McEwen Copper Reports Improved Copper Recovery

- None.

- None.

Insights

An increase in copper recovery from metallurgical testing is a critical factor in enhancing the economic viability of a mining project. The reported 3.2% increase in recovery rate and the 8.3% reduction in net acid consumption can significantly impact the project's net present value (NPV) and internal rate of return (IRR). From a metallurgical standpoint, the optimization of the heap leaching process, including crush size adjustments and pH level management, suggests a technical advancement that could reduce operational costs and improve metal extraction efficiency.

Furthermore, the shift to a pH closer to 2.0 indicates a strategic move to minimize acid consumption without compromising copper recovery. This balance is essential in reducing environmental impacts and operational expenses related to acid procurement and handling. The scalability of the leaching protocol, as indicated by the ongoing Phase 2 and Phase 3 tests, will be critical to confirm these initial findings and ensure they can be replicated on a commercial scale.

The financial implications of the improved recovery rates are substantial. An after-tax NPV(8%) increase of approximately $262 million provides a strong indication of enhanced project profitability. When evaluating a mining project, investors closely monitor changes in recovery rates and acid consumption because these factors directly influence production costs and revenue. It's important to note that while the PEA's assumptions have been positively adjusted based on these results, the feasibility study will provide a more definitive economic analysis.

Investors should also consider the potential risks associated with the scalability of these metallurgical improvements. While the results are promising, the transition from a controlled testing environment to full-scale production can present unforeseen challenges. Consequently, the upcoming feasibility study results will be pivotal in confirming the economic and technical applicability of these findings.

The reduction in sulfuric acid consumption not only has financial benefits but also environmental ones. Lowered acid requirements can lead to a smaller environmental footprint, which is increasingly important in project evaluations, especially given the heightened global focus on sustainable mining practices. The application of bioleaching technology, which utilizes naturally occurring bacteria, aligns with environmentally responsible mining methods. However, it's crucial to monitor the long-term stability and effectiveness of the bacterial cultures in the leaching process to ensure consistent recovery rates over the life of the mine.

As the project progresses, environmental impact assessments will need to address the potential changes in acid mine drainage and waste management strategies due to altered acid consumption. These assessments will be integral in securing operational permits and maintaining social license to operate.

Metallurgical Testing Delivers a

TORONTO, Feb. 22, 2024 (GLOBE NEWSWIRE) -- McEwen Copper Inc.,

Phase 1 Results

Based on the Phase 1 test results available at the time and prior historical column test work, the PEA used an average copper recovery of

The potential impact of the

Deposit Mineralogy

Located in San Juan, Argentina, the Los Azules deposit consists primarily of secondary copper mineralization (supergene zone of predominantly chalcocite), with minimal oxide copper content. Additionally, there is a deeper primary copper (hypogene zone of predominantly chalcopyrite with some zones of significant bornite).

Metallurgical Testing Phases

Preliminary results from the Phase 1 program along with historical metallurgical testing at Los Azules were used to support the 2023 Preliminary Economic Assessment (PEA), which proposed an environmentally friendly heap leach alternative to a conventional copper concentrator. The testing program is now advancing with two additional phases (2 & 3) currently underway to support the Feasibility Study (FS). Drilling activities related to the current study work started in 2021 and are continuing into 2024. The leach testing protocols are based on conventional bio-leaching methods used extensively in commercial applications for supergene copper mineralization. The current phases, 2 & 3, are being conducted at SGS Chile and Alfred H. Knight (ASMIN Industrial Limitada) laboratories, both located in Santiago, Chile.

The Phase 1 program was initiated using drill core from drilling programs completed prior to 2021, but not older than 2015, for a total of 21 column tests. Started in 2022, Phase 1 has now been completed and final results received. Preliminary results of this work and prior historical leach testing information were used for the PEA metallurgical assumptions.

The Phase 2 program utilizes drill core from the 2022-2023 drilling campaign and focuses on deposit-wide variability testing, leaching protocol optimization and scalability. A total of 34 column tests are in progress, with results expected in Q2 2024.

The Phase 3 program is also started, utilizing additional drill core material from the ongoing 2023-2024 drilling program. Phase 3 testing is focusing on the material of the initial 5-year mine plan, as delineated in the PEA. A total of 33 additional column tests are planned as part of this final confirmatory testing program, with results anticipated in Q4 2024.

The combined metallurgical programs comprise a total of 88 column tests to be used for the FS metallurgical design basis and geo-metallurgical model.

Copper assaying is conducted using a sequential method to determine the relative amounts of acid soluble (CuAS) and cyanide soluble (CuCN) copper mineralization (oxides and secondary sulfides). When combined, these two partial assay methods are generally considered readily soluble copper (CuSOL), extractable with conventional heap leaching technologies. Copper assayed that does not report to these two partial assay methods is classified as residual copper (CuRES) and is considered copper that requires additional time or is potentially not recoverable with conventional heap leaching technologies.

