required by law. These forward-looking statements are made as of the date of this news release.

This news release has been prepared in accordance with the requirements of the securities laws in effect in

Additional information relating to the Company, including the Company's Annual Information Form, can be obtained under the Company's profile on SEDAR at www.sedar.com, on EDGAR at www.sec.gov, and on the Company's website at www.newpacificmetals.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/new-pacific-intersects-183-meters-grading-92-grams-per-tonne-silver-in-step-out-drilling-at-the-carangas-project-bolivia-301871572.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/new-pacific-intersects-183-meters-grading-92-grams-per-tonne-silver-in-step-out-drilling-at-the-carangas-project-bolivia-301871572.html

SOURCE New Pacific Metals Corp.