Moody’s Analytics: Most States are Well Prepared to Weather a Recession

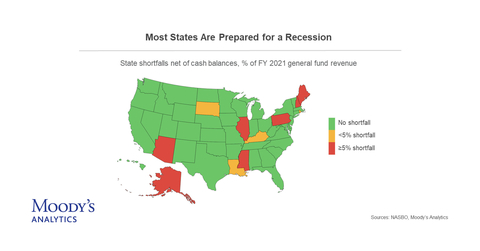

The majority of US states have the resources needed to get through an economic recession, according to a Moody’s Analytics study. A record 43 states have the cash they need to weather an economic slump without having to resort to severe spending cuts or tax increases. (Graphic: Business Wire)

“States have never been in a better position to make it through a recession,” said

The

While the stress test results find most states prepared for a recession, there is some variation in their degrees of readiness, according to the study. In total, 39 states have the funds to significantly reduce stress from a recession. Four states would have to raise taxes or cut spending by less than

States overly dependent on tourism and consumer spending will be most hard hit during a recession, according to the study. States with agriculture and energy-based economies are better positioned to weather the storm.

The bottom five states with less than a

-

Illinois -

Alaska -

Arizona -

Mississippi -

New Hampshire

In contrast, the states most flush with cash are:

-

North Dakota -

Wyoming -

Idaho -

California -

Delaware

To protect their budgets from increased volatility and fiscal drag, state and local policymakers should consider investing in their budget processes and make stress-testing a higher priority. “States may want to consider formulating targeted reserve levels,” Mandel added. “Planning for a recession requires putting away enough money today to prepare for a future downturn, without stunting economic growth.”

Read the state stress test study.

About Moody’s Analytics

Moody’s Analytics provides financial intelligence and analytical tools to help business leaders make better, faster decisions. Our deep risk expertise, expansive information resources, and innovative application of technology help our clients confidently navigate an evolving marketplace. We are known for our industry-leading and award-winning solutions, made up of research, data, software, and professional services, assembled to deliver a seamless customer experience. We create confidence in thousands of organizations worldwide, with our commitment to excellence, open mindset approach, and focus on meeting customer needs. For more information about Moody’s Analytics, visit our website or connect with us on Twitter and LinkedIn.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220929005226/en/

Moody’s

+1.415.874.6013

Tracy.fine@moodys.com

moodysanalytics.com

twitter.com/moodysanalytics

linkedin.com/company/moodysanalytics

Source: Moody’s Analytics