McEwen Copper Update, Excitement in Argentina: Milei Magic Is Turbocharging Foreign Investments; US$4.4 Billion Copper Transaction by BHP and Lundin Mining; Los Azules Infill Drilling Confirmed High Grade Copper Zone

McEwen Copper, 48.3% owned by McEwen Mining (NYSE: MUX) (TSX: MUX), reports exciting developments in Argentina. President Milei's new legislation, the Incentive Regime for Large Investors (RIGI), offers significant tax and foreign exchange incentives for mining investments. A US$4.4 billion transaction by BHP and Lundin Mining to acquire two copper deposits in San Juan province demonstrates Argentina's attractiveness for large-scale mining projects.

At Los Azules, infill drilling during the 2023-24 season upgraded resource categories and confirmed a high-grade copper zone. Highlights include:

- 217 meters of 1.11% Cu, including 100 meters of 1.32% Cu (AZ24375)

- 276 meters of 0.86% Cu, including 160 meters of 0.96% Cu (AZ24403)

- 158 meters of 0.84% Cu, including 78.5 meters of 1.10% Cu (AZ24335)

The Los Azules Feasibility Study remains on track for delivery in early 2025.

McEwen Copper, di cui il 48,3% è controllato da McEwen Mining (NYSE: MUX) (TSX: MUX), riporta sviluppi entusiasmanti in Argentina. La nuova legislazione del presidente Milei, il Regime di Incentivo per Grandi Investitori (RIGI), offre incentivi fiscali e di cambio significativi per gli investimenti minerari. Una transazione di 4,4 miliardi di dollari USA da parte di BHP e Lundin Mining per acquisire due depositi di rame nella provincia di San Juan dimostra l'attrattiva dell'Argentina per progetti minerari su larga scala.

Presso Los Azules, i carotaggi di riempimento durante la stagione 2023-24 hanno aggiornato le categorie delle risorse e confermato una zona ad alto grado di rame. I punti salienti includono:

- 217 metri di 1,11% Cu, inclusi 100 metri di 1,32% Cu (AZ24375)

- 276 metri di 0,86% Cu, inclusi 160 metri di 0,96% Cu (AZ24403)

- 158 metri di 0,84% Cu, inclusi 78,5 metri di 1,10% Cu (AZ24335)

Lo Studio di Fattibilità di Los Azules rimane in corso per la consegna all'inizio del 2025.

McEwen Copper, con un 48.3% de propiedad por parte de McEwen Mining (NYSE: MUX) (TSX: MUX), informa sobre desarrollos emocionantes en Argentina. La nueva legislación del presidente Milei, el Régimen de Incentivos para Grandes Inversores (RIGI), ofrece incentivos fiscales y de cambio significativos para las inversiones mineras. Una transacción de 4.4 mil millones de dólares estadounidenses por parte de BHP y Lundin Mining para adquirir dos depósitos de cobre en la provincia de San Juan demuestra la atracción de Argentina para proyectos mineros a gran escala.

En Los Azules, los sondeos de relleno durante la temporada 2023-24 mejoraron las categorías de recursos y confirmaron una zona de cobre de alta ley. Los aspectos destacados incluyen:

- 217 metros de 1.11% Cu, incluyendo 100 metros de 1.32% Cu (AZ24375)

- 276 metros de 0.86% Cu, incluyendo 160 metros de 0.96% Cu (AZ24403)

- 158 metros de 0.84% Cu, incluyendo 78.5 metros de 1.10% Cu (AZ24335)

El Estudio de Viabilidad de Los Azules sigue en camino para su entrega a principios de 2025.

맥유엔 구리는 맥유엔 마이닝(McEwen Mining)(NYSE: MUX)(TSX: MUX)에서 48.3% 지분을 보유하고 있으며, 아르헨티나에서 흥미로운 개발 사항을 보고합니다. 마일리 대통령의 새로운 법안인 대규모 투자자를 위한 인센티브 제도(RIGI)는 광산 투자에 대한 상당한 세금 및 외환 인센티브를 제공합니다. BHP와 룬딘 마이닝이 산 후안주에서 두 개의 구리 광산을 인수하기 위해 44억 달러 규모의 거래를 체결한 것은 아르헨티나의 대규모 광산 프로젝트에 대한 매력을 입증합니다.

로스 아술레스에서는 2023-24 시즌 동안 채워진 드릴링이 자원 등급을 업그레이드하고 고등급 구리 구역을 확인했습니다. 주요 내용은 다음과 같습니다:

- 217미터의 1.11% Cu, 100미터의 1.32% Cu 포함 (AZ24375)

- 276미터의 0.86% Cu, 160미터의 0.96% Cu 포함 (AZ24403)

- 158미터의 0.84% Cu, 78.5미터의 1.10% Cu 포함 (AZ24335)

로스 아술레스 타당성 조사 결과는 2025년 초에 발표될 예정입니다.

McEwen Copper, détenue à 48,3 % par McEwen Mining (NYSE: MUX) (TSX: MUX), annonce d'excitants développements en Argentine. La nouvelle législation du président Milei, le Régime d'Incentives pour Grands Investisseurs (RIGI), offre d'importants incitatifs fiscaux et de change pour les investissements miniers. Une transaction de 4,4 milliards de dollars américains par BHP et Lundin Mining pour acquérir deux gisements de cuivre dans la province de San Juan démontre l'attractivité de l'Argentine pour les projets miniers à grande échelle.

À Los Azules, le forage de remplissage durant la saison 2023-24 a amélioré les catégories de ressources et confirmé une zone de cuivre de haute teneur. Les points forts incluent :

- 217 mètres à 1,11 % Cu, incluant 100 mètres à 1,32 % Cu (AZ24375)

- 276 mètres à 0,86 % Cu, incluant 160 mètres à 0,96 % Cu (AZ24403)

- 158 mètres à 0,84 % Cu, incluant 78,5 mètres à 1,10 % Cu (AZ24335)

L'Étude de Faisabilité de Los Azules est toujours sur la bonne voie pour être livrée au début de 2025.

McEwen Copper, zu 48,3% im Besitz von McEwen Mining (NYSE: MUX) (TSX: MUX), berichtet von spannenden Entwicklungen in Argentinien. Die neue Gesetzgebung von Präsident Milei, das Anreizregime für große Investoren (RIGI), bietet erhebliche Steuer- und Devisenankreize für Bergbauinvestitionen. Eine 4,4-Milliarden-Dollar-Transaktion von BHP und Lundin Mining zur Übernahme zweier Kupferlagerstätten in der Provinz San Juan zeigt die Attraktivität Argentiniens für groß angelegte Bergbauprojekte.

In Los Azules hat die Infill-Bohrung in der Saison 2023-24 die Ressourcenkategorien aufgewertet und eine Hochgrad-Kupferzone bestätigt. Die Höhepunkte umfassen:

- 217 Meter mit 1,11% Cu, darunter 100 Meter mit 1,32% Cu (AZ24375)

- 276 Meter mit 0,86% Cu, darunter 160 Meter mit 0,96% Cu (AZ24403)

- 158 Meter mit 0,84% Cu, darunter 78,5 Meter mit 1,10% Cu (AZ24335)

Die Machbarkeitsstudie für Los Azules ist auf Kurs zur Fertigstellung zu Beginn des Jahres 2025.

- New legislation in Argentina (RIGI) offers significant tax and foreign exchange incentives for mining investments

- US$4.4 billion transaction by BHP and Lundin Mining demonstrates Argentina's attractiveness for large-scale mining projects

- Infill drilling at Los Azules upgraded resource categories and confirmed high-grade copper zone

- Los Azules Feasibility Study on track for delivery in early 2025

- Drill results show significant copper intercepts, including 217m of 1.11% Cu and 276m of 0.86% Cu

- None.

Insights

The recent developments in Argentina's mining sector are highly positive for McEwen Copper and the Los Azules project. President Milei's new legislation, the Incentive Regime for Large Investors (RIGI), is a game-changer for foreign investments in Argentina's mining sector. This policy shift addresses key obstacles that have historically hindered mining development in the country.

The

The infill drilling results at Los Azules are encouraging, confirming high-grade copper zones and potentially upgrading resource categories. Highlights include intercepts of

The recent developments present a bullish outlook for McEwen Mining (NYSE: MUX). The new RIGI legislation in Argentina could significantly improve the economics of the Los Azules project by offering tax and foreign exchange incentives. This policy shift may lead to reduced operational costs and increased profitability for mining operations in the country.

The

The positive drilling results at Los Azules, particularly the confirmation of high-grade zones, could enhance the project's net present value (NPV). As the Feasibility Study progresses, these results may translate into improved project economics, potentially driving MUX's stock price higher. Investors should monitor the completion of the Feasibility Study in early 2025 as a key catalyst for the company.

The infill drilling campaign at Los Azules has yielded impressive results, confirming the geological model and high-grade copper zones. The intercepts, such as 217 meters of

The geological interpretation reveals a complex system of copper-bearing porphyry dikes and hydrothermal breccias cutting through pre-mineral diorite. The supergene enrichment process has created higher grades in the early mineral porphyry and associated breccias, which is favorable for the planned leach pad operation.

Importantly, many drill holes ended in mineralization, indicating potential for depth extension beyond 1,000 meters. This suggests the possibility of expanding the resource in the future. The confirmation of the geological model and the extension of the supergene enrichment zone both laterally and at depth are positive factors that could enhance the project's overall value and mine life.

Infill Drill Highlights:

AZ24375:217 metersof1.11 % Cu, incl.100 metersof1.32 % Cu

AZ24335:158 metersof0.84 % Cu, incl.78.5 metersof1.10 % Cu

AZ24403:276 metersof0.86 % Cu, incl.160 metersof0.96 % Cu

AZ24320:146 metersof0.89 % Cu

AZ24332:119.6 metersof0.72 % Cu

TORONTO, Aug. 08, 2024 (GLOBE NEWSWIRE) -- McEwen Copper Inc.,

- Remarkable new legislation introduced by President Milei to encourage large domestic and foreign investments in the country;

- A US

$4.4 Billion transaction led by BHP, the world’s largest mining company, and Lundin Mining to acquire two copper deposits located in the same province in Argentina as Los Azules; - At Los Azules, infill drilling during the 2023-24 season upgraded the resource categories, validated the geological model and confirmed the high-grade zone. Resource drilling for the Los Azules Feasibility Study is now complete, and the study remains on track for delivery in early 2025.

Remarkable and Welcoming Legislation – Milei Magic

President Milei’s government introduced legislation that has rolled out the welcome mat for large-scale domestic and foreign direct investments in Argentina.

This legislation recently approved by Argentina’s government is called "Bases and Starting Points for the Freedom of Argentines" and includes the Incentive Regime for Large Investors (RIGI), offering significant tax and foreign exchange incentives to encourage domestic and direct foreign investment in key sectors of the economy, including mining.

This program addresses most of all past stumbling blocks for sustained development of the mining sector in Argentina, and it's a huge step in the right direction.

We are excited about these changes as they open the door for many infrastructure investments in Argentina and significantly improve the economics of the Los Azules project and lower risks for investors. Details of the legislation are found in Appendix A - More Information on RIGI and you can click here for the official summary.

US

Last week, BHP, the world’s largest mining company, and Lundin Mining announced a US

We believe that this transaction is a convincing demonstration of San Juan and Argentina´s attractiveness for large-scale mining projects and evidence of Argentina moving towards becoming a Tier 1 mining jurisdiction. Click on these links to read details of the transaction, in press releases by BHP, Lundin Mining, and Filo Corp.

Los Azules Infill Drilling Highlights Confirming High Grade Copper Zone

At Los Azules, infill drilling upgraded the resource categories, validated the geological model and confirmed the high-grade zone. During the 2023-24 drilling season over 70,000 meters (m) were completed, that have strengthened the interpretation of the geological model in addition to extending the supergene enrichment zone mineralization, both at the edges and to depth.

Resource drilling for the Los Azules Feasibility Study is now complete, and the study remains on track for delivery in early 2025.

Drilling Highlights

- Hole AZ24375, drilled to a depth of 369 m, returned 217 m of 1.11 % Cu in the enriched zone, including 100 m of 1.32 % Cu.

- Hole AZ24335, drilled to a depth of 227.5 m, returned a 158 m intercept of

0.84% Cu within the enriched zone, including 78.5 m of 1.10 % Cu. - Hole AZ24403, drilled to a depth of 427 m, returned a 276 m intercept of

0.86% Cu within the enriched zone, including 160 m of 0.96 % Cu. - Hole AZ24320, drilled to a depth of 204 m, returned 146 m of

0.89% Cu in the enriched zone. - Hole AZ24332, drilled to a depth of 255.6 m, returned 119.6 m of

0.72% Cu in the enriched zone.

The 2023-2024 drill campaign successfully achieved its objective of infilling existing drill hole data to support the conversion of resources to Measured or Indicated Mineral Resources to include in the Los Azules Feasibility Study. In addition, geotechnical, metallurgical, hydrogeological and condemnation drilling was carried out.

