METALLA PROVIDES UPDATE ON CÔTÉ AND GOSSELIN ROYALTY

TSXV: MTA

NYSE AMERICAN: MTA

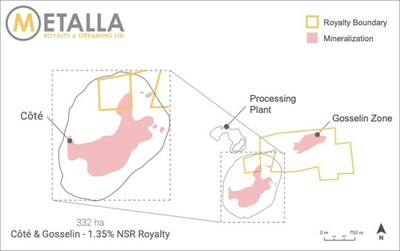

Metalla owns a

Brett Heath, President & CEO of Metalla commented, "We are thrilled to see the continued success in exploration activities at Gosselin, especially the significant intercepts at depth. The results are very exciting and suggest that the Gosselin deposit, subject to the completion of further delineation drilling, has potential to expand in size similar to the adjacent Côté deposit. We look forward to the future at Gosselin and IAMGOLD's work to include the deposit into the future Côté life-of-mine plans."

"We are also pleased to see the continued progress of the construction of the Côté mine as IAMGOLD is near the finish line and has announced that it expects production to commence in early 2024."

IAMGOLD announced the completion of another successful drill campaign at Gosselin and reported additional results. IAMGOLD stated recent drilling at Gosselin provide evidence that the 5 Moz gold Gosselin deposit(1) is approaching similar dimensions as the adjacent ~14 Moz gold Côté deposit(1). IAMGOLD expects to incorporate recent drill results into an updated resource estimate for Gosselin in IAMGOLD's year end Mineral Resources disclosure. In addition, IAMGOLD continues to advance technical studies on Gosselin, including metallurgical testing, mining and infrastructure studies to review alternatives to optimize the possible inclusion of the Gosselin deposit into a future Côté Gold life-of-mine plan.(1)

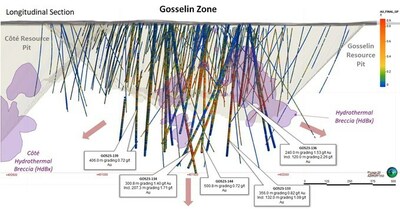

IAMGOLD REPORTED THE FOLLOWING GOSSELIN DRILLING PROGRAM HIGHLIGHTS (1)

- 0.65 g/t gold over 472 meters including 1.59 g/t gold over 51 meters

- 0.82 g/t gold over 356 meters including 1.09 g/t gold over 132 meters

- 1.40 g/t gold over 300.8 meters including 1.71 g/t gold over 207.3 meters

- 1.53 g/t gold over 240 meters including 2.26 g/t gold over 120 meters

- 0.72 g/t gold over 500.8 meters

IAMGOLD REPORTED THE FOLLOWING CÔTÉ HIGHLIGHTS (1)

- Overall Côté project progress was estimated to be

90.6% complete as of September 30, 2023, with construction progress approximately92% complete - Côté development remains on track with production to commence in early 2024

According to IAMGOLD (1):

"This diamond drilling program has strategically targeted the expansion potential of the Gosselin deposit at depth, specifically below the East and newly discovered West hydrothermal breccia bodies, the gap area between these breccia's, and also along the southern edge of the deposit. The assay results confirmed the extension of gold bearing altered and mineralized hydrothermal breccia and associated tonalite intersected in numerous drill holes up to 400 metres vertically below the previous resource pit shell over an approximate one-kilometer strike length. The results are very encouraging and indicate that the Gosselin deposit, subject to the completion of further delineation drilling, has potential to expand in size similar to the adjacent Côté deposit"

Figure 1: Gosselin Composite Longitudinal Section

GOSSELIN RESERVE & RESOURCE ESTIMATE AS OF DECEMBER 31, 2022 (2)

Reserve & Resource Estimate | |||

Tonnes | Gold | ||

(000's) | (g/t) | (Koz) | |

Measured Resources | - | - | - |

Indicated Resources | 124,500 | 0.8 | 3,350 |

Measured & Indicated Resources | 124,500 | 0.8 | 3,350 |

Inferred Resources | 72,900 | 0.7 | 1,710 |

CÔTÉ RESERVE & RESOURCE ESTIMATE AS OF DECEMBER 31, 2022 (2)

Reserve & Resource Estimate | |||

Tonnes | Gold | ||

(000's) | (g/t) | (Koz) | |

Proven Reserves | 130,988 | 1.0 | 4,260 |

Probable Reserves | 102,343 | 0.9 | 2,914 |

Proven & Probable Reserves | 233,331 | 1.0 | 7,174 |

Measured Resources | 152,534 | 1.0 | 4,726 |

Indicated Resources | 213,382 | 0.8 | 5,480 |

Measured & Indicated Resources | 365,916 | 0.9 | 10,206 |

Inferred Resources | 189,108 | 0.6 | 3,813 |

Metalla is also pleased to report that, further to its joint new release with Nova Royalty Corp. ("Nova"), dated September 8, 2023, Nova has announced it has obtained an interim order of the Supreme Court of

The Special Meeting materials, including a management information circular, will be available on SEDAR+ under Nova's profile at www.sedarplus.ca and on Nova's website once they have been mailed to Nova Shareholders in the coming days.

