McEwen Copper: Update on Assay Results at Los Azules

- None.

- None.

Insights

The assay results reported by McEwen Copper Inc. are indicative of significant mineralization, particularly within the Enriched zone of the Los Azules project. The continuity and extension of mineralization are critical factors that can influence the project's economic viability. The reported grades, such as 0.63% Cu over 446 meters, are substantial considering the average grade of copper deposits globally, which often hover below 0.5% Cu. The distinction between Enriched and Primary zones is important, as enriched deposits are typically formed closer to the surface and can be less expensive to mine due to the higher copper concentrations and reduced overburden removal.

The technical aspects of the drilling campaign and the subsequent resource categorization from Inferred to Indicated suggest a maturing project that may soon reach a stage where a decision on mining feasibility can be made. The investment by Nuton and Stellantis underscores the project's potential and the strategic importance of copper as a critical mineral in the global transition to greener technologies. The geological data should be considered in the context of the Feasibility Study, which will provide a more detailed economic analysis of the project.

From a market perspective, the reported drilling results by McEwen Copper Inc. represent a positive development for the company and its stakeholders. The increase in Measured and Indicated resources can lead to a revaluation of the company's assets and potentially attract further investment. The timing of these results aligns with a growing demand for copper, fueled by its essential role in electric vehicles, renewable energy infrastructure and other green technologies.

Investors should note that the project is still in the exploration and pre-feasibility stage and thus carries the inherent risks associated with mining investments, including commodity price fluctuations and operational risks. However, the involvement of a Rio Tinto venture and Stellantis, combined with the positive political climate in Argentina towards mining, could mitigate some of these risks. The market will likely monitor the progress towards the Feasibility Study closely, as it will provide a clearer picture of the project's financial and operational parameters.

Examining the financial implications, the assay results may have a positive impact on McEwen Mining Inc.'s stock valuation, as the parent company of McEwen Copper Inc. The confirmation of high-grade copper over significant intervals enhances the Los Azules project's prospects and could lead to future revenue growth. Investors should consider the project's stage and the capital required to reach production when evaluating the company's financial health and future cash flow projections.

The investments by Nuton and Stellantis not only provide necessary capital for the ongoing drilling campaign but also validate the project's potential. However, the search for additional funding for feasibility-level engineering and pre-construction work indicates that McEwen Copper Inc. will likely incur more expenses before reaching production. Long-term investors might be drawn to the project's growth potential, while short-term investors could be wary of the time required to realize returns.

Remaining assays from the 2022-2023 season, highlights include:

446 m of

TORONTO, Feb. 26, 2024 (GLOBE NEWSWIRE) -- McEwen Copper Inc.,

Selected Highlights:

- Hole AZ23205MET returned 257 m of

0.76% Cu within the Enriched zone. - Hole AZ23228MET returned 446 m of

0.63% Cu in the Enriched zone, including 76 m of0.92% Cu. - Hole AZ23230MET returned 250 m of

0.68% Cu in the Enriched zone, including 192 m of0.83% Cu.

The objective of the 2022-2023 drilling campaign was to collect information needed as the project advances towards the completion of a Feasibility Study in Q1 2025. Work continues during this field season (2023-2024) and includes resource drilling that will convert the initial 5-year pit resources to Measured and Indicated categories and will further upgrade resources from Inferred to Indicated. In addition to resource drilling, geotechnical, metallurgical, hydrogeological, exploration, and condemnation drilling are also being performed.

With the closing in October 2023 of a US

“Argentina’s new president is taking important initiatives to unlock the country’s potential to become a significant supplier of critical minerals to the world, to combat climate change and at the same time strengthening the economy,” said Rob McEwen, Chairman and Chief Owner.

“McEwen Copper’s Los Azules project is progressing at light speed towards completing a feasibility study by Q1 2025 and it has already delivered significant economic benefits to the neighbouring communities. It is a very large copper resource, where recent exploration drilling suggests it definitely has room to grow,” said Michael Meding, Vice President and General Manager of McEwen Copper.

