Grid Metals Corp. Signs Agreement with a Major Mining Company to Fund the Makwa Nickel Project

Grid Metals Corp has signed a definitive option and joint venture agreement with Teck Resources for the Makwa nickel project in Manitoba, Canada. The agreement grants Teck a two-stage option to acquire up to 70% interest by funding CAD$15.7 million in expenditures and making CAD$1.6 million in cash payments. The initial commitment includes a CAD$400,000 cash payment and CAD$450,000 in minimum expenditures.

The Makwa project features two past-producing nickel sulfide mines and a recent pit-constrained mineral resource estimate of 14.2 MMt at 0.75% Ni Eq grade, including a higher-grade core of 4.8 MMt at 1.26% Ni Eq grade. The project benefits from excellent infrastructure and is located 145 km from Winnipeg.

Grid Metals Corp ha firmato un accordo definitivo di opzione e joint venture con Teck Resources per il progetto nickel di Makwa nel Manitoba, Canada. L'accordo concede a Teck un'opzione in due fasi per acquisire fino al 70% di interesse finanziando 15,7 milioni di CAD in spese e effettuando pagamenti in contante di 1,6 milioni di CAD. L'impegno iniziale include un pagamento in contante di 400.000 CAD e 450.000 CAD in spese minime.

Il progetto Makwa presenta due miniere di solfuri di nichel già operative in passato e una recente stima delle risorse minerarie vincolate alla cava di 14,2 MMt con un grado equivalente di 0,75% Ni, inclusa una parte centrale di qualità superiore di 4,8 MMt con un grado equivalente di 1,26% Ni. Il progetto beneficia di un'ottima infrastruttura e si trova a 145 km da Winnipeg.

Grid Metals Corp ha firmado un acuerdo definitivo de opción y asociación conjunta con Teck Resources para el proyecto de níquel Makwa en Manitoba, Canadá. El acuerdo otorga a Teck una opción en dos etapas para adquirir hasta un 70% de interés mediante financiamiento de 15,7 millones de CAD en gastos y realizando pagos en efectivo de 1,6 millones de CAD. El compromiso inicial incluye un pago en efectivo de 400.000 CAD y 450.000 CAD en gastos mínimos.

El proyecto Makwa cuenta con dos minas de sulfuros de níquel que han producido en el pasado y una reciente estimación de recursos minerales limitados por la cantera de 14,2 MMt con una ley de 0,75% Ni Eq, incluyendo un núcleo de mayor calidad de 4,8 MMt con una ley de 1,26% Ni Eq. El proyecto se beneficia de una excelente infraestructura y se ubica a 145 km de Winnipeg.

Grid Metals Corp는 캐나다 매니토바의 마크와 니켈 프로젝트를 위해 Teck Resources와 최종 옵션 및 합작 투자 계약을 체결했습니다. 이 계약은 Teck에게 1,570만 캐나다 달러의 지출을 지원하고 160만 캐나다 달러의 현금 지급을 통해 최대 70%의 지분을 인수할 수 있는 2단계 옵션을 부여합니다. 초기 약속에는 40만 캐나다 달러의 현금 지급과 45만 캐나다 달러의 최소 지출이 포함됩니다.

마크와 프로젝트는 두 개의 과거 생산된 니켈 황화물 광산과 0.75% Ni Eq 등급의 1,420만 톤의 최근 광물 자원 추정치를 특징으로 하며, 이중 1.26% Ni Eq 등급의 고품질 코어 480만 톤이 포함됩니다. 이 프로젝트는 훌륭한 인프라의 혜택을 받고 있으며, 위니펙에서 145km 떨어진 위치에 있습니다.

Grid Metals Corp a signé un accord définitif d'option et de coentreprise avec Teck Resources pour le projet de nickel de Makwa dans le Manitoba, au Canada. Cet accord accorde à Teck une option en deux étapes pour acquérir jusqu'à 70 % d'intérêt en finançant des dépenses de 15,7 millions CAD et en réalisant des paiements en espèces de 1,6 million CAD. L'engagement initial comprend un paiement en espèces de 400 000 CAD et 450 000 CAD en dépenses minimales.

Le projet Makwa comprend deux anciennes mines de sulfures de nickel et une estimation récente des ressources minérales contraintes par la carrière de 14,2 MMt avec une teneur de 0,75 % Ni Eq, incluant un noyau de haute teneur de 4,8 MMt à 1,26 % Ni Eq. Le projet bénéficie d'une excellente infrastructure et est situé à 145 km de Winnipeg.

