Madison Metals Acquires One of Canada’s Largest Undeveloped Antimony Deposits in a Hemlo Gold Camp Setting

Madison Metals has signed binding letters of intent to acquire 100% interest in the Howells Lake Antimony Gold Project, covering 13,990.90 hectares over 697 claims in Ontario, Canada. The project contains a historic resource estimate of 1.7 million tons at 1.70% antimony (approximately 51 million pounds) with associated gold mineralization up to 2.3 ounces per ton. The acquisition involves share issuances and NSR agreements with three vendors. The project is particularly significant as antimony prices have tripled in the past year due to Chinese export restrictions, and the geological setting is similar to the Hemlo gold deposits.

Madison Metals ha firmato lettere di intenti vincolanti per acquisire il 100% di interesse nel Howells Lake Antimony Gold Project, che copre 13.990,90 ettari su 697 concessioni in Ontario, Canada. Il progetto contiene una stima storica delle risorse di 1,7 milioni di tonnellate con una concentrazione di antimonio dell'1,70% (circa 51 milioni di libbre) con mineralizzazione aurifera associata fino a 2,3 once per tonnellata. L'acquisizione prevede emissioni di azioni e accordi NSR con tre fornitori. Il progetto è particolarmente significativo poiché i prezzi dell'antimonio sono triplicati nell'ultimo anno a causa delle restrizioni alle esportazioni cinesi, e il contesto geologico è simile a quello dei giacimenti d'oro di Hemlo.

Madison Metals ha firmado cartas de intención vinculantes para adquirir el 100% de interés en el Howells Lake Antimony Gold Project, que abarca 13,990.90 hectáreas sobre 697 reclamaciones en Ontario, Canadá. El proyecto contiene una estimación histórica de recursos de 1.7 millones de toneladas con un 1.70% de antimonio (aproximadamente 51 millones de libras) y mineralización asociada de oro de hasta 2.3 onzas por tonelada. La adquisición implica la emisión de acciones y acuerdos NSR con tres proveedores. El proyecto es particularmente significativo ya que los precios del antimonio se han triplicado en el último año debido a las restricciones de exportación de China, y el entorno geológico es similar a los depósitos de oro de Hemlo.

매디슨 메탈스는 캐나다 온타리오에서 697개의 청구권을 포함하는 13,990.90 헥타르 면적의 하우웰스 레이크 안티모니 금 프로젝트에 대한 100% 지분 인수를 위한 구속력 있는 의향서에 서명했습니다. 이 프로젝트는 1.7%의 안티모니를 포함한 170만 톤의 역사적 자원 추정치를 보유하고 있으며(약 5100만 파운드), 연관된 금 광물화는 톤당 최대 2.3온스까지 포함됩니다. 이번 인수는 세 명의 공급업체와의 주식 발행 및 NSR 계약을 포함합니다. 이 프로젝트는 중국의 수출 제한으로 인해 안티모니 가격이 지난 1년 동안 세 배로 증가했으며, 지질학적 설정이 헴로 금 매장지와 유사하다는 점에서 특히 중요합니다.

Madison Metals a signé des lettres d'intention contraignantes pour acquérir 100 % d'intérêt dans le Howells Lake Antimony Gold Project, couvrant 13.990,90 hectares sur 697 revendications en Ontario, Canada. Le projet contient une estimation historique des ressources de 1,7 million de tonnes à 1,70 % d'antimoine (environ 51 millions de livres) avec une minéralisation aurifère associée allant jusqu'à 2,3 onces par tonne. L'acquisition implique des émissions d'actions et des accords NSR avec trois fournisseurs. Le projet est particulièrement significatif, car les prix de l'antimoine ont triplé au cours de l'année dernière en raison des restrictions à l'exportation en Chine, et le contexte géologique est similaire à celui des gisements d'or de Hemlo.

