Mace(R) Security International, a Global Leader in Personal Self-Defense Sprays, Announces 2Q24 Financial Results

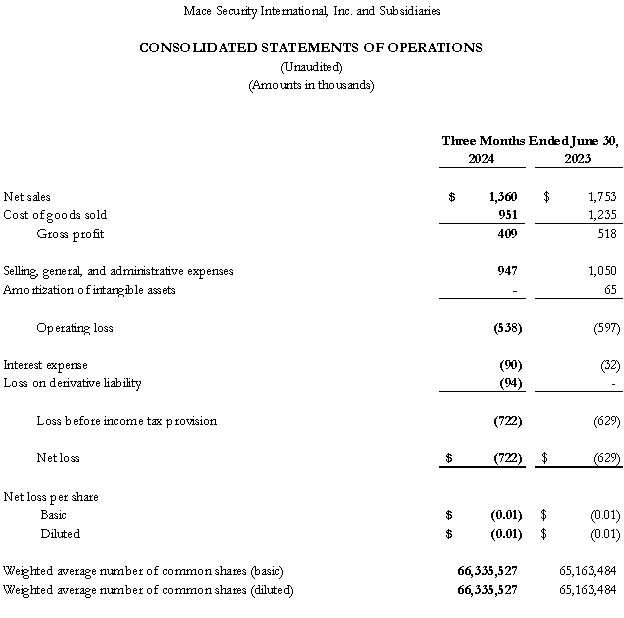

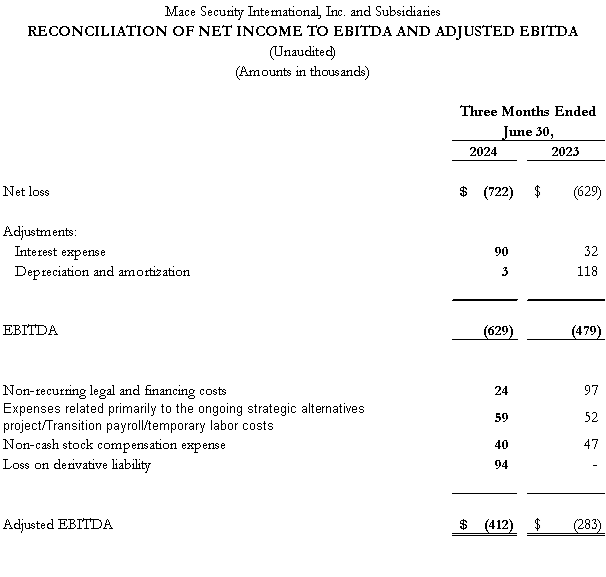

Mace Security International (OTCQB:MACE) announced its Q2 2024 financial results. Net sales were $1,360,000, down 22% from Q2 2023, mainly due to the loss of two larger retail customers and non-recurring international orders. The gross profit rate remained at 30%. SG&A expenses were $947,000, with adjusted SG&A at $824,000, 4% lower than Q2 2023. The company reported a net loss of $722,000 and an Adjusted EBITDA loss of $412,000.