Metalla was created to provide shareholders with leveraged precious and strategic metal exposure by acquiring royalties and streams. Our goal is to increase share value by accumulating a diversified portfolio of royalties and streams with attractive returns. Our strong foundation of current and future cash-generating asset base, combined with an experienced team, gives Metalla a path to become one of the leading royalty companies.

For further information, please visit our website at www.metallaroyalty.com.

ON BEHALF OF METALLA ROYALTY & STREAMING LTD.

(signed) "Brett Heath"

President and CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accept responsibility for the adequacy or accuracy of this release.

Notes:

1. Please see the IAMGOLD Corporation press release dated October 23, 2023

2. Please see reserves and resources statement on Côté and Gosselin by IAMGOLD

Information contained on any website or document referred to or hyperlinked in this press release shall not be deemed to be a part of this press release.

The technical information contained in this news release has been reviewed and approved by Charles Beaudry, geologist M.Sc., member of the Association of Professional Geoscientists of

Except where otherwise stated, the disclosure in this press release relating to the Cote mine and the Gosselin deposit is based on information publicly disclosed by the owners or operators of these properties and information/data available in the public domain as at the date hereof and none of this information has been independently verified by Metalla. Specifically, as a royalty holder, Metalla has limited, if any, access to the properties subject to the Royalty. Although Metalla does not have any knowledge that such information may not be accurate, there can be no assurance that such third party information is complete or accurate. Some information publicly reported by the operator may relate to a larger property than the area covered by Metalla's Royalty interest. Metalla's royalty interests often cover less than

The disclosure was prepared in accordance with Canadian NI 43-101, which differs significantly from the current requirements of the

"Inferred mineral resources" have a great amount of uncertainty as to their geological existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Historical results or feasibility models presented herein are not guarantees or expectations of future performance.

Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budgets", "scheduled", "estimates", "forecasts", "predicts", "projects", "intends", "targets", "aims", "anticipates" or "believes" or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions "may", "could", "should", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements and information include, but are not limited to, statements of management with respect to the potential of the Gosselin deposit; the anticipated timing of production at the Cote mine; the incorporation of recent drill results into an updated resource estimate for Gosselin; the inclusion of the Gosselin deposit into a future Côté Gold life-of-mine plan the conduction of tests and studies at the Gosselin deposit; the production, recoveries, and other anticipated or possible future developments at the Gosselin deposit and Cote mine; mineral resources and reserves estimates; and the potential for Metalla to become one of the leading gold and silver companies for the next commodities cycle. Forward-looking statements and information are based on forecasts of future results, estimates of amounts not yet determinable and assumptions that, while believed by management to be reasonable, are inherently subject to significant business, economic and competitive uncertainties, and contingencies. Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of Metalla to control or predict, that may cause Metalla's actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including but not limited to: the risk that the announced developments at the Gosselin deposit and the Cote mine will not occur as expected at all or within the anticipated timing; risks of mineral resources and mineral resource estimates not being accurate; risks associated with the impact of general business and economic conditions; the absence of control over mining operations from which Metalla will purchase precious metals or from which it will receive stream or royalty payments and risks related to those mining operations, including risks related to international operations, government and environmental regulation, delays in mine construction and operations, actual results of mining and current exploration activities, conclusions of economic evaluations and changes in project parameters as plans are refined; problems related to the ability to market precious metals or other metals; industry conditions, including commodity price fluctuations, interest and exchange rate fluctuations; interpretation by government entities of tax laws or the implementation of new tax laws; regulatory, political or economic developments in any of the countries where properties in which Metalla holds a royalty, stream or other interest are located or through which they are held; risks related to the operators of the properties in which Metalla holds a royalty or stream or other interest, including changes in the ownership and control of such operators; risks related to global pandemics, including the novel coronavirus (COVID-19) global health pandemic, and the spread of other viruses or pathogens; influence of macroeconomic developments; business opportunities that become available to, or are pursued by Metalla; reduced access to debt and equity capital; litigation; title, permit or license disputes related to interests on any of the properties in which Metalla holds a royalty, stream or other interest; the volatility of the stock market; competition; future sales or issuances of debt or equity securities; use of proceeds; dividend policy and future payment of dividends; liquidity; market for securities; enforcement of civil judgments; and risks relating to Metalla potentially being a passive foreign investment company within the meaning of

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/metalla-provides-update-on-cote-and-gosselin-royalty-301967133.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/metalla-provides-update-on-cote-and-gosselin-royalty-301967133.html

SOURCE Metalla Royalty and Streaming Ltd.