Madison Metals hat verbindliche Absichtserklärungen unterzeichnet, um 100 % Interesse am Howells Lake Antimony Gold Project zu erwerben, das 13.990,90 Hektar auf 697 Ansprüchen in Ontario, Kanada, abdeckt. Das Projekt enthält eine historische Schätzung von 1,7 Millionen Tonnen mit 1,70 % Antimon (ca. 51 Millionen Pfund) mit zugehöriger Goldmineralisierung von bis zu 2,3 Unzen pro Tonne. Der Erwerb umfasst die Ausgabe von Aktien und NSR-Vereinbarungen mit drei Anbietern. Das Projekt ist besonders bedeutend, da die Antimonpreise im letzten Jahr aufgrund chinesischer Exportbeschränkungen auf das Dreifache gestiegen sind, und die geologische Umgebung ähnlich ist wie die Goldvorkommen in Hemlo.

- Historic resource estimate of 1.7M tons at 1.70% antimony (~51M pounds)

- Gold mineralization reported up to 2.3 oz/ton associated with antimony

- Strategic timing with antimony prices tripling in the past year

- Mineralization starts from surface to 150m depth and remains open

- Project located in favorable Hemlo gold camp setting

- Historic resource is non-NI 43-101 compliant

- No significant drilling or comprehensive work in past 40 years

- Substantial share dilution through issuance of up to 4.675M shares to vendors

- Multiple NSR obligations (2% to each vendor) adding to future production costs

TORONTO, Dec. 02, 2024 (GLOBE NEWSWIRE) -- Madison Metals Inc. (“Madison” or the “Company”) (CSE: GREN) (OTCQB: MMTLF) (FSE: 4EF0) is pleased to announce it has significantly increased its presence in the critical minerals sector by signing binding letters of intent (the “LOI”) with three separate entities (collectively the “Vendors”) to acquire

“Micro-cap companies rarely, if ever, have the opportunity to obtain complete control of a large, belt-scale asset like the Howells Lake Project, covering such an extensive area of known mineralization that seems to have been overlooked for decades,” said Duane Parnham, Chairman and CEO of Madison Metals. “The Howells Lake Project has enormous potential to have real economic significance, and Madison is seizing this rare opportunity to discover new areas of antimony-gold mineralization as well as define the known areas of antimony and gold mineralization on this very large, underexplored land position. We believe we can drive real shareholder value creation as soon as we get exploration underway on the project.”

The Company will host an online information session about the Howells Lake Project on Tuesday, December 3, 2024, at 2 p.m. Eastern. Investors, analysts, brokers and other participants can register to access the webcast: https://madisonmetals.wistia.com/live/events/bfx2csy1y8.

Howels Lake Highlights

- High-grade antimony was first reported at the Howells Lake Project in the 1940s as mineralization in boulders, and first discovered in drill holes some two kilometres (km) away in the mid-1970s.

- A non-NI 43-101 compliant historic resource estimate for the Howells Lake Project was reported by John Scott, Ontario Resident Geologist – 1,700,000 tons at

1.70% antimony* (*see disclosure below). This tonnage would be equal to approximately 51 million pounds of contained antimony. - Mineralization is located from the surface to about 150 metres (m) depth.

- Mineralization remains open to further expansion both laterally and to depth.

- Mineralization is related to strong deformation, carbonate alteration, green mica, sericite and quartz veining, intrusive rock units, pyrite and pyrrhotite, as well as minor base metal mineralization.

- Gold mineralization associated with the antimony mineralization is reported to be up to 2.3 ounces per ton, although the average gold content is not available for the historic antimony resource tonnage.

- At least CDN

$2 million was spent in the early exploration phase in the 1970s-1980s by just one of the companies. - No significant drilling or other comprehensive work has been completed in the vicinity of the antimony deposit in the past 40 years.

- The property covers 20 km of favourable geology with little drilling outside the resource area.

- Stibnite (antimony mineral) was reported in drill holes over 5,000 m along trend and remains open for expansion and fill-in work.