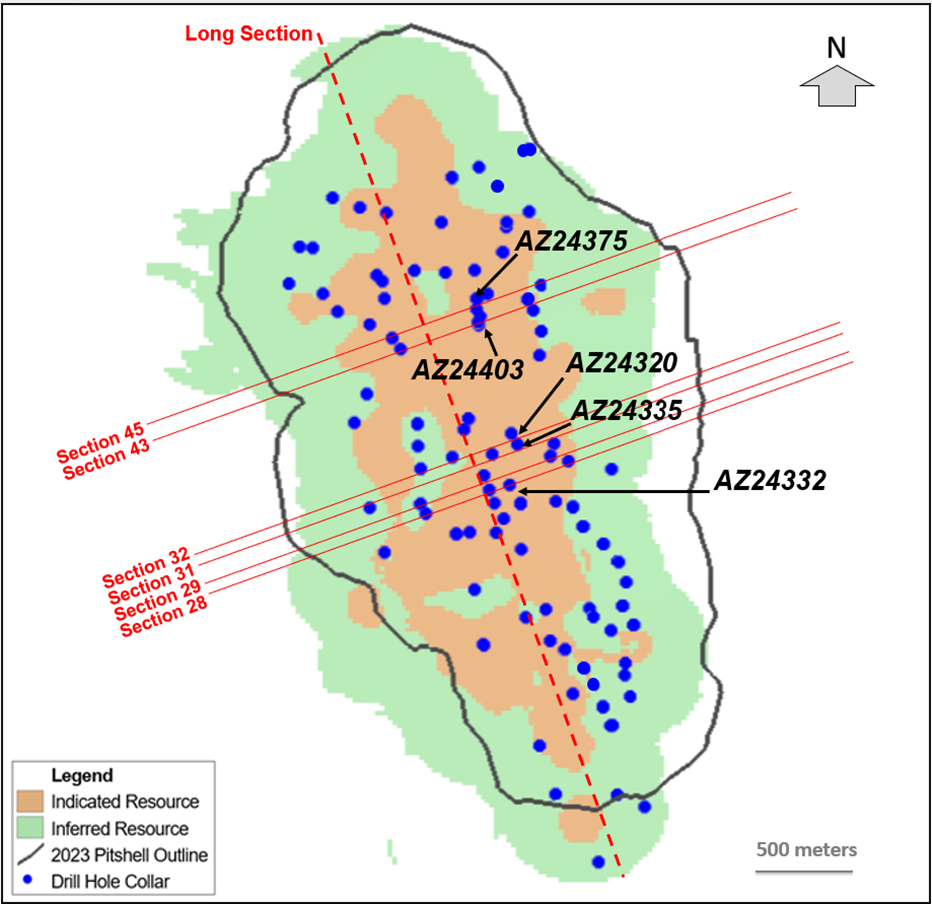

The locations of the highlighted results are presented in 8 figures. A plan or aerial view of the resources and the outline of the PEA pit are shown in Figure 1. Figures 2 to 7 show recent drilling in relation to the overburden, the leached, enriched and primary zones, and the 30-year pit shell of the 2023 Preliminary Economic Assessment (PEA) (marked by the green line in the sections). Figure 8 represents a cross section with recent drill data and inferred geology.

Drill results and location information for this press release are available in Appendix B - Detailed Data From the 2023-2024 Drilling Campaign at Los Azules.

Figure 1 shows a plan view of the location of the sections and drill holes reported in this press release. All cross sections are 50 m equidistant from each other, with the lowest numbered section starting from the southern end of the deposit. Shown in blue are the collars of the drill holes included in this news release.

Figure 1 – Plan View Location of Cross-sections and Drill Holes Reported in This News Release

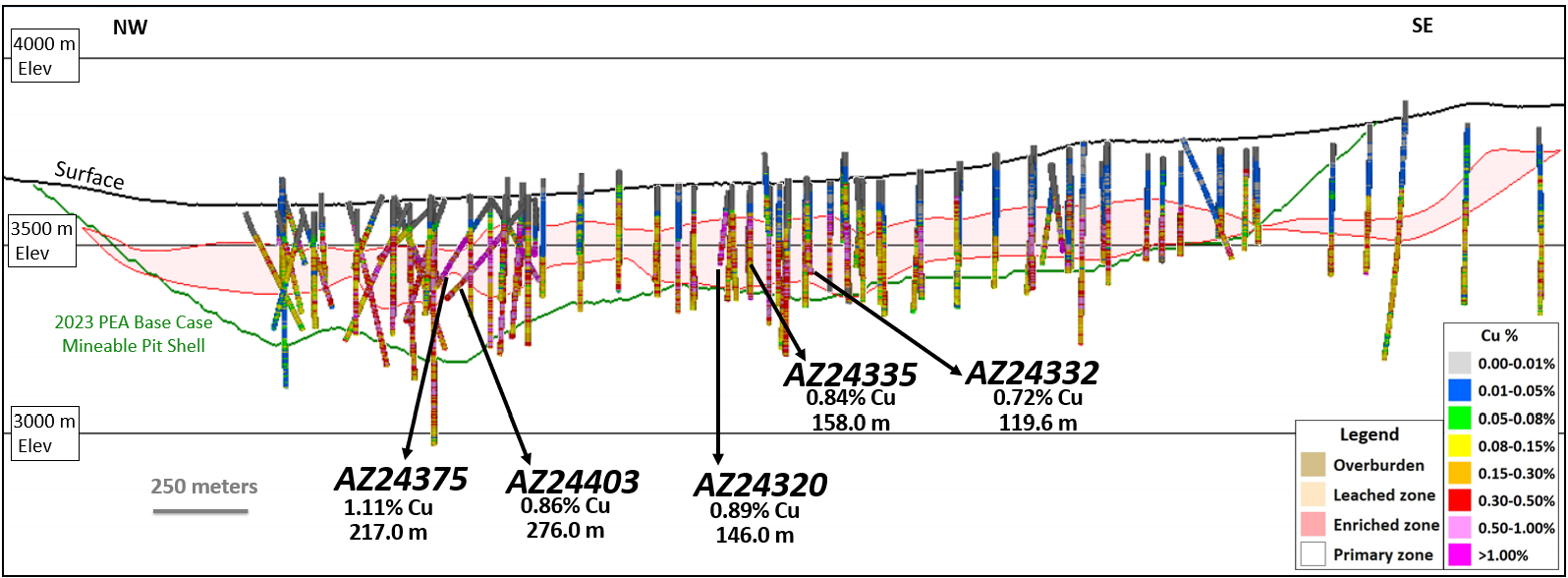

The section marked on Figure 1 by the red dashed line is presented in Figure 2 as the longitudinal view looking northeast and indicating the location of the reported holes. Note the position of the highlighted holes within the zone of enriched (or supergene) mineralization and how they mostly ended in mineralized material, indicating the potential for mineralization to continue at depth. The length of the enriched zone on this section is 3.9 kilometers. The enriched zone now continues beyond the southern limit of the PEA mineable pit shell.

Figure 2 - Longitudinal Section (Looking Northeast)

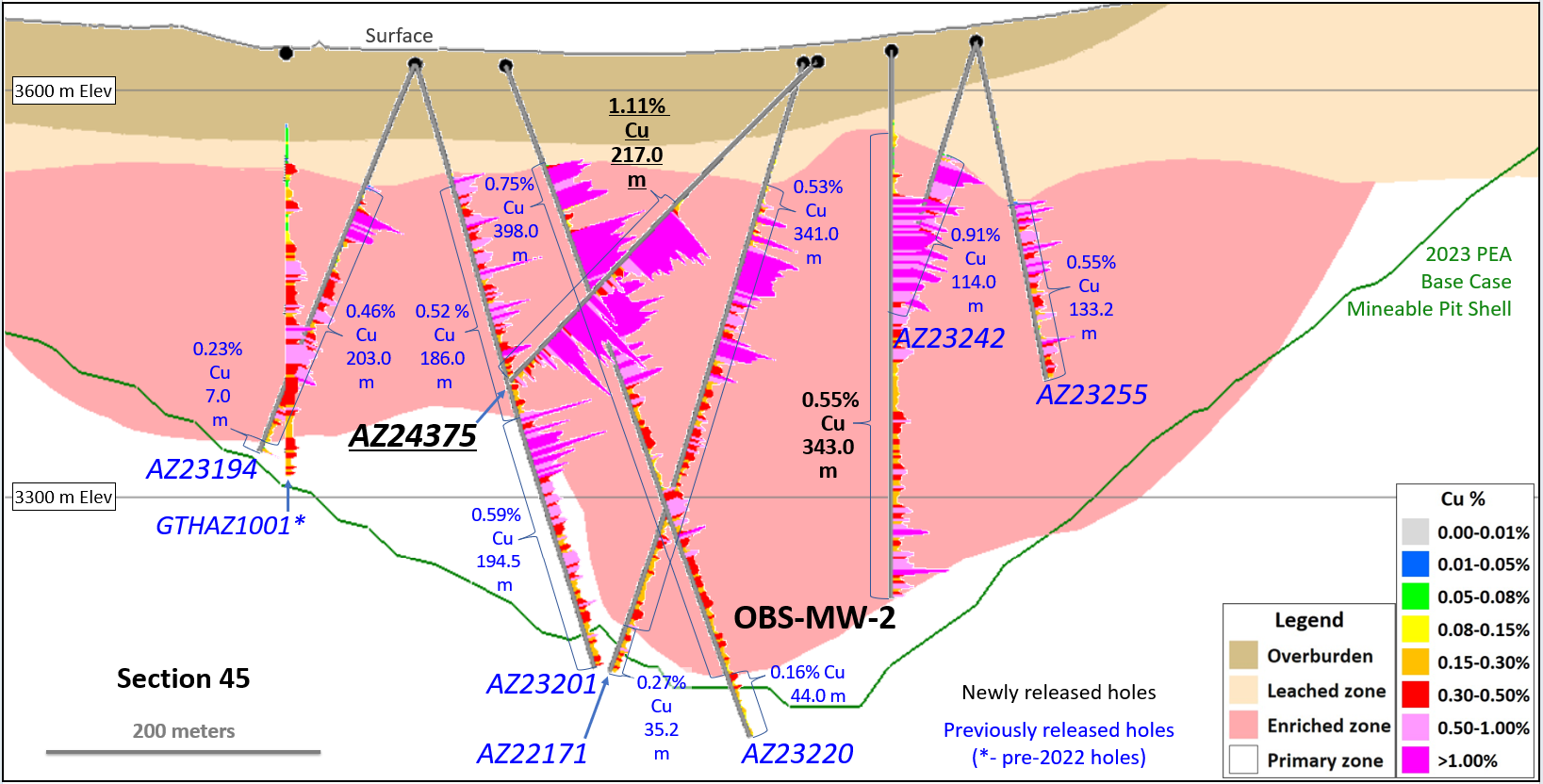

Figure 3 shows a 217 m intercept of 1.11 % Cu (AZ24375) and includes a 100 m interval of

Figure 3 - Section 45 - Drilling, Mineralized Zones and 30-Year PEA Pitshell (Looking Northwest)

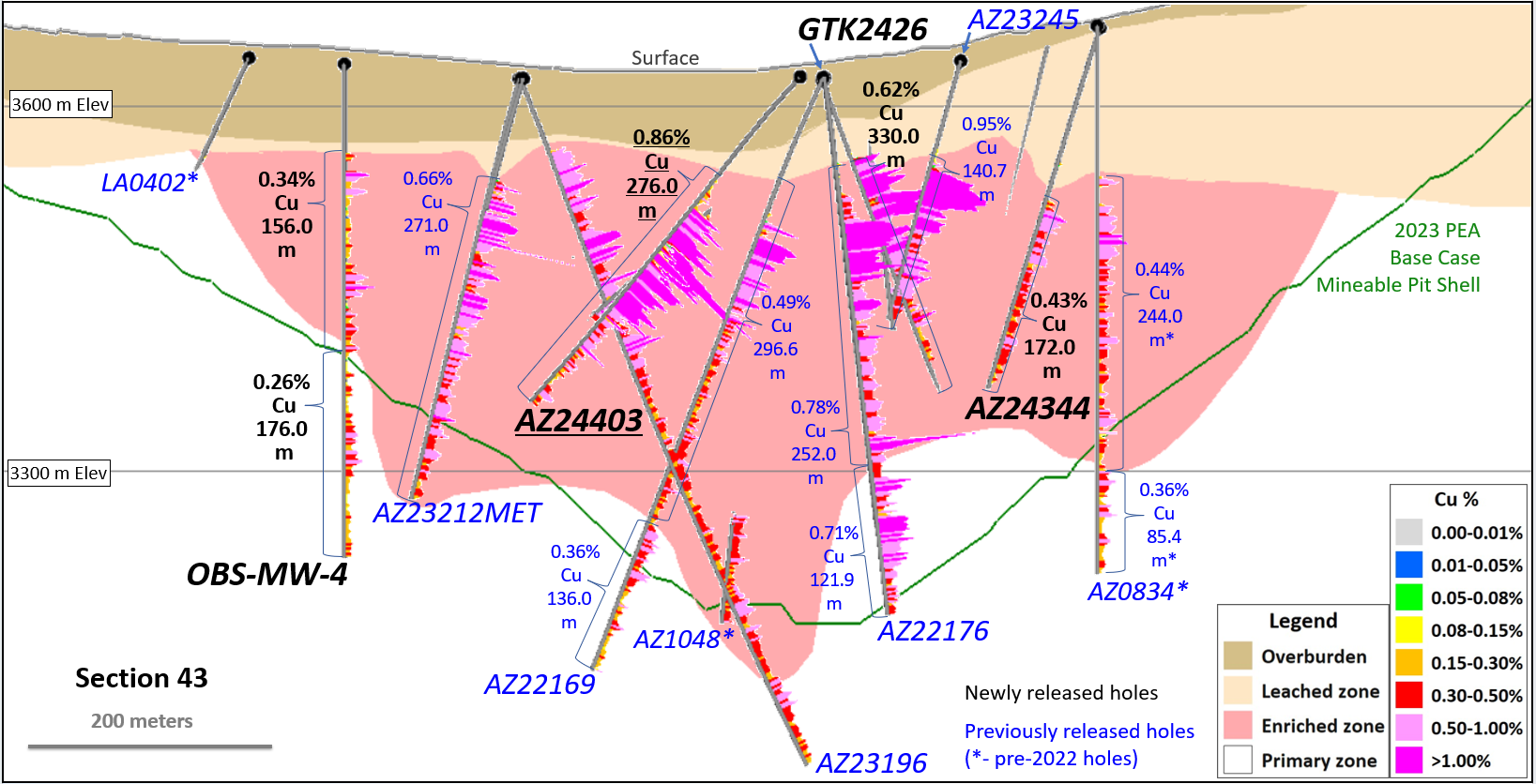

Figure 4 shows an intercept of 276 m of 0.86 % Cu (AZ24403) that includes 160 m of

