LyondellBasell 2022 Sustainability Report: Taking Climate Action

NORTHAMPTON, MA / ACCESSWIRE / June 22, 2023 / LyondellBasell:

View the full LyondellBasell 2022 Sustainability Report.

Addressing climate change is one of the most pressing challenges our world faces and we believe collective action and a sense of urgency are needed.

As a leader in our industry, we have an important role in driving change. We support the objectives of the Paris Agreement to limit global temperature rise to well below 2°C above pre-industrial levels and to pursue efforts to limit the temperature increase even further to 1.5°C.

We are committed to reducing GHG emissions from our global operations and value chain, and to delivering solutions which advance our customers' climate ambitions and support society's transition to a low carbon world. We believe a commitment to net zero scope 1 and scope 2 emissions by 2050 and a credible pathway to 2030 for scopes 1, 2 and 3 are critical to the long-term success of LyondellBasell.

In December 2022, we stepped up our ambition by accelerating our interim targets for 2030 in line with the best available science. We increased our 2030 GHG emissions reduction target for scope 1 and 2 emissions to

Included in our approach is a commitment to secure at least

Importantly, as companies within our value chains increasingly set their own scope 3 goals, we believe our increased climate ambitions will be an advantage. As an early mover, we aim to deliver low carbon foot- print materials that will meet increasing demand across our value chains.

OUR GOALS

- Achieve net zero GHG emissions from our global operations by 20501

- Reduce absolute scope 1 and 2 GHG emissions

42% by 20302 - Reduce absolute scope 3 GHG emissions

30% by 20303 - Procure a minimum of

50% of electricity from renewable sources by 20304

OUR APPROACH

- Integrate proven solutions to improve the efficiency of our manufacturing processes and switch to less carbon intensive fuels

- Assess opportunities in electrification of our processes and in carbon capture technology

- Increase our use of renewable and low carbon energy primarily through power purchase agreements and collaboration with our utility suppliers

- Help accelerate the scale up and deployment of breakthrough technologies to reduce the carbon footprint of chemical processes to net zero by 2050 through collaboration

- Advance our use of circular and renewable-based feedstocks and engage with suppliers to support scope 3 emissions reductions

- Continue to integrate climate impacts into our business processes and strategy

- Engage with governments and industry peers to support effective policies to achieve the goals of the Paris Agreement and our global climate ambitions

The role of public policy

We believe public policy has an essential role to play in the transition to a low carbon economy. Our strategy for achieving our climate ambitions relies on several key enablers. These includes stable positions and policies independent of political cycles, and the development of necessary infrastructure and technologies to support the transition toward net zero.

We support policies that:

- Encourage the development of affordable and reliable low carbon energy needed to support industrial operations through various incentives that reward investment in carbon-reducing technologies and support the development of needed infrastructure.

- Promote advances to develop carbon capture and storage infrastructure at the scale required to enable the storage of GHG emissions, which are technically unavoidable today, or where the solution involves excessively high economic or social costs.

- Promote significant increases in renewable electricity production and grid capacity upgrades needed to support the highelectricity demand tied to the electrification of processes.

- Encourage further development of affordable, reliable renewable energy and baseload generation from other non-emitting sources.

- Accelerate the development of emerging technologies that enable the reduction of emissions from carbon intensive, large scale manufacturing needs, including processes and adjacent infrastructure to enable cost effective use of CO2 at scale for the production of higher value chemicals.

We also support a carbon pricing scheme that effectively facilitates a transition to a net zero economy. We believe a global carbon price provides the most efficient, fair and uniform way to reduce GHG emissions at scale. In the absence of a global price on carbon, in the near-term, we support regionally implemented cap-and-trade programs.

Finally, while we expect the cost of low carbon hydrogen, irrespective of its mode of production, to become increasingly competitive, we will continue to need public support for the development of hydrogen production and transport capabilities in our regions of operations.

In 2023, we will publish more details on our climate advocacy approach, including our approach to participation in trade associations.

Governance of our climate goals

Recognizing the vital importance of the issue, our climate strategy is embedded in our overall business strategy and managed at the highest levels of our company. Our Board of Directors (Board) leads our commitment to sustainability and maintains oversight of our ESG profile on topics including climate change.

At the management level, our CEO oversees the company's ESG profile through regular reporting and discussion on key topics and initiatives among members of the Executive Committee, comprised of senior executives that lead LyondellBasell's businesses and functions. ESG matters including climate change impact, and are impacted by, our operations, with each function playing a role in identifying relevant opportunities, managing associated risks, and contributing to our overall sustainability program. The Executive Committee includes, among others, our Executive Vice President, Sustainability and Corporate Affairs, with responsibility for sustainability strategy and ESG reporting.

