Appendix 4C Quarterly Activity Report for Quarter Ended June 30, 2024

Rhea-AI Summary

Mesoblast (Nasdaq:MESO; ASX:MSB) provided highlights of its activities for Q4 2024 ended June 30. Key points include:

1. Ryoncil BLA resubmission for SR-aGVHD treatment in children accepted by FDA, with a decision expected by January 7, 2025.

2. Phase 3 trial for rexlemestrocel-L in chronic low back pain has commenced enrollment.

3. FDA supports accelerated approval pathway for Revascor in end-stage heart failure patients with LVADs.

4. Cash balance of US$63.0 million as of June 30, 2024, with an additional US$10.0 million available upon Ryoncil approval.

5. 37% reduction in net operating cash spend for Q4 FY2024 compared to Q4 FY2023.

6. Successful implementation of cost containment plan, including voluntary salary reductions for directors.

Positive

- Ryoncil BLA resubmission accepted by FDA for review, with potential approval by January 7, 2025

- Phase 3 trial for rexlemestrocel-L in chronic low back pain has started enrollment

- FDA supports accelerated approval pathway for Revascor in end-stage heart failure patients with LVADs

- 37% reduction in net operating cash spend for Q4 FY2024 compared to Q4 FY2023

- 23% reduction in net operating cash spend for FY2024 compared to FY2023

- Successful implementation of cost containment plan, reducing expenses

Negative

- Net operating cash spend of US$10.2 million for Q4 FY2024, indicating ongoing cash burn

News Market Reaction 1 Alert

On the day this news was published, MESO gained 4.64%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Ryoncil BLA Submission Under FDA Review for Approval in Children with SR-aGVHD

NEW YORK, July 30, 2024 (GLOBE NEWSWIRE) -- Mesoblast Limited (Nasdaq:MESO; ASX:MSB), global leader in allogeneic cellular medicines for inflammatory diseases, today provided highlights of its recent activities for the fourth quarter ended June 30, 2024.

Mesoblast Chief Executive Silviu Itescu said: “We are very pleased with the strong relationship we have built with FDA across our product pipeline and the positive outcomes over the past six months.”

“Our BLA resubmission for approval of Ryoncil® (remestemcel-L) in the treatment of children with acute graft versus host disease (SR-aGVHD) was accepted as a complete response, we received feedback from FDA on the potential accelerated approval pathway for Revascor® (rexlemestrocel-L) in end-stage heart failure patients, and our confirmatory Phase 3 trial in inflammatory back pain is actively enrolling with a primary endpoint of pain reduction aligned with FDA.”

“We are executing on our go-to-market plan to bring Ryoncil to the many children suffering with the devastating disease of acute GVHD. I look forward to an activity update at our full year financials and investor call on August 28th 6.30pm EDT (August 29th 8.30am AEST).”

KEY HIGHLIGHTS

Graft versus Host Disease – Pending Decision on FDA Approval

- FDA informed Mesoblast at the end of March 2024 that, following additional consideration, the available clinical data from the Phase 3 study MSB-GVHD001 appears sufficient to support submission of the proposed BLA for remestemcel-L (RYONCIL) for treatment of pediatric patients with SR-aGVHD.

- Mesoblast resubmitted its BLA for approval of RYONCIL on July 8, 2024, addressing remaining CMC (Chemistry, Manufacturing, and Controls) items in the August 2023 Complete Response Letter (CRL).

- FDA accepted the BLA resubmission within two weeks, considering it to be a complete response.

- Mesoblast anticipates a decision prior to or on the FDA’s Prescription Drug User Fee Act (PDUFA) goal date of January 7, 2025.

- FDA has already conducted the Pre-License Inspection (PLI) of the manufacturing process for RYONCIL in May 2023 and this did not result in the issuance of any Form 483.

- RYONCIL is being reviewed under Priority Review, a designation given to drugs that treat a serious condition and provide a significant improvement in safety or effectiveness over existing treatments.