Figure 4 - Section 43 - Drilling, Mineralized Zones and 30-Year PEA Pitshell (Looking Northwest)

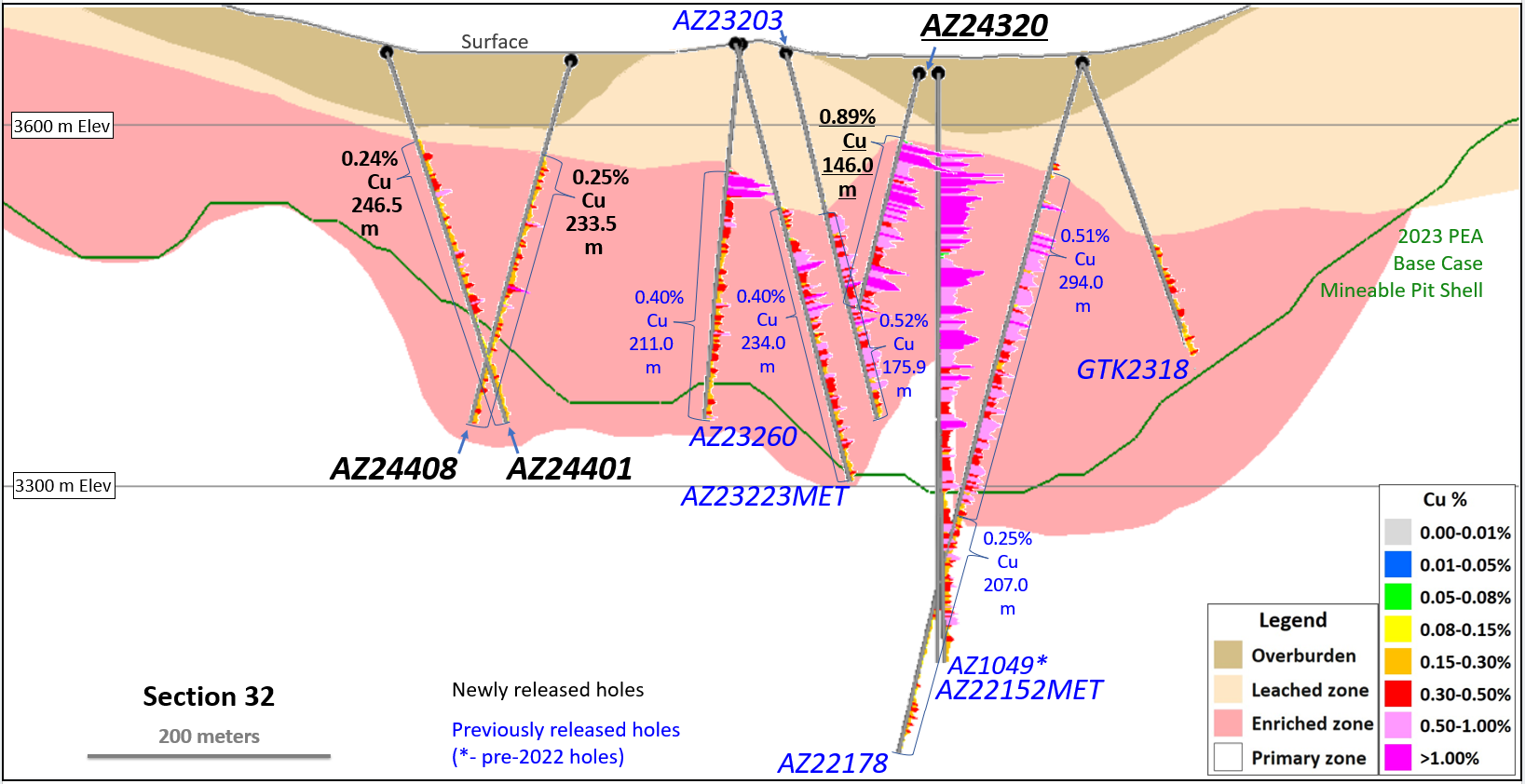

Figure 5 shows a 146 m intercept of 0.89 % Cu (AZ24320). The drill hole extends high grade mineralization to the west of a previously drilled hole (AZ22152MET).

Figure 5 - Section 32 - Drilling, Mineralized Zones and 30-Year PEA Pitshell (Looking Northwest)

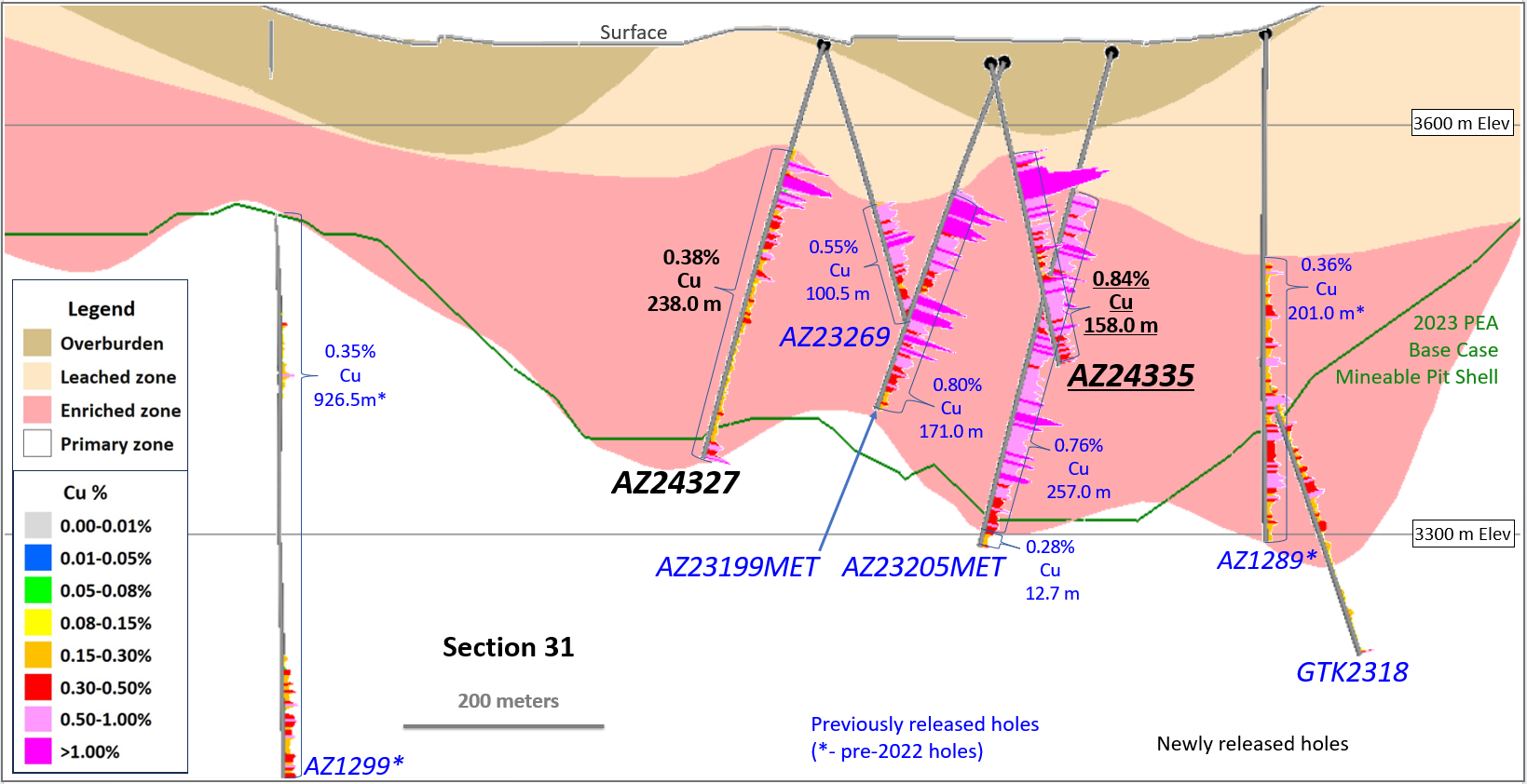

Figure 6 shows an intercept of 158 m of 0.84 % Cu (AZ24335) that includes 78.5 m of

Figure 6 - Section 31 - Drilling, Mineralized Zones and 30-Year PEA Pitshell (Looking Northwest)

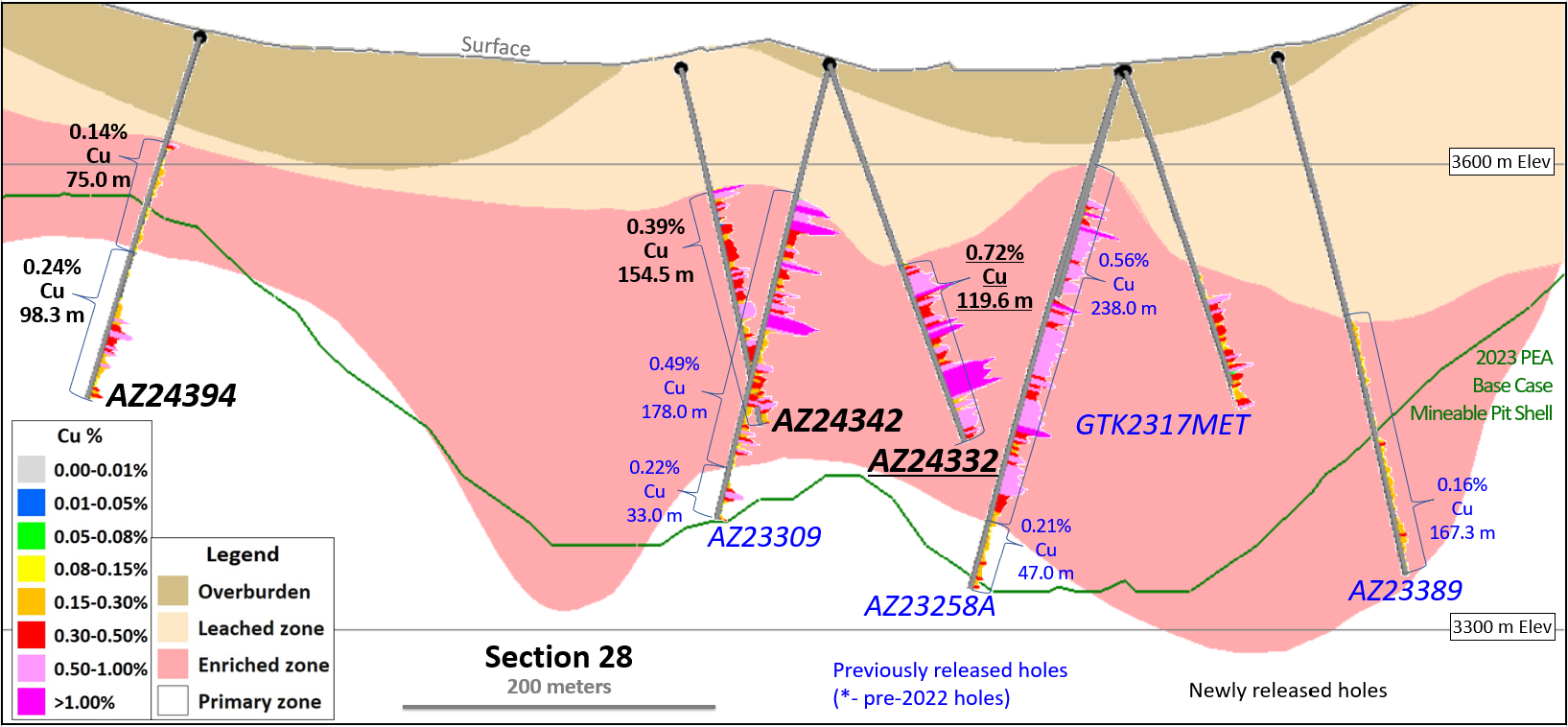

Figure 7 shows a 119.6 m intercept of 0.72 % Cu (AZ24332) in the enriched zone. This hole extends the higher-grade mineralization seen previously in AZ23309 in the central portion of the enriched zone towards the east and at depth.

