CORRECTION: Mace(R) Security International, a Global Leader in Personal Self-Defense Sprays, Announces 1Q22 Financial Results

This press release corrects the press release issued May 2, 2022 at 4:15 EDT to amend the day of week for the conference call to Tuesday instead of Wednesday

CLEVELAND, OH / ACCESSWIRE / May 2, 2022 / Mace Security International (OTCQX:MACE) today announced its first quarter 2022 financial results for the period ended March 31, 2022.

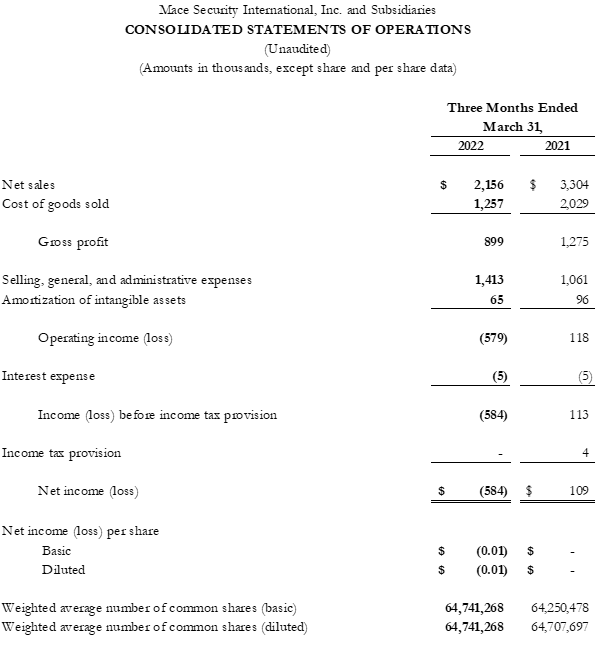

Mace reported net sales for the first quarter of

The Company's gross margin rate for the first quarter of 2022 was

Sanjay Singh, Chairman and CEO, commented, "The sales trend we experienced in the last quarter of 2021 with our large customers continued as expected in the first quarter. Orders from our larger customers remained suppressed as the price of everyday goods continued to rise and there was less discretionary spending on impulse-type purchases which drive a substantial amount of the sales of our products. We addressed the areas of our business that we have control over, product pricing, cost management and manufacturing efficiency. We pivoted our sales strategy towards our base business and international customers and converting B2B prospects. Certain pockets of the country have seen an increase in demand for personal protection devices and those remain an area of focus."

First Quarter 2022 Financial Highlights

- Net sales were

$2,156,000 , down35% from the first quarter of 2021. The decline from prior year was due to the slowdown in retail sales in several of the Company's large retail customers as impulse sales were impacted by a slowing economy and the highest U.S. inflation rate experienced in decades. The Company also had a difficult quarter-over-quarter comparison against its record first quarter sales in 2021 aided by backlogged orders from 2020 and the final quarter of sales to a large private label customer that insourced its filling operations. Mace did achieve significant growth of over200% in its international shipments and its future international customers orders remain strong. - Gross margin rate of

42% increased3% from the same period in 2021 even though the Company had a decline in sales volume. The modifications implemented to its operational cost structure during the second half of 2021 led to a38% reduction in four-wall manufacturing costs on a quarter-over-quarter basis and a40% increase in direct labor efficiency. Product margins improved over the first quarter of 2021 as price increases were implemented throughout the first quarter of 2022 to combat the rising costs of component goods and freight. - Gross profit for the first quarter decreased by

$376,000 , or30% , from the first quarter of 2021, entirely due to the decline in sales volume and increased freight costs. - SG&A expenses increased

$352,000 t o$1,413,000 for the first quarter, or66% of net sales. The increase was primarily due to$220,000 in personnel related expenses for the transition in Mace's CEO role. In addition, the Company continued to invest in its direct-to-consumer initiative through agency, advertising and branding efforts. Mace also incurred expenses associated with the unsolicited interest of a potential acquirer. All these incremental expenses were partially offset with a decrease in sales commissions correlated to the reduction in sales volume. - Net loss of

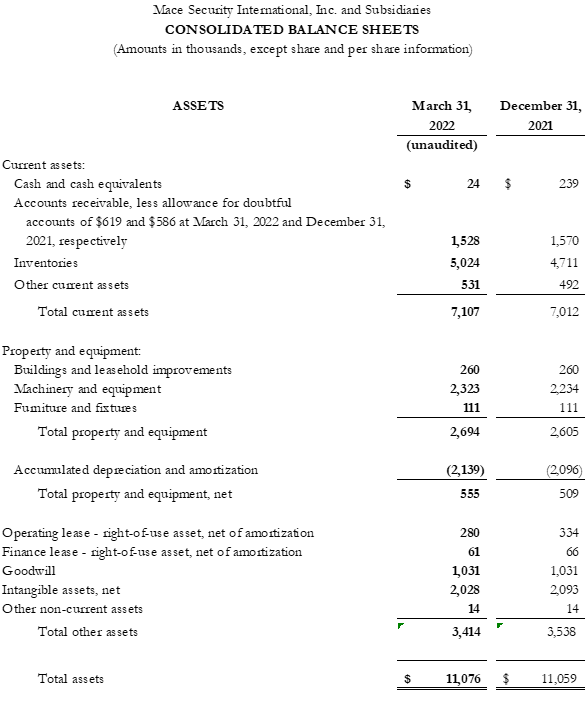

$584,000 for the first quarter was a reduction in income of$693,000 when compared to the Company's first quarter 2021 net income of$108,000. T he decline was primarily attributable to the lower sales volume. - Cash and cash equivalents decreased to

