MultiSensor AI Announces Second Quarter 2024 Results

MultiSensor AI Holdings (NASDAQ:MSAI) reported strong Q2 2024 results, with revenue growing 59% year-over-year to $2.1 million. First-half 2024 revenue increased 90% to $4.4 million, while annual recurring revenue surged 500% to $2.7 million. The company strengthened its financial position through a $26.5 million capital raise and conversion of all remaining convertible notes to equity. MSAI also launched its Inspections business and announced a strategic partnership with Denali Advanced Integration. These developments have improved MSAI's balance sheet, increased liquidity, and positioned the company for sustained growth in its AI-powered industrial maintenance and process control solutions.

MultiSensor AI Holdings (NASDAQ:MSAI) ha riportato risultati solidi per il Q2 2024, con un fatturato in crescita del 59% su base annua a 2,1 milioni di dollari. Il fatturato del primo semestre 2024 è aumentato del 90%, raggiungendo 4,4 milioni di dollari, mentre il fatturato ricorrente annuo è schizzato del 500% a 2,7 milioni di dollari. L'azienda ha rafforzato la sua posizione finanziaria attraverso una raccolta di capitali di 26,5 milioni di dollari e la conversione di tutti i restanti titoli convertibili in capitale. MSAI ha anche lanciato la propria attività di ispezioni e annunciato una partnership strategica con Denali Advanced Integration. Questi sviluppi hanno migliorato il bilancio di MSAI, aumentato la liquidità e posizionato l'azienda per una crescita sostenuta nelle sue soluzioni di manutenzione industriale e controllo dei processi alimentate dall'IA.

MultiSensor AI Holdings (NASDAQ:MSAI) informó resultados sólidos en el Q2 2024, con ingresos que crecieron un 59% interanual, alcanzando 2,1 millones de dólares. Los ingresos de la primera mitad de 2024 aumentaron un 90% a 4,4 millones de dólares, mientras que los ingresos recurrentes anuales se dispararon un 500% a 2,7 millones de dólares. La compañía fortaleció su posición financiera mediante una captación de capital de 26,5 millones de dólares y la conversión de todos los bonos convertibles restantes en acciones. MSAI también lanzó su negocio de Inspecciones y anunció una asociación estratégica con Denali Advanced Integration. Estos desarrollos han mejorado el balance de MSAI, aumentado la liquidez y posicionado a la empresa para un crecimiento sostenido en sus soluciones de mantenimiento industrial y control de procesos impulsadas por IA.

MultiSensor AI Holdings (NASDAQ:MSAI)의 2024년 2분기 실적이 강하게 나타났으며, 전년 대비 59% 증가한 210만 달러의 매출을 기록했습니다. 2024년 상반기 매출은 90% 증가하여 440만 달러에 달했고, 연간 반복 수익은 500% 증가하여 270만 달러에 도달했습니다. 회사는 2650만 달러의 자본 조달을 통해 재무 상태를 강화하고 모든 나머지 전환사채를 자본으로 전환했습니다. MSAI는 또한 검사 사업을 시작하고 Denali Advanced Integration과 전략적 파트너십을 발표했습니다. 이러한 발전은 MSAI의 재무 구조를 개선하고 유동성을 증가시켰으며, AI 기반의 산업 유지 보수 및 공정 제어 솔루션에서 지속 가능한 성장을 위한 기반을 마련했습니다.

MultiSensor AI Holdings (NASDAQ:MSAI) a annoncé de bons résultats pour le T2 2024, avec un chiffre d'affaires en hausse de 59 % par rapport à l'année précédente, atteignant 2,1 millions de dollars. Le chiffre d'affaires du premier semestre 2024 a augmenté de 90 % pour atteindre 4,4 millions de dollars, tandis que le revenu récurrent annuel a bondi de 500 % pour atteindre 2,7 millions de dollars. L'entreprise a renforcé sa position financière grâce à une augmentation de capital de 26,5 millions de dollars et à la conversion de toutes les obligations convertibles restantes en actions. MSAI a également lancé son activité d'inspections et annoncé un partenariat stratégique avec Denali Advanced Integration. Ces évolutions ont amélioré le bilan de MSAI, accru la liquidité et positionné l'entreprise pour une croissance soutenue dans ses solutions de maintenance industrielle et de contrôle de processus alimentées par l'IA.