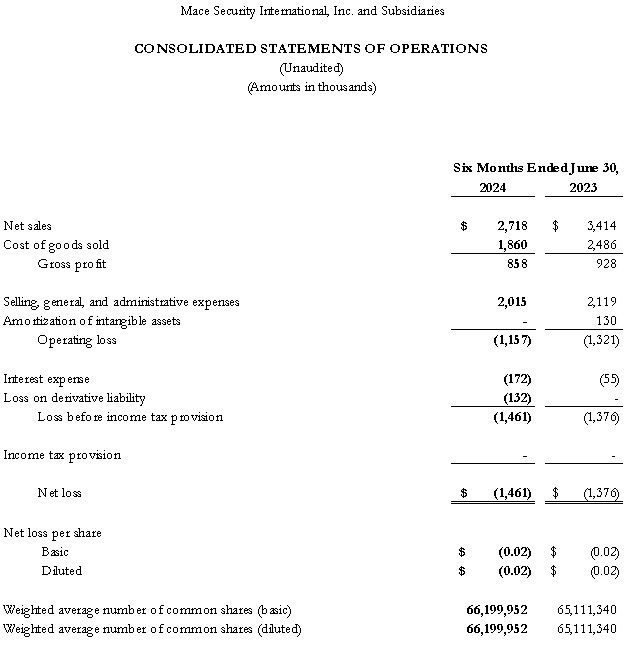

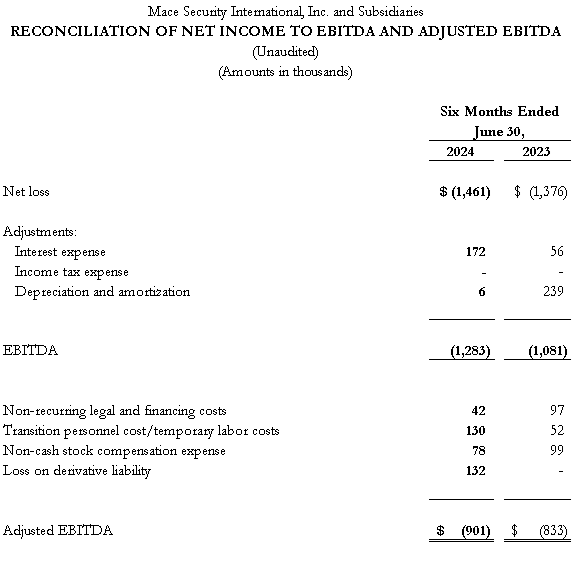

For the first half of 2024, net sales were $2,718,000, down 20% year-over-year. The gross profit rate improved to 32% from 27% in 2023. Net loss was $1,461,000, and Adjusted EBITDA loss was $901,000. The company continues to focus on cost reduction and operational improvements while facing challenges in retail and international markets.

Mace Security International (OTCQB:MACE) ha annunciato i risultati finanziari del secondo trimestre del 2024. Le vendite nette sono state di 1.360.000 dollari, in calo del 22% rispetto al secondo trimestre del 2023, principalmente a causa della perdita di due grandi clienti al dettaglio e di ordini internazionali non ricorrenti. Il tasso di profitto lordo è rimasto al 30%. Le spese generali e amministrative (SG&A) sono state di 947.000 dollari, con il SG&A rettificato a 824.000 dollari, in calo del 4% rispetto al Q2 2023. La società ha riportato una perdita netta di 722.000 dollari e una perdita di EBITDA rettificato di 412.000 dollari.

Per il primo semestre del 2024, le vendite nette sono state di 2.718.000 dollari, in calo del 20% rispetto all'anno precedente. Il tasso di profitto lordo è migliorato al 32% rispetto al 27% del 2023. La perdita netta è stata di 1.461.000 dollari e la perdita di EBITDA rettificato è stata di 901.000 dollari. L'azienda continua a concentrarsi sulla riduzione dei costi e sui miglioramenti operativi, affrontando al contempo sfide nei mercati al dettaglio e internazionali.

Mace Security International (OTCQB:MACE) anunció sus resultados financieros del segundo trimestre de 2024. Las ventas netas fueron de 1.360.000 dólares, lo que representa una disminución del 22% en comparación con el segundo trimestre de 2023, principalmente debido a la pérdida de dos clientes minoristas más grandes y a pedidos internacionales no recurrentes. El margen de beneficio bruto se mantuvo en el 30%. Los gastos SG&A fueron de 947.000 dólares, con un SG&A ajustado de 824.000 dólares, un 4% menos que en el Q2 2023. La empresa reportó una pérdida neta de 722.000 dólares y una pérdida de EBITDA ajustado de 412.000 dólares.