Table 1 - Remaining 2022-2023 Los Azules metallurgical drilling results. All intercepts are approximate true thickness.

| Hole-ID | Section | Predominant Mineral Zone | From (m) | To (m) | Length (m) | Cu % | Au (g/t) | Ag (g/t) | Comment |

| AZ23199MET | 31 | Total | 100.0 | 271.0 | 171.0 | 0.80 | 0.06 | 1.56 | |

| Enriched | 100.0 | 271.0 | 171.0 | 0.80 | 0.06 | 1.56 | Incl. 156.0m of | ||

| Primary | |||||||||

| AZ23200MET | 34-33 | Total | 94.0 | 394.5 | 300.5 | 0.43 | 0.04 | 2.89 | |

| Enriched | 94.0 | 394.5 | 300.5 | 0.43 | 0.04 | 2.89 | Incl. 172.0m of | ||

| Primary | |||||||||

| AZ23204MET | 39 | Total | 116.0 | 312.0 | 196.0 | 0.50 | 0.12 | 1.83 | |

| Enriched | 116.0 | 275.5 | 159.5 | 0.54 | 0.13 | 1.87 | Incl. 38.0m of | ||

| Primary | 275.5 | 312.0 | 36.5 | 0.34 | 0.07 | 1.67 | |||

| AZ23205MET | 31 | Total | 105.0 | 374.7 | 269.7 | 0.73 | 0.08 | 1.77 | |

| Enriched | 105.0 | 362.0 | 257.0 | 0.76 | 0.09 | 1.94 | |||

| Primary | 362.0 | 374.7 | 12.7 | 0.28 | 0.05 | 1.30 | |||

