Morningstar Introduces Industry's First Global Unicorn Index Series

Morningstar has launched the Morningstar® PitchBook Global Unicorn Indexes™, the first daily benchmarks for unicorn companies, which are privately held firms valued at $1 billion or more. This series includes 11 indexes and leverages PitchBook’s extensive VC data and analytics alongside Morningstar’s indexing practices. The indexes aim to enhance investor access to late-stage venture capital markets. This initiative responds to the growing trend of unicorns, facilitating insights into a previously opaque asset class.

- Launch of the first daily unicorn benchmarks enhances transparency in a growing market.

- Combines PitchBook's data with Morningstar's indexing expertise.

- Addresses the demand for nontraditional asset classes, providing individual investors access to late-stage VC-backed companies.

- The product aims to increase investors' success odds through sophisticated valuation methodologies.

- None.

Insights

Analyzing...

Powered by PitchBook and Morningstar Indexes, the new benchmarks are the first to daily measure Unicorns, or privately held venture-capital companies with valuations of

CHICAGO, Nov. 9, 2022 /PRNewswire/ -- Today, Morningstar, Inc. (Nasdaq: MORN), a leading provider of independent investment research, introduces the Morningstar® PitchBook Global Unicorn Indexes™, the first index series to provide daily insights into the behavior and performance of late-stage venture capital (VC)-backed companies, empowering investors to better understand and access this rapidly growing but difficult-to-track asset class.

This new series of market indexes combines the leading VC data, analytics, and insights from PitchBook, an independent subsidiary of Morningstar, with the indexing best practices of Morningstar Indexes, one of the fastest-growing global index providers.

"In today's market, investors are increasingly looking to nontraditional asset classes like private markets for portfolio diversification and investment opportunity," said Ron Bundy, president, Morningstar Indexes. "Our new global unicorn indexes combine the deep data and insight of PitchBook with the best practices of Morningstar Indexes to deliver a new series of benchmarks for the late-stage venture capital market."

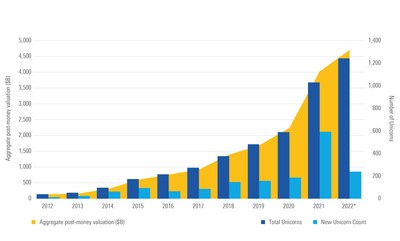

According to Morningstar research, private capital markets have grown substantially in the last decade, with more companies staying private longer or pursuing less traditional funding strategies. This trend has fueled a growing number of "unicorns," or VC-backed companies valued at

Once only accessible to sophisticated investors like pension funds and the ultra-high net worth, late-stage VC-backed companies are increasingly making inroads into individual portfolios through retirement plans and ownership of "crossover" mutual funds. But investor access and insight into the late-stage VC market has not improved as quickly as the market has grown. This market has been difficult for index providers to track due to its illiquidity, lack of reporting standards, and no mark-to-market pricing capability.

The Morningstar PitchBook Global Unicorn Indexes, a series of 11 global, regional, and single country indexes, address these challenges as the first daily published unicorn market benchmarks. The index series employs a proprietary three factor mark-to-model pricing methodology to provide more frequent valuations for the asset class. The model employs a range of valuation measures and comparable data from private and public market peers to bring transparency to an asset class that has been hard for investors to track.

"Our new unicorn indexes will go a long way toward bringing transparency to what has become a significant segment of the capital markets," said Sanjay Arya, head of innovation, Morningstar Indexes. "Investors will be able to gain insights into late-stage venture capital markets through our sophisticated daily valuation methodology, increasing their odds of success."

"This product is a unique way to deliver PitchBook's extensive data and insights from its deeply ingrained industry analysts to investors," added Kyle Stanford, senior venture capital analyst, PitchBook. "This is another important step in expanding our research capabilities for this growing area of venture capital."

About Morningstar, Inc.

Morningstar, Inc. is a leading provider of independent investment research in North America, Europe, Australia, and Asia. The Company offers an extensive line of products and services for individual investors, financial advisors, asset managers and owners, retirement plan providers and sponsors, and institutional investors in the debt and private capital markets. Morningstar provides data and research insights on a wide range of investment offerings, including managed investment products, publicly listed companies, private capital markets, debt securities, and real-time global market data. Morningstar also offers investment management services through its investment advisory subsidiaries, with approximately

About PitchBook

PitchBook is a financial data and software company that provides transparency into the capital markets to help professionals discover and execute opportunities with confidence and efficiency. PitchBook collects and analyzes detailed data on the entire venture capital, private equity and M&A landscape—including public and private companies, investors, funds, investments, exits and people. The company's data and analysis are available through the PitchBook Platform, industry news and in-depth reports. Founded in 2007, PitchBook has offices in Seattle, San Francisco, New York, London and Hong Kong and serves more than 90,000 professionals around the world. In 2016, Morningstar acquired PitchBook, which now operates as an independent subsidiary.

About Morningstar Indexes

Morningstar Indexes, recently named the fastest growing global index provider by Burton-Taylor, was built to keep up with the evolving needs of investors—and to be a leading-edge advocate for them. Our rich heritage as a transparent, investor-focused leader in data and research uniquely equips us to support individuals, institutions, wealth managers and advisors in navigating investment opportunities across all major asset classes, styles and strategies. From assessing risk and return with traditional benchmarks to helping investors effectively incorporate ESG objectives into their investment process, our range of index solutions spans an investment landscape as diverse as investors themselves. We help investors answer today's increasingly complex questions so that they can more easily reach tomorrow's goals.

Please visit indexes.https://indexes.morningstar.com for more information.

©2022 Morningstar, Inc. All Rights Reserved.

MORN-P

Media Contact:

Tim Benedict, +1 203 339-1912 or newsroom@morningstar.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/morningstar-introduces-industrys-first-global-unicorn-index-series-301672972.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/morningstar-introduces-industrys-first-global-unicorn-index-series-301672972.html

SOURCE Morningstar, Inc.