*The historic mineral resource was prepared before the implementation of NI-43-101 standards for disclosure for Mineral Projects. The historic resource does not meet the disclosure required under the provisions of NI-43-101 and should not be relied upon. The report was prepared by New Jersey Zinc staff in 1977 and reported on by then Ontario Resident Geologist John Scott. While the resources should not be relied upon, the QP for this release considers the resource estimate to be pertinent and of value for readers to consider.

“Antimony was historically discovered in drilling alongside gold mineralization on the Howells Lake Project in the early 1970s,” said Parnham. “The antimony price run-up has been driven by its supply-demand fundamentals, and its tripling in price over the past year has been largely sparked by increasing demand and the Chinese export restrictions that took effect September 15, 2024. Expanding our portfolio to include this high-impact, high-grade project complements our existing uranium assets and positions us as a first mover in the space.”

Parnham continues, “In addition to the antimony potential, the Howells Lake Project is very similar in its geochemistry and geological setting to that found in the world-class Hemlo gold deposits, where gold production and resources now exceed 25 million ounces. Many setting similarities make the Howells Lake Project a very rare ‘Hemlo copy.’ They include the presence of antimony, quartz sericite alteration, green mica, felsic dikes, evidence of regional faults and unconformities with the unique addition of the presence of high-grade antimony associated with some of the gold mineralization, which was largely overlooked or thought to have little value given the antimony price of the 1970s, which was a fraction of the current pricing. Millions were spent exploring the area and defining mineralization, and this work produced a substantial non-43-101 compliant historical resource* of approximately 51 million pounds of antimony, along with gold mineralization. With gold prices soaring past US

Madison also wishes to welcome Mr. Bruce Durham to our team as special technical advisor to the Board of Directors and lead technical manager of all activities at the Howells Lake Project.

Antimony is a critical mineral that is vital for numerous applications. In defence applications, it is becoming increasingly strategic and growing in use for military applications, such as hardening bullets, reinforcing shell casings, and enhancing high-tech military screens, among other uses. It is also used in semiconductor manufacturing and is a key ingredient in fire retardants and solar panel manufacturing.

Global antimony supply faces significant challenges. China produced

Antimony is on the critical metals list of Canada, the United States, and the European Union. In Canada, projects that qualify as critical minerals projects can receive funding incentives not available for other exploration projects.