| AZ23226AMET | 33 | Total | 90.0 | 275.3 | 185.3 | 0.47 | 0.03 | 0.91 | |

| Enriched | 90.0 | 275.3 | 185.3 | 0.47 | 0.03 | 0.91 | Incl. 38.0m of | ||

| Primary | |||||||||

| AZ23228MET | 47 | Total | 170.0 | 616.0 | 446.0 | 0.63 | 0.07 | 3.58 | |

| Enriched | 170.0 | 430.0 | 260.0 | 0.72 | 0.07 | 4.18 | Incl. 76.0m of | ||

| Primary | 430.0 | 616.0 | 186.0 | 0.49 | 0.07 | 2.74 | Incl. 52.0m of | ||

| AZ23229MET | 50-51 | Total | 92.0 | 262.4 | 170.4 | 0.46 | 0.04 | 1.80 | |

| Enriched | 92.0 | 262.4 | 170.4 | 0.46 | 0.04 | 1.80 | Incl. 76.4m of | ||

| Primary | |||||||||

| AZ23230MET | 30 | Total | 104.0 | 438.2 | 334.2 | 0.59 | 0.06 | 3.66 | |

| Enriched | 104.0 | 354.0 | 250.0 | 0.68 | 0.06 | 3.67 | Incl. 192.0m of | ||

| Primary | 354.0 | 438.2 | 84.2 | 0.31 | 0.07 | 3.61 | |||

| AZ23232MET | 48-49 | Total | 94.0 | 464.0 | 370.0 | 0.40 | 0.04 | 0.95 | |

| Enriched | 94.0 | 414.0 | 320.0 | 0.44 | 0.05 | 1.02 | Incl. 76.0m of | ||

| Primary | 414.0 | 464.0 | 50.0 | 0.12 | 0.03 | 0.45 | |||

| GTK2315MET | 52-53 | Total | 69.0 | 521.2 | 452.2 | 0.29 | 0.05 | 1.09 | |