Figure 7 - Section 28 - Drilling, Mineralized Zones and 30-Year PEA Pitshell (Looking Northwest)

Geological Model - Interpretation and Its Relationship with the Copper Mineralization

Geological understanding of the Los Azules deposit has increased significantly with the drilling performed from 2022 to 2024. A series of copper-bearing early and inter-mineral porphyry dikes and hydrothermal magmatic breccias are cutting across a pre-mineral diorite intrusive. The dikes dip steeply to the east in their northwest-southeast orientations.

All rock types contain variable copper mineralization, depending on their position within the deposit’s vertical profile. From top to bottom, the zoning includes leached, supergene (enriched) and primary (hypogene), which are characteristic of many porphyry copper deposits worldwide.

Hypogene mineralization, associated with the early mineral porphyry and proximal host rock, is characterized by a stockwork of abundant type A veinlets containing quartz, pyrite, and chalcopyrite. In much of the deposit’s footprint, mineralization encountered at depth strongly indicates the potential to extend further, beyond 1,000 meters.

The supergene copper enrichment process created higher grades in the early mineral porphyry and associated hydrothermal magmatic breccias, and lower grades in the less permeable pre-mineral pluton and inter-mineral porphyries. The supergene mineralization will be the principal mineral feed for the leach pad for the Feasibility Study.

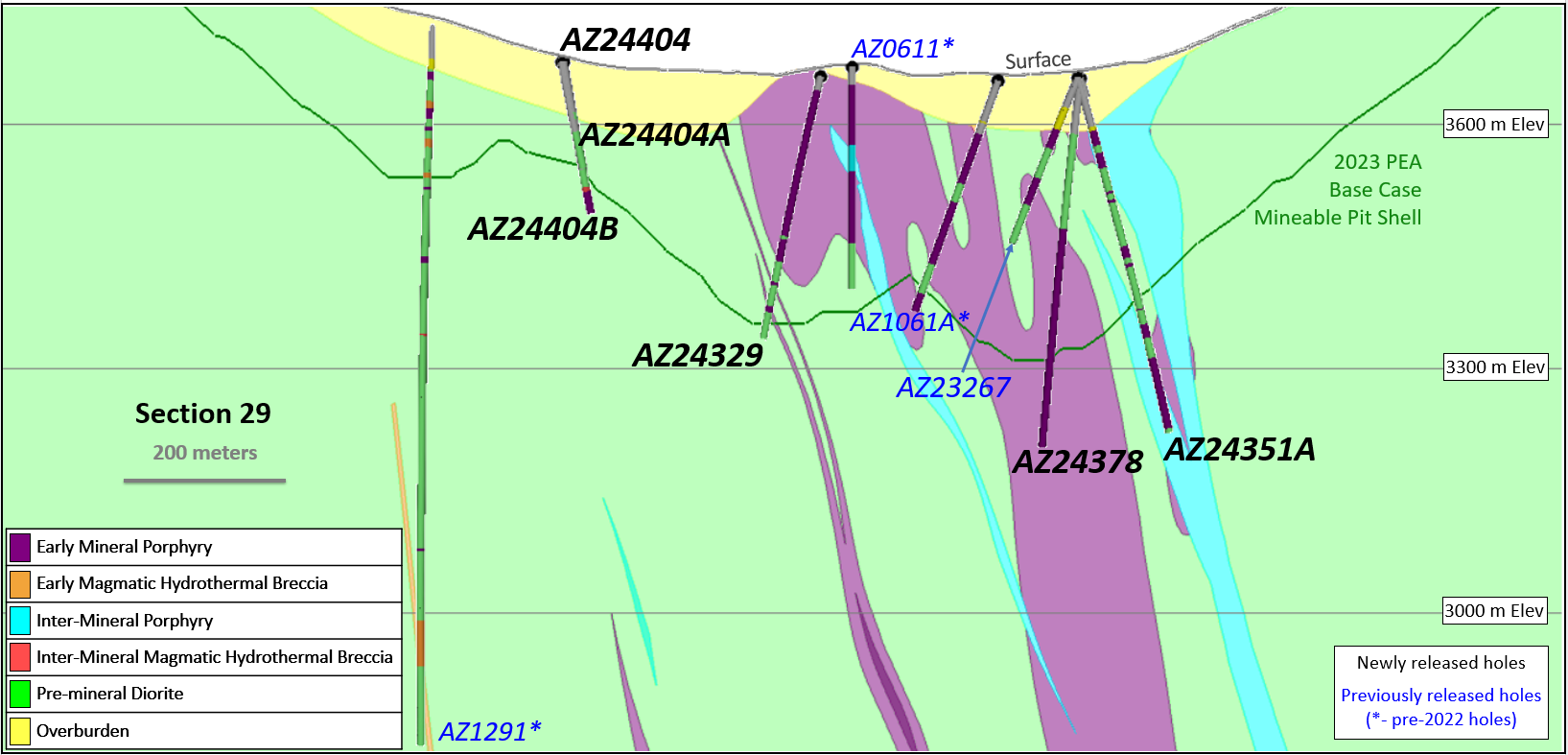

In Figure 8 Section 29 shows, in its central part, the early mineral porphyry (purple color) intruding or cutting the pre-mineral diorite (light green color). To a lesser extent, thin inter-mineral porphyry dikes (light blue color), affect both the early mineral porphyry and the pre-mineral diorite. The early mineral porphyry is the primary source of copper mineralization in the deposit.

Figure 8 - Recent Drill Data and Inferred Geology in Cross Section 29

Technical Information

The technical content of this press release has been reviewed and approved by Darren King, Director of Exploration of McEwen Copper, who serves as the qualified person (QP) under the definitions of National Instrument 43-101.

All tasks, including the collection of samples for geochemical analysis, were carried out in accordance with generally accepted mining industry standards. Drill core samples were analyzed by Alex Stewart International laboratory, located in the Province of Mendoza, Argentina, whose assays consisted of: gold analysis by fire fusion assay and an atomic absorption spectroscopy finish (Au4-30); multiple element studies by ICP-OES analysis (ICP-AR 39); determination of copper content by sequential copper analysis (Cu-Sequential LMC-140). In addition, and for samples with high sulfide content (Cu, Ag, Pb and Zn) and exceeding the limits of analysis, an ICP-ORE type analysis was performed.

The company is conducting a quality control/assurance program in accordance with NI 43-101, and industry best practices, using a combination of standards and blanks on approximately one out of every 25 samples. Results are monitored as final certificates are received and any re-assay requests are sent immediately. Analysis of pulp and preparation samples is also performed as part of the quality control process. Approximately

ABOUT MCEWEN COPPER

McEwen Copper is a well-funded, private company that owns

Los Azules is being designed to be distinctly different from a conventional copper mine by consuming significantly less water, emitting much lower carbon, progressing towards carbon neutral by 2038, and being powered by

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with operations in Nevada, Canada, Mexico, and Argentina. McEwen Mining also owns a

Appendix A

- More Information on RIGI -

The RIGI grants a series of benefits in tax, customs and foreign exchange regulations for investment projects in the mining sector that comply with the requirements set up by the law.

The main requirements for beneficiaries of RIGI are as follows:

- The amount for an investment to qualify within the regime will be >US

$200 million , as determined for different industries by the regulations. - Export projects with investments greater than US

$1 billion are considered strategic and have additional benefits. - At least

40% of the minimum amount must be invested in the first two years. - The regime will be open to applications for 2 years. The application period can be extended for 1 more year. The investment can be completed after the application period.

- The use of incentives may require collateral.

The Los Azules project is believed to be able to meet all criteria to be considered a strategic project under the terms of the RIGI legislation.

The main benefits to the beneficiaries of the RIGI are the following:

1. Income Tax

- Corporate income tax rate is reduced from the current

35% to25% . - Equipment is subject to accelerated depreciation in 2 years, and infrastructure and cost of mine in

60% of its useful life. - Net Operating Losses (NOLs) can be carried forward without a time limit. After a 5-year carry forward, NOLs can be transferred (sold) to third parties. NOLs are adjusted for inflation.

- Interest is deductible without limitations during the first 5 years even when the lender is foreign related party.

- Dividend payments are subject to tax at

7% , which will be reduced to3.5% after 7 years. - In the case of Strategic Export projects, payments to foreign beneficiaries for technical assistance are not subject to withholding tax. Other payments to foreign beneficiaries are capped at

10.5% withholding with no grossing up.

2. Value Added Tax (VAT)

- Rather than paying VAT on purchases, the beneficiaries of the RIGI will provide its suppliers with Tax Credit Certificates. The Tax Credit Certificates can also be used to pay the VAT generated by imports of equipment. This prevents from tying up funds as VAT credits to be recovered against future exports. Implementation of this benefit will require extensive regulation.

- Suppliers may use the certificates to offset their VAT obligations and, if there is a VAT credit left to recover, they may transfer (sell) the VAT credit to third parties.

3. Other Taxes

- The beneficiaries of the regimen will have a

100% tax credit for the amounts paid for Bank Transactions Tax to offset the income tax obligations. - Provinces and Municipalities cannot establish new taxes affecting the projects, except for service fees that do not exceed the cost of the service provided to the beneficiary.

4. Imports

- Freedom to import without quotas or restrictions.

- Exemption from import duties on capital goods, spare parts, parts, components and consumables.

5. Exports

- Freedom to export the products produced by the project.

- Exemption from export duties after three years of registration. The exemption applies for two years in Strategic Export projects.

- Maximum Principal gross revenue royalty of

5% (at the discretion of the Province).

6. Foreign Exchange Regime

- Foreign proceeds from exports are freely available:

20% of proceeds after two years of the commencement of production;40% after three years, and100% after four years onwards. - In the case of a Strategic Export project, the foreign proceeds are freely available as follows:

20% of proceeds after one year of the commencement of production;40% after two years, and100% after three years onwards. - Foreign proceeds from external financing are freely available. Foreign assets abroad do not generate foreign exchange restrictions.

- Free access to the foreign exchange market for the repayment of loans, repatriation of investments, payment of interests and dividends, conditional on the investment or loan having been entered through the exchange market.

7. Stability Safeguards

Beneficiaries are also granted tax, customs and foreign exchange stability for 30 years from joining the RIGI. In the case of Strategic Export projects developed in stages, stability can be extended up to 40 years from the commencement of production of the first stage.

The safeguards offered by the stability have these main features:

- Tax stability applies by tax and not by total tax burden. It also applies to withholding taxes on payments to foreign beneficiaries. In the event of an increase in taxes, the beneficiaries of the regimen may reject the payment of the tax exceeding stability or pay the tax and use the amount of the tax paid as a tax credit against any other national tax. A breach of stability is presumed (it is not necessary to prove it) if it comes from a legal or regulatory change. In the case of tax reduction, the beneficiaries can automatically take advantage of it.

- Customs stability includes a mechanism that allows the beneficiaries to make a manual self-assessment applying the stabilized duties instead of the automatic calculation by the customs system.

- Foreign exchange stability protects against regulations imposing more burdensome or restrictive conditions. The law allows beneficiaries to reject the application of the new rule. The Central Bank cannot initiate criminal proceedings without first carrying out a process to determine whether the exchange stability applies to the case.

Dispute Resolution

- Disputes can be resolved by administrative proceedings or international arbitration outside Argentina. Arbitration can be initiated, even if the administrative procedure has not been completed.

- The arbitration is to be done outside of Argentina, under the rules of the PCA, ICC or ICSID, with arbitrators who are neither Argentine nor nationals of the investor's country.