Para el primer semestre de 2024, las ventas netas fueron de 2.718.000 dólares, una caída del 20% interanual. El margen de beneficio bruto mejoró al 32% desde el 27% en 2023. La pérdida neta fue de 1.461.000 dólares y la pérdida de EBITDA ajustado fue de 901.000 dólares. La empresa sigue enfocándose en la reducción de costos y mejoras operativas mientras enfrenta desafíos en los mercados minoristas e internacionales.

Mace Security International (OTCQB:MACE)는 2024년 2분기 재무 결과를 발표했습니다. 순매출은 1,360,000달러로, 2023년 2분기 대비 22% 감소했으며, 이는 주로 두 개의 대형 소매 고객의 손실과 비정기적인 국제 주문 때문입니다. 총 이익률은 30%로 유지되었습니다. SG&A 비용은 947,000달러였고, 조정된 SG&A는 824,000달러로, 2023년 2분기보다 4% 감소했습니다. 회사는 순손실 722,000달러와 조정된 EBITDA 손실 412,000달러를 보고했습니다.

2024년 상반기 동안 순매출은 2,718,000달러로, 전년 대비 20% 감소했습니다. 총 이익률은 27%에서 32%로 개선되었습니다. 순손실은 1,461,000달러였고, 조정된 EBITDA 손실은 901,000달러였습니다. 회사는 소매 및 국제 시장의 도전에 직면하면서 비용 절감과 운영 개선에 계속 집중하고 있습니다.

Mace Security International (OTCQB:MACE) a annoncé ses résultats financiers du deuxième trimestre 2024. Les ventes nettes ont atteint 1.360.000 dollars, soit une baisse de 22 % par rapport au deuxième trimestre 2023, principalement en raison de la perte de deux grands clients de détail et d'ordres internationaux non récurrents. Le taux de marge brute est resté à 30 %. Les dépenses SG&A ont été de 947.000 dollars, avec un SG&A ajusté de 824.000 dollars, soit 4 % de moins que le Q2 2023. L'entreprise a déclaré un perte nette de 722.000 dollars et une perte d'EBITDA ajusté de 412.000 dollars.

Pour le premier semestre 2024, les ventes nettes se sont élevées à 2.718.000 dollars, en baisse de 20 % d'une année sur l'autre. Le taux de marge brute s'est amélioré à 32 % contre 27 % en 2023. La perte nette était de 1.461.000 dollars, et la perte d'EBITDA ajusté était de 901.000 dollars. L'entreprise continue de se concentrer sur la réduction des coûts et les améliorations opérationnelles tout en faisant face à des défis sur les marchés de détail et internationaux.

Mace Security International (OTCQB:MACE) hat seine finanziellen Ergebnisse für das zweite Quartal 2024 bekannt gegeben. Der Nettoumsatz betrug 1.360.000 Dollar, was einem Rückgang von 22 % gegenüber dem zweiten Quartal 2023 entspricht, hauptsächlich aufgrund des Verlusts von zwei größeren Einzelhandelskunden und einmaligen internationalen Aufträgen. Die Bruttogewinnquote blieb bei 30 %. Die SG&A-Ausgaben betrugen 947.000 Dollar, wobei die angepassten SG&A bei 824.000 Dollar lagen, was einem Rückgang von 4 % gegenüber dem Q2 2023 entspricht. Das Unternehmen berichtete von einem Nettoverlust von 722.000 Dollar und einem angepassten EBITDA-Verlust von 412.000 Dollar.

Im ersten Halbjahr 2024 betrugen die Nettoumsätze 2.718.000 Dollar, was einem Rückgang von 20 % im Vergleich zum Vorjahr entspricht. Die Bruttogewinnquote verbesserte sich auf 32 % von 27 % im Jahr 2023. Der Nettoverlust betrug 1.461.000 Dollar, und der angepasste EBITDA-Verlust betrug 901.000 Dollar. Das Unternehmen konzentriert sich weiterhin auf Kostensenkungen und betriebliche Verbesserungen, während es Herausforderungen in den Einzelhandels- und internationalen Märkten gegenübersteht.

