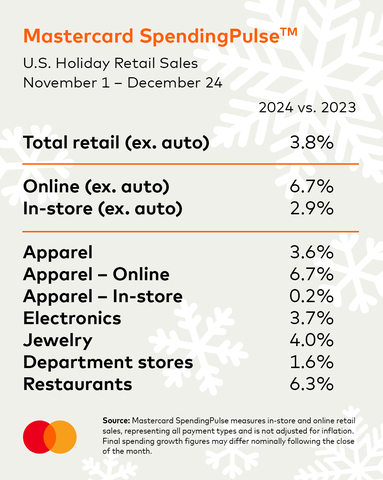

Mastercard SpendingPulse: Total U.S. Retail Sales Grew 3.8%* This Holiday Season; Online Remained Choice for Consumers, Increasing 6.7% YOY

Mastercard SpendingPulse

“The holiday shopping season revealed a consumer who is willing and able to spend but driven by a search for value as can be seen by concentrated e-commerce spending during the biggest promotional periods,” said Michelle Meyer, chief economist, Mastercard Economics Institute. “Solid spending during this holiday season underscores the strength we observed from the consumer all year, supported by the healthy labor market and household wealth gains.”

Key retail trends for the full holiday season included:

-

The most ‘valuable’ time of the year – Empowered consumers sought value at every turn this year, responding to promotions during the November and Black Friday shopping period, and filling their baskets in the run-up to December 24. Overall retail sales saw a

3.8% increase compared to 2023, with the last five days of the holiday season accounting for10% of all holiday spending.

-

A balanced basket – Consumer demand for experiences like dining out strengthened in the holiday season, with Restaurant spending growth up

6.3% compared to last year. Additionally, this season saw an increase in spending growth on goods compared to last year, with Apparel (3.6% ), Jewelry (4.0% ) and Electronics (3.7% ) as notable sectors for gift-giving.

-

Clicking all the way – Consumers increasingly preferred digital-first shopping this year, with e-commerce, curbside pick-up and delivery being top-of-mind for the festive season. Online retail sales grew

6.7% year-over-year, whereas in-store sales increased2.9% . Notably, the Apparel sector showed a strong lead in e-commerce sales, with6.7% growth for online purchases compared to last year.

-

Digital-savvy shopping cities – While many Americans shop online for the holidays, there are some cities in particular that have embraced e-commerce. Cities like

Tampa (10.6% ) andPhoenix (10.0% ) lead with double digital growth followed byMinneapolis (8.9% ),Dallas (8.4% ),Charlotte (7.9% ),Orlando (7.8% ), andHouston (7.6% ) coming in well above the national total for e-commerce sales compared to 2023.

“This holiday season, we saw consumers motivated by deals and retailers respond with promotions to meet the demand,” said Steve Sadove, senior advisor for Mastercard and former CEO and chairman of Saks Incorporated. “The value-minded consumer showed up to shop at brick-and-mortar stores and e-commerce platforms, with retailers managing across both to capture attention throughout the season.”

*Excluding automotive

About Mastercard SpendingPulse

Mastercard SpendingPulse measures national retail sales based on aggregated and anonymized Mastercard insights, representing all payment types in select markets around the world.

Mastercard SpendingPulse defines “U.S. retail sales” as sales at retailers and food services merchants of all sizes. Sales activity within the services sector (for example, travel services such as airlines and lodging) are not included in the total retail sales figure. SpendingPulse insights are not indicative of Mastercard company performance; insights and forecast are subject to change.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241225785240/en/

Raul Lopez | raul.lopez@mastercard.com | 914-841-7049

Alyssa O’Brien | alyssa.o'brien@mastercard.com | 914-336-1981

Source: Mastercard Investor Relations