MultiSensor AI Holdings (NASDAQ:MSAI) hat starke Ergebnisse für das 2. Quartal 2024 gemeldet, mit einem Umsatzwachstum von 59% im Jahresvergleich auf 2,1 Millionen Dollar. Der Umsatz im ersten Halbjahr 2024 stieg um 90% auf 4,4 Millionen Dollar, während die wiederkehrenden jährlichen Einnahmen um 500% auf 2,7 Millionen Dollar anstiegen. Das Unternehmen stärkte seine finanzielle Position durch eine Kapitalerhöhung von 26,5 Millionen Dollar und die Umwandlung aller verbleibenden wandelbaren Anleihen in Eigenkapital. MSAI startete auch sein Inspektionsgeschäft und gab eine strategische Partnerschaft mit Denali Advanced Integration bekannt. Diese Entwicklungen haben die Bilanz von MSAI verbessert, die Liquidität erhöht und das Unternehmen für ein nachhaltiges Wachstum seiner KI-gestützten industriellen Wartungs- und Prozesskontrolllösungen positioniert.

- Q2 2024 revenue increased 59% year-over-year to $2.1 million

- First half 2024 revenue grew 90% year-over-year to $4.4 million

- Annual recurring revenue increased 500% to $2.7 million

- Raised $26.5 million through public offering and private placement

- Converted all remaining convertible notes and debt to equity

- Launched Inspections business, expanding service offerings

- Announced strategic partnership with Denali Advanced Integration

- None.

Insights

MultiSensor AI's Q2 2024 results showcase impressive growth, with revenue up 59% year-over-year to

MultiSensor AI's strategic moves in Q2 2024 position it well in the competitive AI-powered industrial solutions market. The launch of the Inspections business expands their service offerings, potentially opening new revenue streams. The partnership with Denali Advanced Integration is a smart move to leverage an established channel for market penetration. The company's focus on scaling within existing blue-chip customers while expanding to new ones demonstrates a balanced growth strategy. However, the AI industry is rapidly evolving and MSAI must continue innovating to maintain its competitive edge. Investors should watch for metrics on customer acquisition costs and retention rates to gauge the effectiveness of these strategies.

MultiSensor AI's Q2 2024 results reflect growing market demand for AI-powered industrial solutions. The 90% year-over-year revenue growth in H1 2024 outpaces many peers in the sector, indicating strong product-market fit. The launch of the Inspections business aligns with the trend towards comprehensive, data-driven industrial maintenance solutions. The Denali partnership could accelerate market penetration, especially among enterprise clients. However, the industrial AI market is becoming increasingly crowded. Investors should monitor MSAI's ability to maintain its growth rate and differentiate its offerings. Key metrics to watch include customer acquisition costs, churn rate and the success of upselling additional services to existing clients.

Second quarter revenue grew

Recent capital raise and debt conversion represent meaningful inflection points, strengthening the Company's balance sheet and financial flexibility

HOUSTON, TX / ACCESSWIRE / August 14, 2024 / MultiSensor AI Holdings, Inc. (NASDAQ:MSAI), a pioneer in AI-powered industrial condition-based maintenance and process control solutions, announced results for the second quarter ended June 30, 2024.

Financial Highlights:

First half of 2024 revenue increased

90% year over year from$2.3 million to$4.4 million ; Q2 revenue increased59% year over year from$1.3 million to$2.1 million .Annual recurring revenue1 at the end of the period increased approximately

500% from approximately$450 thousand to$2.7 million .Subsequent to quarter end, the Company raised

$26.5 million through a combination of a$11.5 million public offering and a$15 million private placement.During the quarter, MSAI completed the conversion of all remaining convertible notes and other debt to equity.

Subsequent to quarter end, the Company strengthened its balance sheet by improving net working capital, decreasing current liabilities, and increasing liquidity.

Strategic Business Highlights:

MSAI demonstrated compliance with NASDAQ listing requirements as a result of significantly strengthening its shareholders equity.

Announced strategic channel partner relationship with Denali Advanced Integration which will make it easier for Denali's customers to purchase MSAI's multi-sensor solutions.

MSAI launched its Inspections business, expanding service offerings to include additional sensor modalities and services to meet the needs of enterprise customers.

David Gow, MultiSensor AI's Chair, commented: "I am pleased with the recent milestones and financial strength of the business as MSAI continues to mature as a public company. We continue to position the Company for sustained growth and to expand our presence within our existing customer base. We continue to implement our commercial strategy, highlighted by the launch of our Inspections business and our strategic channel partnership with Denali Advanced Integration. These successes demonstrate the Company's commitment to continue scaling our offerings while expanding within current and new blue-chip customers. We expect these efforts to support ARR growth and momentum during the second half of 2024 and into our bright future."

