Montage Gold Repurchases 1% NSR Royalty on Its Koné Project

Montage Gold Corp (TSXV: MAU, OTCQX: MAUTF) has repurchased a 1.0% net smelter returns royalty on its Koné project in Côte d'Ivoire for US$10 million. This transaction reduces the total royalty on the Mankono Property from 2.0% to 1.0%, with Barrick and Endeavour retaining 0.7% and 0.3% respectively. The company is conducting a 60,000-meter drilling programme with the goal of discovering at least 1 million ounces of Measured and Indicated Resources at a grade exceeding 1 g/t Au, which would be 50% higher than the current Koné deposit grade. Montage aims to maintain an annual production of at least 300koz for more than 10 years.

Montage Gold Corp (TSXV: MAU, OTCQX: MAUTF) ha riacquistato una royalty sulle entrate di fusione netta dell'1,0% sul suo progetto Koné in Costa d'Avorio per 10 milioni di dollari USA. Questa operazione riduce la royalty totale sulla proprietà di Mankono dal 2,0% all'1,0%, con Barrick e Endeavour che mantengono rispettivamente lo 0,7% e lo 0,3%. L'azienda sta conducendo un programma di perforazione di 60.000 metri con l'obiettivo di scoprire almeno 1 milione di once di Risorse Misurate e Indicate con un grado superiore a 1 g/t Au, il che sarebbe il 50% superiore al grado attuale del deposito di Koné. Montage mira a mantenere una produzione annuale di almeno 300.000 once per oltre 10 anni.

Montage Gold Corp (TSXV: MAU, OTCQX: MAUTF) ha recomprado una regalía neta sobre retornos de fundición del 1.0% sobre su proyecto Koné en Costa de Marfil por 10 millones de dólares EE. UU.. Esta transacción reduce la regalía total en la Propiedad de Mankono del 2.0% al 1.0%, con Barrick y Endeavour manteniendo respectivamente el 0.7% y el 0.3%. La empresa está llevando a cabo un programa de perforación de 60,000 metros con el objetivo de descubrir al menos 1 millón de onzas de Recursos Medidos e Indicados a un grado superior a 1 g/t Au, que sería un 50% más alto que el grado actual del depósito de Koné. Montage tiene como objetivo mantener una producción anual de al menos 300,000 onzas durante más de 10 años.

Montage Gold Corp (TSXV: MAU, OTCQX: MAUTF)는 코트디부아르에 있는 코네 프로젝트에 대한 1.0% 순 용광로 수익 로얄티를 1천만 달러에 재구매했습니다. 이 거래로 망코노 소유지의 총 로얄티가 2.0%에서 1.0%로 감소하였으며, 바릭과 엔데버는 각각 0.7%와 0.3%를 유지합니다. 회사는 60,000미터의 시추 프로그램을 진행 중이며, 1g/t Au 이상의 품위를 가진 최소 100만 온스의 측정 및 표시 자원을 발견하는 것을 목표로 하고 있습니다. 이는 현재 코네 매장량의 품위보다 50% 높은 것입니다. Montage는 10년 이상 연간 최소 300,000온스의 생산을 유지할 계획입니다.

Montage Gold Corp (TSXV: MAU, OTCQX: MAUTF) a racheté une redevance nette de 1,0 % sur les retours de fonderie de son projet Koné en Côte d'Ivoire pour 10 millions de dollars US. Cette transaction réduit la redevance totale sur la propriété de Mankono de 2,0 % à 1,0 %, Barrick et Endeavour conservant respectivement 0,7 % et 0,3 %. L'entreprise mène un programme de forage de 60 000 mètres dans le but de découvrir au moins 1 million d'onces de Ressources Mesurées et Indiquées avec un grade supérieur à 1 g/t Au, ce qui serait 50 % supérieur au grade actuel du gisement de Koné. Montage vise à maintenir une production annuelle d'au moins 300 000 onces pendant plus de 10 ans.

Montage Gold Corp (TSXV: MAU, OTCQX: MAUTF) hat eine 1,0% Netto-Schmelzrendite-Royalty auf sein Koné-Projekt in Côte d'Ivoire für 10 Millionen US-Dollar zurückgekauft. Diese Transaktion reduziert die gesamte Royalty auf das Mankono-Grundstück von 2,0% auf 1,0%, wobei Barrick und Endeavour jeweils 0,7% und 0,3% behalten. Das Unternehmen führt ein 60.000-Meter-Bohrprogramm durch, mit dem Ziel, mindestens 1 Million Unzen an gemessenen und angezeigt Ressourcen mit einem Gehalt von über 1 g/t Au zu entdecken, was 50% höher wäre als der aktuelle Gehalt des Koné-Lagers. Montage strebt an, eine jährliche Produktion von mindestens 300.000 Unzen über einen Zeitraum von mehr als 10 Jahren aufrechtzuerhalten.