| Enriched | 69.0 | 260.0 | 191.0 | 0.45 | 0.04 | 0.86 | Incl. 76.0m of | ||

| Primary | 260.0 | 521.2 | 261.2 | 0.18 | 0.05 | 1.26 | |||

| GTK2316MET | 30 | Total | 94.0 | 319.1 | 225.1 | 0.38 | 0.02 | 0.88 | |

| Enriched | 94.0 | 319.1 | 225.1 | 0.38 | 0.02 | 0.88 | Incl. 48.0m of | ||

| Primary | |||||||||

| GTK2317MET | 28-27 | Total | 156.0 | 326.0 | 170.0 | 0.42 | 0.02 | 2.15 | |

| Enriched | 156.0 | 326.0 | 170.0 | 0.42 | 0.02 | 2.15 | Incl. 58.0m of | ||

| Primary | |||||||||

| AZ23210MET | 30 | Total | 110.0 | 415.0 | 305.0 | 0.64 | 0.07 | 1.62 | |

| Enriched | 110.0 | 352.0 | 242.0 | 0.73 | 0.07 | 1.59 | |||

| Primary | 352.0 | 415.0 | 63.0 | 0.28 | 0.06 | 1.73 | |||

| AZ23223MET | 32 | Total | 142.0 | 376.0 | 234.0 | 0.40 | 0.03 | 0.52 | |

| Enriched | 142.0 | 376.0 | 234.0 | 0.40 | 0.03 | 0.52 | Incl. 76.0m of | ||

| Primary | |||||||||

| AZ23227MET | 34 | Total | 69.0 | 334.0 | 265.0 | 0.68 | 0.07 | 1.27 | |

| Enriched | 69.0 | 284.0 | 215.0 | 0.73 | 0.06 | 1.30 | Incl. 137.0m of | ||