In 2022, we promoted our Director, Global Sustainability to the role of Vice President and Chief Sustainability Officer (CSO). The CSO is responsible for the management of sustainability programs, strategy, and reporting.

In 2022, we reviewed our approach to our climate strategy, and created a new organization dedicated to the execution of our strategy to reach our 2050 net zero goal and underlying interim targets for scope 1 and 2 emissions. This organization is directly embedded within our business, with a direct reporting line to business executive leadership to facilitate the integration of climate as part of our overall business strategy. In addition, with the announcement of our commitment to reduce our value chain (scope 3) emissions, we are establishing an internal network to address and reduce our scope 3 emissions, which will include representatives from several business units across the company due to the diversity of scope 3 emission sources.

OUR GOAL: ACHIEVE NET ZERO GHG EMISSIONS FROM OUR GLOBAL OPERATIONS BY 2050

Our strategy to reach net zero scope 1 and scope 2 emissions from our global operations by 2050 is focused on six levers.

Energy efficiency: Lowering the energy demand of our operations through initiatives including flare gas recovery, heat integration and process optimization.

Fuel Switching: Reducing the carbon intensity of the fuels we use on site by increasing the share of lower carbon intensive fuels in our fuel mix, and in particular hydrogen, to displace other fuels.

Electrification: Electrifying our processes to replace the use of fossil fuels with low carbon or renewable electricity.

Carbon Capture and Storage/Utilization (CCS/CCU): Reducing direct emissions by enabling the capture and storage or reuse of CO2 from our operations.

Emerging technologies: Developing and utilizing new technologies for the production of olefins, chemicals and polyolefins with a lower carbon footprint compared to traditional processes. This includes technologies that enable circularity, such as our MoReTec advanced recycling technology.

Low Carbon Energy: Reducing emissions associated with our purchased electricity and steam needs by sourcing electricity from renewable energy projects, and collaborating with utility suppliers to lower the carbon intensity of the energy we purchase.

