Spark Energy Minerals Closes Nova Energia Property Acquisition in “Lithium Valley”, Brazil

Spark Energy Minerals Inc. (CSE:EMIN)(OTC:MTEHF) has successfully completed a mineral claims purchase from Talisman Venture Partners Ltd., acquiring a 100% interest in six exploration permits spanning approximately 8,600 hectares in Minas Gerais, Brazil. The total cost of the transaction was $100,000 plus 10 million units at a deemed price of $0.07 per share. Notably, Talisman retained a 1% net smelter return, and Spark can acquire an additional 0.5% at a cost of $1 million. This acquisition follows recent favorable exploration results, suggesting significant potential for lithium discovery in the area.

- Acquisition expands land package in a significant lithium exploration region.

- Potential for increased investor confidence following favorable preliminary exploration results.

- Transaction requires substantial financing with 10 million units issued which may dilute existing shareholders.

Insights

Analyzing...

VANCOUVER, BC / ACCESSWIRE / March 21, 2023 / Spark Energy Minerals Inc., ("Spark" or the "Company" (CSE:EMIN)(Frankfurt:M1N)(OTC:MTEHF) has closed on a mineral claims purchase agreement dated March. 9, 2023, with Talisman Venture Partners Ltd. of Victoria, B.C. (www.talismanventurepartners.com), pursuant to which it acquired a 100-per-cent ownership interest in 6 exploration permits comprising approximately 8,600 hectares of surface area in Minas Gerais, Brazil.

Peter Wilson, CEO commented, "With the recent preliminary exploration results announced March 7, 2023 with our joint venture partner Foxfire Metals Pty., this acquisition creates a much larger and localized land package for us to explore which generates an increased confidence level of a significant discovery in the Lithium Valley".

Talisman retained a 1-per-cent net smelter return. The company can purchase 0.5 per cent from Talisman at any time for

The company paid a total of

The transaction is arm's length, and the company is not paying any finders' fees in connection therewith.

About Spark Energy Minerals Inc.

Spark Energy Minerals, Inc., is a Canadian company pursuing battery metals and mineral assets with newly acquired interests in Brazil and Canada. The Company has acquired assets in some of the world's most prolific mining jurisdictions, Brazil's growing lithium and provinces and in the Newfoundland, Canada region which is gaining recognition as a world hot spot for lithium and rare earth mineral exploration.

FOR ADDITIONAL INFORMATION SEE THE COMPANY'S WEB SITE AT

https://sparkenergyminerals.com

Email to info@sparkenergyminerals.com

Contact:

Peter Wilson, CEO, Tel. +1-604-649-0945

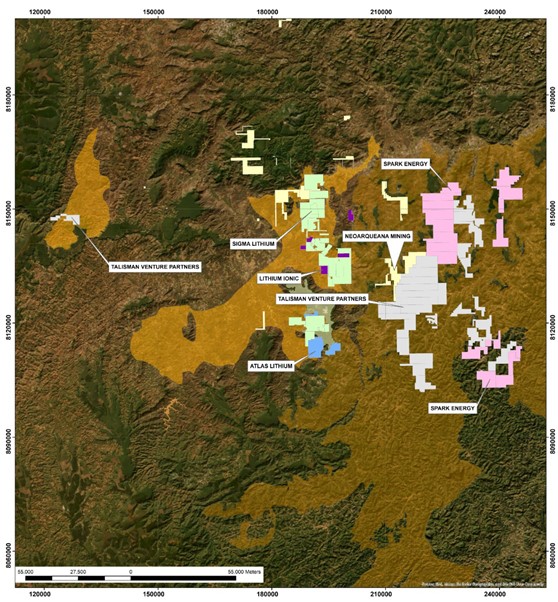

Minas Gerais, Brazil Area Mining Map

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Further information about the Company is available on www.SEDAR.com under the Company's profile.

Certain statements contained in this release may constitute "forward-looking statements" or "forward-looking information" (collectively "forward-looking information") as those terms are used in the Private Securities Litigation Reform Act of 1995 and similar Canadian laws. These statements relate to future events or future performance. The use of any of the words "could", "intend", "expect", "believe", "will", "projected", "estimated", "anticipates" and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on the Company's current belief or assumptions as to the outcome and timing of such future events. Actual future results may differ materially. In particular, this release contains forward-looking information relating to the business of the Company, the Property, financing and certain corporate changes. The forward-looking information contained in this release is made as of the date hereof and the Company is not obligated to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Certain statements contained in this release may constitute "forward-looking statements" or "forward-looking information" (collectively "forward-looking information") as those terms are used in the Private Securities Litigation Reform Act of 1995 and similar Canadian laws. These statements relate to future events or future performance. The use of any of the words "could", "intend", "expect", "believe", "will", "projected", "estimated", "anticipates" and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on the Company's current belief or assumptions as to the outcome and timing of such future events. Actual future results may differ materially. In particular, this release contains forward-looking information relating to the business of the Company, the Property, financing and certain corporate changes. The forward-looking information contained in this release is made as of the date hereof and the Company is not obligated to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws.

SOURCE: Spark Energy Minerals Inc.

View source version on accesswire.com:

https://www.accesswire.com/744915/Spark-Energy-Minerals-Closes-Nova-Energia-Property-Acquisition-in-Lithium-Valley-Brazil