MicroVision Announces First Quarter 2025 Results

- 47% YoY reduction in operating expenses to $14.1 million

- Access to $143.4 million in additional capital

- Production partnership with ZF enabling potential $30-$50 million revenue over 12-18 months

- Seven high-volume RFQs from automotive OEMs

- Strategic expansion into defense tech sector with new advisory board

- Revenue declined 40% YoY to $0.6 million in Q1 2025

- Net loss increased to $28.8 million from $26.3 million YoY

- Cash and equivalents decreased to $69.0 million from $74.7 million in Q4 2024

- $16.9 million in non-cash charges including debt extinguishment and interest expense

Insights

MicroVision's Q1 shows 47% YoY cost reduction amid concerning revenue decline, with significant potential in $30-50M industrial pipeline.

MicroVision's Q1 2025 results reveal a company in transition, balancing cost-cutting achievements against concerning revenue trends. Revenue dropped 40% year-over-year to

The most impressive aspect of the quarterly performance is the substantial

The company's net loss increased to

Financially, MicroVision has strengthened its position with

Most significantly, management's projection of

The addition of Glen DeVos, former CTO of Aptiv, brings valuable automotive industry expertise that could accelerate technology development and partnerships. However, investors should carefully monitor whether these strategic initiatives translate into actual revenue growth in upcoming quarters, as the company has historically struggled to convert technical capabilities into substantial commercial success.

REDMOND, WA / ACCESS Newswire / May 12, 2025 / MicroVision, Inc. (NASDAQ:MVIS), a technology pioneer delivering advanced perception solutions in autonomy and mobility, today announced its first quarter 2025 results.

Key Business Highlights

Established defense industry advisory board to accelerate strategic expansion and pursuit of revenue opportunities in the defense tech and military sectors.

Elevated momentum toward near-term revenue opportunities from multiple leading industrial companies in the autonomous mobile robot (AMR) and automated guided vehicle (AGV) sector.

Deepened executive leadership expertise, onboarding Glen DeVos, former CTO of Aptiv, as MicroVision's Chief Technology Officer, leading the Company's innovative product roadmapping and enhanced go-to-market strategy.

Continued engagement with top-tier global automotive OEMs, with seven high-volume RFQs for passenger vehicles and custom development opportunities.

Ramped production to meet anticipated volume demand, ensuring continuous and uninterrupted supply of sensors and integrated software.

Maintained fiscal discipline following 2024 streamlining of cost structure, resulting in another quarter of sequential improvement in cash burn.

Raised

$8 million in the first quarter of 2025 through an equity sale, building upon the$75 million convertible note facility with an institutional investor in Q4 2024.

"MicroVision is well positioned to secure revenue opportunities for 2025 from the industrial vertical," said Sumit Sharma, MicroVision's Chief Executive Officer. "Our unique value proposition continues to be our integrated perception software. We offer compelling solutions to industrial customers and automotive OEMs at attractive price points."

"The recent capital raises have positioned MicroVision well in the marketplace with an improved cost structure to support customer demand. In addition, our production commitment with ZF enables us to commit to high-volume deliveries to fulfil demand in the range of