| Primary | 284.0 | 334.0 | 50.0 | 0.44 | 0.09 | 1.13 | Incl. 22.0m of | ||

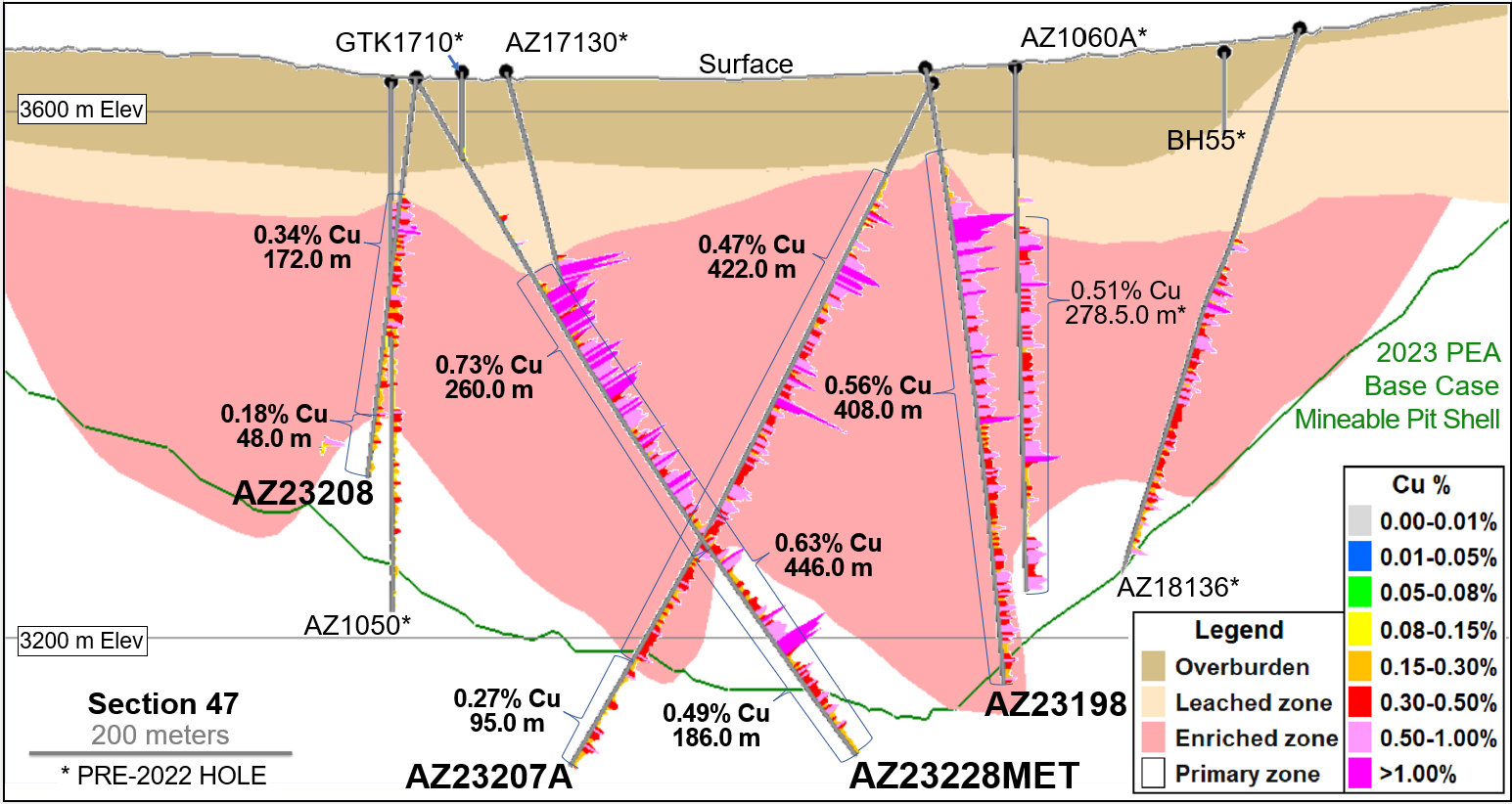

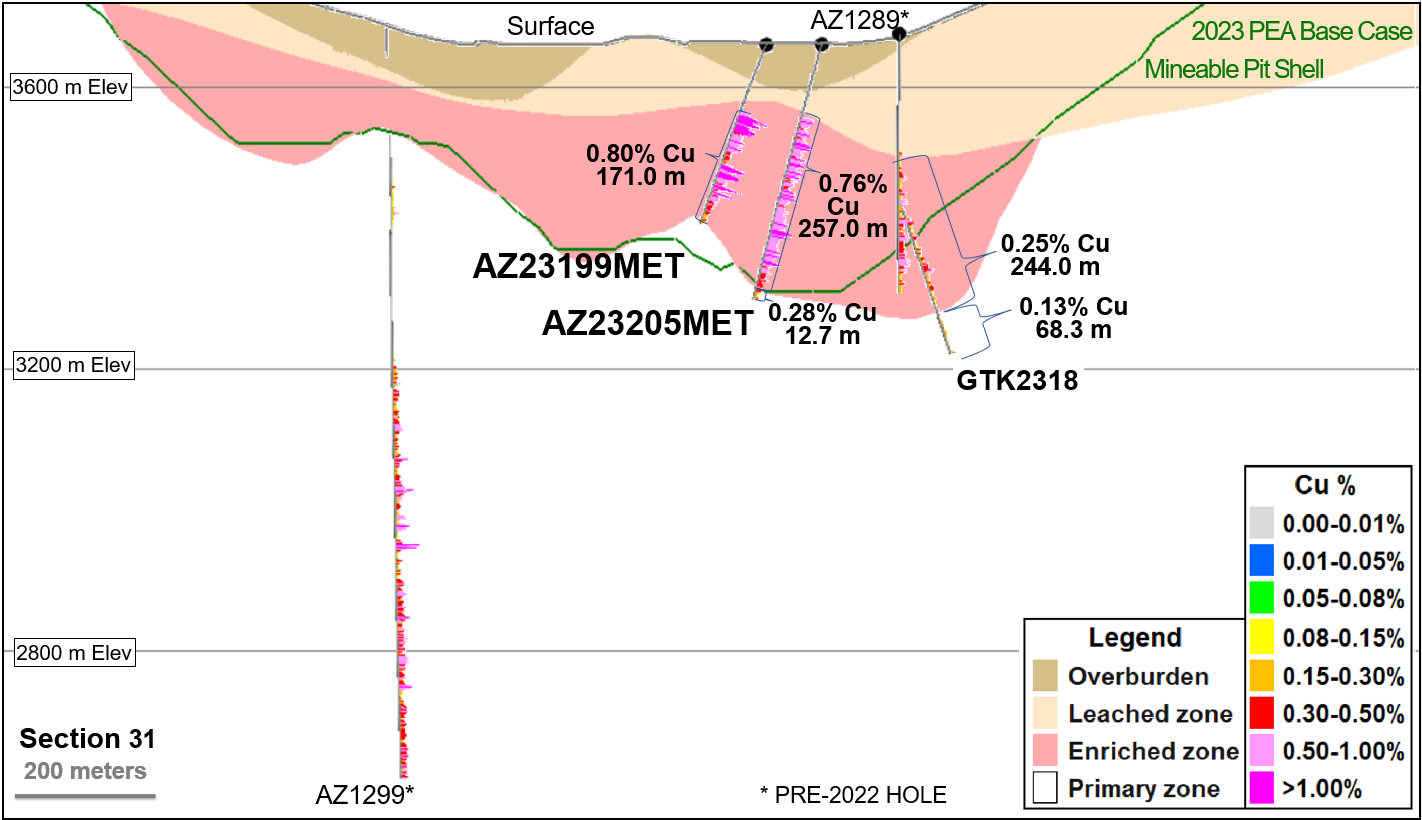

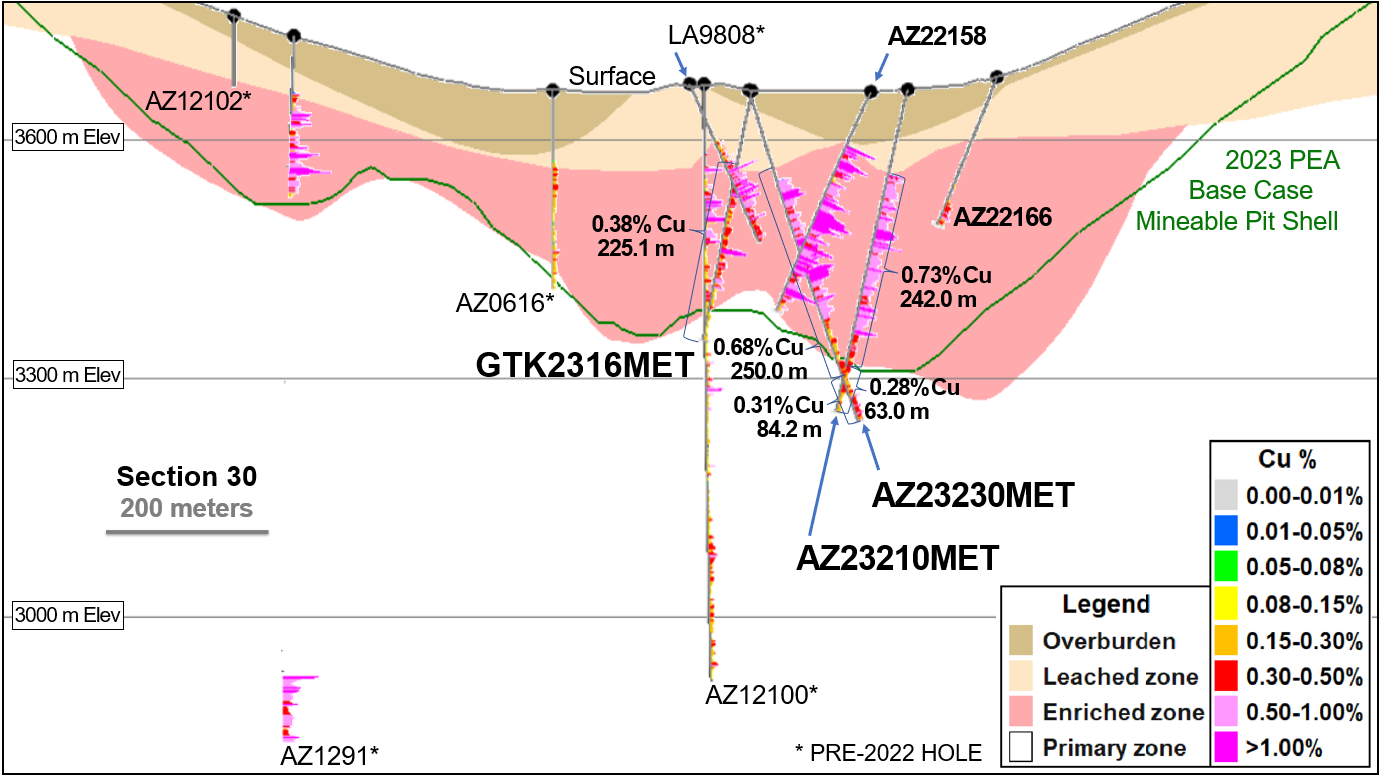

Results are summarized in three schematic cross sections (Figures 2, 3, and 4), which include simplified interpretations of the Overburden, Leached, Enriched and Primary zones. The Enriched mineral zone refers to a copper deposit enriched by precipitation-derived water circulation that carries copper minerals downward through the rocks to accumulate in a thick, often horizontal “blanket”. Immediately above the Enriched zone is the Leached zone, from which copper was removed and transported. Weathering and oxidation often contribute to this process. Below the Enriched zone, the Primary (or Hypogene) zone is formed by ascending copper-rich thermal fluids, originating from a much deeper magmatic source. The green line indicates the pit floor of the 30-year pit shell from the 2023 NI 43-101 Preliminary Economic Assessment (PEA).