- Reduction of royalty burden from 2.0% to 1.0% on the Koné project

- Ongoing 60,000-meter drilling program targeting 1 million ounces at >1 g/t Au grade

- Strategic target of maintaining 300koz annual production for over 10 years

- US$10 million cash expenditure for royalty buyback

VANCOUVER, British Columbia, Nov. 21, 2024 (GLOBE NEWSWIRE) -- Montage Gold Corp. (“Montage” or the “Company”) (TSXV: MAU, OTCQX: MAUTF) is pleased to announce that it has repurchased a

Martino De Ciccio, CEO of Montage, commented: “Given the strong liquidity sources recently secured, we are pleased to have the strategic and financial flexibility to exercise our right to repurchase a

Moreover, we are delighted with the results of the ongoing 60,000-meter drilling programme as it provides confidence in our ability to deliver on our recently announced Measured and Indicated Resource discovery target of at least 1 million ounces at a grade of more than 1 g/t Au, which would be

We are excited with the momentum generated across our business and look forward to continuing to rapidly progress our strategy of creating a premier African gold producer while delivering value for all our stakeholders.”

The Royalty covers the properties previously held under Mankono Exploration Limited (“Mankono” or the “Property”) which Montage purchased from Barrick Gold Corporation (“Barrick”) and Endeavour Gold Corporation (“Endeavour”) in November 2022. As part of the acquisition, Barrick and Endeavour were granted a

