Nasdaq Announces Mid-Month Open Short Interest Positions in Nasdaq Stocks as of Settlement Date January 12, 2024

- None.

- None.

Insights

An uptick in short interest can signal varied market sentiment, often reflecting a bearish outlook by investors on the securities in question. The reported increase in short interest across Nasdaq Global MarketSM securities to over 10.5 billion shares represents a notable shift from the prior period. This change could suggest growing skepticism about the valuations or future performance of these companies.

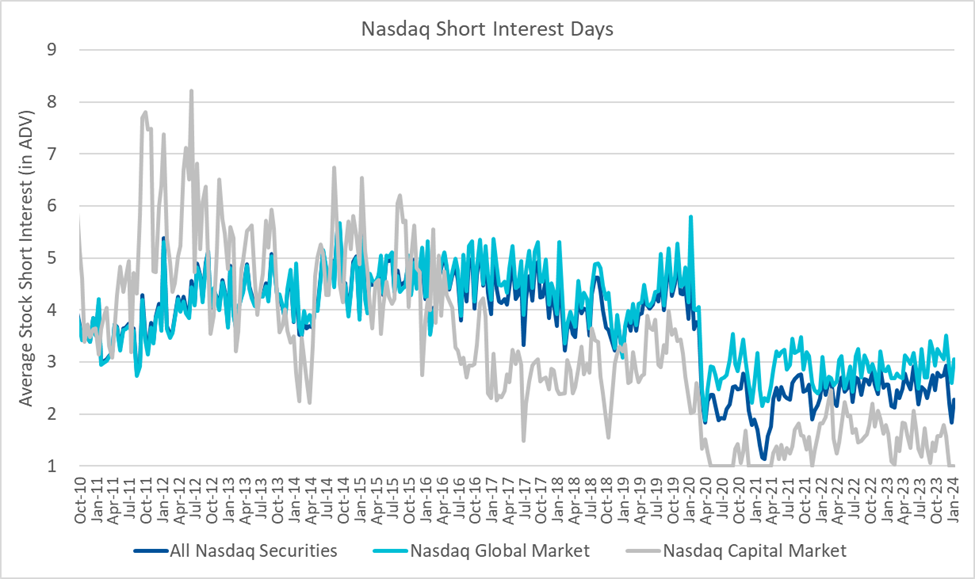

From a liquidity standpoint, the rise in short interest to 3.05 days to cover compared to 2.60 days in the previous period indicates that it would take more time to buy back the short positions, potentially leading to increased volatility if a short squeeze were to occur. Investors should monitor these developments as they can affect stock prices and market stability, especially in sectors where short interest is concentrated.

The data indicating an increase in short positions on The Nasdaq Capital MarketSM, albeit slight, could reflect broader market trends or specific challenges within smaller cap companies. With the average daily volume remaining constant at 1.00 day, this metric suggests that trading activity has not significantly changed, but investor sentiment might be shifting.

Understanding the sectors and individual securities with the highest short interest could provide insights into potential market corrections or identify industries facing headwinds. It is vital for investors to consider the context of these short interest figures within broader economic indicators and sector-specific news.

The aggregate short interest across all Nasdaq securities offering a broader perspective shows an increase in short positions, which may be indicative of market participants bracing for an economic downturn or reacting to macroeconomic factors such as interest rate changes, geopolitical risks, or sector disruptions. The reported average daily volume over the period has increased, which could be reflective of heightened market activity and investor caution.

It is crucial to analyze these figures in light of current economic conditions, including inflation rates, employment data and GDP growth, as they can significantly influence investor behavior and market dynamics.

NEW YORK, Jan. 24, 2024 (GLOBE NEWSWIRE) -- At the end of the settlement date of January 12, 2024, short interest in 3,156 Nasdaq Global MarketSM securities totaled 10,526,593,349 shares compared with 10,419,434,627 shares in 3,166 Global Market issues reported for the prior settlement date of December 29, 2023. The mid-January short interest represents 3.05 days compared with 2.60 days for the prior reporting period.

Short interest in 1,726 securities on The Nasdaq Capital MarketSM totaled 2,003,311,075 shares at the end of the settlement date of January 12, 2024, compared with 1,955,740,100 shares in 1,717 securities for the previous reporting period. This represents a 1.00 day average daily volume; the previous reporting period’s figure was 1.00.

In summary, short interest in all 4,882 Nasdaq® securities totaled 12,529,904,424 shares at the January 12, 2024 settlement date, compared with 4,883 issues and 12,375,174,727 shares at the end of the previous reporting period. This is 2.28 days average daily volume, compared with an average of 1.84 days for the prior reporting period.

The open short interest positions reported for each Nasdaq security reflect the total number of shares sold short by all broker/dealers regardless of their exchange affiliations. A short sale is generally understood to mean the sale of a security that the seller does not own or any sale that is consummated by the delivery of a security borrowed by or for the account of the seller.

For more information on Nasdaq Short interest positions, including publication dates, visit http://www.nasdaq.com/quotes/short-interest.aspx or http://www.nasdaqtrader.com/asp/short_interest.asp.

About Nasdaq:

Nasdaq (Nasdaq: NDAQ) is a global technology company serving the capital markets and other industries. Our diverse offering of data, analytics, software and services enables clients to optimize and execute their business vision with confidence. To learn more about the company, technology solutions and career opportunities, visit us on LinkedIn, on Twitter @Nasdaq, or at www.nasdaq.com.

NDAQO

Media Contact:

Camille Stafford

camille.stafford@nasdaq.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/0e4fb360-2ea3-4f18-871a-1901d07fdd85