MAVERIX ACQUIRES ROYALTIES ON GOLD PROJECTS IN NEVADA

Maverix Metals has acquired three gold royalty projects in Nevada for $5 million from Waterton Precious Metals Fund II. The acquisition includes royalties on the Lewis, Dixie Creek, and Railroad properties, expected to provide steady cash flow through advance payments. The Lewis property has an inferred resource of 205,827 ounces of gold and is adjacent to the Phoenix mine, while the Dixie Creek project shows promising production potential of approximately 152,000 ounces annually. This strategic investment aligns with Maverix's commitment to enhance shareholder value.

- Acquisition of three royalties expected to generate immediate cash flow through advance payments.

- Lewis property adjacent to producing Phoenix mine, enhancing exploration potential.

- Dixie Creek project has projected annual production of approximately 152,000 ounces.

- None.

Insights

Analyzing...

All amounts are in U.S. dollars unless otherwise indicated.

VANCOUVER, BC, March 8, 2022 /PRNewswire/ - Maverix Metals Inc. ("Maverix" or the "Company") (NYSE: MMX) (TSX: MMX) is pleased to announce that it has acquired a package of three royalties on gold projects located in Nevada from an indirect, wholly-owned subsidiary of Waterton Precious Metals Fund II Cayman, LP for a

Dan O'Flaherty, CEO of Maverix, commented, "This royalty package fits Maverix's strategy perfectly. The properties have excellent exploration and development potential for gold in a great jurisdiction while, uniquely, providing immediate cash flow via advance royalty payments while the projects continue to be advanced."

Royalties

Asset | Location | Stage | Royalty | Advance Royalty Payment |

Lewis | Nevada, USA | Resource | ~ | |

Dixie Creek | Nevada, USA | Exploration | ||

Railroad | Nevada, USA | Exploration |

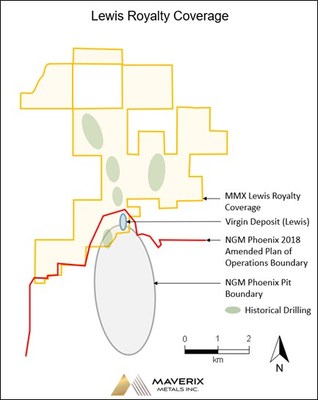

Lewis

A

There is an existing resource on the Lewis property that is identified as the Virgin deposit. The Virgin deposit has an inferred mineral resource of 205,827 contained ounces of gold and 3,537,268 contained ounces of silver in 7.74 million tonnes at a grade of 0.83 grams per tonne ("g/t") of gold and at a grade of 14.22 g/t of silver.1 Gold Standard believes that the Lewis inferred mineral resource estimate at the Virgin deposit is a continuation of the Phoenix-Fortitude mineralization currently being mined by NGM in the Phoenix mine. In 2021, the Phoenix mine produced approximately 177,000 ounces of gold at an all-in sustaining cost of

Lewis also has several known mineralized zones and has the potential for new gold and silver discoveries on the 2,161 hectare land package.

Dixie Creek

A

Railroad

A

1 Mineral resource effective May 2020. For more information please refer to the Technical Report entitled "Technical Report and Mineral Resource Estimate for the Lewis Project, Lander County, Nevada, USA" dated May 1, 2020 available at www.goldstandardv.com, or under Gold Standard's profile at www.sedar.com. |

2 For more information please refer to www.barrick.com and see the Q4 2021 Management's Discussion and Analysis. |

3 For more information please refer to www.goldstandardv.com and see the news release dated February 23, 2022. |

Qualified Person

Brendan Pidcock, P.Eng., is Vice President, Technical Services for Maverix, and a qualified person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has reviewed and approved the scientific and technical disclosure contained in this news release.

About Maverix

Maverix is a gold-focused royalty and streaming company with a globally diversified portfolio of over 120 assets. Maverix's mission is to increase per share value by acquiring precious metals royalties and streams. Its shares trade on both the NYSE American and the TSX under the symbol "MMX".