Appendix B

- Detailed Data From the 2023-2024 Drilling Campaign at Los Azules -

Table 1 – Recent Los Azules Drilling Results

| Hole-ID | Section | Predominant Mineral Zone | From (m) | To (m) | Length (m) | Cu (%) | Au (g/t) | Ag (g/t) | Comment |

| AZ24316 | 26 | Total | 111.0 | 315.5 | 204.5 | 0.63 | 0.05 | 1.23 | |

| Enriched | 111.0 | 293.0 | 182.0 | 0.64 | 0.05 | 1.22 | Incl. 123 m of | ||

| Primary | 293.0 | 315.5 | 22.5 | 0.26 | 0.00 | 1.70 | |||

| AZ24317 | 56 | Total | 107.0 | 305.0 | 198.0 | 0.18 | 0.03 | 0.61 | |

| Enriched | 107.0 | 305.0 | 198.0 | 0.18 | 0.03 | 0.61 | |||

| Primary | |||||||||

| AZ24318MET | 50 | Total | 124.0 | 229.5 | 105.5 | 0.70 | 0.05 | 2.53 | |

| Enriched | 124.0 | 229.5 | 105.5 | 0.70 | 0.05 | 2.53 | Incl. 12 m of | ||

| Primary | |||||||||

| AZ24319 | 35 | Total | 160.0 | 355.0 | 195.0 | 0.45 | 0.04 | 0.96 | |

| Enriched | 160.0 | 332.0 | 172.0 | 0.48 | 0.04 | 1.04 | Incl. 84 m of | ||

| Primary | 332.0 | 355.0 | 23.0 | 0.27 | 0.03 | 0.36 | |||

| AZ24320 | 32 | Total | 58.0 | 204.0 | 146.0 | 0.89 | 0.05 | 1.67 | |

| Enriched | 58.0 | 204.0 | 146.0 | 0.89 | 0.05 | 1.67 | |||

| Primary | |||||||||

| AZ24321 | 30 | Total | 117.0 | 389.8 | 272.8 | 0.60 | 0.05 | 1.32 | |

| Enriched | 117.0 | 389.8 | 272.8 | 0.60 | 0.05 | 1.32 | Incl. 12 m of | ||

| Primary | |||||||||

| AZ24322 | 44 | Total | 144.0 | 491.0 | 347.0 | 0.43 | 0.06 | 1.78 | |

| Enriched | 144.0 | 491.0 | 347.0 | 0.43 | 0.06 | 1.78 | Incl. 130 m of | ||

| Primary | |||||||||

| AZ24323 | 26 | Total | 86.0 | 184.6 | 98.6 | 0.19 | 0.01 | 0.64 | |

| Enriched | 86.0 | 184.6 | 98.6 | 0.19 | 0.01 | 0.64 | |||

| Primary | |||||||||

| AZ24324 | 34 | Total | 108.0 | 343.0 | 235.0 | 0.37 | 0.02 | 0.36 | |

| Enriched | 108.0 | 322.0 | 214.0 | 0.40 | 0.02 | 0.37 | Incl. 12 m of | ||

| Primary | 322.0 | 343.0 | 21.0 | 0.12 | 0.02 | 0.30 | |||

| AZ24325 | 25 | Total | 76.0 | 338.0 | 262.0 | 0.19 | 0.02 | 0.65 | |

| Enriched | 76.0 | 266.0 | 190.0 | 0.21 | 0.02 | 0.65 | |||

| Primary | 266.0 | 338.0 | 72.0 | 0.14 | 0.02 | 0.64 | |||

| AZ24326 | 26 | Total | 108.0 | 331.0 | 223.0 | 0.42 | 0.05 | 1.30 | |

| Enriched | 108.0 | 256.0 | 148.0 | 0.52 | 0.07 | 1.47 | Incl. 57.7 m of | ||

| Primary | 256.0 | 331.0 | 75.0 | 0.23 | 0.03 | 0.95 | |||

| AZ24327 | 31 | Total | 78.0 | 316.0 | 238.0 | 0.38 | 0.03 | 1.10 | |

| Enriched | 78.0 | 316.0 | 238.0 | 0.38 | 0.03 | 1.10 | |||

| Primary | |||||||||

| AZ24328 | 48 | Total | 126.0 | 231.0 | 105.0 | 0.08 | 0.02 | 1.13 | |

| Enriched | 126.0 | 231.0 | 105.0 | 0.08 | 0.02 | 1.13 | |||

| Primary | |||||||||

| AZ24329 | 29 | Total | 90.0 | 332.0 | 242.0 | 0.24 | 0.03 | 0.89 | |

| Enriched | 90.0 | 290.0 | 200.0 | 0.25 | 0.03 | 0.96 | |||

| Primary | 290.0 | 332.0 | 42.0 | 0.17 | 0.02 | 0.56 | |||

| AZ24330 | 56 | Total | 164.0 | 185.0 | 21.0 | 0.70 | 0.03 | 1.26 | |

| Enriched | 164.0 | 185.0 | 21.0 | 0.70 | 0.03 | 1.26 | |||

| Primary | |||||||||

| AZ24332 | 28 | Total | 136.0 | 255.6 | 119.6 | 0.72 | 0.06 | 1.72 | |

| Enriched | 136.0 | 255.6 | 119.6 | 0.72 | 0.06 | 1.72 | |||

| Primary | |||||||||

| AZ24334 | 48 | Total | 104.0 | 657.0 | 553.0 | 0.42 | 0.07 | 2.94 | |

| Enriched | 104.0 | 412.0 | 308.0 | 0.50 | 0.08 | 3.53 | Incl. 60 m of | ||

| Primary | 412.0 | 657.0 | 245.0 | 0.32 | 0.06 | 2.21 | |||

| AZ24335 | 31 | Total | 69.5 | 227.5 | 158.0 | 0.84 | 0.10 | 0.98 | |

| Enriched | 69.5 | 227.5 | 158.0 | 0.84 | 0.10 | 0.98 | Incl. 78.5 m of | ||

| Primary | |||||||||

| AZ24336CC | 8a | Total | 218.0 | 501.0 | 283.0 | 0.20 | 0.08 | 1.93 | |

| Enriched | 218.0 | 370.0 | 152.0 | 0.25 | 0.14 | 2.76 | |||

| Primary | 370.0 | 501.0 | 131.0 | 0.14 | 0.02 | 0.91 | |||

| AZ24338 | 5a | Total | 252.0 | 729.5 | 477.5 | 0.19 | 0.02 | 0.88 | |

| Enriched | 252.0 | 490.0 | 238.0 | 0.23 | 0.04 | 0.97 | |||

| Primary | 490.0 | 729.5 | 239.5 | 0.14 | 0.01 | 0.78 | |||

| AZ24339CC | 12a | Total | 140.0 | 517.5 | 377.5 | 0.16 | 0.02 | 0.68 | |

| Enriched | 140.0 | 470.0 | 330.0 | 0.17 | 0.02 | 0.67 | |||

| Primary | 470.0 | 517.5 | 47.5 | 0.11 | 0.01 | 0.74 | |||

| AZ24340 | 26 | Total | 66.0 | 300.5 | 234.5 | 0.50 | 0.04 | 1.04 | |

| Enriched | 66.0 | 300.5 | 234.5 | 0.50 | 0.04 | 1.04 | Incl. 72 m of | ||

| Primary | |||||||||

| AZ24341 | 48 | Total | 87.0 | 261.5 | 174.5 | 0.57 | 0.07 | 1.09 | |

| Enriched | 87.0 | 261.5 | 174.5 | 0.57 | 0.07 | 1.09 | |||

| Primary | |||||||||

| AZ24342 | 28 | Total | 81.0 | 235.5 | 154.5 | 0.39 | 0.05 | 2.82 | |

| Enriched | 81.0 | 235.5 | 154.5 | 0.39 | 0.05 | 2.82 | |||

| Primary | |||||||||

| AZ24343 | 58 | Total | 71.0 | 365.6 | 294.6 | 0.17 | 0.01 | 0.67 | |

| Enriched | 71.0 | 344.0 | 273.0 | 0.18 | 0.01 | 0.70 | |||

| Primary | 344.0 | 365.6 | 21.6 | 0.07 | 0.00 | 0.30 | |||

| AZ24344 | 43 | Total | 140.0 | 312.0 | 172.0 | 0.43 | 0.05 | 1.50 | |

| Enriched | 140.0 | 312.0 | 172.0 | 0.43 | 0.05 | 1.50 | Incl. 52 m of | ||

| Primary | |||||||||

| AZ24345 | 44 | Total | 80.7 | 291.2 | 210.5 | 0.37 | 0.02 | 1.98 | |

| Enriched | 80.7 | 190.0 | 109.3 | 0.55 | 0.02 | 1.68 | Incl. 66 m of | ||

| Primary | 190.0 | 291.2 | 101.2 | 0.17 | 0.02 | 2.31 | |||

| AZ24346 | 40 | Total | 44.0 | 196.6 | 152.6 | 0.06 | 0.00 | 0.64 | |

| Enriched | 44.0 | 100.0 | 56.0 | 0.07 | 0.00 | 0.33 | |||

| Primary | 100.0 | 196.6 | 96.6 | 0.06 | 0.00 | 0.83 | |||

| AZ24347 | 14 | Total | 88.0 | 295.8 | 207.8 | 0.30 | 0.05 | 0.90 | |

| Enriched | 88.0 | 286.0 | 198.0 | 0.30 | 0.05 | 0.94 | |||

| Primary | 286.0 | 295.8 | 9.8 | 0.15 | 0.06 | 0.30 | |||

| AZ24348 | 40 | Total | 168.0 | 373.7 | 205.7 | 0.20 | 0.01 | 0.56 | |

| Enriched | 168.0 | 373.7 | 205.7 | 0.20 | 0.01 | 0.56 | |||

| Primary | |||||||||

| AZ24349 | 22 | Total | 98.0 | 356.0 | 258.0 | 0.44 | 0.04 | 1.27 | |

| Enriched | 98.0 | 339.4 | 241.4 | 0.46 | 0.04 | 1.31 | Incl. 84 m of | ||

| Primary | 339.4 | 356.0 | 16.6 | 0.20 | 0.03 | 0.63 | |||

| AZ24350 | 30 | Total | 96.0 | 224.0 | 128.0 | 0.10 | 0.02 | 1.01 | |

| Enriched | 96.0 | 154.0 | 58.0 | 0.12 | 0.03 | 1.21 | |||

| Primary | 154.0 | 224.0 | 70.0 | 0.08 | 0.02 | 0.85 | |||

| AZ24351A | 29 | Total | 110.0 | 449.4 | 339.4 | 0.29 | 0.03 | 1.52 | |

| Enriched | 110.0 | 400.0 | 290.0 | 0.31 | 0.03 | 1.69 | |||

| Primary | 400.0 | 449.4 | 49.4 | 0.12 | 0.01 | 0.51 | |||

| AZ24352 | 12 | Total | 168.3 | 379.3 | 211.0 | 0.34 | 0.05 | 0.67 | |

| Enriched | 168.3 | 358.0 | 189.7 | 0.36 | 0.05 | 0.56 | |||

| Primary | 358.0 | 379.3 | 21.3 | 0.13 | 0.03 | 1.62 | |||

| AZ24353 | 46 | Total | 90.0 | 338.5 | 248.5 | 0.35 | 0.04 | 1.85 | |

| Enriched | 90.0 | 320.0 | 230.0 | 0.37 | 0.04 | 1.96 | |||

| Primary | 320.0 | 338.5 | 18.5 | 0.12 | 0.00 | 0.52 | |||

| AZ24354 | 42 | Total | 194.0 | 331.0 | 137.0 | 0.14 | 0.01 | 0.71 | |

| Enriched | 194.0 | 331.0 | 137.0 | 0.14 | 0.01 | 0.71 | |||

| Primary | |||||||||

| AZ24355 | 56 | Total | 84.5 | 288.5 | 204.0 | 0.23 | 0.01 | 0.87 | |

| Enriched | 84.5 | 288.5 | 204.0 | 0.23 | 0.01 | 0.87 | |||

| Primary | |||||||||

| AZ24356 | 56 | Total | 51.0 | 205.5 | 154.5 | 0.70 | 0.15 | 3.79 | |

| Enriched | 51.0 | 108.0 | 57.0 | 0.17 | 0.04 | 1.43 | |||

| Primary | 108.0 | 205.5 | 97.5 | 1.01 | 0.21 | 5.14 | Incl. 30 m of | ||

| AZ24357 | 22 | Total | 152.0 | 386.0 | 234.0 | 0.21 | 0.02 | 2.51 | |

| Enriched | 152.0 | 302.0 | 150.0 | 0.24 | 0.02 | 0.45 | |||

| Primary | 302.0 | 386.0 | 84.0 | 0.17 | 0.02 | 6.18 | |||

| AZ24358 | 36 | Total | 70.2 | 264.5 | 194.3 | 0.23 | 0.01 | 0.57 | |

| Enriched | 70.2 | 188.0 | 117.8 | 0.18 | 0.01 | 0.53 | |||

| Primary | 188.0 | 264.5 | 76.5 | 0.31 | 0.00 | 0.62 | |||

| AZ24360 | 24 | Total | 84.0 | 335.5 | 251.5 | 0.21 | 0.02 | 0.89 | |

| Enriched | 84.0 | 258.0 | 174.0 | 0.25 | 0.02 | 0.87 | |||

| Primary | 258.0 | 335.5 | 77.5 | 0.12 | 0.02 | 0.93 | |||

| AZ24361 | 12 | Total | 220.0 | 335.2 | 115.2 | 0.42 | 0.06 | 1.37 | |

| Enriched | 220.0 | 308.0 | 88.0 | 0.49 | 0.07 | 1.35 | Incl. 28 m of | ||

| Primary | 308.0 | 335.2 | 27.2 | 0.17 | 0.03 | 1.45 | |||

| AZ24362 | 34 | Total | 76.0 | 309.0 | 233.0 | 0.34 | 0.01 | 1.01 | |

| Enriched | 76.0 | 309.0 | 233.0 | 0.34 | 0.01 | 1.01 | |||

| Primary | |||||||||

| AZ24363 | 48 | Total | 96.0 | 335.6 | 239.6 | 0.18 | 0.01 | 0.71 | |

| Enriched | 96.0 | 250.0 | 154.0 | 0.20 | 0.00 | 0.57 | |||

| Primary | 250.0 | 335.6 | 85.6 | 0.14 | 0.01 | 0.96 | |||

| AZ24364 | 51 | Total | 92.0 | 215.4 | 123.4 | 0.21 | 0.03 | 0.82 | |