$24,000 as of March 31, 2022, a decline of$215,000 from the$239,000 on hand on December 31, 2021. The Company had a borrowed position of$490,000 at March 31, 2022 as it closed out its historically slowest quarter of the year. - Working capital decreased by

$509,000 compared to December 31, 2021, with an increase in debt and accounts payable of$650,000 partially offset with a$313,000 increase in inventory, of which51% of the increase was in finished goods that were converted to be ready for shipping as sales volume picks up. Supply chain reliability, uncertainty and delays have expanded lead times resulting in a higher inventory level which positions the Company well to service its customers going forward. The Company has implemented action plans to convert its inventory and accounts receivable and generate cash to curtail its borrowings. - Adjusted EBITDA for the first quarter was a loss of

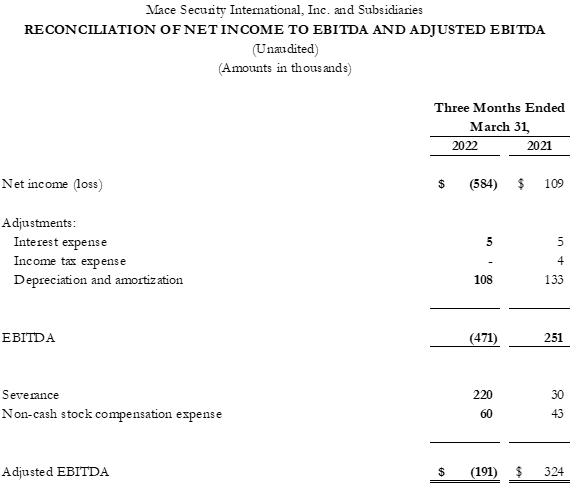

$191,000 compared to Mace's first quarter record adjusted EBITDA income of$324,000 for the first quarter of 2021.

Conference Call

Mace® will conduct a conference call on Tuesday, May 3, 2022, at 11:00 AM EDT, 8:00 AM PDT to discuss its financial and operational performance for the first quarter of 2022. The call can be accessed by telephone within the US at (833) 360-0862. Please use the conference identification number 3433019.

A digital recording of the conference call will be available for replay after the call's completion. It will be available two hours after the call and will expire on May 10, 2022, at 11:59 PM. To access the recording, use the dial in numbers listed below and the conference ID 3433019.

Encore dial-in number: (855) 859-2056 or internationally on (404) 537-3406.

The full set of financial statements and an accompanying slide presentation is available on Mace's website www.corp.mace.com under the subheading "Newsroom."

About Mace Security International, Inc.

Mace® Security International, Inc. (MACE) is a globally recognized leader in personal safety and security. Based in Cleveland, Ohio, the Company has spent more than 40 years designing and manufacturing consumer and tactical products for personal defense and security under its world-renowned Mace® Brand - the original trusted brand of defense spray products. The Company also offers aerosol defense sprays and tactical products for law enforcement and security professionals worldwide through its Mace® Take Down® brand, KUROS!® Brand personal safety products, Vigilant® Brand alarms, and Tornado® Brand pepper spray and stun guns. MACE® distributes and supports Mace® Brand products through mass market retailers, wholesale distributors, independent dealers, Amazon.com, Mace.com, and other channels. For more information, visit www.mace.com.

Forward-Looking Statements

Certain statements and information included in this press release constitute "forward-looking statements" within the meaning of the Federal Private Securities Litigation Reform Act of 1995. When used, the words or phrases "will likely result," "are expected to," "will continue," "is anticipated," "estimate," "projected," "intend to" or similar expressions are intended to identify "forward-looking statements" within the meaning of the Federal Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to several known and unknown risks and uncertainties that may cause our actual results, trends, performance or achievements, or industry trends and results, to differ materially from the future results, trends, performance, or achievements expressed or implied by such forward-looking statements. Those risks and uncertainties may include, but are not limited to, (a) general economic and business conditions, including the impact of the COVID-19 pandemic and other possible pandemics and similar outbreaks; (b) competition; (c) potential changes in customer spending; (d) acceptance of our product offerings and designs; (e) the variability of consumer spending resulting from changes in domestic economic activity; (f) a highly promotional retail environment; (g) any significant variations between actual amounts and the amounts estimated for those matters identified as our critical accounting estimates, as well as other significant accounting estimates made in the preparation of our financial statements; (h) the impact of current and potential hostilities in various parts of the world, including but not limited to the war which resulted from Russia's invasion of Ukraine, as well as other geopolitical or public health concerns; (i) the impact of international supply chain disruptions and delays; (j) the impact on the Company of changes in U.S. Federal and State income tax regulations; and (k) the impact of inflation and the ability of the Company to pass on rising prices to its customers. You are urged to consider all such factors. Because of the uncertainty inherent in such forward-looking statements, you should not consider their inclusion to be a representation that such forward-looking matters will be achieved. Mace Security International, Inc. assumes no obligation for updating any such forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting such forward-looking statements.

In this press release, the Company's financial results and financial guidance are provided in accordance with accounting principles generally accepted in the United States (GAAP) and using certain non-GAAP financial measures. Management believes that presentation of operating results using non-GAAP financial measures provides useful supplemental information to investors and facilitates the analysis of the Company's core operating results and comparison of operating results across reporting periods. Management also uses non-GAAP financial measures to establish budgets and to manage the Company's business. A reconciliation of the GAAP financial results to non-GAAP financial results is included in the attached schedule.

Contacts:

Mike Weisbarth

Chief Financial Officer

mweisbarth@mace.com

SOURCE: Mace Security International

View source version on accesswire.com:

https://www.accesswire.com/699830/CORRECTION-MaceR-Security-International-a-Global-Leader-in-Personal-Self-Defense-Sprays-Announces-1Q22-Financial-Results