OUR GOAL: REDUCE ABSOLUTE SCOPE 1 AND 2 GHG EMISSIONS

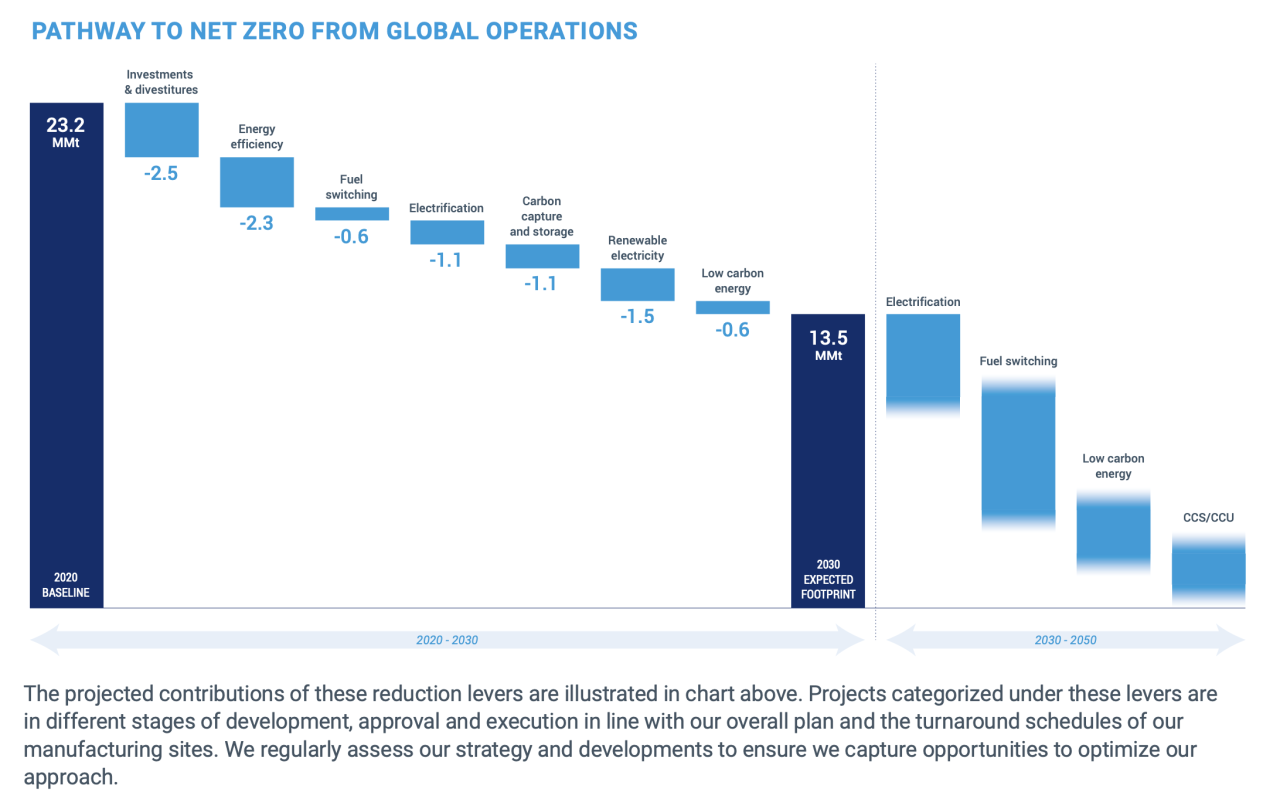

Our 2030 strategy for scope 1 and 2 emissions includes a portfolio of projects categorized under the levers listed below. We take into account organic growth and divestitures and previously announced closures of assets. We have accounted for the additional emissions from our new PO/TBA plant in Channelview, Texas, commissioned in March 2023. As announced in April 2022, we plan to close the Houston refinery by the end of December 2023. This is expected to reduce scope 1 and scope 2 emissions by more than 3 million metric tons annually.

Levers for reducing scope 1 and scope 2 emissions by 2030 include:

Electrification

Electrification is part of our approach to achieving our 2030 target and our 2050 net zero goal for scope 1 and scope 2 emissions. Part of our 2030 approach will be to reduce the use of fossil fuels in our utilities, in particular through electrifying our steam production. When coupled with renewable or low carbon electricity, this approach will allow us to lower the carbon footprint of our onsite produced energy.

Longer term, we anticipate process electrification will be an integral part of our approach to achieving net zero in our operations, and notably in our olefins plants, which represent more than half of our scope 1 and 2 footprint.

Fuel switching

We refer to fuel switching as the use of hydrogen and other fuels with low carbon intensity to displace higher carbon intensive fuels and thereby reduce GHG emissions in our operations. We anticipate fuel switching will be another key element in our approach to achieving our 2030 target and 2050 net zero goal for scope 1 and 2 emissions, in particular for our olefin and other higher energy intensive process units.

We are evaluating hydrogen supplies from a variety of sources, both internal and external, in our effort to reduce GHG emissions from fuels used in our operations. Internally, we are evaluating reforming gases from our processes to produce hydrogen, and the production of on-purpose hydrogen. Externally, we support the development of a hydrogen value chain. To enable this development, we believe supportive policies and value chain collaboration will be critical. This is why we are working with several parties, including Air Liquide, Uniper and Chevron, on a joint study to evaluate and potentially advance the development of a production facility for low carbon hydrogen and ammonia in the U.S. Gulf Coast.

We are also pursuing other opportunities to reduce the carbon intensity of the fuels we use. Our collaboration with Evonik will allow us to phase out coal from our power plant in Wesseling, Germany, by 2024, replacing it with high pressure steam produced from natural gas at Evonik's neighboring site.

Carbon capture storage and utilization

We support the development of infrastructure for the capture and storage of CO2 to enable emission reductions from processes where no other suitable technical or economical solution exists today. In particular, carbon capture and storage (CCS) can be used in combination with hydrogen production from natural gas, to create what is known as blue hydrogen. Recognizing economically feasible CCS infrastructure as a critical lever to reduce emissions and enable a supply of blue hydrogen, we are conducting feasibility studies at key manufacturing sites in Europe and in the U.S. for the potential deployment of carbon capture equipment with linkages to storage infrastructure under development.

Longer term, we believe in the potential of CO2 utilization as an alternative to permanent storage. We are exploring collaboration opportunities with different stakeholders to bring CO2 utilization approaches to technological and commercial maturity. CO2 utilization not only has the potential to reduce scope 1 and 2 emissions through CO2 capture, but also to reduce scope 3 emissions by converting the captured CO2 to higher value chemicals that could replace current fossil-based feedstocks.

The graph represents our expected progress toward our 2030 target. We expect our scope 1 and 2 emissions will increase temporarily in 2023 due to the commissioning of our PO/TBA plant. We estimate that a significant portion of our reduction efforts will take place in the latter half of the decade, as many of these projects are aligned with the turnaround schedules of our manufacturing sites. Several of our projects are also dependent on key enablers, such as the construction of infrastructure.

Estimates of the capital expenditures necessary to achieve our emissions reduction goals are built into the company's long-range plan. These investments are not expected to represent a significant portion of total capital expenditures over the next three years, nor change the capital allocation strategy. While many of the GHG emissions reduction projects are still in the early stages of development, the company will evaluate, pursue and prioritize its GHG emission reduction investments based on each project's rate of return.