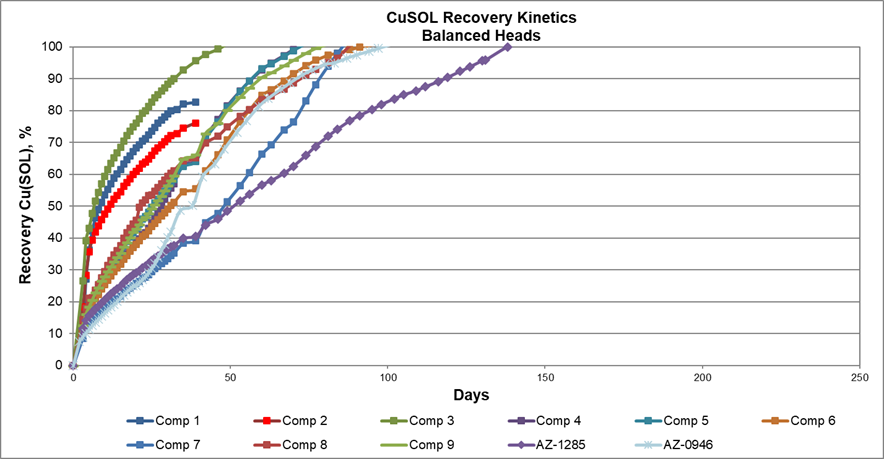

The finalized results from the Phase 1 metallurgy program for tests completed at minus ½" and ¾" crush sizes confirmed that soluble copper (CuSOL) component recovery is

Figure 1 – Soluble Copper Recovery Kinetics

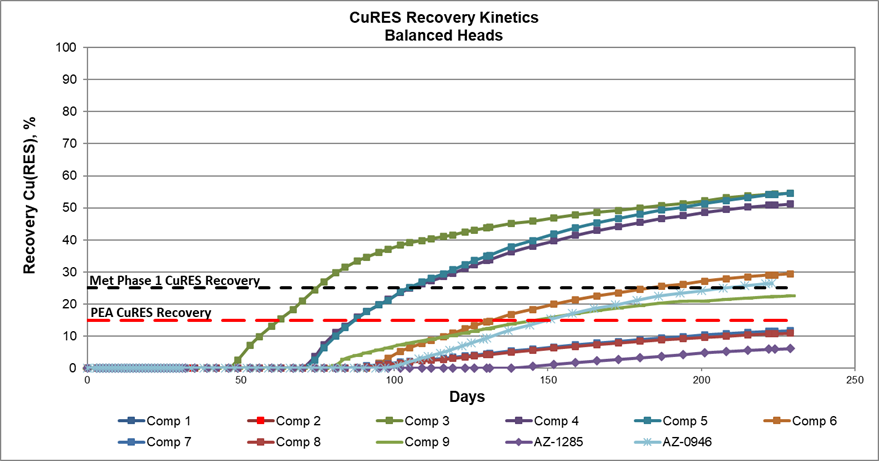

The recovery results for the residual copper (CuRES) component shown in Figure 2 indicated an average recovery of

Figure 2 – Residual Copper Recovery Kinetics

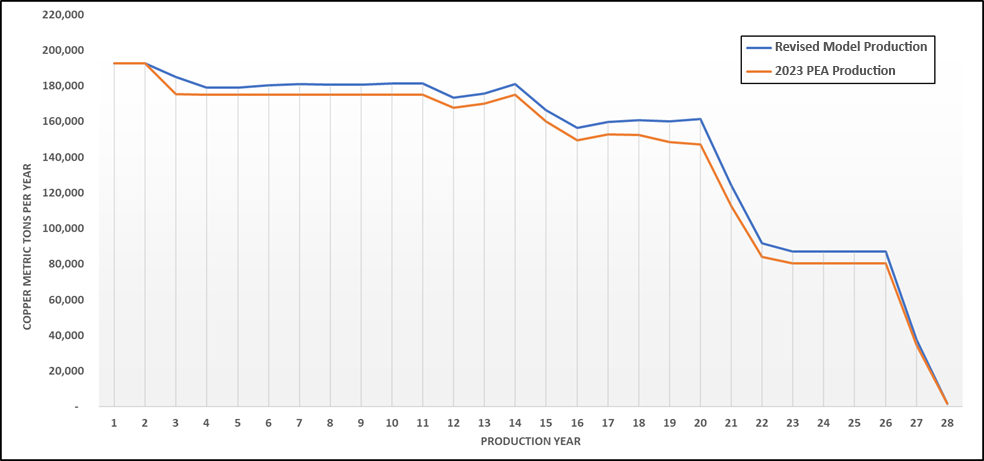

Figure 3 below illustrates the increase in potential copper production throughout the mine life, attributable to the improved recovery, in comparison with the PEA assumptions. The initial two production years do not show additional recovered copper, as the design capacity of the electrowinning plant considered in the PEA is fully utilized.

