Luvu Brands Reports Fiscal First Quarter 2023 Results and Announces Conference Call

Luvu Brands reported a record Q1 net sales of $8.1 million for the fiscal quarter ending September 30, 2022, marking a 29.5% increase from the previous year. Gross profit rose to $2.0 million, a 31.6% increase, and net income was $0.5 million, or $0.01 per share. Operating expenses rose to $1.4 million, but decreased as a percentage of sales. Significant growth was driven by an 86% increase in sales of the Liberator brand, while sales for Jaxx and Avana declined. The company’s cash reserves improved to $1.3 million.

- Q1 net sales increased 29.5% to $8.1 million.

- Gross profit rose 31.6% to $2.0 million.

- Net income increased to $0.5 million, or $0.01 per share.

- Liberator brand sales surged 86% to $5.1 million.

- Adjusted EBITDA grew to $675,000.

- Jaxx product sales declined 5% to $1.8 million.

- Avana sales decreased 25% to $0.6 million.

- Products purchased for resale decreased 26% to $0.3 million.

- Other revenue fell 30% to $0.3 million.

Insights

Analyzing...

Reports Record Q1 Net Sales of

ATLANTA, GA / ACCESSWIRE / November 15, 2022 / Luvu Brands, Inc. (OTCQB:LUVU), a designer, manufacturer and marketer of a portfolio of consumer lifestyle brands, yesterday reported financial results for its fiscal first quarter, which ended September 30, 2022.

Fiscal Third Quarter 2023 Highlights

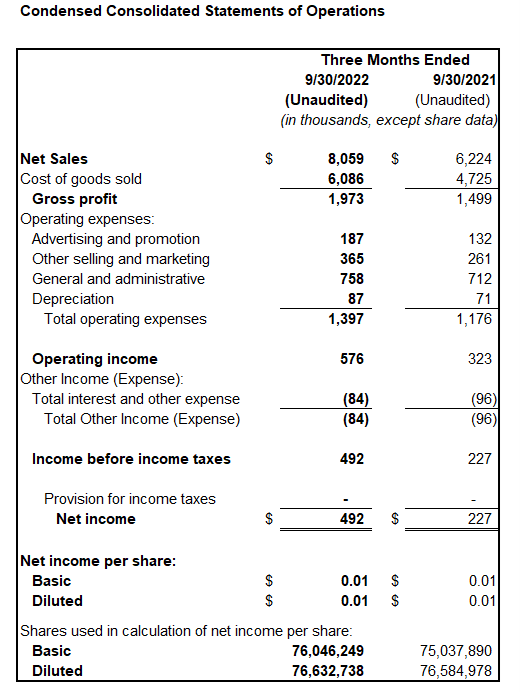

Three months ended September 30, 2022 as compared to the three months ended September 30, 2021

- Net sales increased

29.5% to a record$8.1 million . - Total gross profit of

$2.0 million , an increase from prior year's$1.5 million . - Gross profit as a percentage of net sales of

24.5% compared to24.1% in the prior year. - Operating expenses were

$1.4 million compared to$1.2 million in fiscal 2022. - Net income was

$0.5 million , or$0.01 per share, compared to net income of$0.2 million , or$0.00 per share, in 2022. - Adjusted EBITDA of

$675,000 compared to$398,000 in the prior fiscal year first three months.

Louis Friedman, Chairman and Chief Executive Officer, commented, "At the end of September, we are encouraged by ongoing business performance as we continue to have strong revenue and gross profit expansion. We continue to be positioned to innovate and make great new products with sustainable materials, while lowering our carbon footprint. Our growth initiatives include a multi-channel marketing approach now adding partnerships that allow us to further expand our brand territory with sexual wellness retailers, Amazon, and mass market e-tailers. Our product placement on Netflix's "How to Build a Sex Room" resulted in an

