Nasdaq Announces End of Month Open Short Interest Positions in Nasdaq Stocks as of Settlement Date January 31, 2024

- None.

- None.

Insights

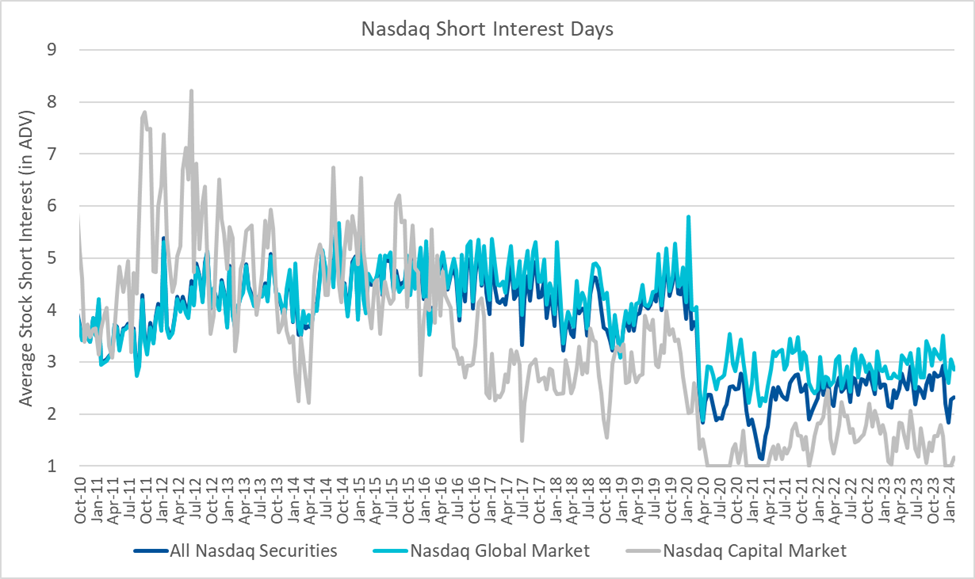

The recent data on short interest positions in Nasdaq Global Market and Nasdaq Capital Market securities provides a snapshot of market sentiment and potential volatility. An increase in short interest can indicate that investors are expecting prices to decline, while a decrease might suggest a more bullish outlook. The reported uptick in short interest for the Nasdaq Global Market, coupled with a slight decrease in the Nasdaq Capital Market, suggests a diverging perspective among traders regarding these markets.

It's important to note that the short interest ratio, also known as 'days to cover', has decreased slightly, from 3.05 to 2.85 days for the Global Market and increased from 1.00 to 1.16 days for the Capital Market. This metric is crucial as it indicates how many days it would take to cover all short positions given the average daily volume. A higher ratio can lead to a potential short squeeze if the stock price starts to rise, prompting short sellers to buy shares to cover their positions. Conversely, a lower ratio may imply less risk of a short squeeze.

Short interest is a valuable indicator for investors as it can signal market trends and risk levels. The slight increase in short interest in Nasdaq securities overall could be interpreted as a bearish signal, potentially leading to increased market volatility. Investors often monitor these changes to gauge the sentiment and to identify stocks that may be overvalued or undervalued.

From a financial analysis standpoint, the disclosed short interest data can have implications for individual stock performance and broader market indices. Stocks with high short interest may experience more intense price fluctuations, particularly around the release of significant news or earnings reports. For portfolio managers and individual investors, this information could lead to a reassessment of risk and potential adjustments in investment strategies.

Short selling activity is an integral part of market dynamics and can reflect broader economic trends. While short selling contributes to liquidity and price discovery, it can also exacerbate downward price movements during market downturns. The current short interest levels across Nasdaq securities provide insight into macroeconomic conditions and investor expectations.

An economist might analyze this data in the context of economic indicators such as interest rates, inflation and GDP growth to predict potential impacts on the stock market. A high aggregate short interest might suggest that the market is hedging against economic uncertainty or anticipating a correction. Conversely, if short interest levels were to decline significantly, this might indicate growing investor confidence and a more optimistic economic outlook.

NEW YORK, Feb. 09, 2024 (GLOBE NEWSWIRE) -- At the end of the settlement date of January 31, 2024, short interest in 3,159 Nasdaq Global MarketSM securities totaled 10,558,925,893 shares compared with 10,526,593,349 shares in 3,156 Global Market issues reported for the prior settlement date of January 12, 2024. The end of January short interest represent 2.85 days average daily Nasdaq Global Market share volume for the reporting period, compared with 3.05 days for the prior reporting period.

Short interest in 1,730 securities on The Nasdaq Capital MarketSM totaled 1,985,023,644 shares at the end of the settlement date of January 31, 2024 compared with 2,003,311,075 shares in 1,726 securities for the previous reporting period. This represents a 1.16 day average daily volume; the previous reporting period’s figure was 1.00.

In summary, short interest in all 4,889 Nasdaq® securities totaled 12,543,949,537 shares at the January 31, 2024 settlement date, compared with 4,882 issues and 12,529,904,424 shares at the end of the previous reporting period. This is 2.32 days average daily volume, compared with an average of 2.28 days for the previous reporting period.

The open short interest positions reported for each Nasdaq security reflect the total number of shares sold short by all broker/dealers regardless of their exchange affiliations. A short sale is generally understood to mean the sale of a security that the seller does not own or any sale that is consummated by the delivery of a security borrowed by or for the account of the seller.

For more information on Nasdaq Short interest positions, including publication dates, visit http://www.nasdaq.com/quotes/short-interest.aspx or http://www.nasdaqtrader.com/asp/short_interest.asp.

About Nasdaq:

Nasdaq (Nasdaq: NDAQ) is a leading global technology company serving corporate clients, investment managers, banks, brokers, and exchange operators as they navigate and interact with the global capital markets and the broader financial system. We aspire to deliver world-leading platforms that improve the liquidity, transparency, and integrity of the global economy. Our diverse offering of data, analytics, software, exchange capabilities, and client-centric services enables clients to optimize and execute their business vision with confidence. To learn more about the company, technology solutions, and career opportunities, visit us on LinkedIn, on X @Nasdaq, or at www.nasdaq.com.

NDAQO

Media Contact:

Camille Stafford

camille.stafford@nasdaq.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/14693bdd-a50d-460d-96cf-722842a04b05