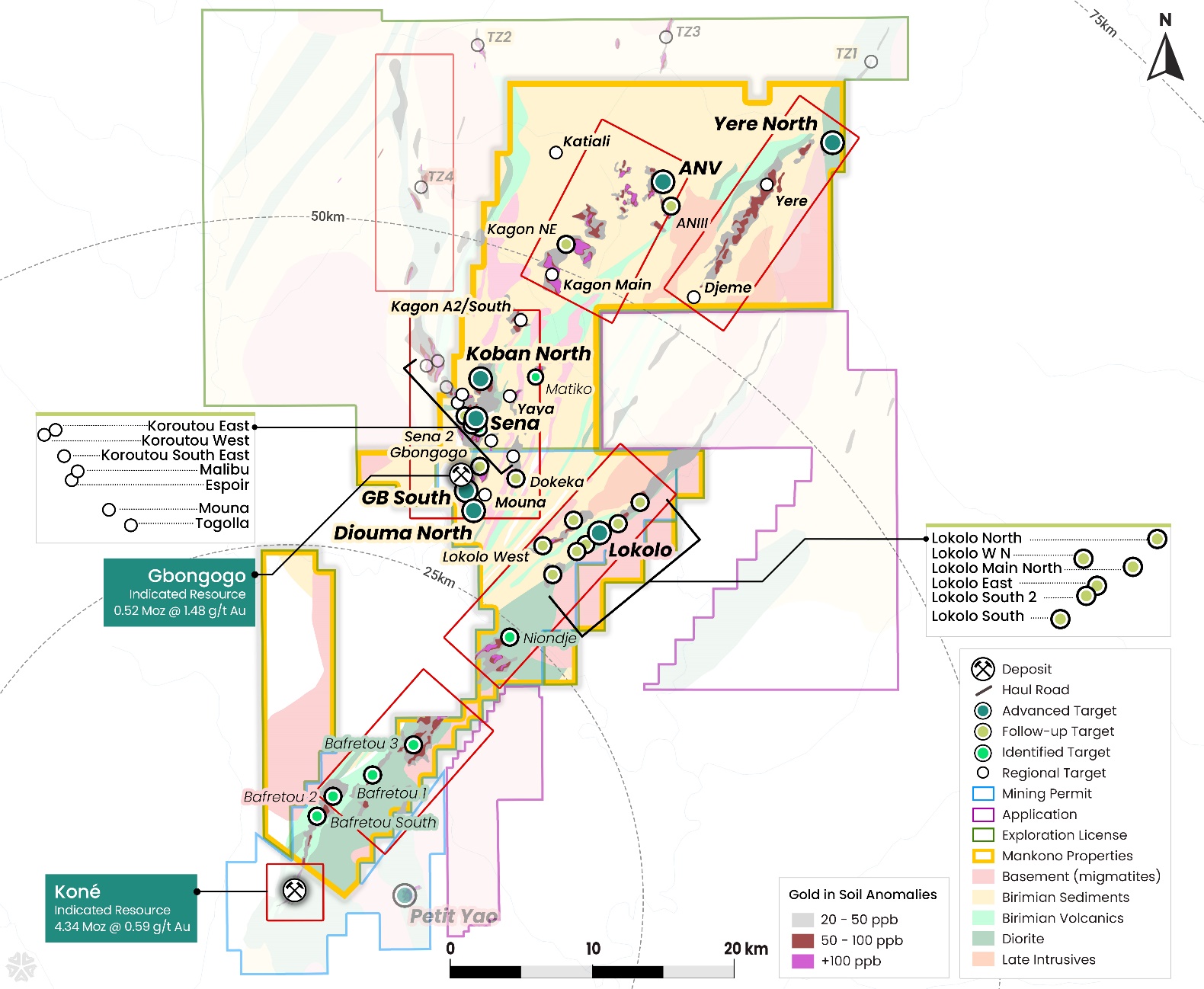

As shown in Figure 1, below, the Property initially comprised of 893km2, covers the original Gbongogo, Sissédougou and Sisséplé exploration licenses. The majority of the Gbongogo permit is now captured under the Koné project’s mining permit, as announced on July 10, 2024, with the remaining retained under exploration licenses. The area hosts significant exploration potential as it encompasses the Gbongogo deposit along with a number of advanced exploration targets including Gbongogo South, Diouma North, Lokolo Main, Sean, Koban North, ANV and Yere North. Many of these targets support the Company’s short-term strategic objective, as announced on October 7, 2024, of discovering more than 1 million ounces of higher-grade Measured and Indicated resources at a grade

Figure 1: The Mankono Property outline and exploration targets

Source for Indicated Resources stated in map above: Updated Feasibility Study press release dated January 16, 2024 available on Montage’s website and on SEDAR+. See “Technical Disclosure”.

Neither TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

ABOUT MONTAGE GOLD CORP.

Montage Gold Corp. (TSXV: MAU) is a Canadian-listed company focused on becoming a premier multi-asset African gold producer, with its flagship Koné project, located in Côte d’Ivoire, at the forefront. Based on the Feasibility Study published in 2024, the Koné project has an estimated 16-year mine life and sizeable annual production of +300koz of gold over the first 8 years. Over the course of 2024, the Montage management team will be leveraging their extensive track record in financing and developing projects in Africa to progress the Koné project towards a construction launch.

TECHNICAL DISCLOSURE

Mineral Resource and Reserve Estimates

The Koné and Gbongogo Main Mineral Resource Estimates were carried out by Mr. Jonathon Abbott of Matrix Resource Consultants of Perth, Western Australia, who is considered to be independent of Montage Gold. Mr. Abbott is a member in good standing of the Australian Institute of Geoscientists and has sufficient experience which is relevant to the commodity, style of mineralisation under consideration and activity which he is undertaking to qualify as a Qualified Person under NI 43–101.

The Mineral Reserve Estimate was carried out by Ms. Joeline McGrath of Carci Mining Consultants Ltd., who is considered to be independent of Montage Gold. Ms. McGrath is a member in good standing of the Australian Institute of Mining and Metallurgy and has sufficient experience which is relevant to the work which she is undertaking to qualify as a Qualified Person under NI 43–101.

2024 Exploration

All exploration work on Kone project is designed and carried out under the supervision of Montage Gold Corp, Executive Vice President, Exploration, Silvia Bottero, a registered Professional Natural Scientist with the South African Council for Natural Scientific Professions (SACNASP) and Qualified Person as defined in National Instrument 43-101 developed by the Canadian Securities Administrators.

Samples used for the results described above come from Diamond Drilling Holes and are based on 1 metre composite sample. Core samples have been cut in two by core blade at the camp facilities then shipped by road to Bureau Veritas facility in Abidjan, Côte d’Ivoire.

For RC drilling, samples were collected over 1 metre downhole intervals from the base of the cyclone and split with a three-tier riffle split. Three kilograms samples were collected then shipped by road to Bureau Veritas facility in Abidjan, Côte d’Ivoire. All samples have been crushed to 2mm (

Field duplicate samples are taken, and blanks and standards are inserted by Montage geologists into the sample sequence at a rate of one of each sample type per 25 samples. This ensures that there is a minimum

For further details of the data verification undertaken, exploration methods undertaken and associated QA/QC programs, and the interpretation thereof, and the assumptions, parameters and methods used to develop the Mineral Resource Estimates and the Mineral Reserve Estimate for the Koné Gold Project, please see the UFS, entitled "Koné Gold Project, Côte d'Ivoire Updated Feasibility Study National Instrument 43-101 Technical Report" and filed on SEDAR+ at www.sedarplus.ca. Readers are encouraged to read the UFS in its entirety, including all qualifications, assumptions and exclusions that relate to the details summarized in this news release. The UFS is intended to be read as a whole, and sections should not be read or relied upon out of context.