For further information, please visit our website at www.maverixmetals.com

Cautionary statements to U.S. investors

Information contained or referenced in this press release or in the documents referenced herein concerning the properties, technical information and operations of Maverix has been prepared in accordance with requirements and standards under Canadian securities laws, which differ from the requirements of the U.S. Securities and Exchange Commission ("SEC") under subpart 1300 of Regulation S-K ("S-K 1300"). The terms "mineral resource" and "inferred mineral resource" used in this press release or in the documents incorporated by reference herein are mining terms as defined in accordance with NI 43-101 under guidelines set out in the Definition Standards for Mineral Resources and Mineral Reserves adopted by the Canadian Institute of Mining, Metallurgy and Petroleum Council. While the terms are substantially similar to the same terms defined under S-K 1300 there are differences in the definitions. Accordingly, there is no assurance any mineral resources that the Company may report under NI 43-101 will be the same as resource estimates prepared under the standards adopted under S-K 1300. Because the Company is eligible for the Multijurisdictional Disclosure System adopted by the SEC and Canadian Securities Administrators, the Company is not required to present disclosure regarding its mineral properties in compliance with S-K 1300. Accordingly, certain information contained in this press release concerning descriptions of mineralization and mineral resources under these standards may not be comparable to similar information made public by US companies subject to reporting and disclosure requirements of the SEC.

Cautionary note regarding forward-looking statements

This release contains certain "forward looking statements" and certain "forward-looking information" as defined under applicable Canadian and U.S. securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "intend", "estimate", "anticipate", "believe", "continue", "plans" or similar terminology. The forward-looking information contained herein is provided for the purpose of assisting readers in understanding management's current expectations and plans relating to the future. Readers are cautioned that such information may not be appropriate for other purposes. Forward-looking statements and information include, but are not limited to, developments in respect of the projects that underly each of the Lewis, Dixie Creek and Railroad royalties, and Maverix's portfolio of royalties and streams and those developments at certain of the mines, projects or properties that underlie the Company's interests. Forward-looking statements and information are based on forecasts of future results, estimates of amounts not yet determinable and assumptions that, while believed by management to be reasonable, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual actions, events or results to be materially different from those expressed or implied by such forward-looking information, including but not limited to: the impact of general business and economic conditions; the absence of control over mining operations from which Maverix will purchase gold and other metals or from which it will receive royalty payments and risks related to those mining operations, including risks related to international operations, government and environmental regulation, delays in mine construction and operations, actual results of mining and current exploration activities, conclusions of economic evaluations and changes in project parameters as plans continue to be refined; accidents, equipment breakdowns, title matters, labor disputes or other unanticipated difficulties or interruptions in operations; problems inherent to the marketability of gold and other metals; the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; industry conditions, including fluctuations in the price of the primary commodities mined at such operations, fluctuations in foreign exchange rates and fluctuations in interest rates; government entities interpreting existing tax legislation or enacting new tax legislation in a way which adversely affects Maverix; stock market volatility; regulatory restrictions; liability, competition, the potential impact of epidemics, pandemics or other public health crises, including the current outbreak of the novel coronavirus known as COVID-19 on Maverix's business, operations and financial condition, loss of key employees, as well as those risk factors discussed in the section entitled "Risk Factors" in Maverix's annual information form dated March 23, 2021 available at www.sedar.com. Maverix has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information. Maverix undertakes no obligation to update forward-looking information except as required by applicable law. Such forward-looking information represents management's best judgment based on information currently available.

Technical and third-party information

The disclosure herein and relating to properties and operations on the properties in which Maverix holds royalty, stream or other interests is based on information publicly disclosed by the owners or operators of these properties and information/data available in the public domain as at the date hereof, and none of this information has been independently verified by Maverix. Specifically, as a royalty or stream holder, Maverix has limited, if any, access to properties included in its asset portfolio. Additionally, Maverix may from time to time receive operating information from the owners and operators of the properties, which it is not permitted to disclose to the public. Maverix is dependent on, (i) the operators of the properties and their qualified persons to provide information to Maverix, or (ii) on publicly available information to prepare disclosure pertaining to properties and operations on the properties on which Maverix holds royalty, stream or other interests, and generally has limited or no ability to independently verify such information. Although Maverix does not have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate. Some information publicly reported by operators may relate to a larger property than the area covered by Maverix's royalty, stream or other interest. Maverix's royalty, stream or other interests often cover less than

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/maverix-acquires-royalties-on-gold-projects-in-nevada-301497462.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/maverix-acquires-royalties-on-gold-projects-in-nevada-301497462.html

SOURCE Maverix Metals Inc.