Chronic Inflammatory Low Back Pain – Phase 3 Program

- The confirmatory Phase 3 trial of Mesoblast’s second generation allogeneic, immunoselected, and industrially manufactured stromal cell product rexlemestrocel-L in patients with chronic low back pain (CLBP) due to inflammatory degenerative disc disease of less than five years duration has commenced enrollment at multiple sites across the United States.

- FDA has previously confirmed alignment with Mesoblast on the design of the 300-patient randomized, placebo-controlled trial and the 12-month primary endpoint of pain reduction as an approvable indication. Key secondary measures include improvement in quality of life, function, and reduced opioid usage.

- FDA has designated rexlemestrocel-L a Regenerative Medicine Advanced Therapy (RMAT) for the treatment of chronic low back pain. RMAT designation provides all the benefits of Breakthrough and Fast Track designations, including rolling review and eligibility for priority review on filing of a Biologics License Application (BLA).

Chronic Heart Failure with Reduced Ejection Fraction (HFrEF) and Persistent Inflammation

- FDA informed Mesoblast that it supports an accelerated approval pathway for its second generation allogeneic, immunoselected, and industrially manufactured stromal cell product rexlemestrocel-L (Revascor®), for patients with end-stage ischemic heart failure with reduced ejection fraction (HFrEF) and a left ventricular assist device (LVAD).

- In these patients, a single administration of REVASCOR reduced inflammation, strengthened left ventricular function, reduced right ventricular failure, and reduced hospitalizations.

- REVASCOR has also reduced major adverse cardiac events (MACE) (cardiovascular death, heart attacks and strokes) in a completed Phase 3 trial in ischemic HFrEF patients with NYHA class II /III disease and inflammation.

- Mesoblast has received RMAT designation for rexlemestrocel-L in the treatment of end-stage heart failure in LVAD patients and intends to meet with FDA to discuss data presentation, timing and FDA expectations for an accelerated approval filing in these patients.

FINANCIAL REPORT

We will take a measured approach to preparing for the commercial launch of RYONCIL for treatment of children with SR-aGVHD in anticipation of potential FDA BLA approval and ensure prudent cash management. The successful implementation of the cost containment plan from August 2023 and the re-prioritization of projects has enabled us to reduce cash expenditure whilst still making significant strides forward on key programs as outlined above. We continue to work on corporate and strategic initiatives to access commercial distribution channels and optimize our balance sheet.

Fourth Quarter and Full Year Results

- Cash balance at June 30, 2024 is US

$63.0 million , with additional US$10.0 million available from an existing facility on FDA approval of RYONCIL. - Net operating cash spend of US

$10.2 million for the fourth quarter FY2024. 37% (US$6.0 million ) reduction in net operating cash spend for the fourth quarter FY2024 versus the prior comparative quarter in FY2023.23% (US$14.8 million ) reduction in net operating cash spend in FY2024 compared to FY2023.

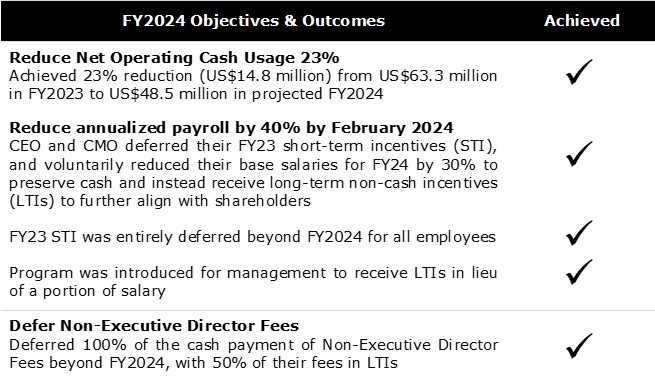

Cost containment strategy achieved

On completion of the FY2024 financial year we are pleased to report the results of the successful cost containment plan announced in August 2023 as follows:

Other

Fees to Non-Executive Directors were nil, consulting payments to Non-Executive Director were US

A copy of the Appendix 4C – Quarterly Cash Flow Report for the fourth quarter FY2024 is available on the investor page of the company’s website www.mesoblast.com.

