METALLA ANNOUNCES FIRST GOLD PRODUCED AT TOCANTINZINHO

Metalla Royalty & Streaming announced the first gold pour at the Tocantinzinho (TZ) gold project in Pará, Brazil, where Metalla holds a 0.75% Gross Value Royalty (GVR). The project, developed by G Mining Ventures, is expected to become Brazil's third-largest primary gold mine with a 10.5-year mine life and an average annual gold production of 175,000 ounces. The first pour yielded 440 ounces of gold. TZ remains on budget and on schedule for commercial production in H2 2024. Metalla purchased the 0.75% GVR on TZ in March 2021 for $9 million. Proven and probable reserves are estimated at 2,042,000 ounces of gold. This project is projected to be a significant revenue contributor for Metalla.

- First gold pour at Tocantinzinho project.

- Projected 10.5-year mine life with significant resource potential.

- Average annual gold production of 175,000 ounces.

- First pour yielded 440 ounces of gold.

- Project remains on time and on budget for commercial production in H2 2024.

- Acquisition of 0.75% GVR in March 2021 for $9 million.

- Proven and probable reserves estimated at 2,042,000 ounces.

- None.

Insights

The announcement of the first gold pour at the Tocantinzinho (TZ) project marks a significant milestone for Metalla Royalty & Streaming Ltd. From a financial perspective, this development underscores the company's strategic investment in lucrative royalty streams. The 0.75% Gross Value Royalty (GVR) held by Metalla on the TZ project is expected to become a substantial revenue contributor.

Given the proven and probable reserves of over 2 million ounces of gold, with an estimated 175,000 ounces of annual production over a 10.5-year mine life, Metalla stands to gain reliably from this project. Assuming gold prices remain stable or increase, the revenue generated from this royalty interest will bolster Metalla's cash flow and potentially enhance shareholder value.

The successful execution of the project, being on time and on budget, also reflects well on G Mining Ventures Corp., indicating strong project management and operational efficiency, which is beneficial for Metalla as a royalty holder. Investors should monitor gold production rates and gold market prices, as these will directly impact Metalla's top line.

The Tocantinzinho gold project's completion and first gold pour is a notable achievement in the mining sector. The project's anticipated status as Brazil's third-largest primary gold mine, with a significant 10+ year mine life, highlights its strategic importance. This milestone indicates the viability and potential longevity of the TZ project, which is critical for the continuous stream of royalty revenues for Metalla.

From a technical standpoint, the reported processing of approximately 77 thousand tonnes of ore during hot commissioning with all circuits operating as expected is a positive sign. It suggests that the processing plant is functioning efficiently, which should lead to steady-state operations and consistent gold output.

The mineral resource estimates, with proven and probable reserves totaling over 2 million ounces at a relatively high grade, point to a robust project. The feasibility study's findings validate the project's economic and operational feasibility. Investors should consider the long-term stability and potential expansion of the resource base as key factors in Metalla's future royalty income.

(All dollar amounts are in thousands of United States dollars unless otherwise indicated)

TSXV: MTA

NYSE AMERICAN: MTA

Brett Heath, President & CEO of Metalla commented, "We would like to congratulate the G Mining team for bringing TZ into production on time and on budget less than two years after the formal construction decision. TZ will become Brazil's third-largest primary gold mine with a 10+ year mine life and significant potential to grow the resource base. Once at full production, TZ will be one of our largest revenue contributors, underpinning our portfolio of high-quality growth and cash flowing royalties."

TOCANTINZINHO

Metalla acquired the

G Mining stated in their press release1 that construction of TZ commenced in September 2022, following the completion of a Definitive Feasibility Study ("DFS") dated February 09, 2022 (filed under G Mining's profile on Sedar+, entitled "Feasibility Study – NI 43-101 Technical Report, Tocantinzinho Gold Project"). The DFS contemplates a 10.5-year mine life with an average annual gold production of 175,000 ounces.

G Mining also stated in their press release1 that since the start of hot commissioning on June 11, 2024, approximately 77 thousand tonnes of ore had been processed through the TZ process plant, with all circuits operating as expected. The first pour yielded approximately 440 ounces of gold, and the TZ project remains on time and budget for commercial production in the second half of 2024.

