St. Anthony Gold Corp. Completes Acquisition of Key Brazilian Lithium and Rare Earth Exploration Licenses

St. Anthony Gold Corp. has finalized its acquisition of a 75% interest in eight Brazilian exploration licenses targeting lithium and rare earth elements. This Brazilian Portfolio spans 12,315 hectares in Minas Gerais and Bahia, areas recognized for high-grade lithium production. The initial exploration program has confirmed pegmatite outcropping, with samples being sent for testing. The acquisition includes a cash payment of $250,000 and 21,165,000 shares issued to Foxfire Metals. Further details on remaining licenses are expected in Q1 2023.

- Acquisition of 75% interest in 12,315 hectares of lithium and REE exploration licenses.

- Located in a highly prospective region known for significant lithium production.

- Initial exploration confirmed pegmatite outcropping, indicating potential resource presence.

- No historical data on previous mining operations may hinder understanding of the project's potential.

- Cash payment and share issuance could result in financial strain or shareholder dilution.

Insights

Analyzing...

Early Exploration Identifies Pegmatite Outcropping and Historical Mine Workings Throughout the Licenses in Minas Gerais

VANCOUVER, BC / ACCESSWIRE / December 22, 2022 / St. Anthony Gold Corp. ("St. Anthony" or the "Company") (CSE:STAG)(Frankfurt:M1N)(OTC PINK:MTEHF) announces that it has closed its previously announced (October 21, 2022) transaction with Foxfire Metals Pty Ltd ("Foxfire"), an arms-length Australian Company, pursuant to which the Company acquired a

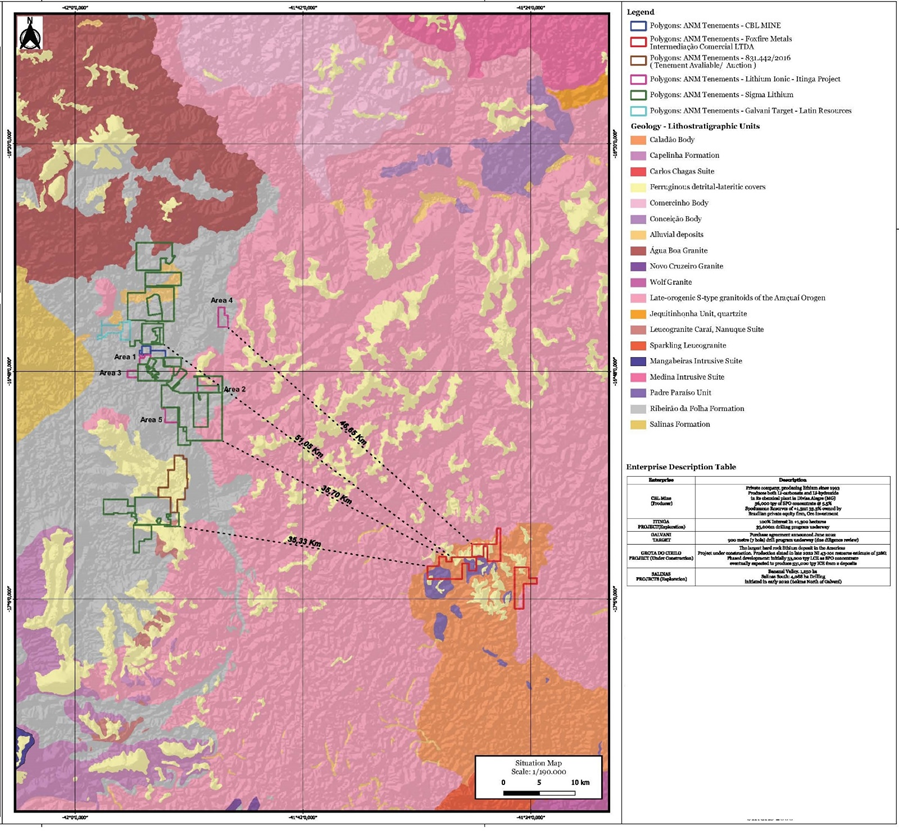

The Brazilian Portfolio totals 12,315 hectares of highly prospective lithium and REE exploration licenses, in the states of Minas Gerais and Bahia for lithium and Goas for REEs. Brazil is now recognized as one of the world's major high grade lithium producers confirmed by Tesla (TSLA:NASDAQ) supplier recently securing off take agreements with Sigma Lithium Corporation's (SGML: NASDAQ) subsidiary Brazilian Sigma Mineração SA (Sigma).