About Mesoblast

Mesoblast (the Company) is a world leader in developing allogeneic (off-the-shelf) cellular medicines for the treatment of severe and life-threatening inflammatory conditions. The Company has leveraged its proprietary mesenchymal lineage cell therapy technology platform to establish a broad portfolio of late-stage product candidates which respond to severe inflammation by releasing anti-inflammatory factors that counter and modulate multiple effector arms of the immune system, resulting in significant reduction of the damaging inflammatory process.

Mesoblast has a strong and extensive global intellectual property portfolio with protection extending through to at least 2041 in all major markets. The Company’s proprietary manufacturing processes yield industrial-scale, cryopreserved, off-the-shelf, cellular medicines. These cell therapies, with defined pharmaceutical release criteria, are planned to be readily available to patients worldwide.

Mesoblast is developing product candidates for distinct indications based on its remestemcel-L and rexlemestrocel-L allogeneic stromal cell technology platforms. Remestemcel-L is being developed for inflammatory diseases in children and adults including steroid refractory acute graft versus host disease, and biologic-resistant inflammatory bowel disease. Rexlemestrocel-L is being developed for advanced chronic heart failure and chronic low back pain. Two products have been commercialized in Japan and Europe by Mesoblast’s licensees, and the Company has established commercial partnerships in Europe and China for certain Phase 3 assets.

Mesoblast has locations in Australia, the United States and Singapore and is listed on the Australian Securities Exchange (MSB) and on the Nasdaq (MESO). For more information, please see www.mesoblast.com, LinkedIn: Mesoblast Limited and Twitter: @Mesoblast

References / Footnotes

- As required by ASX listing rule 4.7 and reported in Item 6 of the Appendix 4C, reported are the aggregated total payments to related parties being Executive Directors and Non-Executive Directors.

Forward-Looking Statements

This press release includes forward-looking statements that relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. We make such forward-looking statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Forward-looking statements should not be read as a guarantee of future performance or results, and actual results may differ from the results anticipated in these forward-looking statements, and the differences may be material and adverse. Forward-looking statements include, but are not limited to, statements about: the initiation, timing, progress and results of Mesoblast’s preclinical and clinical studies, and Mesoblast’s research and development programs; Mesoblast’s ability to advance product candidates into, enroll and successfully complete, clinical studies, including multi-national clinical trials; Mesoblast’s ability to advance its manufacturing capabilities; the timing or likelihood of regulatory filings and approvals, manufacturing activities and product marketing activities, if any; the commercialization of Mesoblast’s product candidates, if approved; regulatory or public perceptions and market acceptance surrounding the use of stem-cell based therapies; the potential for Mesoblast’s product candidates, if any are approved, to be withdrawn from the market due to patient adverse events or deaths; the potential benefits of strategic collaboration agreements and Mesoblast’s ability to enter into and maintain established strategic collaborations; Mesoblast’s ability to establish and maintain intellectual property on its product candidates and Mesoblast’s ability to successfully defend these in cases of alleged infringement; the scope of protection Mesoblast is able to establish and maintain for intellectual property rights covering its product candidates and technology; estimates of Mesoblast’s expenses, future revenues, capital requirements and its needs for additional financing; Mesoblast’s financial performance; developments relating to Mesoblast’s competitors and industry; and the pricing and reimbursement of Mesoblast’s product candidates, if approved. You should read this press release together with our risk factors, in our most recently filed reports with the SEC or on our website. Uncertainties and risks that may cause Mesoblast’s actual results, performance or achievements to be materially different from those which may be expressed or implied by such statements, and accordingly, you should not place undue reliance on these forward-looking statements. We do not undertake any obligations to publicly update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise.

Release authorized by the Chief Executive.

For more information, please contact:

| Corporate Communications / Investors | Media |

| Paul Hughes | BlueDot Media |

| T: +61 3 9639 6036 | Steve Dabkowski |

| E: investors@mesoblast.com | T: +61 419 880 486 |

| E: steve@bluedot.net.au | |

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ea78d212-3108-47c8-805d-fd80206fd7c4