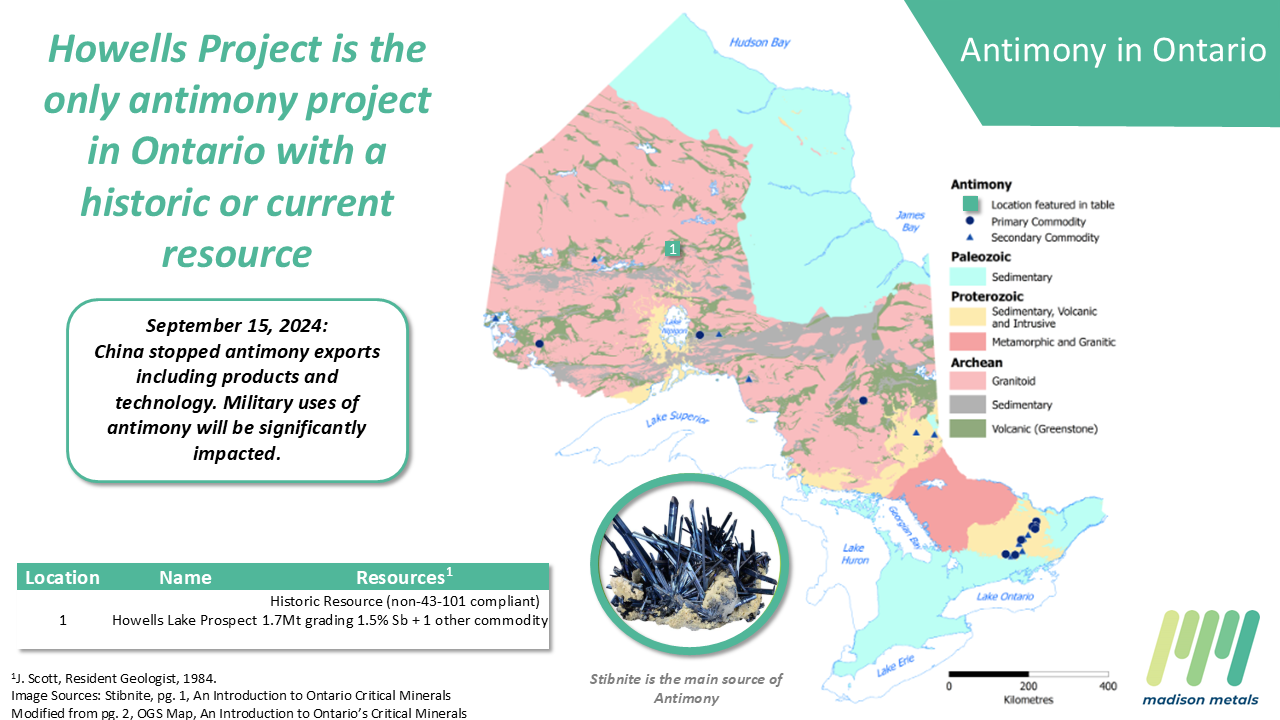

Figure 1: Map showing the Howells Lake Project as the only significant primary antimony project in Ontario, Canada. Source: “An Introduction to Ontario’s Critical Minerals, With Highlights from the Ontario Mineral Inventory,” published in 2022 by the Ontario Geological Survey, Ministry of Northern Development, Mines, Natural Resources and Forestry highlighting the Howells Antimony deposit (modified December 2024 by Madison).