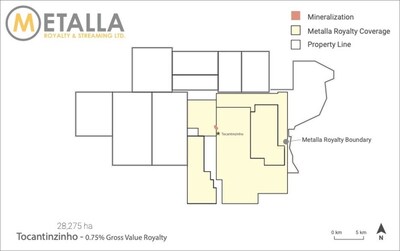

ROYALTY MAP

TOCANTINZINHO RESERVE & RESOURCE ESTIMATE AS OF DECEMBER 10, 20211

Tonnes | Gold | Royalty Ounces | |||

(000's) | (g/t) | (000's) | (000's) | ||

Proven Reserves | 17,973 | 1.46 | 842 | ||

Probable Reserves | 30,703 | 1.22 | 1,200 | ||

Proven & Probable | 48,676 | 1.31 | 2,042 | 15.3 | |

Measured Resources | 17,609 | 1.49 | 841 | ||

Indicated Resources | 30,505 | 1.29 | 1,261 | ||

Measured & Indicated | 48,114 | 1.36 | 2,102 | 15.8 | |

Inferred Resources | 1,580 | 0.98 | 50 | 0.4 | |

For royalty ounces calculation, Metalla estimates |

QUALIFIED PERSON

The technical information contained in this news release has been reviewed and approved by Charles Beaudry, geologist M.Sc., member of the Association of Professional Geoscientists of

ABOUT METALLA

Metalla was created to provide shareholders with leveraged precious and strategic metal exposure by acquiring royalties and streams. Our goal is to increase share value by accumulating a diversified portfolio of royalties and streams with attractive returns. Our strong foundation of current and future cash-generating asset base, combined with an experienced team, gives Metalla a path to become one of the leading royalty companies.

For further information, please visit our website at www.metallaroyalty.com.

ON BEHALF OF METALLA ROYALTY & STREAMING LTD.

(signed) "Brett Heath"

President and CEO

Website: www.metallaroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accept responsibility for the adequacy or accuracy of this release.

Notes:

1. Please see G Mining's press release dated July 9, 2024,G Mining's Annual Information Form dated March 27, 2024 and the DFS.

Information contained on any website or document referred to or hyperlinked in this press release shall not be deemed to be a part of this press release.

Technical and Third-Party Information

Metalla has limited, if any, access to the properties on which Metalla holds a royalty, stream or other interest. Metalla is dependent on (i) the operators of the mines or properties and their qualified persons to provide technical or other information to Metalla, or (ii) publicly available information to prepare disclosure pertaining to properties and operations on the mines or properties on which Metalla holds a royalty, stream or other interest, and generally has limited or no ability to independently verify such information. Although Metalla does not have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate. Some information publicly reported by operators may relate to a larger property than the area covered by Metalla's royalty, stream or other interests. Metalla's royalty, stream or other interests can cover less than

Unless otherwise indicated, the technical and scientific disclosure contained or referenced in this press release, including any references to mineral resources or mineral reserves, was prepared in accordance with Canadian NI 43-101, which differs significantly from the requirements of the

"Inferred mineral resources" have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Historical results or feasibility models presented herein are not guarantees or expectations of future performance.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable securities legislation. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budgets", "scheduled", "estimates", "forecasts", "predicts", "projects", "intends", "targets", "aims", "anticipates" or "believes" or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions "may", "could", "should", "would", "might" or "will" be taken, occur, or be achieved. Forward-looking statements include, but are not limited to, the statements regarding the size and potential of TZ to grow the resource base; TZ becoming the third-largest primary gold mine in

Forward-looking statements and information are based on forecasts of future results, estimates of amounts not yet determinable and assumptions that, while believed by management to be reasonable, are inherently subject to significant business, economic and competitive uncertainties, and contingencies. Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of Metalla to control or predict, that may cause Metalla's actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including but not limited to: that TZ will not become the third largest primary gold mine in

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/metalla-announces-first-gold-produced-at-tocantinzinho-302193084.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/metalla-announces-first-gold-produced-at-tocantinzinho-302193084.html

SOURCE Metalla Royalty & Streaming Ltd.