Grid Metals Corp hat einen endgültigen Options- und Joint-Venture-Vertrag mit Teck Resources für das Nickelprojekt Makwa in Manitoba, Kanada, unterzeichnet. Der Vertrag gewährt Teck eine zweistufige Option, bis zu 70 % Eigenanteil zu erwerben, indem 15,7 Millionen CAD an Ausgaben finanziert und 1,6 Millionen CAD in Barzahlungen geleistet werden. Die anfängliche Verpflichtung umfasst eine Barzahlung von 400.000 CAD und 450.000 CAD an minimalen Ausgaben.

Das Projekt Makwa verfügt über zwei in der Vergangenheit produzierende Nickel-Sulfidminen und eine aktuelle, grubenbegrenzte Mineralressourcenschätzung von 14,2 MMt mit einem Grad von 0,75 % Ni Eq, einschließlich eines höhergradigen Kerns von 4,8 MMt mit einem Grad von 1,26 % Ni Eq. Das Projekt profitiert von einer hervorragenden Infrastruktur und befindet sich 145 km von Winnipeg entfernt.

- Secured partnership with major mining company Teck Resources

- Potential funding of up to CAD$15.7 million for project development

- Strong mineral resource estimate: 14.2 MMt at 0.75% Ni Eq grade

- Excellent infrastructure with access to roads, power, and transportation

- High-grade core of 4.8 MMt with 1.26% Ni Eq grade

- Grid's interest could be diluted below 10% if unable to fund its pro-rata share

- Project success dependent on discovery of new high-grade deposits

TORONTO, ON / ACCESSWIRE / December 12, 2024 / Grid Metals Corp. (TSXV:GRDM)(OTCQB:MSMGF) ("Grid" or the "Company") is pleased to announce it has executed a definitive option and joint venture agreement (the "Agreement") with Teck Resources Limited ("Teck"), a leading Canadian resource company, to explore and develop the Mawka nickel project ("Makwa" or the "Project") in southeastern Manitoba, Canada. The Makwa nickel project sits on the southern arm of the Bird River Greenstone Belt approximately 145 km from Winnipeg, the provincial capital. The focus of the Agreement will be the discovery of a Tier 1 magmatic nickel-copper-PGM-cobalt deposit at Makwa. Grid will maintain its

The Agreement grants Teck a two-stage option to acquire up to a

Robin Dunbar, P. Geo., Grid's CEO & President, stated, "We are pleased to announce a definitive agreement with Teck, a leading Canadian resource company focused on responsibly providing the metals essential to economic development and the energy transition. Teck's significant technical and operational know-how will be of immediate benefit to the Makwa nickel project. Having Teck involved in the Project will provide financial support and added technical expertise to give our shareholders the maximum opportunity to participate in a Tier 1 nickel discovery."

Stuart McCracken, Vice President, Exploration, Teck stated, "We are excited to announce this agreement with Grid, providing a framework to explore for magmatic Ni-Cu-PGE systems in a prospective and readily accessible area. Bringing together resources and expertise from both Grid and Teck will support an agile, efficient, and focused discovery program."

Key Project Milestones at the Makwa Project include:

The recent consolidation of the known nickel copper sulfide occurrences and deposits at Makwa

The delineation of a pit-constrained nickel sulfide resource at the former Makwa mine site announced in 2024 (see The Makwa Nickel Project below)

A recent exploration agreement and ongoing collaboration with the Sagkeeng First Nation on whose ancestral lands the Makwa Project is situated

Grid assembling of a base metals technical team led by Dave Peck, P. Geo., who was instrumental in positioning the project to attract a partner like Teck.

Transaction Terms

Pursuant to the Agreement, Teck has the options ("Options") to acquire up to an

Teck may exercise the first option (the "First Option") by making an aggregate of CAD

On or Before | Cumulative Aggregate | Cash Payments | Interest Earned |

First Option | |||

January 31, 2025 |

|

| |

May 31, 2025 |

|

| |

January 31, 2026 |

|

| |

May 31, 2026 |

|

| |

January 31, 2027 |

|

| |

May 31, 2027 |

|

| |

May 31, 2028 |

| ||

Second Option | |||

January 31, 2031 |

|

| |

May 31, 2031 |

| ||

*May be in the form of an Equity Placement at a

Upon completion of the First Option requirements above and delivery of notice thereof to Grid (the "First Option Exercise Notice"), Teck would have exercised the First Option, and the Property would be owned by Teck as to

If Teck exercises the First Option, Teck will have a further sole and exclusive option to acquire an additional

Provided that Teck exercises the First Option, a contractual joint venture (the "Joint Venture") will be formed between Grid and Teck. Thereafter, each Party would fund its pro-rata share of future expenditures on the Property or incur dilution. For a period of six months following the formation of the Joint Venture (the "Initial Period"), Grid may elect to defer the contributions required to fund its pro-rata share of expenditures, for which Teck would agree to temporarily contribute in lieu (the "Grid Deferrals"). Should Grid elect to defer contributions during the Initial Period, Grid would have until twelve months after the formation of the Joint Venture to reimburse Teck for the Grid Deferrals, otherwise Grid would incur proportionate dilution. The party with the majority interest shall be the "Operator" of the Joint Venture, and each party would control their pro-rata share of offtake from the Property.