Three of these lithium licences lie within the highly prospective northern portion of the state of Minas Gerais in the municipality of Padre Paraiso, approximately ~38 Km's east of Sigma Lithium's Grota Cirilo property in Minas Gerais, Brazil. Sigma Lithium recently announced it is on schedule to make its first shipment of spodumene concentrate in April of 2023 and stands to become one of the largest and greenest lithium operations in the world.

Minas Gerais state owned Companhia Brasileira de Litio's mining operation, Lithium Ionic (TSX-V: LTH) and Australian-based Latin Resources Limited (ASX: LRS) have also recently made significant discoveries in the same, well known lithium district in Minas Gerais.

The initial exploration program commenced December 2022 on the Foxfire licences in Minas Gerais and has confirmed pegmatite outcropping and historic mine workings where pegmatites have been mined. The Company has not acquired any historical data on the previous mining operations, however rock chip and soil samples are being collected and will be forwarded to SGS laboratories in Brazil to test for LCT pegmatites (lithium, cesium, and tantalum) in line with the historic production within the district. Results are expected in the 1st quarter of 2022.

The Company will provide further details on the remaining lithium and REE licences in Q1 2023.

Commenting on the transaction, Peter Wilson, CEO of St. Anthony stated, "We are excited about the acquisition of these highly prospective lithium and rare earth element projects across three states in Brazil."

"Brazil has benefited from several major lithium discoveries, the realization of production and the fulfilment of multiple off-take agreements. The Foxfire licenses provide an exciting opportunity for early-stage, green field exploration in a known lithium province, particularly given their proximity to multiple high-grade lithium discoveries and producers"

Commercial Terms of the transaction allows St. Anthony to acquire an immediate

- Grant a free carried interest for Foxfire's

25% equity in the Brazilian Portfolio to the end of a bankable feasibility study. - A cash payment to Foxfire of

$250,000 - Issuing 21,165,000 shares of St. Anthony to Foxfire under agreed escrow terms.

- Maintenance of the existing net smelter and gross sales royalties totalling

2% held by the original vendors remains, with a buy back provision of50% for CAD$1,000,000. - Maintenance of management rights of the project by Foxfire for two years with both parties to formulate an agreed upon expenditure budget for the period.

- St. Anthony being granted the "first right of refusal" to acquire Foxfire's

25% equity intrest in the Brazilian Portfolio

The technical information contained in this news release has been reviewed and approved by Dr. Paul Woolrich (BSc Geology, MSc Geochemistry, PhD Metallurgy) who is a Member of the MAusIMM, Technical Director of Foxfire Metals and a Qualified Person as defined under National Instrument 43-101.

FOR ADDITIONAL INFORMATION SEE THE COMPANY'S WEB SITE AT

https://stanthonygoldcorp.com

Email to info@stanthonygoldcorp.com

Contact: Peter Wilson CEO - 604-649-0945

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Further information about the Company is available on www.SEDAR.com under the Company's profile.

Certain statements contained in this release may constitute "forward-looking statements" or "forward-looking information" (collectively "forward-looking information") as those terms are used in the Private Securities Litigation Reform Act of 1995 and similar Canadian laws. These statements relate to future events or future performance. The use of any of the words "could", "intend", "expect", "believe", "will", "projected", "estimated", "anticipates" and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on the Company's current belief or assumptions as to the outcome and timing of such future events. Actual future results may differ materially. In particular, this release contains forward-looking information relating to the business of the Company, the Property, financing and certain corporate changes. The forward-looking information contained in this release is made as of the date hereof and the Company is not obligated to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities.

SOURCE: St. Anthony Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/733024/St-Anthony-Gold-Corp-Completes-Acquisition-of-Key-Brazilian-Lithium-and-Rare-Earth-Exploration-Licenses