Fiscal Third Quarter 2023 Results

Net sales increased

Total gross profit for the first quarter was

Operating expenses were approximately

Net income for the quarter was

Adjusted EBITDA for the three months ended September 30, 2022, was

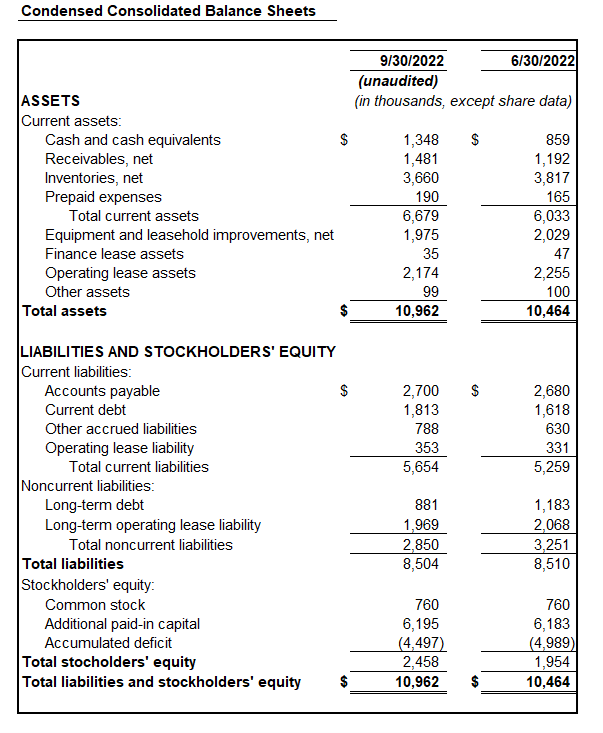

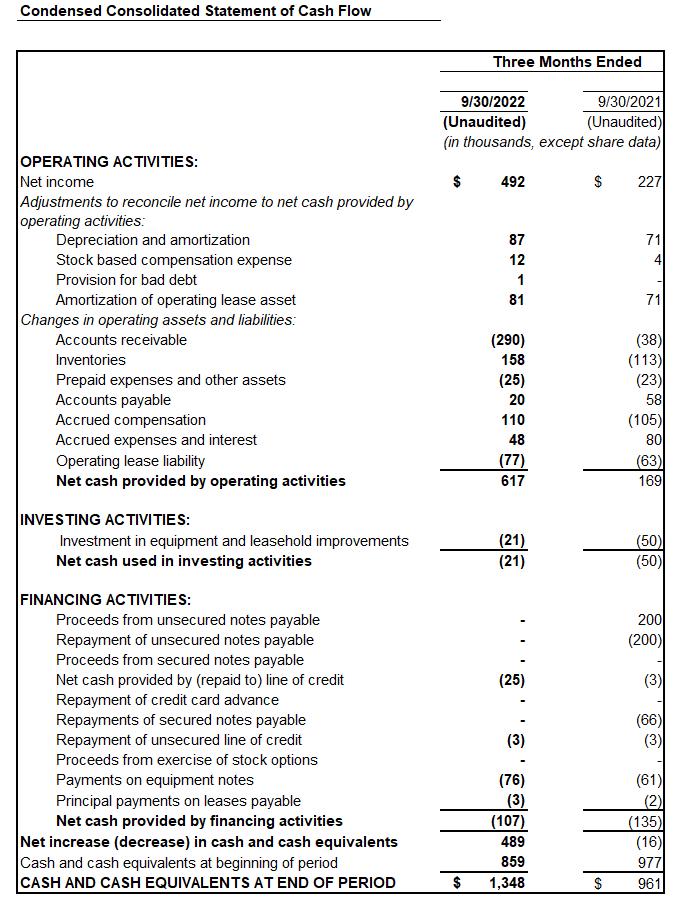

Cash and cash equivalents on September 30, 2022 totaled

Conference Call

Management will host a conference call at 11:00 a.m. EST (10:00 a.m. CST; 8:00 a.m. PST) on Friday, November 18, 2022. To listen and participate in the call, please register on this weblink: https://www.webcaster4.com/Webcast/Page/2527/47147

A Q&A session will take place after the formal presentation, which shareholders and other interested parties can partake in through the aforementioned weblink or by dialing 888-506-0062 (international: 973-528-0011) using the participant access code 895731.

Forward-Looking Statements

Certain matters discussed in this press release may be forward-looking statements. Such forward-looking statements can be identified by the use of words such as ''should,'' ''may,'' ''intends,'' ''anticipates,'' ''believes,'' ''estimates,'' ''projects,'' ''forecasts,'' ''expects,'' ''plans,'' and ''proposes.'' These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties, and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. You are urged to carefully review and consider any cautionary statements and other disclosures in our Annual Report on Form 10-K for the fiscal year ended June 30, 2022 as filed with the Securities and Exchange Commission (the "SEC") on October 12, 2022 and our other filings with the SEC. All forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements, many of which are generally outside the control of Luvu Brands, Inc. and are difficult to predict. Luvu Brands, Inc. does not undertake any duty to update any forward-looking statements except as may be required by law. The information which appears on our websites and our social media platforms is not part of this press release.

Use of Non-GAAP Financial Measures

Luvu Brands' management evaluates and makes operating decisions using various financial metrics.In addition to the Company's GAAP results, management also considers the non-GAAP measure of Adjusted EBITDA and Non-GAAP Operating Margin. As used herein, Adjusted EBITDA represents net income before interest income, interest expense, income taxes, depreciation, amortization, and stock-based compensation expense, and Non-GAAP Operating Margin means Adjusted EBITDA divided by net sales. Management believes that these non-GAAP measures provide useful information about the Company's operating results. Neither Adjusted EBITDA nor Non-GAAP Operating Margin have been prepared in accordance with GAAP. These non-GAAP financial measures should not be considered as alternatives to, or more meaningful than, gross profit and net income as indicators of the Company's operating performance. Further, these non-GAAP financial measures, as presented by the Company, may not be comparable to similarly titled measures reported by other companies. The Company has attached to this press release a reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures.

About Luvu Brands

Luvu Brands, Inc. designs, manufactures and markets a portfolio of consumer lifestyle brands through the Company's websites, online mass merchants and specialty retail stores worldwide. Brands include: Liberator®, a brand category of iconic products for enhancing sexual performance; Avana®, inclined bed therapy products, assistive in relieving medical conditions associated with acid reflux and surgery recovery; and Jaxx®, a diverse range of casual fashion daybeds, sofas and beanbags made from polyurethane foam and repurposed polyurethane foam trim. Headquartered in Atlanta, Georgia, the Company occupies a 140,000 square foot vertically-integrated manufacturing facility and employs over 200 people. The Company's brand sites include: www.liberator.com, www.jaxxbeanbags.com, www.avanacomfort.com plus other global e-commerce sites. For more information about Luvu Brands, please visit www.luvubrands.com.

Company Contact:

Luvu Brands, Inc.

Alexander A. Sannikov

Chief Financial Officer

770-246-6426

IR@LuvuBrands.com

Full-Year First Quarter 2023 Results

SUPPLEMENTAL FINANCIAL INFORMATION

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

SOURCE: Luvu Brands, Inc.

View source version on accesswire.com:

https://www.accesswire.com/725940/Luvu-Brands-Reports-Fiscal-First-Quarter-2023-Results-and-Announces-Conference-Call