Key Financial Highlights for Q1 2025

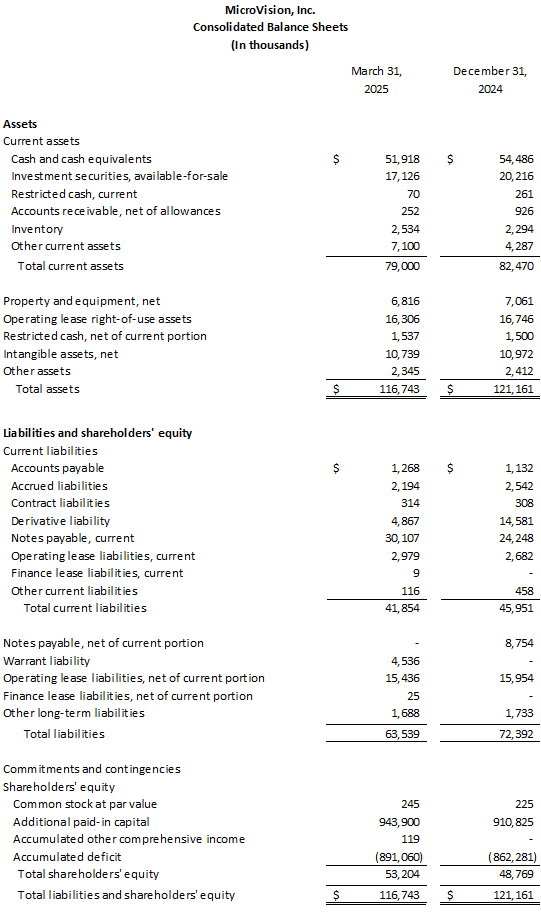

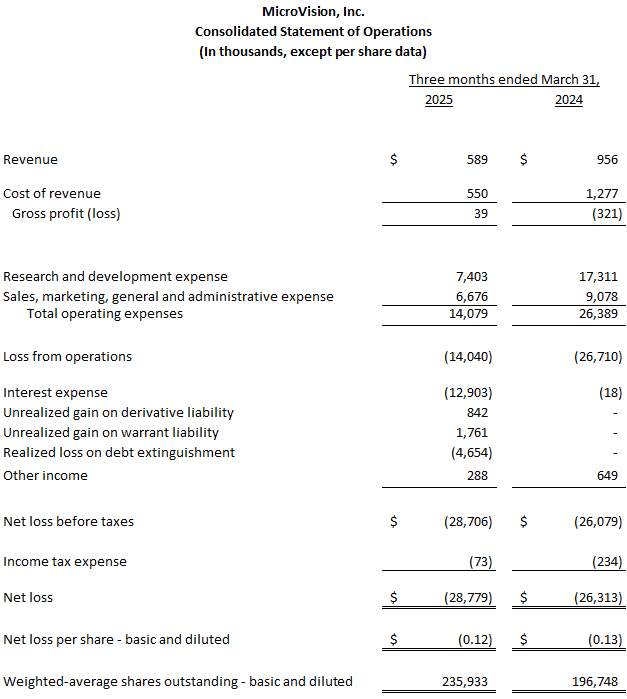

Revenue for the first quarter of 2025 was

$0.6 million , compared to$1.0 million for the first quarter of 2024 driven by demand primarily from industrial customers.Total operating expenses for the first quarter of 2025 were

$14.1 million , representing a47% decline YoY as compared to$26.4 million for the first quarter of 2024.Net loss for the first quarter of 2025 was

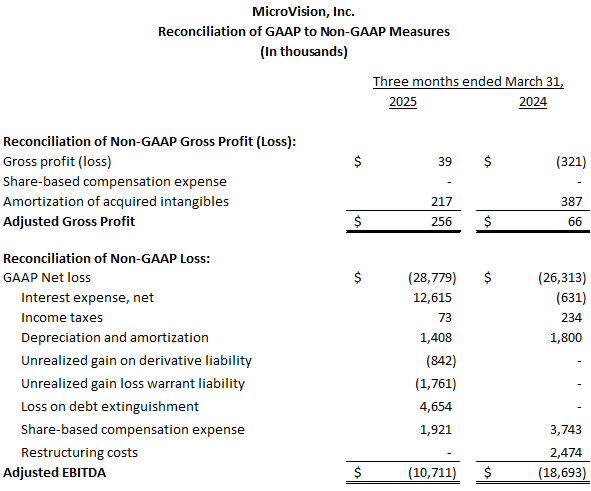

$28.8 million , or$0.12 per share, which includes$16.9 million of non-cash charges including$4.7 million of non-cash charges on debt extinguishment,$2.6 million of non-cash unrealized gains on warrants and derivatives,$12.9 million of non-cash interest expense related to the financings,$1.9 million of non-cash share-based compensation expense, compared to a net loss of$26.3 million , or$0.13 per share, which includes$3.7 million of non-cash share-based compensation expense, for the first quarter of 2024.Adjusted EBITDA for the first quarter of 2025 was a

