Nasdaq Announces Mid-Month Open Short Interest Positions in Nasdaq Stocks as of Settlement Date December 15, 2023

- None.

- None.

Insights

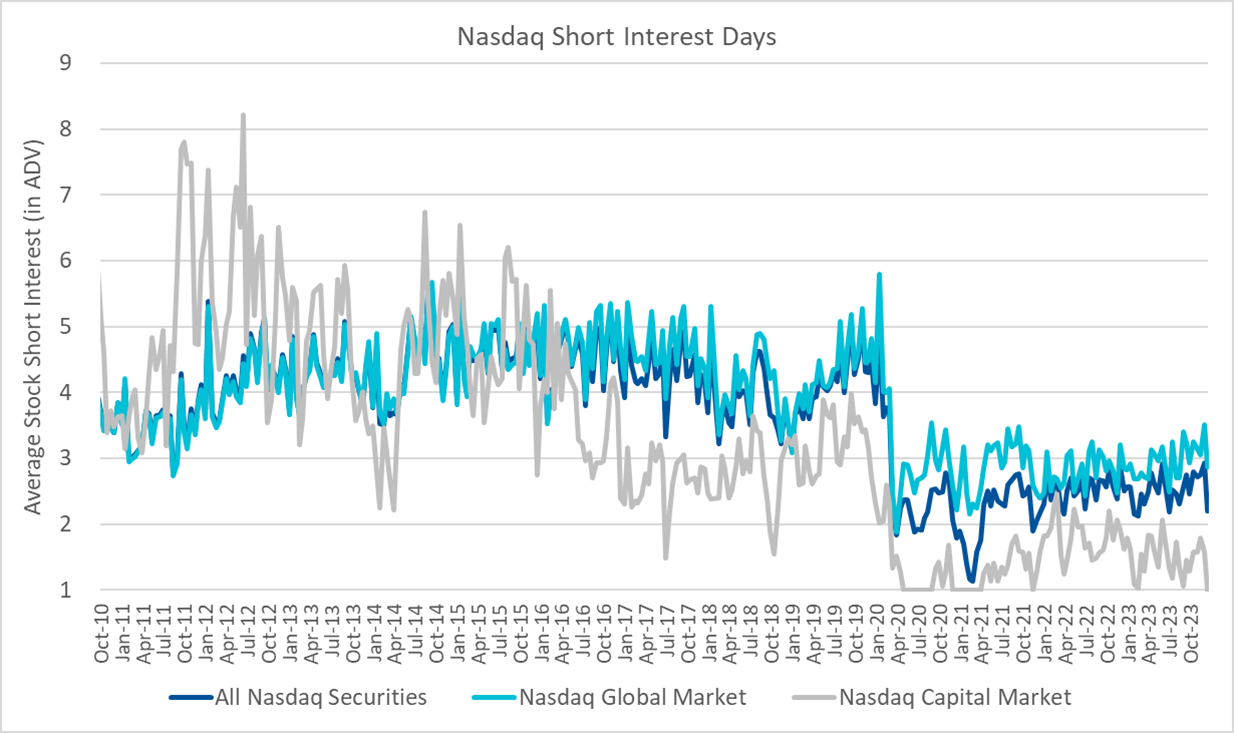

The recent report on short interest across Nasdaq securities provides a snapshot of market sentiment and potential volatility. A decrease in short interest can imply that investors are less bearish on the market or specific stocks. Conversely, an increase might suggest growing skepticism. The reported reduction in the average days to cover from 3.51 to 2.88 days indicates that it could take less time for short sellers to cover their positions, possibly due to a decrease in the overall bearish sentiment or changes in liquidity.

Moreover, tracking short interest is crucial for understanding potential short squeezes, where a rapid increase in stock prices forces short sellers to buy back shares at higher prices, further driving up the stock. This metric is an important indicator for market analysts to assess the risk-reward profile of securities, especially for those heavily shorted.

From a financial perspective, the slight decrease in short interest across Nasdaq securities might not be significant enough to indicate a major shift in market trends. However, it is essential for investors to monitor these trends as they can affect stock prices in the short term. The reduction in average daily volume from 2.93 to 2.21 days suggests that liquidity is tightening, which could lead to increased volatility in stock prices.

Investors and portfolio managers should consider the implications of these short interest figures on their investment strategies, particularly when it comes to risk management and the timing of entry or exit from positions. It is also important to analyze the short interest in the context of broader market indicators and individual stock fundamentals.

Short interest data is a valuable economic indicator that reflects broader market trends and investor confidence. A decrease in short interest may indicate improving economic conditions or investor optimism about corporate earnings and growth prospects. Conversely, high levels of short interest can be symptomatic of economic uncertainty or expected downturns.

It is important to correlate short interest data with other economic indicators such as GDP growth, unemployment rates and consumer sentiment to gain a comprehensive understanding of the economic landscape. This correlation helps in making informed predictions about market movements and potential shifts in investor behavior.

NEW YORK, Dec. 27, 2023 (GLOBE NEWSWIRE) -- At the end of the settlement date of December 15, 2023, short interest in 3,191 Nasdaq Global MarketSM securities totaled 10,832,646,277 shares compared with 10,851,113,277 shares in 3,183 Global Market issues reported for the prior settlement date of November 30, 2023. The mid-December short interest represents 2.88 days compared with 3.51 days for the prior reporting period.

Short interest in 1,732 securities on The Nasdaq Capital MarketSM totaled 2,089,500,802 shares at the end of the settlement date of December 15, 2023, compared with 2,091,196,638 shares in 1,752 securities for the previous reporting period. This represents a 1.00 day average daily volume; the previous reporting period’s figure was 1.58.

In summary, short interest in all 4,923 Nasdaq® securities totaled 12,922,147,079 shares at the December 15, 2023 settlement date, compared with 4,935 issues and 12,942,309,915 shares at the end of the previous reporting period. This is 2.21 days average daily volume, compared with an average of 2.93 days for the prior reporting period.

The open short interest positions reported for each Nasdaq security reflect the total number of shares sold short by all broker/dealers regardless of their exchange affiliations. A short sale is generally understood to mean the sale of a security that the seller does not own or any sale that is consummated by the delivery of a security borrowed by or for the account of the seller.

For more information on Nasdaq Short interest positions, including publication dates, visit

http://www.nasdaq.com/quotes/short-interest.aspx

or http://www.nasdaqtrader.com/asp/short_interest.asp.

About Nasdaq:

Nasdaq (Nasdaq: NDAQ) is a leading global technology company serving corporate clients, investment managers, banks, brokers, and exchange operators as they navigate and interact with the global capital markets and the broader financial system. We aspire to deliver world-leading platforms that improve the liquidity, transparency, and integrity of the global economy. Our diverse offering of data, analytics, software, exchange capabilities, and client-centric services enables clients to optimize and execute their business vision with confidence. To learn more about the company, technology solutions, and career opportunities, visit us on LinkedIn, on X @Nasdaq, or at www.nasdaq.com.

Media Contact:

Jennifer Lawson

jennifer.lawson@nasdaq.com

A chart accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/522d9d17-4942-440f-88ee-c88864e0d95a

NDAQO