OUR GOAL: PROCURE A MINIMUM OF

Renewable electricity is a critical reduction lever in our journey to achieve net zero scope 1 and scope 2 emissions by 2050.

We have made significant progress toward achieving our renewable energy procurement goal. Renewable energy is an important component of our 2030 and 2050 strategy, and power purchase agreements are our preferred approach to decarbonizing our electricity supply. These strategic projects propel us forward in greenhouse gas emissions reduction, and they also provide scalability and support investment in new renewable energy capability. Power purchase agreements also are a good business decision, helping to protect businesses against a potentially volatile market.

In 2022, we signed eight renewable electricity power purchase agreements (PPAs) in the U.S. and Europe, achieving more than

In March 2023, LyondellBasell and Grenergy signed five long-term solar power PPAs. Under the 15-year contracts, the Spanish renewable energy producer will supply solar energy from the La Cereal solar farm project, which is expected to be operational at the end of 2025. The agreements represent approximately 141 MW of solar energy capacity, equivalent to the annual electricity consumption of approximately 90,000 European homes. With these agreements, LyondellBasell achieved

In addition, we are working to identify and implement solutions to secure low carbon energy through various projects under evaluation to supplement our renewable electricity supply at our sites in North America and Europe. These include working with our current utility suppliers to reduce the carbon intensity of the energy we procure, and assessing the feasibility of emerging technologies to deploy at our sites.

OUR GOAL: REDUCE ABSOLUTE SCOPE 3 GHG EMISSIONS

Our scope 3 goal was developed following the best available science, and we are seeking SBTi validation of our goal.

Our scope 3 goal was developed following the best available science, with a coverage of two thirds of our total scope 3 emission inventory in line with the latest SBTi guidance. We are currently seeking validation of our goal with the SBTi. Several reduction levers are important for achieving scope 3 reductions:

The exit from our refining business: Our exit from the sale of refined products, including gasoline, diesel and jet fuel, and corresponding exit from procuring various raw materials including crude oil, will represent in total a reduction of approximately 40 million metric tons of scope 3 emissions annually.

Use of circular feedstocks: We are increasing our use of renewable bio-based and recycled feedstocks, in line with our commitment to produce and market at least 2 million metric tons of recycled and renewable-based polymers annually by 2030.

Engaging with suppliers: By engaging with suppliers, including those that supply our feedstocks and raw materials, we can better understand the product carbon footprint of the materials we procure from them and explore the potential for collaboration on emissions reduction opportunities. We will also utilize the product carbon footprint guidance from Together for Sustainability to enable further harmonization on scope 3 accounting approaches across the value chain.

Shifting to less carbon intensive fuels: Switching to the use of lower carbon intensive fuels in our operations may offer the potential to lower our scope 3 emissions, in addition to reducing our scope 1 and/or scope 2 emissions.

Engaging with logistics providers: We are engaging with our logistics suppliers to better understand emissions linked to the transportation of our products to our customers, and reviewing opportunities to optimize our distribution routes to reduce GHG emissions. We participated in the development of the Global Logistics Emissions Council (GLEC) guidance for the European Chemical Industry as part of the Smart Freight Centre and are working with logistics suppliers to improve the accuracy of emissions reporting to guide optimization efforts.

Estimating scope 3 emissions can be challenging as the industry's understanding of sources and appropriate emission methodologies is evolving. Additional guidance for calculating and addressing scope 3 emissions is currently underway across many industries, including the chemical sector. We are engaged in several sector initiatives to improve the consistency and accuracy of scope 3 emission estimates and reporting, including in SBTi Chemical Industry Guidance and Together for Sustainability's Product Carbon Footprints.

1 Our 2050 net zero GHG emissions goal includes scope 1 and 2 emissions.

2 Relative to a 2020 baseline.

3 Relative to a 2020 baseline.

4 Based on 2020 procured levels.

5 Relative to a 2020 baseline.

6 Based on 2020 procured levels.

7 Relative to a 2020 baseline.

View the full LyondellBasell 2022 Sustainability Report.

For information about the factors that could impact our forward-looking statements, please see page two of the LyondellBasell Sustainability Report.

View additional multimedia and more ESG storytelling from LyondellBasell on 3blmedia.com.

Contact Info:

Spokesperson: LyondellBasell

Website: https://www.3blmedia.com/profiles/lyondellbasell

Email: info@3blmedia.com

SOURCE: LyondellBasell

View source version on accesswire.com:

https://www.accesswire.com/763150/LyondellBasell-2022-Sustainability-Report-Taking-Climate-Action