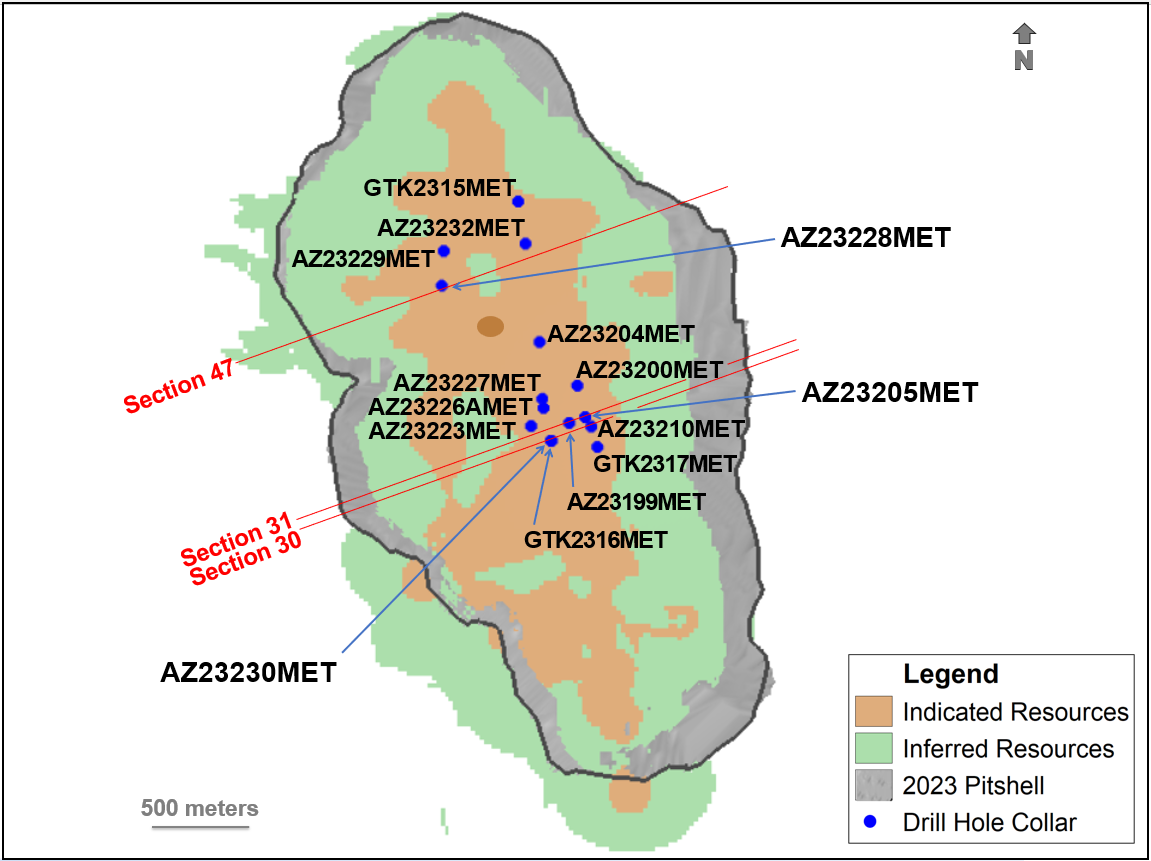

Figure 1 presents a plan view of the location of three sections and the holes reported. Adjacent cross sections are located 50 m apart from each other, starting with the lowest numbered section at the south end of the deposit and progressing to the north.

Figure 1 – Plan View Location of Cross-sections and Drill Holes in the Deposit

Figure 2 displays an intercept of 446 m grading

Figure 2 - Section 47 - Drilling, Mineralized Zones and 30-year PEA Pit (Looking North)

Figure 3 highlights a 257 m interval grading

Figure 3 - Section 31 - Drilling, Mineralized Zones and 30-year PEA Pit (Looking North)

Figure 4 presents an intercept of 250.0 m of

Figure 4 - Section 30 - Drilling, Mineralized Zones and 30-year PEA Pit (Looking North)

Technical information

The technical content of this press release has been reviewed and approved by Darren King, Director of Exploration of McEwen Copper, who serves as the qualified person (QP) under the definitions of National Instrument 43-101.

All samples were collected in accordance with generally accepted industry standards. Drill core samples, usually taken at 2 m intervals, were split and submitted to the Alex Stewart International laboratory located in the Province of Mendoza, Argentina, for the following assays: gold determination using fire fusion assay and an atomic absorption spectroscopy finish (Au4-30); a 39 multi-element suite using ICP-OES analysis (ICP-AR 39); copper content determination using a sequential copper analysis (Cu-Sequential LMC-140). An additional 19-element analysis (ICP-ORE) was performed for samples with high sulphide content and that exceeded the limits of the ICP-OES analysis.