If a party's interest in the Property is diluted below

The Makwa Nickel Project

The Makwa project is one of two copper-nickel-PGM properties owned by Grid and located in the Archean-age Bird River greenstone belt of southeastern Manitoba. The project has excellent infrastructure, e.g., all season roads, local hydro-electric power, proximity to major trans-continental rail and trucking arteries. The Bird River belt is a direct analogue of the Ring of Fire district in northwestern Ontario in terms of the variety of mineral deposit types and geology, scale and structure. The primary target rocks at Makwa are ultramafic cumulates of the >30 km long Bird River Sill, which represents a dynamic intrusive complex featuring a wide range of intrusion shapes, sizes and structural associations. Despite its excellent pedigree as a past nickel producer, it was not until 2023 - when Grid completed its consolidation of the nickel-copper sulfide properties in the belt, that a comprehensive district-scale magmatic sulfide exploration program could be enacted. In particular, a historical property boundary severely hampered exploration for high-grade massive sulfide deposits within an interpreted >5 km long feeder system (the ‘ore fault corridor'). Prior exploration efforts were also impaired by the limited depth of penetration of historical geophysical surveys.

The Makwa project features two past producing nickel sulfide mines, three pit-constrained nickel sulfide resources and numerous high-grade nickel- and/or copper-rich magmatic sulfide surface showings. The Company recently published an updated pit-constrained mineral resource estimate for the Makwa deposit comprising 14.2 MMt of

Several depositional models will help guide future exploration at the Makwa project including conventional basal-accumulation disseminated and local massive sulfide deposits; feeder-structure related high-grade massive sulfide deposits; and hydrothermal massive sulfide vein systems produced from interaction of magmatic Cu-Ni and volcanogenic Cu-Zn-Ag-Au sulfide mineralization. The critical new discoveries needed to support a robust future mining operation will be based on a new bank of drill targets. These targets will be defined by integrating historical and new geophysical and geochemical surveys with the use of leading-edge 3D analytics methods. Teck and Grid jointly anticipate the launch of an initial drilling campaign that will focus on the discovery of structurally-controlled high-grade massive sulfide deposits.