| Enriched | 92.0 | 215.4 | 123.4 | 0.21 | 0.03 | 0.82 | |||

| Primary | |||||||||

| AZ24365 | 55 | Total | 118.0 | 291.5 | 173.5 | 0.40 | 0.01 | 1.32 | |

| Enriched | 118.0 | 291.5 | 173.5 | 0.40 | 0.01 | 1.32 | Incl. 10 m of | ||

| Primary | |||||||||

| AZ24366 | 22 | Total | 182.0 | 328.2 | 146.2 | 0.17 | 0.02 | 0.78 | |

| Enriched | 182.0 | 298.0 | 116.0 | 0.19 | 0.02 | 0.91 | |||

| Primary | 298.0 | 328.2 | 30.2 | 0.10 | 0.01 | 0.25 | |||

| AZ24367 | 50 | Total | 94.0 | 433.5 | 339.5 | 0.32 | 0.05 | 1.30 | |

| Enriched | 94.0 | 400.0 | 306.0 | 0.32 | 0.06 | 1.30 | |||

| Primary | 400.0 | 433.5 | 33.5 | 0.26 | 0.04 | 1.34 | |||

| AZ24368 | 4 | Total | 138.0 | 220.5 | 82.5 | 0.21 | 0.03 | 0.52 | |

| Enriched | 138.0 | 220.5 | 82.5 | 0.21 | 0.03 | 0.52 | |||

| Primary | |||||||||

| AZ24369A | 48 | Total | 122.0 | 248.0 | 126.0 | 0.61 | 0.05 | 1.14 | |

| Enriched | 122.0 | 248.0 | 126.0 | 0.61 | 0.05 | 1.14 | Incl. 58 m of | ||

| Primary | |||||||||

| AZ24370 | 8 | Total | 156.0 | 290.0 | 134.0 | 0.39 | 0.04 | 0.53 | |

| Enriched | 156.0 | 262.0 | 106.0 | 0.44 | 0.05 | 0.60 | Incl. 20 m of | ||

| Primary | 262.0 | 290.0 | 28.0 | 0.22 | 0.04 | 0.25 | |||

| AZ24371 | 36 | Total | 98.0 | 302.1 | 204.1 | 0.31 | 0.03 | 0.74 | |

| Enriched | 98.0 | 290.0 | 192.0 | 0.32 | 0.03 | 0.77 | |||

| Primary | 290.0 | 302.1 | 12.1 | 0.16 | 0.00 | 0.25 | |||

| AZ24372 | 10 | Total | 155.7 | 298.2 | 142.5 | 0.38 | 0.06 | 0.99 | |

| Enriched | 155.7 | 298.2 | 142.5 | 0.38 | 0.06 | 0.99 | |||

| Primary | |||||||||

| AZ24373 | 54 | Total | 120.0 | 291.5 | 171.5 | 0.22 | 0.00 | 0.71 | |

| Enriched | 120.0 | 264.0 | 144.0 | 0.23 | 0.00 | 0.75 | |||

| Primary | 264.0 | 291.5 | 27.5 | 0.13 | 0.00 | 0.53 | |||

| AZ24374 | 52 | Total | 91.3 | 340.6 | 249.3 | 0.35 | 0.01 | 0.54 | |

| Enriched | 91.3 | 340.6 | 249.3 | 0.35 | 0.01 | 0.54 | |||

| Primary | |||||||||

| AZ24375 | 45 | Total | 152.0 | 369.0 | 217.0 | 1.11 | 0.07 | 3.65 | |

| Enriched | 152.0 | 369.0 | 217.0 | 1.11 | 0.07 | 3.65 | Incl. 100 m of | ||

| Primary | |||||||||

| AZ24376 | 4 | Total | 158.0 | 261.9 | 103.9 | 0.21 | 0.05 | 1.13 | |

| Enriched | 158.0 | 193.0 | 35.0 | 0.28 | 0.02 | 0.69 | |||

| Primary | 193.0 | 261.9 | 68.9 | 0.18 | 0.06 | 1.35 | |||

| AZ24377 | 9 | Total | 148.0 | 297.5 | 149.5 | 0.40 | 0.04 | 0.89 | |

| Enriched | 148.0 | 291.4 | 143.4 | 0.41 | 0.04 | 0.88 | Incl. 40 m of | ||

| Primary | 291.4 | 297.5 | 6.2 | 0.20 | 0.04 | 0.92 | |||

| AZ24378 | 29 | Total | 174.0 | 454.0 | 280.0 | 0.38 | 0.05 | 1.31 | |

| Enriched | 174.0 | 314.0 | 140.0 | 0.41 | 0.05 | 1.19 | |||

| Primary | 314.0 | 454.0 | 140.0 | 0.34 | 0.06 | 1.43 | |||

| AZ24379 | 24 | Total | 114.0 | 365.8 | 251.8 | 0.22 | 0.02 | 0.89 | |

| Enriched | 114.0 | 365.8 | 251.8 | 0.22 | 0.02 | 0.89 | |||

| Primary | |||||||||

| AZ24380 | 5 | Total | 60.0 | 287.5 | 227.5 | 0.16 | 0.01 | 0.62 | |

| Enriched | 60.0 | 256.0 | 196.0 | 0.17 | 0.01 | 0.63 | |||

| Primary | 256.0 | 287.5 | 31.5 | 0.12 | 0.00 | 0.58 | |||

| AZ24381 | 18 | Total | 234.0 | 375.1 | 141.1 | 0.16 | 0.02 | 0.90 | |

| Enriched | 234.0 | 292.0 | 58.0 | 0.22 | 0.02 | 0.90 | |||

| Primary | 292.0 | 375.1 | 83.1 | 0.12 | 0.02 | 0.90 | |||

| AZ24382 | 20 | Total | 194.0 | 385.0 | 191.0 | 0.13 | 0.02 | 0.60 | |

| Enriched | 194.0 | 329.0 | 135.0 | 0.15 | 0.02 | 0.70 | |||

| Primary | 329.0 | 385.0 | 56.0 | 0.10 | 0.01 | 0.37 | |||

| AZ24383 | 50 | Total | 74.2 | 371.7 | 297.5 | 0.38 | 0.01 | 8.00 | |

| Enriched | 74.2 | 356.0 | 281.8 | 0.39 | 0.01 | 8.39 | |||

| Primary | 356.0 | 371.7 | 15.7 | 0.18 | 0.01 | 0.86 | |||

| AZ24384 | 18 | Total | 202.3 | 270.0 | 67.7 | 0.16 | 0.01 | 0.29 | |

| Enriched | 202.3 | 270.0 | 67.7 | 0.16 | 0.01 | 0.29 | |||

| Primary | |||||||||

| AZ24385 | 38 | Total | 84.0 | 250.4 | 166.4 | 0.21 | 0.00 | 0.44 | |

| Enriched | 84.0 | 216.0 | 132.0 | 0.21 | 0.00 | 0.46 | |||

| Primary | 216.0 | 250.4 | 34.4 | 0.19 | 0.01 | 0.33 | |||

| AZ24386 | 1a | Total | 228.0 | 380.3 | 152.3 | 0.21 | 0.06 | 1.07 | |

| Enriched | 228.0 | 378.0 | 150.0 | 0.21 | 0.06 | 1.06 | |||

| Primary | 378.0 | 380.3 | 2.3 | 0.22 | 0.02 | 1.50 | |||

| AZ24387 | 52 | Total | 62.0 | 452.0 | 390.0 | 0.46 | 0.07 | 2.27 | |

| Enriched | 62.0 | 106.0 | 44.0 | 0.69 | 0.10 | 2.72 | Incl. 44 m of | ||

| Primary | 106.0 | 202.0 | 96.0 | 0.43 | 0.06 | 2.33 | Incl. 132 m of | ||

| AZ24388 | 6 | Total | 170.0 | 245.3 | 75.3 | 0.21 | 0.10 | 1.22 | |

| Enriched | 170.0 | 221.7 | 51.7 | 0.22 | 0.10 | 0.99 | |||

| Primary | 221.7 | 245.3 | 23.6 | 0.20 | 0.11 | 1.77 | |||

| AZ24389 | 28 | Total | 176.0 | 343.3 | 167.3 | 0.16 | 0.01 | 0.52 | |

| Enriched | 176.0 | 343.3 | 167.3 | 0.16 | 0.01 | 0.52 | |||

| Primary | |||||||||

| AZ24390 | 24 | Total | 194.0 | 338.8 | 144.8 | 0.15 | 0.01 | 0.38 | |

| Enriched | 194.0 | 338.8 | 144.8 | 0.15 | 0.01 | 0.38 | |||

| Primary | |||||||||

| AZ24391 | 45 | Total | 133.0 | 331.0 | 198.0 | 0.84 | 0.09 | 2.32 | |

| Enriched | 133.0 | 331.0 | 198.0 | 0.84 | 0.09 | 2.32 | Incl. 129 m of | ||

| Primary | |||||||||

| AZ24392A | 54 | Total | 100.0 | 324.0 | 224.0 | 0.15 | 0.01 | 0.68 | |

| Enriched | 100.0 | 306.0 | 206.0 | 0.16 | 0.01 | 0.71 | |||

| Primary | 306.0 | 324.0 | 18.0 | 0.13 | 0.00 | 0.27 | |||

| AZ24393 | 16 | Total | 186.0 | 264.7 | 78.7 | 0.08 | 0.02 | 0.42 | |

| Enriched | 186.0 | 264.7 | 78.7 | 0.08 | 0.02 | 0.42 | |||

| Primary | |||||||||

| AZ24394 | 28 | Total | 69.0 | 242.3 | 173.3 | 0.20 | 0.02 | 1.65 | |

| Enriched | 69.0 | 144.0 | 75.0 | 0.14 | 0.01 | 0.46 | |||

| Primary | 144.0 | 242.3 | 98.3 | 0.24 | 0.03 | 2.55 | |||

| AZ24395A | 20 | Total | 168.0 | 407.0 | 239.0 | 0.16 | 0.01 | 0.45 | |

| Enriched | 168.0 | 407.0 | 239.0 | 0.16 | 0.01 | 0.45 | |||

| Primary | |||||||||

| AZ24396 | 49 | Total | 81.0 | 497.0 | 416.0 | 0.37 | 0.13 | 2.40 | |

| Enriched | 81.0 | 440.0 | 359.0 | 0.39 | 0.15 | 2.50 | |||

| Primary | 440.0 | 497.0 | 57.0 | 0.25 | 0.05 | 1.76 | |||

| AZ24397 | 16 | Total | 198.0 | 412.4 | 214.4 | 0.25 | 0.05 | 1.11 | |

| Enriched | 198.0 | 322.0 | 124.0 | 0.34 | 0.07 | 1.39 | |||

| Primary | 322.0 | 412.4 | 90.4 | 0.13 | 0.02 | 0.72 | |||

| AZ24398 | 3a | Total | 194.0 | 408.8 | 214.8 | 0.23 | 0.04 | 45.73 | |

| Enriched | 194.0 | 408.8 | 214.8 | 0.23 | 0.04 | 45.73 | |||

| Primary | |||||||||

| AZ24399 | 16 | Total | 172.0 | 367.9 | 195.9 | 0.55 | 0.07 | 0.96 | |

| Enriched | 172.0 | 367.9 | 195.9 | 0.55 | 0.07 | 0.96 | Incl. 104 m of | ||

| Primary | |||||||||

| AZ24400 | 26 | Total | 176.0 | 227.0 | 51.0 | 0.36 | 0.01 | 2.33 | |

| Enriched | 176.0 | 227.0 | 51.0 | 0.36 | 0.01 | 2.33 | |||

| Primary | |||||||||

| AZ24401 | 32 | Total | 78.0 | 324.5 | 246.5 | 0.24 | 0.00 | 0.62 | |

| Enriched | 78.0 | 324.5 | 246.5 | 0.24 | 0.00 | 0.62 | |||

| Primary | |||||||||

| AZ24402 | 20 | Total | 66.0 | 230.0 | 164.0 | 0.24 | 0.01 | 0.56 | |

| Enriched | 66.0 | 166.0 | 100.0 | 0.29 | 0.01 | 0.64 | |||

| Primary | 166.0 | 230.0 | 64.0 | 0.17 | 0.01 | 0.44 | |||

| AZ24403 | 43 | Total | 151.0 | 427.0 | 276.0 | 0.86 | 0.06 | 2.32 | |

| Enriched | 151.0 | 427.0 | 276.0 | 0.86 | 0.06 | 2.32 | Incl. 160.0 m of | ||

| Primary | |||||||||

| AZ24404 | 29 | Total | 66.7 | 73.5 | 6.9 | 0.19 | 0.02 | 0.58 | |

| Enriched | 66.7 | 72.0 | 5.4 | 0.18 | 0.01 | 0.25 | |||

| Primary | 72.0 | 73.5 | 1.5 | 0.23 | 0.04 | 1.80 | |||

| AZ24404A | 29 | Total | 87.0 | 133.0 | 46.0 | 0.14 | 0.01 | 2.18 | |

| Enriched | |||||||||

| Primary | 87.0 | 133.0 | 46.0 | 0.14 | 0.01 | 2.18 | |||

| AZ24404B | 29 | Total | 133.0 | 187.5 | 54.5 | 0.22 | 0.01 | 0.56 | |

| Enriched | |||||||||

| Primary | 133.0 | 187.5 | 54.5 | 0.22 | 0.01 | 0.56 | |||

| AZ24405 | 14 | Total | 246.0 | 317.6 | 71.6 | 0.15 | 0.03 | 0.65 | |

| Enriched | 246.0 | 314.0 | 68.0 | 0.15 | 0.03 | 0.65 | |||

| Primary | 314.0 | 317.6 | 3.6 | 0.16 | 0.02 | 0.61 | |||

| AZ24406 | 55 | Total | 84.0 | 324.2 | 240.2 | 0.10 | 0.03 | 0.78 | |

| Enriched | 84.0 | 230.0 | 146.0 | 0.14 | 0.02 | 0.79 | |||

| Primary | 230.0 | 324.2 | 94.2 | 0.05 | 0.04 | 0.77 | |||

| AZ24407 | 12 | Total | 186.0 | 259.0 | 73.0 | 0.09 | 0.03 | 0.42 | |

| Enriched | 186.0 | 259.0 | 73.0 | 0.09 | 0.03 | 0.42 | |||

| Primary | |||||||||

| AZ24408 | 32 | Total | 80.0 | 313.5 | 233.5 | 0.25 | 0.01 | 0.67 | |

| Enriched | 80.0 | 313.5 | 233.5 | 0.25 | 0.01 | 0.67 | |||

| Primary | |||||||||