The company conducts a Quality Assurance/Quality Control program in accordance with NI 43-101 and industry best practices, using a combination of standards and blanks on approximately one out of every 25 samples. Results are monitored as final certificates are received, and any re-assay requests are sent back immediately. Pulp and preparation sample analyses are also performed as part of the QAQC process. Approximately

Table 2 – Hole Locations and Lengths for Los Azules Drilling Results

| HOLE-ID | Azimuth | Dip | Length | Loc X | Loc Y | Loc Z |

| AZ23199MET | 250 | -67 | 271.0 | 2383430 | 6558947 | 3659 |

| AZ23226AMET | 250 | -77 | 275.3 | 2383311 | 6559016 | 3656 |

| AZ23228MET | 70 | -60 | 616.0 | 2382837 | 6559585 | 3625 |

| AZ23229MET | 70 | -70 | 262.4 | 2382846 | 6559746 | 3616 |

| AZ23230MET | 70 | -73 | 438.2 | 2383344 | 6558864 | 3664 |

| AZ23232MET | 45 | -70 | 464.0 | 2383226 | 6559780 | 3632 |

| GTK2315MET | 38 | -70 | 521.2 | 2383192 | 6559976 | 3639 |

| GTK2316MET | 250 | -78 | 319.1 | 2383348 | 6558863 | 3664 |

| GTK2317MET | 90 | -70 | 326.0 | 2383561 | 6558835 | 3665 |

| AZ23200MET | 90 | -70 | 394.5 | 2383467 | 6559120 | 3657 |

| AZ23204MET | 250 | -76 | 312 | 2383292 | 6559323 | 3643 |

| AZ23205MET | 250 | -74 | 374.7 | 2383504 | 6558973 | 3660 |

| AZ23210MET | 250 | -76 | 415 | 2383533 | 6558930 | 3664 |

| AZ23223MET | 66 | -73 | 376 | 2383253 | 6558932 | 3670 |

| AZ23227MET | 70 | -79 | 334 | 2383305 | 6559059 | 3654 |

| Coordinates listed in Table 2 based on Gauss Kruger - POSGAR 94 Zone 2 | ||||||

