Magellan Rx Management’s Medical Pharmacy Trend Report Unlocks the Latest Trends and Emerging Strategies to Manage Rising Medical Benefit Specialty Drug Spend

Magellan Rx Management, a division of Magellan Health, Inc. (NASDAQ: MGLN), released its eleventh annual Medical Pharmacy Trend ReportTM, featuring a comprehensive view of provider-administered medical benefit drug trends—one of the largest drivers of total specialty drug spend.

(Graphic: Business Wire)

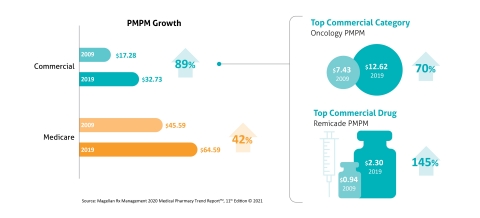

Through 11 years of market evolution and claims data trends, the Report highlights how total medical benefit costs and per-member-per-month (PMPM) trends have continued to rise. Since the first edition of the Report, commercial PMPM has nearly doubled. Market dynamics have evolved significantly, including the introduction and growth of biosimilars, and the science has advanced faster than ever with new mechanisms of action, novel therapies for orphan diseases, targeted oncology therapeutics, and the introduction of gene therapy. These innovations have helped countless patients, while also presenting new complexities for managed care organizations and clinicians. These challenges are why it is critical for payers to be increasingly focused on managing drug spend on the medical benefit.

“These trends continue to be a challenge for all stakeholders involved in the care of patients with complex specialty conditions, making it vital for them to stay current and informed for better decision-making,” said Kristen Reimers, RPh, senior vice president, specialty clinical solutions, Magellan Rx Management. “At Magellan Rx, we have a deep understanding of trends based on intricate knowledge and detailed analysis of medical benefit drug claims as well as current management approaches and innovative solutions that are being deployed to combat rising costs while maintaining quality care for patients.”

Key Findings and Trends in the 2020 Report

- The top five commercial drugs are now: Remicade, Neulasta, Ocrevus, Rituxan, and Herceptin. This is a historic shift—after a decade of Remicade, Neulasta, Rituxan, Herceptin, and Avastin being the top-five drugs, Avastin has been replaced by Ocrevus (No. 3).

- Biosimilars RENFLEXIS and Inflectra in the Biologic Drugs for Autoimmune Disorders (BDAIDs) category are making an impact with a 4-6 percentage point increase in market share for commercial and Medicare and a substantial 24 percentage point increase in Medicaid. The average annual cost per patient for these agents were 22-28 less than the reference product, Remicade.

- Colony stimulating factors (CSFs) in Medicare and Medicaid experienced a decline in spend, potentially attributed to a decrease in the use of cytotoxic chemotherapy. This reduction in the use of cytotoxic agents drove higher oncology spend as use of immunotherapy and monoclonal antibody (MoAb) drugs increased.

-

Driven by the decrease in CSF cost and spend, oncology support spend is forecasted to decrease by

32% over the next five years—the only category profiled with a steady reduction in cost. -

The oncology pipeline had more than 700 drugs in clinical trials in 2019 and is forecasted to increase

105% in PMPM spend from$52 in 2019 to$106 in 2024.

This Report is just one of the ways Magellan Rx keeps the market updated on the latest trends for medical benefit drugs. To learn about Magellan Rx’s 16+ years of experience and commitment to developing innovative clinical programs that address these trends and help payers stay ahead of the curve to improve overall cost and quality, click here to read about the company’s total specialty drug management approach and medical pharmacy solutions.

About Magellan Rx Management: Magellan Rx Management, a division of Magellan Health, Inc., is a next-generation pharmacy organization that is delivering meaningful solutions to the people we serve. As pioneers in specialty drug management, industry leaders in medical pharmacy programs and disruptors in pharmacy benefit management, we partner with our customers and members to deliver a best-in-class healthcare experience.

About Magellan Health: Magellan Health, Inc., is a leader in managing the fastest growing, most complex areas of health, including special populations, complete pharmacy benefits and other specialty areas of healthcare. Magellan supports innovative ways of accessing better health through technology, while remaining focused on the critical personal relationships that are necessary to achieve a healthy, vibrant life. Magellan's customers include health plans and other managed care organizations, employers, labor unions, various military and governmental agencies and third-party administrators. For more information, visit MagellanHealth.com.

(MGLN-GEN)

View source version on businesswire.com: https://www.businesswire.com/news/home/20210520005141/en/