- Gross profit rate maintained at 30% in Q2 2024

- 28% reduction in four-wall manufacturing costs in Q2 2024

- Adjusted SG&A expenses decreased by 4% in Q2 2024 compared to Q2 2023

- Gross profit rate improved to 32% for H1 2024 from 27% in H1 2023

- 23% reduction in four-wall manufacturing costs for H1 2024 compared to H1 2023

- 6% decrease in adjusted SG&A expenses for H1 2024 compared to H1 2023

- Sales to one of the largest retail customers increased by approximately 100% in Q2 2024 compared to Q1 2024

- Sales of S2 pepper spray launchers in Q3 to date are 10% higher than in Q2 2024

- Net sales decreased by 22% in Q2 2024 compared to Q2 2023

- Net loss increased to $722,000 in Q2 2024 from $629,000 in Q2 2023

- Adjusted EBITDA loss widened to $412,000 in Q2 2024 from $283,000 in Q2 2023

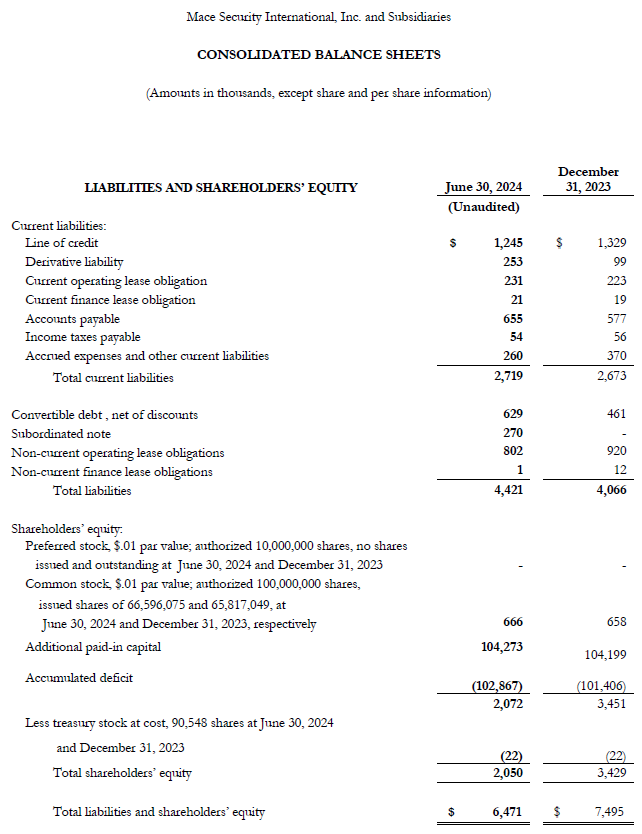

- Cash and cash equivalents decreased to $60,000 as of June 30, 2024, down from $239,000 on December 31, 2023

- Working capital decreased by $948,000 compared to December 31, 2023

- Net sales for H1 2024 decreased by 20% compared to H1 2023

- Net loss for H1 2024 increased to $1,461,000 from $1,376,000 in H1 2023

- Adjusted EBITDA loss for H1 2024 widened to $901,000 from $833,000 in H1 2023

CLEVELAND, OH / ACCESSWIRE / September 30, 2024 / Mace Security International (OTCQB:MACE) today announced its second quarter 2024 financial results for the period ended June 30, 2024.