ABOUT MCEWEN COPPER

McEwen Copper is a well-funded, private company which owns

Los Azules is being designed to be distinctly different from conventional copper mines, consuming significantly less water, emitting much lower carbon levels and progressing to be carbon neutral by 2038, being powered by

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with operations in Nevada, Canada, Mexico and Argentina. McEwen Mining also holds a

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements and information, including "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements and information expressed, as at the date of this news release, McEwen Mining Inc.'s (the "Company") estimates, forecasts, projections, expectations or beliefs as to future events and results. Forward-looking statements and information are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies, and there can be no assurance that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements and information. Risks and uncertainties that could cause results or future events to differ materially from current expectations expressed or implied by the forward-looking statements and information include, but are not limited to, effects of the COVID-19 pandemic, fluctuations in the market price of precious metals, mining industry risks, political, economic, social and security risks associated with foreign operations, the ability of the corporation to receive or receive in a timely manner permits or other approvals required in connection with operations, risks associated with the construction of mining operations and commencement of production and the projected costs thereof, risks related to litigation, the state of the capital markets, environmental risks and hazards, uncertainty as to calculation of mineral resources and reserves, and other risks. Readers should not place undue reliance on forward-looking statements or information included herein, which speak only as of the date hereof. The Company undertakes no obligation to reissue or update forward-looking statements or information as a result of new information or events after the date hereof except as may be required by law. See McEwen Mining's Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and other filings with the Securities and Exchange Commission, under the caption "Risk Factors", for additional information on risks, uncertainties and other factors relating to the forward-looking statements and information regarding the Company. All forward-looking statements and information made in this news release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by the management of McEwen Mining Inc.

Want News Fast?

Subscribe to our email list by clicking here:

https://www.mcewenmining.com/contact-us/#section=followUs

and receive news as it happens!!

| WEB SITE | SOCIAL MEDIA | |||||

| www.mcewenmining.com | McEwen Mining | Facebook: | facebook.com/mcewenmining | |||

| LinkedIn: | linkedin.com/company/mcewen-mining-inc- | |||||

| CONTACT INFORMATION | Twitter: | twitter.com/mcewenmining | ||||

| 150 King Street West | Instagram: | instagram.com/mcewenmining | ||||

| Suite 2800, PO Box 24 | ||||||

| Toronto, ON, Canada | McEwen Copper | Facebook: | facebook.com/ mcewencopper | |||

| M5H 1J9 | LinkedIn: | linkedin.com/company/mcewencopper | ||||

| Twitter: | twitter.com/mcewencopper | |||||

| Relationship with Investors: | Instagram: | instagram.com/mcewencopper | ||||

| (866)-441-0690 - Toll free line | ||||||

| (647)-258-0395 | Rob McEwen | Facebook: | facebook.com/mcewenrob | |||

| Mihaela Iancu ext. 320 | LinkedIn: | linkedin.com/in/robert-mcewen-646ab24 | ||||

| info@mcewenmining.com | Twitter: | twitter.com/robmcewenmux | ||||

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/ab63eef5-5ec9-436d-81b5-0ead4d4041e1

https://www.globenewswire.com/NewsRoom/AttachmentNg/07f30ddd-1a49-4770-b141-7bdb440e4e65

https://www.globenewswire.com/NewsRoom/AttachmentNg/e3714f0b-53f7-41b8-a533-0cc526b932d9

https://www.globenewswire.com/NewsRoom/AttachmentNg/39a906eb-2ff7-4388-baa5-a4474d67c3cc