| AZ24409 | 54 | Total | 102.0 | 270.0 | 168.0 | 0.23 | 0.01 | 0.90 | |

| Enriched | 102.0 | 270.0 | 168.0 | 0.23 | 0.01 | 0.90 | |||

| Primary | |||||||||

| AZ24410 | 6 | Total | 186.0 | 241.0 | 55.0 | 0.19 | 0.02 | 0.43 | |

| Enriched | 186.0 | 241.0 | 55.0 | 0.19 | 0.02 | 0.43 | |||

| Primary | |||||||||

| AZ24411 | 14 | Total | 180.0 | 334.0 | 154.0 | 0.19 | 0.06 | 0.80 | |

| Enriched | 180.0 | 232.0 | 52.0 | 0.31 | 0.08 | 0.70 | |||

| Primary | 232.0 | 334.0 | 102.0 | 0.13 | 0.05 | 0.86 | |||

| AZ24412 | 12 | Total | 180.2 | 297.5 | 117.3 | 0.20 | 0.04 | 0.96 | |

| Enriched | 180.2 | 272.0 | 91.8 | 0.22 | 0.04 | 0.99 | |||

| Primary | 272.0 | 297.5 | 25.5 | 0.13 | 0.04 | 0.85 | |||

| AZ24413 | 38 | Total | 136.0 | 317.0 | 181.0 | 0.19 | 0.01 | 0.64 | |

| Enriched | 136.0 | 317.0 | 181.0 | 0.19 | 0.01 | 0.64 | |||

| Primary | |||||||||

| AZ24414 | 47 | Total | 110.0 | 415.6 | 305.6 | 0.55 | 0.06 | 2.25 | |

| Enriched | 110.0 | 415.6 | 305.6 | 0.55 | 0.06 | 2.25 | Incl. 104.5 m of | ||

| Primary | |||||||||

| AZ24415 | 56 | Total | 108.0 | 346.0 | 238.0 | 0.15 | 0.04 | 0.74 | |

| Enriched | 108.0 | 322.0 | 214.0 | 0.15 | 0.04 | 0.74 | |||

| Primary | 322.0 | 346.0 | 24.0 | 0.12 | 0.05 | 0.73 | |||

| AZ24417 | 12 | Total | 126.0 | 253.7 | 127.7 | 0.32 | 0.04 | 0.90 | |

| Enriched | 126.0 | 253.7 | 127.7 | 0.32 | 0.04 | 0.90 | |||

| Primary | |||||||||

| AZ24418 | 16 | Total | 141.0 | 329.0 | 188.0 | 0.57 | 0.09 | 0.70 | |

| Enriched | 141.0 | 284.0 | 143.0 | 0.63 | 0.09 | 0.77 | Incl. 64 m of | ||

| Primary | 284.0 | 329.0 | 45.0 | 0.41 | 0.11 | 0.48 | Incl. 7 m of | ||

| AZ24419 | 6 | Total | 182.0 | 248.0 | 66.0 | 0.15 | 0.04 | 1.16 | |

| Enriched | 182.0 | 204.0 | 22.0 | 0.27 | 0.03 | 0.77 | |||

| Primary | 204.0 | 248.0 | 44.0 | 0.09 | 0.05 | 1.35 | |||

| AZ24421 | 44 | Total | 100.0 | 229.0 | 129.0 | 0.64 | 0.06 | 1.71 | |

| Enriched | 100.0 | 229.0 | 129.0 | 0.64 | 0.06 | 1.71 | Incl. 72 m of | ||

| Primary | |||||||||

| AZ24422 | 42 | Total | 184.0 | 236.2 | 52.2 | 1.31 | 0.11 | 2.16 | |

| Enriched | 184.0 | 236.2 | 52.2 | 1.31 | 0.11 | 2.16 | |||

| Primary | |||||||||

| GTK2424 | 15 | Total | 106.0 | 152.8 | 46.8 | 0.44 | 0.05 | 3.62 | |

| Enriched | 106.0 | 152.8 | 46.8 | 0.44 | 0.05 | 3.62 | Incl. 29.0 m of | ||

| Primary | |||||||||

| GTK2424B | 15 | Total | 152.8 | 272.9 | 120.2 | 0.69 | 0.03 | 1.30 | |

| Enriched | 152.8 | 155.0 | 2.3 | 0.28 | 0.06 | 6.50 | |||

| Primary | 155.0 | 272.9 | 117.9 | 0.70 | 0.03 | 1.18 | |||

| GTK2425 | 15 | Total | 150.0 | 300.0 | 150.0 | 0.21 | 0.05 | 1.00 | |

| Enriched | 150.0 | 300.0 | 150.0 | 0.21 | 0.05 | 1.00 | |||

| Primary | |||||||||

| GTK2426 | 43 | Total | 70.0 | 400.0 | 330.0 | 0.62 | 0.09 | 1.99 | |

| Enriched | 70.0 | 400.0 | 330.0 | 0.62 | 0.09 | 1.99 | Incl. 150 m of | ||

| Primary | |||||||||

| GTK2427 | 25 | Total | 160.0 | 250.0 | 90.0 | 0.14 | 0.00 | 0.37 | |

| Enriched | 160.0 | 250.0 | 90.0 | 0.14 | 0.00 | 0.37 | |||

| Primary | |||||||||

| GTK2430 | 25 | Total | 121.5 | 125.0 | 3.5 | 0.08 | 0.00 | 0.25 | |

| Enriched | 121.5 | 125.0 | 3.5 | 0.08 | 0.00 | 0.25 | |||

| Primary | |||||||||

| GTK2430A | 25 | Total | 98.0 | 300.0 | 202.0 | 0.19 | 0.02 | 1.13 | |

| Enriched | 98.0 | 300.0 | 202.0 | 0.19 | 0.02 | 1.13 | |||

| Primary | |||||||||

| GTK2431 | 49 | Total | 72.0 | 400.0 | 328.0 | 0.35 | 0.03 | 1.48 | |

| Enriched | 72.0 | 400.0 | 328.0 | 0.35 | 0.03 | 1.48 | |||

| Primary | |||||||||

| GTK2432 | 8 | Total | 236.0 | 350.0 | 114.0 | 0.30 | 0.05 | 0.99 | |

| Enriched | 236.0 | 350.0 | 114.0 | 0.30 | 0.05 | 0.99 | |||

| Primary | |||||||||

| OBS-MW-1 | 56 | Total | 42.0 | 519.0 | 477.0 | 0.08 | 0.04 | 0.50 | |

| Enriched | 42.0 | 198.0 | 156.0 | 0.15 | 0.08 | 0.75 | |||

| Primary | 198.0 | 519.0 | 321.0 | 0.05 | 0.01 | 0.38 | |||

| OBS-MW-2 | 45 | Total | 58.0 | 401.0 | 343.0 | 0.55 | 0.07 | 1.72 | |

| Enriched | 58.0 | 401.0 | 343.0 | 0.55 | 0.07 | 1.72 | Incl. 124 m of | ||

| Primary | |||||||||

| OBS-MW-3 | 13 | Total | 196.0 | 332.0 | 136.0 | 0.55 | 0.06 | 1.28 | |

| Enriched | 196.0 | 318.0 | 122.0 | 0.58 | 0.06 | 1.38 | Incl. 116 m of | ||

| Primary | 318.0 | 332.0 | 14.0 | 0.22 | 0.06 | 0.25 | |||

| OBS-MW-3A | 13 | Total | 331.5 | 542.0 | 210.5 | 0.28 | 0.03 | 0.53 | |

| Enriched | |||||||||

| Primary | 331.5 | 542.0 | 210.5 | 0.28 | 0.03 | 0.53 | |||

| OBS-MW-4 | 43 | Total | 72.0 | 404.0 | 332.0 | 0.30 | 0.02 | 1.31 | |

| Enriched | 72.0 | 228.0 | 156.0 | 0.34 | 0.03 | 1.60 | |||

| Primary | 228.0 | 404.0 | 176.0 | 0.26 | 0.01 | 1.06 |

Table 2 – Locations and Lengths of Recent Los Azules Drilling Results

| HOLE-ID | Azimuth | Dip | Length | Loc X | Loc Y | Loc Z | |

| AZ24316 | 250 | -73 | 315.5 | 2383435.1 | 6558678.2 | 3666.7 | |

| AZ24317 | 70 | -69 | 305.0 | 2383122 | 6560160.6 | 3674.5 | |

| AZ24318MET | 90 | -36 | 229.5 | 2382779.4 | 6559715.5 | 3599.8 | |

| AZ24319 | 70 | -74 | 355.0 | 2383196.1 | 6559064.4 | 3662.8 | |

| AZ24320 | 270 | -74 | 204.0 | 2383392.9 | 6558995.4 | 3643.8 | |

| AZ24321 | 250 | -71 | 389.8 | 2383587.5 | 6558949.7 | 3658.1 | |

| AZ24322 | 250 | -74 | 491.0 | 2383529.3 | 6559670.4 | 3678.8 | |

| AZ24323 | 250 | -75 | 184.6 | 2382815.5 | 6558454.5 | 3745.7 | |

| AZ24324 | 70 | -74 | 343.0 | 2383177 | 6559013.5 | 3655.6 | |

| AZ24325 | 70 | -75 | 338.0 | 2383203 | 6558546.2 | 3674.4 | |

| AZ24326 | 70 | -75 | 331.0 | 2383435 | 6558675.4 | 3666.9 | |

| AZ24327 | 250 | -73 | 316.0 | 2383306.1 | 6558900.8 | 3659 | |

| AZ24328 | 68 | -78 | 231.0 | 2383354.5 | 6559819.4 | 3629.4 | |

| AZ24329 | 250 | -76 | 332.0 | 2383267.6 | 6558804.7 | 3662.4 | |

| AZ24330 | 263 | -70 | 185.0 | 2383121.7 | 6560157.4 | 3674.5 | |

| AZ24332 | 70 | -70 | 255.6 | 2383385.1 | 6558761.7 | 3663.1 | |

| AZ24333 | 301 | -52 | 194.8 | 2383371.7 | 6559955.7 | 3634.3 | |

| AZ24334 | 250 | -80 | 657.0 | 2383092.1 | 6559726.7 | 3614.6 | |

| AZ24335 | 70 | -78 | 227.5 | 2383420.4 | 6558945.8 | 3646 | |

| AZ24336CC | 250 | -75 | 501.0 | 2383790.1 | 6557046.2 | 3823 | |

| AZ24338 | 250 | -70 | 729.5 | 2384000 | 6557297.5 | 3883.3 | |

| AZ24339CC | 250 | -75 | 517.5 | 2383757.2 | 6556832.1 | 3814.6 | |

| AZ24340 | 70 | -75 | 300.5 | 2383315.6 | 6558678 | 3668.4 | |

| AZ24341 | 250 | -70 | 261.5 | 2383352 | 6559818.5 | 3629.4 | |

| AZ24342 | 70 | -77 | 235.5 | 2383292.3 | 6558738.8 | 3661.9 | |

| AZ24343 | 185 | -66 | 365.6 | 2382578.4 | 6560067 | 3586.9 | |

| AZ24344 | 250 | -72 | 312.0 | 2383467.1 | 6559604.4 | 3666.3 | |

| AZ24345 | 250 | -71 | 291.2 | 2382849.6 | 6559429.1 | 3630 | |

| AZ24346 | 249 | -67 | 196.6 | 2382734.1 | 6559174.8 | 3658.4 | |

| AZ24347 | 250 | -75 | 295.8 | 2383765.6 | 6558161.7 | 3713.7 | |

| AZ24348 | 70 | -76 | 373.7 | 2383529.3 | 6559460.5 | 3689.2 | |

| AZ24349 | 250 | -71 | 356.0 | 2383437.7 | 6558468.5 | 3700.7 | |

| AZ24350 | 243 | -68 | 224.0 | 2382747.6 | 6558657.2 | 3744.2 | |

| AZ24351A | 70 | -73 | 449.4 | 2383570.2 | 6558891.6 | 3657 | |

| AZ24352 | 250 | -76 | 379.3 | 2383637.7 | 6558013.6 | 3763 | |

| AZ24353 | 250 | -71 | 338.5 | 2382747.2 | 6559491.2 | 3634.9 | |

| AZ24354 | 70 | -72 | 331.0 | 2383492 | 6559556 | 3675.8 | |

| AZ24355 | 198 | -69 | 288.5 | 2382702.8 | 6560022.5 | 3591 | |

| AZ24356 | 119 | -63 | 205.5 | 2383473.6 | 6560288.5 | 3635.9 | |

| AZ24357 | 250 | -74 | 386.0 | 2383719.2 | 6558572.6 | 3692.8 | |

| AZ24358 | 250 | -74 | 264.5 | 2382963.9 | 6559038.7 | 3656.4 | |

| AZ24360 | 242 | -81 | 335.5 | 2383323.4 | 6558544.4 | 3672.3 | |

| AZ24361 | 70 | -67 | 335.2 | 2383633.7 | 6558012.4 | 3762.8 | |

| AZ24362 | 70 | -77 | 309.0 | 2382967.6 | 6558938 | 3658 | |

| AZ24363 | 250 | -68 | 335.6 | 2382600.9 | 6559549.9 | 3631.6 | |

| AZ24364 | 305 | -63 | 215.4 | 2383473.5 | 6560004.4 | 3632.3 | |

| AZ24365 | 209 | -65 | 291.5 | 2382823.8 | 6559998.4 | 3596.3 | |

| AZ24366 | 70 | -74 | 328.2 | 2383719.2 | 6558572.5 | 3692.9 | |

| AZ24367 | 150 | -70 | 433.5 | 2383369.4 | 6559934.6 | 3632.3 | |

| AZ24368 | 70 | -70 | 220.5 | 2383843.8 | 6557666.9 | 3759.5 | |

| AZ24369A | 15 | -35 | 248.0 | 2382815.2 | 6559609.1 | 3611.2 | |

| AZ24370 | 70 | -73 | 290.0 | 2383762.9 | 6557847.5 | 3751 | |

| AZ24371 | 70 | -80 | 302.1 | 2382963.7 | 6559039.3 | 3656.6 | |

| AZ24372 | 70 | -72 | 298.2 | 2383721.7 | 6557926.1 | 3743.3 | |

| AZ24373 | 70 | -75 | 291.5 | 2382487.8 | 6559839.3 | 3587.8 | |

| AZ24374 | 70 | -80 | 340.6 | 2382378.8 | 6559677.2 | 3595.8 | |