Results for exploration drillholes used the following parameters: 0.3 g/t Au cut off for samples, 0.5 g/t Au minimum value composite and 2.0 metre maximum interval dilution length. Composite intervals represent (apparent) downhole thickness. “Including” represents >10 g/t Au.

QUALIFIED PERSONS STATEMENT

The scientific and technical contents of this press release have been verified and approved by Silvia Bottero, BSc, MSc, a Qualified Person pursuant to NI 43-101. Mrs. Bottero, EVP Exploration of Montage, is a registered Professional Natural Scientist with the South African Council for Natural Scientific Professions (SACNASP), a member of the Geological Society of South Africa and a Member of AusIMM.

CONTACT INFORMATION

| For Investor Relations Inquiries: Jake Cain Strategy & Investor Relations Manager jcain@montagegold.com +44 7788 687 567 | For Media Inquiries: John Vincic Oakstrom Advisors john@oakstrom.com +1-647-402-6375 | For Regulatory Inquiries: Kathy Love Corporate Secretary klove@montagegold.com +1-604-512-2959 |

FORWARD-LOOKING STATEMENTS

This press release contains certain forward-looking information and forward-looking statements within the meaning of Canadian securities legislation (collectively, “Forward-looking Statements”). All statements, other than statements of historical fact, constitute Forward-looking Statements. Words such as “will”, “intends”, “proposed” and “expects” or similar expressions are intended to identify Forward-looking Statements. Forward-looking Statements in this press release include statements related to the Company’s objectives of discovering more than 1 million ounces of higher-grade measured and indicated resources at a grade

Forward-looking Statements involve various risks and uncertainties and are based on certain factors and assumptions. There is no assurance that any economic satellite deposits will be discovered, and if discovered ever developed or mined. There can be no assurance that any Forward-looking Statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include uncertainties inherent in the preparation of mineral reserve and resource estimates and definitive feasibility studies such as the Mineral Reserve Estimate and the UFS, and in delineating new mineral reserve and resource estimates, including but not limited to, assumptions underlying the production estimates not being realized, incorrect cost assumptions, unexpected variations in quantity of mineralized material, grade or recovery rates being lower than expected, unexpected adverse changes to geotechnical or hydrogeological considerations, or expectations in that regard not being met, unexpected failures of plant, equipment or processes, unexpected changes to availability of power or the power rates, failure to maintain permits and licenses, higher than expected interest or tax rates, adverse changes in project parameters, unanticipated delays and costs of consulting and accommodating rights of local communities, environmental risks inherent in the Côte d’Ivoire, title risks, including failure to renew concessions, unanticipated commodity price and exchange rate fluctuations, delays in or failure to receive access agreements or amended permits, and other risk factors set forth in the Company’s 2023 Annual Information form available at www.sedarplus.ca, under the heading “Risk Factors”. The Company undertakes no obligation to update or revise any Forward-looking Statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for Montage to predict all of them, or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any Forward-looking Statement. Any Forward-looking Statements contained in this press release are expressly qualified in their entirety by this cautionary statement.

NON-GAAP MEASURES

This press release includes certain terms or performance measures commonly used in the mining industry that are not defined under International Financial Reporting Standards (“IFRS”), including AISC or “all-in sustaining costs” per payable ounce of gold sold and per tonne processed and mining, processing and operating costs reported on a unit basis. Non-GAAP measures do not have any standardized meaning prescribed under IFRS and, therefore, they may not be comparable to similar measures employed by other companies. The Company discloses “all-in sustaining costs” and other unit costs because it understands that certain investors use this information to determine the Company’s ability to generate earnings and cash flows for use in investing and other activities. The Company believes that conventional measures of performance prepared in accordance with IFRS, do not fully illustrate the ability of mines to generate cash flows. The measures, as determined under IFRS, are not necessarily indicative of operating profit or cash flows from operating activities. The measures cash costs and all-in sustaining costs and unit costs are considered to be key indicators of a project’s ability to generate operating earnings and cash flows. Non-GAAP financial measures should not be considered in isolation as a substitute for measures of performance prepared in accordance with IFRS and are not necessarily indicative of operating costs, operating profit or cash flows presented under IFRS. Readers should also refer to our management’s discussion and analysis, available under our corporate profile at www.sedarplus.ca for a more detailed discussion of how we calculate such measures.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/b5741dad-e65c-4009-b0c4-8179a3d21d7e

FAQ

How much did Montage Gold (MAUTF) pay to repurchase the Koné project royalty?

What is Montage Gold's (MAUTF) production target for the Koné project?