Mr. Gow continued, "Subsequent to quarter end, we closed on a combined

The Company's Quarterly Report is filed with the SEC, and is available at www.sec.gov as well as in the Investor Relations section of the Company's website (www.multisensorai.com).

About MultiSensor AI

MultiSensor AI provides turnkey condition-based maintenance and process control solutions, which combine cutting edge imaging and sensing technologies with AI-powered enterprise software. Powered by AWS, MSAI's software leverages a continuous stream of data from thermal imaging, visible imaging, acoustic imaging, vibration sensing, and laser sensing devices to provide comprehensive, real-time condition monitoring for a customer's critical assets, processes, and manufactured outputs. This full-stack solution measures heat, vision, vibration, and gas in the surrounding environment, helping companies gain predictive insights to better manage their asset reliability and manufacturing processes. MSAI Cloud and MSAI Edge software solutions are deployed by customers to protect critical assets across a wide range of industries including distribution & logistics, manufacturing, utilities, and oil & gas.

For more information, please visit https://www.multisensorai.com

Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. In some cases, forward-looking statements can be identified by words such as "will," "believe," "anticipate," "expect," "estimate," "intend," "plan," or their negatives or variations of these words, or similar expressions. All statements contained in this press release that do not strictly relate to matters of historical fact should be considered forward-looking statements, including, without limitation, statements regarding the Company management's expectations regarding its financial outlook, strategic priorities and objectives, future plans, business prospects and financial performance. These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual outcomes may differ materially from the information contained in the forward-looking statements as a result of a number of factors, including the "Risk Factors" section of the Company's Annual Report on Form 10-Q filed with the SEC on August 14, 2024 and the Company's other periodic filings with the SEC. Because forward-looking statements are inherently subject to risks and uncertainties, you should not rely on these forward-looking statements as predictions of future events. Any forward-looking statement made in this press release is based only on information currently available and speaks only as of the date on which it is made. Except as required by applicable law, the Company expressly disclaims any obligations to publicly update any forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

Media Contact:

MultiSensor AI

Andrew Klobucar

Director of Marketing

andrew.klobucar@multisensorai.com

Investor Contact:

Alpha IR Group

Mike Cummings or Griffin Morris

MSAI@alpha-ir.com

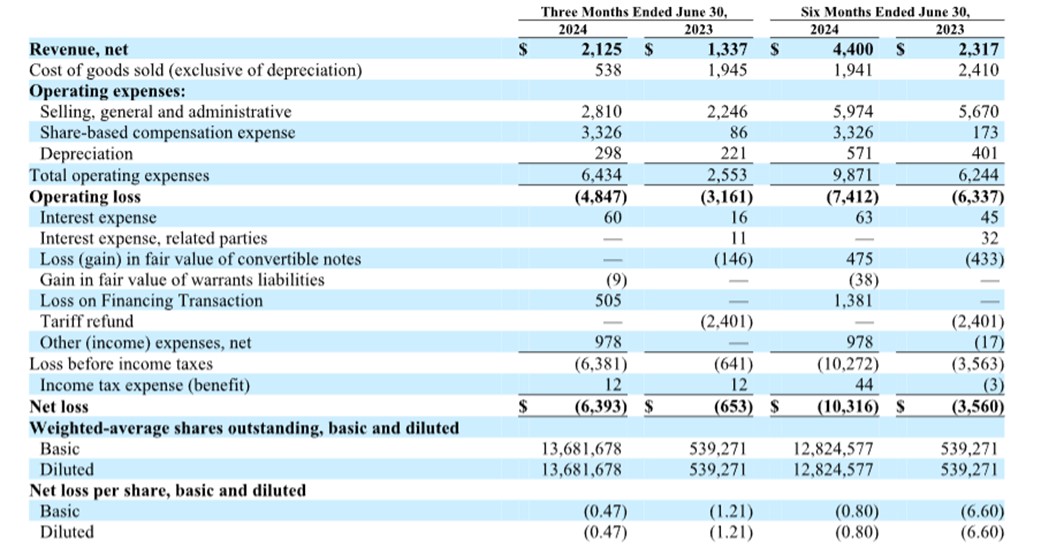

MultiSensor AI Holdings, Inc.

Condensed Consolidated Statements of Operations

(Amounts in thousands of U.S. dollars, except share and per share data)

____________

1 Non-GAAP measure, defined as annualized current software and services revenue under contract for one year or longer.

SOURCE: MultiSensor AI, Inc.

View the original press release on accesswire.com