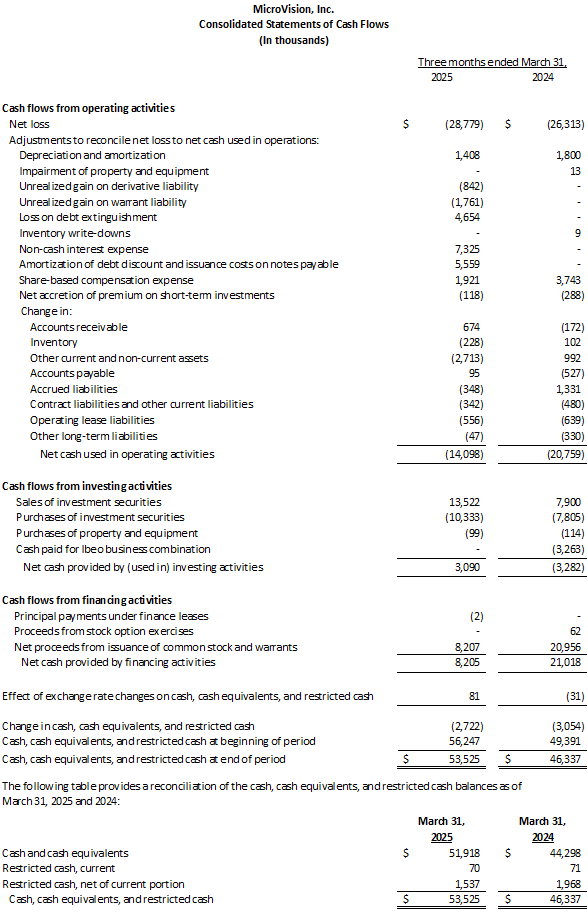

$10.7 million loss, compared to a$18.7 million loss for the first quarter of 2024.Cash used in operations in the first quarter of 2025 was

$14.1 million , compared to cash used in operations in the first quarter of 2024 of$20.8 million .The Company ended the first quarter of 2025 with

$69.0 million in cash and cash equivalents, including investment securities, compared to$74.7 million as of December 31, 2024.

As of March 31, 2025, the Company has access to

Conference Call and Webcast: Q1 2025 Results

MicroVision will host a conference call and webcast, consisting of prepared remarks by management, a slide presentation, and a question-and-answer session at 1:30 PM PT/4:30 PM ET on Monday, May 12, 2025 to discuss the financial results and provide a business update. Analysts and investors may pose questions to management during the live webcast on May 12, 2025 and may submit questions HERE in advance of the conference call.

The live webcast can be accessed on the Company's Investor Relations website under the Events tab HERE. The webcast will be archived on the website for future viewing.

Upcoming MicroVision Retail Investor Day on May 20, 2025

MicroVision's Retail Investor Day in Redmond, Washington on Tuesday, May 20, 2025.

At MicroVision Retail Investor Day, shareholders will have the opportunity to meet and ask questions of the Company's executive team, including new Chief Technology Officer Glen DeVos. Executives will discuss advancements in MicroVision's product portfolio, expansion of the Company's business strategy, and emerging market opportunities.

Space is limited. Click HERE to request an invitation to attend in person in Redmond, Washington. Video highlights from the MicroVision Retail Investor Day will be available HERE within a week after the event. Information communicated in the Town Hall and interactive lunch will be information that MicroVision has publicly reported.

Agenda in Redmond, Washington on Tuesday, May 20, 2025:

9:00 AM to 10:30 AM PT: Ride-along demo vehicle will tour local streets and highways, plus live interactive product demonstrations.

10:30 to 12:00 PM PT: Town Hall including management remarks and presentation.

12:00 PM to 1:00 PM PT: Interactive lunch.

About MicroVision

MicroVision drives global adoption of innovative perception solutions to make mobility and autonomy safer. Fueled by engineering excellence in Redmond, Washington and Hamburg, Germany, MicroVision develops and supplies an integrated solution built on its perception software stack, incorporating application software and processing data from differentiated sensor systems. MicroVision's proprietary technology solutions deliver enhanced safety for a variety of industrial applications, including robotics, automated warehouse, and agriculture, and the automotive industry accelerating advanced driver-assistance systems (ADAS) and autonomous driving, as well as for military applications. With deep roots in MEMS-based laser beam scanning technology that integrates MEMS, lasers, optics, hardware, algorithms and machine learning software, MicroVision has the expertise to deliver safe mobility at the speed of life.