Figure 3 – Copper Cathode Production (PEA & Revised Model)

The sulfuric acid consumption has also been updated with the Phase 1 final results. The averaged net sulfuric acid consumption reported in the PEA was 18 kilograms per ton of ore processed. The finalized Phase 1 testing now indicates a reduction of

Bioleaching Summary

Copper bioleaching has been a commercially applied technology at altitudes similar to the Los Azules site and as much as 1,000 meters higher for several decades, in multiple locations around the world. Testing is conducted in conventional leach test columns by inoculation of the columns with naturally occurring bacterial ferrooxidans and thiooxidans prior to introduction of the leach solution. Bacterial cultures for the inoculum were sourced from the testing laboratories and adapted to the Los Azules leach material. Ferrooxidans convert the ferrous iron in solution to ferric iron, while thiooxidans convert the sulfur produced in the copper sulfide leaching activity to sulfuric acid/sulfate. Ferric iron is the key chemical component necessary for leaching of copper sulfide material. Bioactivity in the tests is monitored by measurement of the ferrous/ferric ratios and electrochemical oxidation potential in the leaching solutions.

ABOUT MCEWEN COPPER

McEwen Copper is a well-funded, private company which owns

Los Azules is being designed to be distinctly different from conventional copper mines, consuming significantly less water, emitting much lower carbon levels and progressing to be carbon neutral by 2038, being powered by

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with operations in Nevada, Canada, Mexico and Argentina. In addition, it owns approximately

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements and information, including "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements and information expressed, as at the date of this news release, McEwen Mining Inc.'s (the "Company") estimates, forecasts, projections, expectations or beliefs as to future events and results. Forward-looking statements and information are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies, and there can be no assurance that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements and information. Risks and uncertainties that could cause results or future events to differ materially from current expectations expressed or implied by the forward-looking statements and information include, but are not limited to, fluctuations in the market price of precious and base metals, mining industry risks, political, economic, social and security risks associated with foreign operations, the ability of the corporation to receive or receive in a timely manner permits or other approvals required in connection with operations, risks associated with the construction of mining operations and commencement of production and the projected costs thereof, risks related to litigation, the state of the capital markets, environmental risks and hazards, uncertainty as to calculation of mineral resources and reserves, and other risks. Readers should not place undue reliance on forward-looking statements or information included herein, which speak only as of the date hereof. The Company undertakes no obligation to reissue or update forward-looking statements or information as a result of new information or events after the date hereof except as may be required by law. See McEwen Mining's Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and other filings with the Securities and Exchange Commission, under the caption "Risk Factors", for additional information on risks, uncertainties and other factors relating to the forward-looking statements and information regarding the Company. All forward-looking statements and information made in this news release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by the management of McEwen Mining Inc.

Want News Fast?

Subscribe to our email list by clicking here:

https://www.mcewenmining.com/contact-us/#section=followUs

and receive news as it happens!!

| WEB SITE | SOCIAL MEDIA | ||

| www.mcewenmining.com | McEwen Mining | Facebook: | facebook.com/mcewenmining |

| LinkedIn: | linkedin.com/company/mcewen-mining-inc- | ||

| CONTACT INFORMATION | Twitter: | twitter.com/mcewenmining | |

| 150 King Street West | Instagram: | instagram.com/mcewenmining | |

| Suite 2800, PO Box 24 | |||

| Toronto, ON, Canada | McEwen Copper | Facebook: | facebook.com/ mcewencopper |

| M5H 1J9 | LinkedIn: | linkedin.com/company/mcewencopper | |

| Twitter: | twitter.com/mcewencopper | ||

| Relationship with Investors: | Instagram: | instagram.com/mcewencopper | |

| (866)-441-0690 - Toll free line | |||

| (647)-258-0395 | Rob McEwen | Facebook: | facebook.com/mcewenrob |

| Mihaela Iancu ext. 320 | LinkedIn: | linkedin.com/in/robert-mcewen-646ab24 | |

| info@mcewenmining.com | Twitter: | twitter.com/robmcewenmux | |

Figures accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/a00f17e3-f10b-4352-a03b-0d5f24cad26d

https://www.globenewswire.com/NewsRoom/AttachmentNg/dc6f3341-d17c-4a66-b6ad-060ef3149d8e

https://www.globenewswire.com/NewsRoom/AttachmentNg/1f5e3e19-5a50-4e5e-941e-758057522548