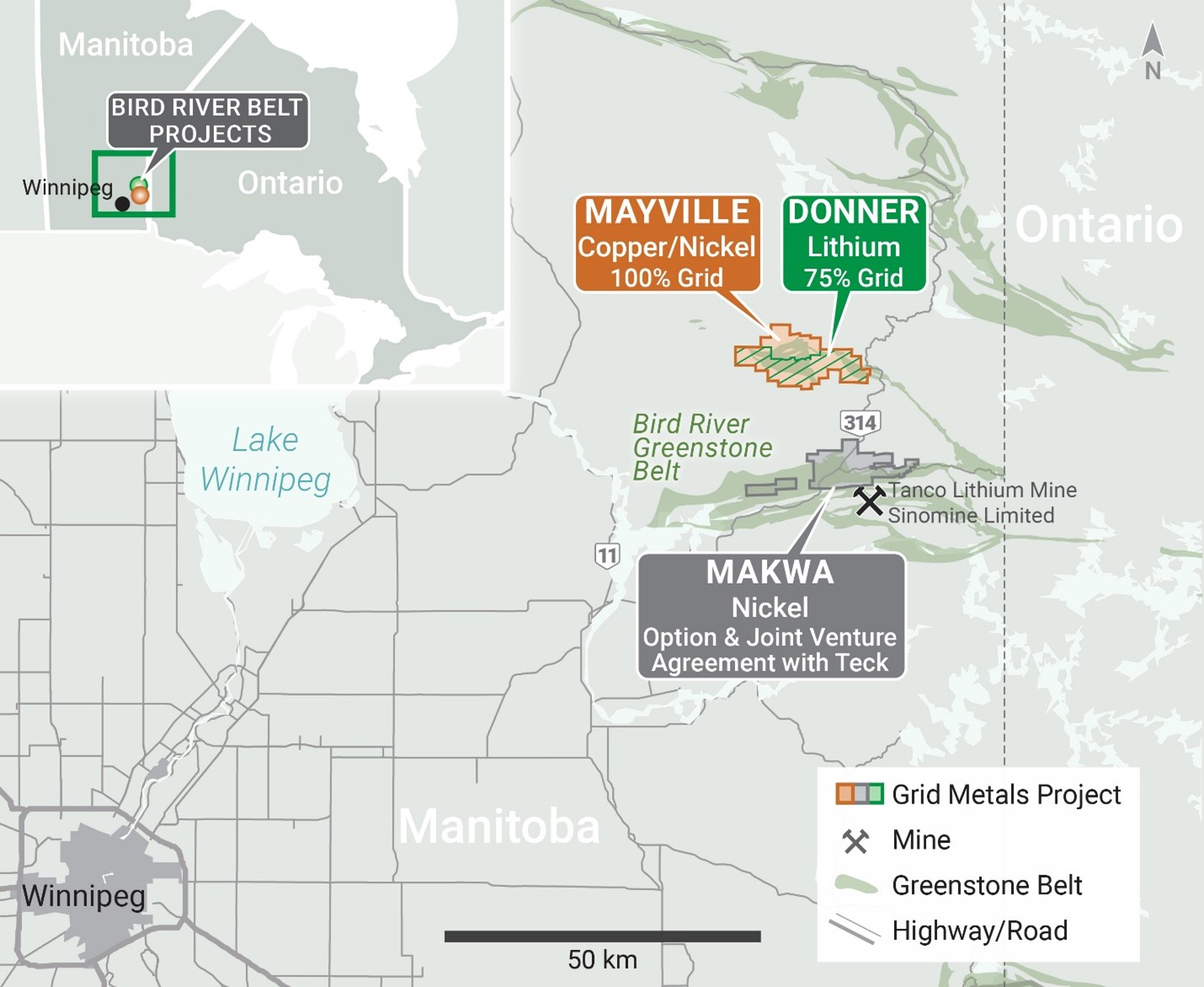

Figure 1: Map of Grid Metals Corp. Bird River Greenstone Belt Property holdings (Mayville Cu-Ni Project and Makwa Ni Project, previously called the MM Cu-Ni Project) in SE Manitoba located 150 northeast of Winnipeg. The north arm hosts the Mayville Cu-Ni Deposit3 (32 Mt with

Qualified Persons Statements

Dr. Dave Peck, P.Geo., is the Qualified Person for purposes of National Instrument 43-101 and has reviewed and approved the technical content of this release.

About Grid Metals Corp.

Grid Metals is focused on exploration and development in southeastern Manitoba with three key projects in the Bird River area.

The Makwa Property (Ni-Cu-PGM-Co), which is subject to an Option and Joint Venture Agreement with Teck Resources Limited ("Teck"). Teck can earn up to a

70% interest in Makwa by incurring a total of$17.3 million , comprising project expenditures ($15.7 million ) and cash payments or equity participation ($1.6 million ) with Grid. Makwa is located on the south arm of the Bird River Greenstone Belt.The Mayville Property (Cu-Ni) is located on the north arm of the Bird River Greenstone Belt. Grid owns

100% of the Mayville Property subject to a minority interest. The Company is currently drilling at Mayville.The Donner Lithium Project is adjacent to the Mayville Property, and Grid owns

75% of the project.

All of the Company's southeastern Manitoba projects are located on the ancestral lands of the Sagkeeng First Nation with whom the Company maintains an Exploration Agreement.

On Behalf of the Board of Grid Metals Corp.

For more information about the Company, please see the Company website at www.gridmetalscorp.com or contact:

Robin Dunbar - President, CEO & Director Telephone: 416-955-4773 Email: rd@gridmetalscorp.com

Brandon Smith - Chief Development Officer - bsmith@gridmetalscorp.com

David Black - Investor Relations Email: info@gridmetalscorp.com

We seek safe harbour. This news release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of the Securities Act (Ontario) (together, "forward-looking statements"). Such forward-looking statements include the Company's closing of the proposed financial transactions, sale of royalty and property interests. the overall economic potential of its properties, the availability of adequate financing and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements expressed or implied by such forward- looking statements to be materially different. Such factors include, among others, risks and uncertainties relating to potential political risk, uncertainty of production and capital costs estimates and the potential for unexpected costs and expenses, physical risks inherent in mining operations, metallurgical risk, currency fluctuations, fluctuations in the price of nickel, cobalt, copper and other metals, completion of economic evaluations, changes in project parameters as plans continue to be refined, the inability or failure to obtain adequate financing on a timely basis, and other risks and uncertainties, including those described in the Company's Management Discussion and Analysis for the most recent financial period and Material Change Reports filed with the Canadian Securities Administrators and available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

SOURCE: Grid Metals Corp.

View the original press release on accesswire.com