| AZ24375 | 280 | -40 | 369.0 | 2383234.7 | 6559609 | 3618 | |

| AZ24376 | 250 | -76 | 261.9 | 2383854.5 | 6557668 | 3759.8 | |

| AZ24377 | 250 | -70 | 297.5 | 2383912.7 | 6557951.5 | 3733.8 | |

| AZ24378 | 249 | -84 | 454.0 | 2383572.8 | 6558894.3 | 3656.9 | |

| AZ24379 | 250 | -79 | 365.8 | 2383672.9 | 6558661.5 | 3671.5 | |

| AZ24380 | 250 | -69 | 287.5 | 2383520.9 | 6557574.7 | 3754.9 | |

| AZ24381 | 250 | -73 | 375.1 | 2383881.6 | 6558410.5 | 3744.4 | |

| AZ24382 | 250 | -75 | 385.0 | 2383812.9 | 6558493.9 | 3722.1 | |

| AZ24383 | 250 | -75 | 371.7 | 2382534.8 | 6559631 | 3619.9 | |

| AZ24384 | 70 | -72 | 270.0 | 2383876 | 6558413.8 | 3744 | |

| AZ24385 | 250 | -74 | 250.4 | 2382677.9 | 6559044.2 | 3699.1 | |

| AZ24386 | 70 | -66 | 380.3 | 2383594.5 | 6557354.9 | 3770 | |

| AZ24387 | 160 | -75 | 452.0 | 2383073.9 | 6559955.7 | 3615.8 | |

| AZ24388 | 250 | -73 | 245.3 | 2383809 | 6557753.3 | 3759.2 | |

| AZ24389 | 70 | -75 | 343.3 | 2383652.7 | 6558870.2 | 3668.6 | |

| AZ24390 | 70 | -67 | 338.8 | 2383672.7 | 6558661.5 | 3671.8 | |

| AZ24391 | 218 | -37 | 331.0 | 2383237.1 | 6559607.8 | 3618 | |

| AZ24392A | 250 | -71 | 324.0 | 2382488.6 | 6559841.7 | 3587.7 | |

| AZ24393 | 70 | -74 | 264.7 | 2383915.7 | 6558318.9 | 3763.5 | |

| AZ24394 | 250 | -71 | 242.3 | 2383003.5 | 6558630.9 | 3681.5 | |

| AZ24395A | 70 | -72 | 407.0 | 2383810.6 | 6558491.4 | 3722.2 | |

| AZ24396 | 70 | -70 | 497.0 | 2382951.1 | 6559736.8 | 3610.2 | |

| AZ24397 | 250 | -73 | 412.4 | 2383914.1 | 6558320 | 3763.5 | |

| AZ24398 | 250 | -75 | 408.8 | 2383875.3 | 6557352.8 | 3819.4 | |

| AZ24399 | 250 | -71 | 367.9 | 2383549.7 | 6558195.1 | 3737.3 | |

| AZ24400 | 70 | -80 | 227.0 | 2383849.2 | 6558833.7 | 3730 | |

| AZ24401 | 70 | -71 | 324.5 | 2382979.8 | 6558834.9 | 3659.8 | |

| AZ24402 | 70 | -79 | 230.0 | 2383224.9 | 6558285.7 | 3695.7 | |

| AZ24403 | 288 | -38 | 427.0 | 2383241 | 6559501 | 3622.5 | |

| AZ24404 | 70 | -80 | 73.5 | 2382979.1 | 6558675.9 | 3676.6 | |

| AZ24404A | 70 | -80 | 133.0 | 2382976.8 | 6558675.1 | 3676.4 | |

| AZ24404B | 70 | -80 | 187.5 | 2382979.2 | 6558676.2 | 3676.5 | |

| AZ24405 | 70 | -70 | 317.6 | 2383898.7 | 6558212.1 | 3758.5 | |

| AZ24406 | 5 | -73 | 324.2 | 2382428.7 | 6559844.6 | 3584.9 | |

| AZ24407 | 70 | -75 | 259.0 | 2383947.8 | 6558123.8 | 3772.9 | |

| AZ24408 | 250 | -73 | 313.5 | 2383123.5 | 6558887.3 | 3652.9 | |

| AZ24409 | 70 | -71 | 270.0 | 2383325.1 | 6560123.8 | 3637 | |

| AZ24410 | 70 | -74 | 241.0 | 2383810.2 | 6557751.3 | 3759.3 | |

| AZ24411 | 250 | -75 | 334.0 | 2383900.6 | 6558211.4 | 3758.5 | |

| AZ24412 | 250 | -77 | 297.5 | 2383951.4 | 6558124.2 | 3773.1 | |

| AZ24413 | 70 | -71 | 317.0 | 2383520.4 | 6559350.7 | 3679.3 | |

| AZ24414 | 270 | -48 | 415.6 | 2383225.1 | 6559738 | 3619.7 | |

| AZ24415 | 70 | -70 | 346.0 | 2383245 | 6560206.7 | 3679.7 | |

| AZ24416 | 250 | -75 | 201.0 | 2380165.6 | 6563489.6 | 3660.7 | |

| AZ24417 | 250 | -67 | 253.7 | 2383846.3 | 6558100 | 3721.4 | |

| AZ24418 | 70 | -77 | 329.0 | 2383458.5 | 6558159 | 3714.9 | |

| AZ24419 | 70 | -73 | 248.0 | 2383934.6 | 6557799 | 3756.1 | |

| AZ24420 | 70 | -72 | 130.2 | 2383908.7 | 6557896.2 | 3737 | |

| AZ24421 | 259 | -62 | 229.0 | 2383234.5 | 6559560.4 | 3621.3 | |

| AZ24422 | 250 | -35 | 236.2 | 2383244 | 6559487.3 | 3620.8 | |

| GTK2424 | 240 | -60 | 152.8 | 2383264.4 | 6558036.3 | 3715.5 | |

| GTK2424B | 240 | -60 | 272.9 | 2383267 | 6558032.5 | 3715.7 | |

| GTK2425 | 60 | -60 | 300.0 | 2383748.7 | 6558200.4 | 3706.7 | |

| GTK2426 | 60 | -70 | 400.0 | 2383250.9 | 6559528.2 | 3623.5 | |

| GTK2427 | 60 | -65 | 250.0 | 2383595.5 | 6558686.7 | 3667 | |

| GTK2428 | 0 | -90 | 100.2 | 2383357.8 | 6558607.9 | 3682.7 | |

| GTK2429 | 0 | -90 | 100.0 | 2383198.9 | 6559061.2 | 3662.6 | |

| GTK2430 | 240 | -65 | 125.0 | 2383142.9 | 6558538.2 | 3676.3 | |

| GTK2430A | 240 | -65 | 300.0 | 2383142.1 | 6558540.1 | 3676.3 | |

| GTK2431 | 340 | -65 | 400.0 | 2382804.6 | 6559687.8 | 3607.7 | |

| GTK2432 | 170 | -65 | 350.0 | 2383672.8 | 6557811.5 | 3784.3 | |

| OBS-MW-1 | 0 | -90 | 519 | 2383457.9 | 6560277.3 | 3636.7 | |

| OBS-MW-2 | 0 | -90 | 401 | 2383284.9 | 6559630 | 3627.1 | |

| OBS-MW-3 | 0 | -90 | 332 | 2383569.5 | 6558052.6 | 3777 | |

| OBS-MW-3A | 0 | -90 | 542 | 2383570.4 | 6558052.5 | 3776.8 | |

| OBS-MW-4 | 0 | -90 | 404 | 2382888.5 | 6559379 | 3633.9 | |

| Coordinates listed in Table 2 based on Gauss Kruger - POSGAR 94 Zone 2 | |||||||

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements and information, including "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements and information expressed, as at the date of this news release, McEwen Mining Inc.'s (the "Company") estimates, forecasts, projections, expectations, or beliefs as to future events and results. Forward-looking statements and information are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies, and there can be no assurance that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements and information. Risks and uncertainties that could cause results or future events to differ materially from current expectations expressed or implied by the forward-looking statements and information include, but are not limited to, effects of the COVID-19 pandemic, fluctuations in the market price of precious metals, mining industry risks, political, economic, social and security risks associated with foreign operations, the ability of the corporation to receive or receive in a timely manner permits or other approvals required in connection with operations, risks associated with the construction of mining operations and commencement of production and the projected costs thereof, risks related to litigation, the state of the capital markets, environmental risks and hazards, uncertainty as to calculation of mineral resources and reserves, and other risks. Readers should not place undue reliance on forward-looking statements or information included herein, which speak only as of the date hereof. The Company undertakes no obligation to reissue or update forward-looking statements or information as a result of new information or events after the date hereof except as may be required by law. See McEwen Mining's Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and other filings with the Securities and Exchange Commission, under the caption "Risk Factors", for additional information on risks, uncertainties and other factors relating to the forward-looking statements and information regarding the Company. All forward-looking statements and information made in this news release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by management of McEwen Mining Inc.

Want News Fast?

Subscribe to our email list by clicking here:

https://www.mcewenmining.com/contact-us/#section=followUs

and receive news as it happens!

| WEB SITE | SOCIAL MEDIA | |||||

| www.mcewenmining.com | McEwenMining | Facebook: | facebook.com/mcewenmining | |||

| LinkedIn: | linkedin.com/company/mcewen-mining-inc- | |||||

| CONTACT INFORMATION | X: | x.com/mcewenmining | ||||

| 150 King Street West | Instagram: | instagram.com/mcewenmining | ||||

| Suite 2800, PO Box 24 | ||||||

| Toronto, ON, Canada | McEwenCopper | Facebook: | facebook.com/ mcewencopper | |||

| M5H 1J9 | LinkedIn: | linkedin.com/company/mcewencopper | ||||

| X: | x.com/mcewencopper | |||||

| Relationship with Investors: | Instagram: | instagram.com/mcewencopper | ||||

| (866)-441-0690 - Toll free line | ||||||

| (647)-258-0395 | Rob McEwen | Facebook: | facebook.com/mcewenrob | |||

| Mihaela Iancu ext. 320 | LinkedIn: | linkedin.com/in/robert-mcewen-646ab24 | ||||

| info@mcewenmining.com | X: | x.com/robmcewenmux | ||||

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/1b207c75-f162-4b47-ae5a-821d4a4f011b

https://www.globenewswire.com/NewsRoom/AttachmentNg/5b50b2e1-0728-49b5-a0c4-7bf225be6b72

https://www.globenewswire.com/NewsRoom/AttachmentNg/d743d6c9-feef-490f-b566-431ce52bbf87

https://www.globenewswire.com/NewsRoom/AttachmentNg/645b4f26-b185-4407-a8d6-de1095aeae67

https://www.globenewswire.com/NewsRoom/AttachmentNg/c556c85d-a659-4a20-80a7-b86bc49dd340

https://www.globenewswire.com/NewsRoom/AttachmentNg/d90d8121-e535-415b-80d0-cab4ee125c64

https://www.globenewswire.com/NewsRoom/AttachmentNg/e334a17d-f72f-4a2f-874d-fea9871e8fa2

https://www.globenewswire.com/NewsRoom/AttachmentNg/391e22f5-2cab-42ef-8e8f-308112612943