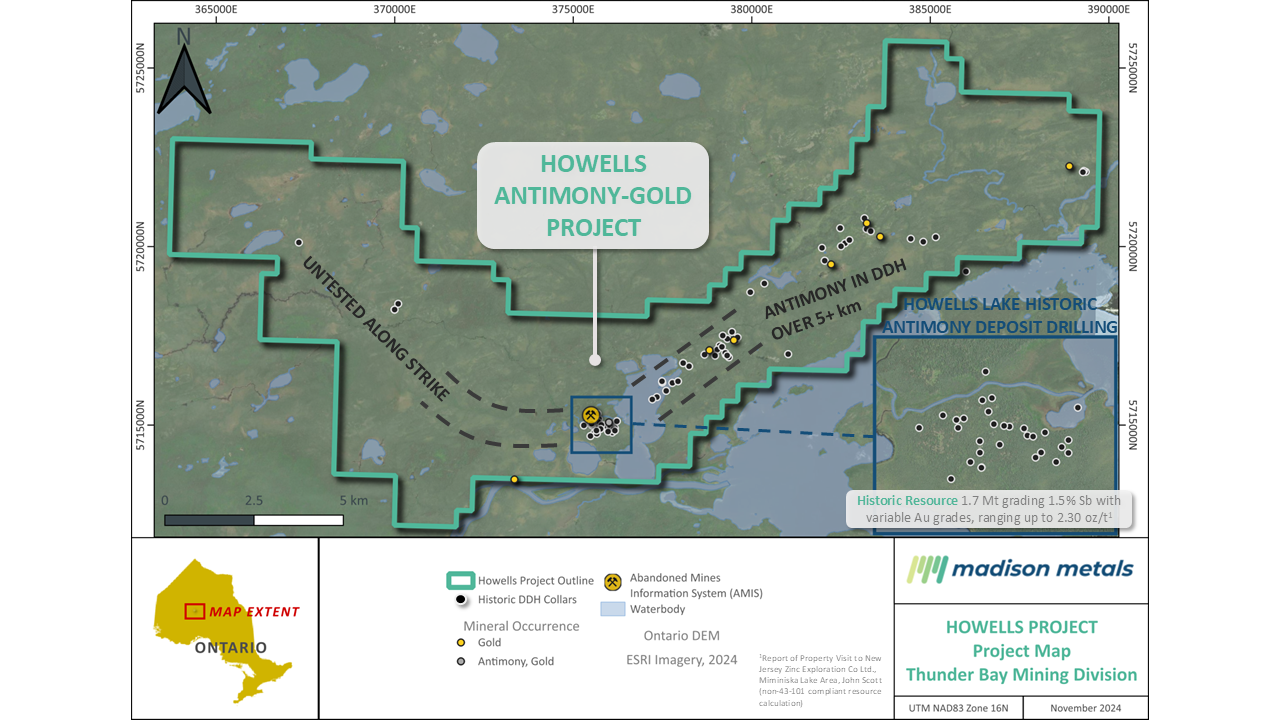

Figure 2: Claims map of the Howells Lake Project in the Thunder Bay Mining Division of Ontario, Canada.

For consideration to acquire

Qualified Person

Bruce Durham, P.Geo., a qualified person under National Instrument 43-101, has reviewed and approved the technical content of this news release as it pertains to the Howells Lake Project.

Other Business

The Company plans to undergo a name change and apply for a new CUSIP number within the week. More information will be available when confirmed.

With respect to the joint venture with Star Minerals announced September 19, 2024, Madison anticipates the closing of the transaction in early December 2024, which includes the initial US

About Madison Metals Inc.

Madison Metals Inc. (CSE: GREN) (OTCQB: MMTLF) (FSE: 4EF0) is an upstream mining and exploration company focused on critical minerals and metals, led by antimony, uranium, and copper. With over 50 years of mining experience, its management team has geological and financial expertise and a track record of creating shareholder value.

Additional information about Madison Metals Inc. can be found at madisonmetals.ca and on the Company’s SEDAR+ profile at http://www.sedarplus.ca/.

For further information, please contact:

Duane Parnham

Executive Chairman & CEO

Madison Metals Inc.

+1 (416) 489-0092

ir@madisonmetals.ca

Media inquiries:

Adam Bello

Manager, Media & Analyst Relations

Primoris Group Inc.

+1 (416) 489-0092

media@primorisgroup.com

Neither the Canadian Securities Exchange nor CIRO accepts responsibility for the adequacy or accuracy of this release.

Forward-looking Statements

This press release contains forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and assumptions and accordingly, actual results and future events could differ materially from those expressed or implied in such statements. You are hence cautioned not to place undue reliance on forward-looking statements. All statements other than statements of present or historical fact are forward-looking statements and include but are not limited to statements with respect to the LOI and the likelihood that the definitive agreement(s) will be entered into and that the transaction will be completed on the terms provided herein or at all, the benefits of the transaction to the Company and the Vendor and the receipt of all required approvals. Forward-looking statements include words or expressions such as “proposed”, “will”, “subject to”, “near future”, “in the event”, “would”, “expect”, “prepared to” and other similar words or expressions. Factors that could cause future results or events to differ materially from current expectations expressed or implied by the forward-looking statements include general business, economic, competitive, political and social uncertainties; the state of capital markets; risks relating to (i) the ability of the parties to satisfy the conditions precedent to the execution of any definitive agreement(s) or to ultimately agree on definitive terms, (ii) the impact on the respective businesses, operations and financial condition of the Company and the Vendor resulting from the announcement of the transaction and/or the failure to enter into definitive agreement(s) or to complete the transaction on terms described or at all, (iii) delay or failure to receive board, shareholder, regulatory or court approvals, wherever applicable, or any other conditions precedent to the completion of the transaction, (iv) failure to realize the anticipated benefits of the transaction, (v) other unforeseen events, developments, or factors causing any of the aforesaid expectations, assumptions, and other factors ultimately being inaccurate or irrelevant; and any risks associated with the ongoing COVID-19 pandemic. You can find further information with respect to these and other risks in filings made with the Canadian securities regulatory authorities that are available at www.sedar.com. The Company disclaims any obligation to update or revise these forward-looking statements, except as required by applicable law.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/4968855e-0264-459a-8307-b2d29b30ed03

https://www.globenewswire.com/NewsRoom/AttachmentNg/145df9b2-b71a-42e9-83af-10fa209f3937