Murchison Minerals is Granted Conditional Approval by the TSXV for the Early Warrant Incentive Program and Confirms Insiders Participation

Murchison Minerals Ltd. announced conditional approval from the TSXV for its Early Warrant Incentive Program aimed at encouraging early exercise of unlisted Warrants. The Program will run from March 17 to April 15, 2022, allowing Warrant holders to receive Incentive Warrants upon early exercise. Major shareholders, including board member Donald K. Johnson, will participate, resulting in gross proceeds of CAD $1,116,786. The initiative targets exercising up to 27,118,788 Warrants at a price of $0.12 each, with potential positive implications for MURMF investors.

- Approval for Early Warrant Incentive Program could enhance liquidity.

- Strong insider participation indicates confidence in Murchison's prospects.

- Increased dilution risk for existing shareholders due to additional shares being issued.

BURLINGTON, ON / ACCESSWIRE / March 23, 2022 / Murchison Minerals Ltd. ("Murchison" or the "Company") (TSXV:MUR)(OTCQB:MURMF) is pleased to announce that, following the press release dated March 17, 2022, the TSXV has provided conditional approval of the Early Warrant Incentive Program (the "Program"). The terms and conditions of the Program and the method of exercising Warrants pursuant to the Program are set forth in a letter which has been posted on SEDAR and is available on the Company's website at: https://murchisonminerals.ca/corporate-filings-and-presentation/#financials

Insider Participation:

Board of Director Member, and Murchison's largest shareholder, Mr. Donald K. Johnson O.C. holds 8,454,000 Warrants representing approximately

The exercise of Warrants by Mr. Johnson and Mr. Boisjoli will constitute a "related party transaction" as defined in Multilateral Instrument 61-101 - Protection of Minority Securityholders in Special Transactions ("MI 61-101"). As insiders of the Company, they will acquire an aggregate of 9,306,550 common shares following the exercise of Warrants and acquire 4,653,275 new Warrants in the process. The Company will be relying on exemptions from the valuation and minority shareholder approval requirements of MI 61-101 contained in sections 5.5(a) and 5.7(1)(a) of MI 61-101, as the fair market value of the participation in the Program by insiders will not exceed

As previously announced, the Program is designed to encourage the early exercise of up to 27,118,788 of its outstanding unlisted Warrants (the "Warrants") exercisable for common shares of the Company ("Common Shares"). The Warrants are currently exercisable as follows: (i) 5,000,000 Warrants at a price of

Under the Program, the Company will issue to each Warrant holder that exercises their Warrants between March 17 and April 15, 2022 (the "Early Exercise Period"), one-half of an additional common share purchase warrant (each whole warrant, an "Incentive Warrant") for each warrant early exercised. Each Incentive Warrant will entitle the holder to purchase one additional Common Share until April 15, 2023, at a price of

The Incentive Warrants will be subject to a four month hold period from the date of issuance. The transaction is subject to the receipt of all final regulatory approvals, including the final approval of the TSXV. The underlying Common Shares and Incentive Shares to be issued pursuant to the exercise of the Warrants have not been, and will not be, registered under the U.S. Securities Act or any U.S. state securities laws, and may not be offered or sold in the United States or to, or for the account or benefit of, United States persons absent registration or any applicable exemption from the registration requirements of the U.S. Securities Act and applicable U.S. state securities laws. This press release does not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor in any other jurisdiction.