Second Quarter 2024 Financial Highlights

The Company's net sales for the second quarter of 2024 were

Mace reported a gross profit rate of

SG&A expense were

Net loss was (

Adjusted EBITDA for Q2, 2024 was a loss of (

Cash and cash equivalents decreased to

Working capital decreased by (

Sanjay Singh, Chairman and CEO commented, "Sales continued to decline across our base business and retail segments partially offset by a pick-up in the Amazon vendor central platform. Also, impacting our revenues were suspension of our popular pepper gun and alarms on the Amazon seller central platform due to Amazon's implementation of a new policy regarding products carrying button cell buttons. The Company along with its agency are working hard to regain compliance and resume sales of products containing button cell batteries. The Company continued to reduce S, G and A costs due to the sales decreases. Sales to one of our largest retail customers increased by approximately

Year-to-Date June 2024 Financial Highlights

The Company's net sales for the six months ended June 30, 2024 were

Mace reported a gross profit rate of

SG&A expense were

Net loss was (

Adjusted EBITDA for the six months ended June 30, 2024 was a loss of (

Annual Shareholder Meeting Date

The Company's Board of Directors has set Monday, November 18, 2024 as the date of the 2024 Annual Meeting of Shareholders of Mace Security International, Inc.

About Mace Security International, Inc.

Mace® Security International, Inc. (MACE) is a globally recognized leader in personal safety and security. Based in Cleveland, Ohio, the Company has spent more than 40 years designing and manufacturing consumer and tactical products for personal defense and security under its world-renowned Mace® Brand - the original trusted brand of defense spray products. The Company also offers aerosol defense sprays and tactical products for law enforcement and security professionals worldwide through its Mace® Take Down® brand, KUROS!® Brand personal safety products, Vigilant® Brand alarms, and Tornado® Brand pepper spray and stun guns. MACE® distributes and supports Mace® Brand products through mass market retailers, wholesale distributors, independent dealers, Amazon.com, Mace.com, and other channels. For more information, visit www.mace.com.

Forward-Looking Statements

Certain statements and information included in this press release constitute "forward-looking statements" within the meaning of the Federal Private Securities Litigation Reform Act of 1995. When used, the words or phrases "will likely result," "are expected to," "will continue," "is anticipated," "estimate," "projected," "intend to" or similar expressions are intended to identify "forward-looking statements" within the meaning of the Federal Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to several known and unknown risks and uncertainties that may cause our actual results, trends, performance or achievements, or industry trends and results, to differ materially from the future results, trends, performance, or achievements expressed or implied by such forward-looking statements. Those risks and uncertainties may include, but are not limited to, (a) general economic and business conditions, including the impact of the COVID-19 pandemic and other possible pandemics and similar outbreaks; (b) competition; (c) potential changes in customer spending; (d) acceptance of our product offerings and designs; (e) the variability of consumer spending resulting from changes in domestic economic activity; (f) a highly promotional retail environment; (g) any significant variations between actual amounts and the amounts estimated for those matters identified as our critical accounting estimates, as well as other significant accounting estimates made in the preparation of our financial statements; (h) the impact of current and potential hostilities in various parts of the world, including but not limited to the war which resulted from Russia's invasion of Ukraine, as well as other geopolitical or public health concerns; (i) the impact of international supply chain disruptions and delays; (j) the impact on the Company of changes in U.S. Federal and State income tax regulations; and (k) the impact of inflation and the ability of the Company to pass on rising prices to its customers. You are urged to consider all such factors. Because of the uncertainty inherent in such forward-looking statements, you should not consider their inclusion to be a representation that such forward-looking matters will be achieved. Mace Security International, Inc. assumes no obligation for updating any such forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting such forward-looking statements.

In this press release, the Company's financial results and financial guidance are provided in accordance with accounting principles generally accepted in the United States (GAAP) and using certain non-GAAP financial measures. Management believes that presentation of operating results using non-GAAP financial measures provides useful supplemental information to investors and facilitates the analysis of the Company's core operating results and comparison of operating results across reporting periods. Management also uses non-GAAP financial measures to establish budgets and to manage the Company's business. A reconciliation of the GAAP financial results to non-GAAP financial results is included in the attached schedule.

Contact:

Investor Relations

InvestorRelations@mace.com

SOURCE: Mace Security International, Inc.

View the original press release on accesswire.com