For more information, visit the Company's website at www.microvision.com, on Facebook at www.facebook.com/microvisioninc, and LinkedIn at https://www.linkedin.com/company/microvision/.

MicroVision, MAVIN, MOSAIK, and MOVIA are trademarks of MicroVision, Inc. in the United States and other countries. All other trademarks are the properties of their respective owners.

Non-GAAP information

To supplement MicroVision's condensed financial statements presented in accordance with GAAP, the Company presents investors with the non-GAAP financial measures "adjusted EBITDA" and "adjusted Gross Profit." Adjusted EBITDA consists of GAAP net income (loss) excluding the impact of the following: interest income and interest expense; income tax expense; depreciation and amortization; non-cash gains and losses; share-based compensation; and restructuring costs. Adjusted Gross Profit is calculated as GAAP gross profit before share-based compensation expense and the amortization of acquired intangibles included in cost of revenue.

MicroVision believes that the presentation of adjusted EBITDA and adjusted Gross Profit provides important supplemental information to management and investors regarding financial and business trends, provides consistency and comparability with MicroVision's past financial reports, and facilitates comparisons with other companies in the Company's industry, many of which use similar non-GAAP financial measures to supplement their GAAP results. Internally, management uses these non-GAAP measures when evaluating operating performance because the exclusion of the items described above provides an additional useful measure of the Company's operating results and facilitates comparisons of the Company's core operating performance against prior periods and its business objectives. Externally, the Company believes that adjusted EBITDA and adjusted Gross Profit are useful to investors in their assessment of MicroVision's operating performance and the valuation of the Company.

Adjusted EBITDA and adjusted Gross Profit are not calculated in accordance with GAAP, and should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. Non-GAAP financial measures have limitations in that they do not reflect all of the costs associated with the operations of MicroVision's business as determined in accordance with GAAP. The Company expects to continue to incur expenses similar to the non-GAAP adjustments described above, and exclusion of these items from its non-GAAP financial measures should not be construed as an inference that these costs are unusual or infrequent.

The Company compensates for limitations of the adjusted EBITDA measure by prominently disclosing GAAP net income (loss), which the Company believes is the most directly comparable GAAP measure, and providing investors with a reconciliation from GAAP net income (loss) to adjusted EBITDA.

Similarly for adjusted Gross Profit, the Company compensates for limitations of the measure by prominently disclosing GAAP gross profit which is the difference between Revenue and Cost of revenue, which the Company believes is the most directly comparable GAAP measure, and providing investors with a reconciliation by backing out share-based compensation expense and the amortization of acquired intangibles included in cost of revenue.

Forward-Looking Statements

Certain statements contained in this release, including customer engagement and the likelihood of success; opportunities for revenue and cash; expense reduction; market position; product portfolio; product and manufacturing capabilities; access to capital and capital-raising opportunities; and expected revenue, expenses and cash usage are forward-looking statements that involve a number of risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those projected in such forward-looking statements include the risk its ability to operate with limited cash or to raise additional capital when needed; market acceptance of its technologies and products or for products incorporating its technologies; the failure of its commercial partners to perform as expected under its agreements; its financial and technical resources relative to those of its competitors; its ability to keep up with rapid technological change; government regulation of its technologies; its ability to enforce its intellectual property rights and protect its proprietary technologies; the ability to obtain customers and develop partnership opportunities; the timing of commercial product launches and delays in product development; the ability to achieve key technical milestones in key products; dependence on third parties to develop, manufacture, sell and market its products; potential product liability claims; its ability to maintain its listing on The Nasdaq Stock Market, and other risk factors identified from time to time in the Company's SEC reports, including the Company's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other reports filed with the SEC. These factors are not intended to represent a complete list of the general or specific factors that may affect the Company. It should be recognized that other factors, including general economic factors and business strategies, may be significant, now or in the future, and the factors set forth in this release may affect the Company to a greater extent than indicated. Except as expressly required by federal securities laws, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changes in circumstances or any other reason.

Investor Relations Contact

Jeff Christensen

Darrow Associates Investor Relations

MVIS@darrowir.com

Media Contact

SOURCE: MicroVision, Inc

View the original press release on ACCESS Newswire