About the HPM Project

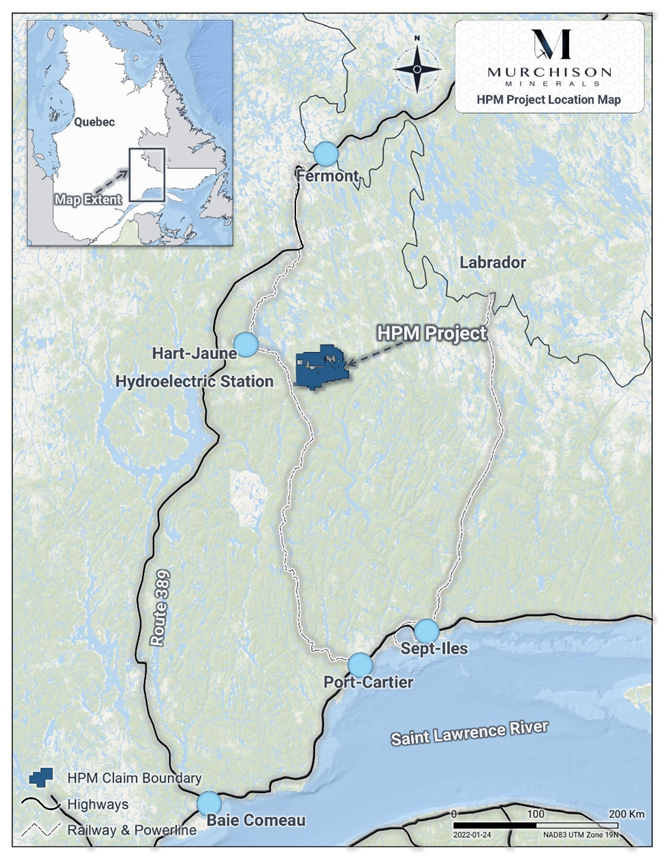

The HPM Project is located east of the Manicouagan structure, the site of a major 215 Ma impact event. The extensive reservoir at Manicouagan supports five hydro-power plants. The existing Quebec Cartier rail line, located eight kilometres west of the PYC project area, links Labrador City to Port Cartier and Sept Iles, two major iron ore port facilities.

Figure 1: HPM Location Map

The Project is located within the Haut-Plateau de la Manicouagan area. The claims host prospective gabbroic, ultramafic and anorthositic rock bodies within the Manicouagan metamorphic complex and are associated with significant nickel-copper-cobalt sulphide mineralization first identified by Falconbridge in 1999, and discovered extensive nickel-bearing sulphide mineralization at Barre de Fer during drilling in 2001 - 2002. Pure Nickel and Murchison Minerals Ltd.'s predecessor - Manicouagan Minerals - continued drilling in the area until 2008. The majority of the past drilling at the HPM Project targeted the Barre de Fer geophysical conductor and confirmed the presence of nickel-copper-cobalt sulphide mineralization over approximately 300 metres strike length to a depth of 280 metres. The mineralization remains open at depth and partially along strike.

After Murchison Minerals Ltd. acquired

Qualifying Statement

The foregoing scientific and technical disclosures on the HPM Project have been reviewed by John Shmyr, P.Geo., VP Exploration, a registered member of the Professional Engineers and Geoscientists of Saskatchewan and current holder of a special authorization with the Ordre des Géologues du Québec. Mr. Shmyr is a Qualified Person as defined by National Instrument 43-101.

About Murchison Minerals Ltd. (TSXV:MUR)

Murchison is a Canadian‐based exploration company focused on nickel-copper-cobalt exploration at the

Additional information about Murchison and its exploration projects can be found on the Company's website at www.murchisonminerals.ca. For further information, please contact:

Troy Boisjoli, President and CEO or

Erik H Martin, CFO

Tel: (416) 350‐3776

info@murchisonminerals.com

CHF Capital Markets

Thomas Do, IR Manager

Tel: (416) 868-1079 x 232

thomas@chfir.com

Forward‐Looking Information

Certain information set forth in this news release may contain forward‐looking information that involves substantial known and unknown risks and uncertainties. This forward‐looking information is subject to numerous risks and uncertainties, certain of which are beyond the control of the Company, including, but not limited to, the impact of general economic conditions, industry conditions, and dependence upon regulatory approvals. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward‐looking information. The parties undertake no obligation to update forward‐looking information except as otherwise may be required by applicable securities law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Murchison Minerals Ltd.

View source version on accesswire.com:

https://www.accesswire.com/694290/Murchison-Minerals-is-Granted-Conditional-Approval-by-the-TSXV-for-the-Early-Warrant-Incentive-Program-and-Confirms-Insiders-Participation

FAQ

What is the Early Warrant Incentive Program for Murchison Minerals Ltd. (MURMF)?

When does the Early Warrant Incentive Program expire?

Who are the major participants in the Early Warrant Incentive Program?

What are the financial implications of the Warrant exercise for Murchison Minerals (MURMF)?