Luminex Extends High Grade Gold at Camp Deposit; Results Include 15.4 Metres Grading 5.25 g/t Au Eq

Luminex Resources Corp. announced positive drill results from the Camp deposit in its Condor North project area, highlighting significant intersections across six drill holes. CC19-02EXT reported a notable 15.4 metres at 5.25 g/t Au Eq and a deeper extension was successful, confirming the mineralization model. Additional results include 137 metres at 1.19 g/t Au Eq from CC22-42 and 53 metres at 2.00 g/t Au Eq from CC22-43, indicating potential resource expansion. The results enhance the preliminary economic assessment previously conducted in 2021.

- CC19-02EXT intersected 15.4 metres grading 5.25 g/t Au Eq, confirming high-grade mineralization.

- CC22-42 showed 137 metres at 1.19 g/t Au Eq, including 6 metres of 11.62 g/t Au Eq, suggesting improved resource estimates.

- Drilling results indicate continued mineralization beyond previous models, raising potential resource size.

- None.

Insights

Analyzing...

Camp Deposit Drilling Highlights:

- CC19-02EXT – 15.4 metres grading 5.25 g/t Au Eq

- CC22-42 – 137 metres grading 1.19 g/t Au Eq starting 22 metres form surface

- Including 6 metres of 11.62 g/t Au Eq

- CC22-43 – 53 metres grading 2.00 g/t Au Eq starting 50 metres from surface

- CC22-44 – 2 metres grading 10.25 g/t Au Eq

- CC22-46 – 19.1 metres grading 2.46 g/t Au Eq

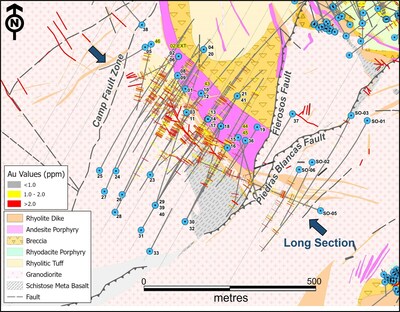

VANCOUVER, BC, Jan. 10, 2023 /PRNewswire/ - Luminex Resources Corp. (TSXV: LR) (OTCQX: LUMIF) (the "Company" or "Luminex") is pleased to announce drill results from six holes at the Camp deposit, part of the Condor North project area. The drill holes are from the ongoing infill and step-out program aimed at increasing and enhancing the 2021 Preliminary Economic Assessment ("PEA") resource of the Camp deposit. Hole CC19-02 was deepened from its original length (295.7 metres) based on a better understanding of the deposit and the Company's modeling, which showed a strong probability of more mineralization at depth. The extension proved extremely successful, yielding an intersection of 15.4 metres grading 5.25 g/t Au Eq and substantial additional mineralization higher up in the hole.

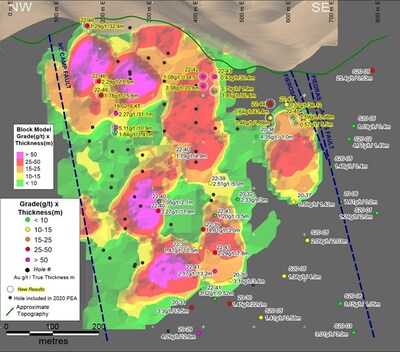

Figure 2 shows the progress of the Company's Camp drill program since the 2021 PEA (see news release from July 28, 2021). The background of the longitudinal section shows the contoured grade multiplied by the horizontal thickness for the 2021 PEA block model. The same colour/interval threshold has been used to colour pierce points of the post-resource drill holes for comparison. All coloured holes plotted were drilled since the PEA resource and show the continuation of mineralization past what was modeled for the resource, as well as a possible upgrade to some of the areas of the block model. Notably, the thicker deep zone (see news release from November 3, 2022) and the thicker shallow zone announced in this press release demonstrate higher grades than previously known. The areas where higher grades have been expanded are indicated with coloured arrows. All drill results are detailed in Table 1.

Hole CC19-02EXT was an extension of a previously drilled hole (CC19-02) and intersected 44.0 metres from 258 metres down hole grading 2.27 g/t gold and 19.5 g/t silver (2.51 g/t Au Eq). In addition, hole CC19-02EXT intersected 15.4 metres from 308 metres down hole grading 5.11 g/t gold and 11.9 g/t silver (5.25g/t Au Eq), confirming the Company's mineralization model.

Hole CC22-42 intersected several high-grade intervals within thick lower-grade zones, including 137.0 metres from 22 metres down hole grading 1.08 g/t gold and 9.2 g/t silver (1.19g/t Au Eq). Within this interval, three high-grade zones were intercepted including 6.0 metres from 89 metres down hole grading 11.40 g/t gold and 17.9 g/t silver (11.62g/t Au Eq). Hole CC22-42 and CC22-43 were aimed at increasing the resource size by infilling zones of the block model where thicker zones of mineralization were interpreted to exist.

Holes CC22-44 and CC22-45 were further step-out holes aimed at testing shallower mineralization. Hole CC22-44 intercepted 44.0 metres from 102 metres down hole of 0.64g/t gold and 7.3 g/t silver (0.72g/t Au Eq), extending mineralization to the southeast.

CC22-46 was the final hole of the 2022 program. Drilled on the northwest end of the deposit, it intercepted several higher-grade zones, including 19.1 metres from 214 metres down hole grading 2.29 g/t gold and 14.8 g/t silver (2.46g/t Au Eq).

Table 1. Drill intercepts for the Camp Deposit.

Hole | Azimuth / | From (m) | To (m) | Interval | True Thickness (m) | Au (g/t) | Ag (g/t) | Au Eq (g/t) |

CC19-02EXT | 210° / -60° / 425m | 258.0 | 302.0 | 44.0 | 31.11 | 2.27 | 19.5 | 2.51 |

And | 308 | 323.4 | 15.4 | 10.89 | 5.11 | 11.9 | 5.25 | |

And | 339.0 | 341.0 | 2.0 | 1.41 | 1.84 | 3.1 | 1.87 | |

CC22-42 | 227° / -26° / | 22.0 | 159.0 | 137.0* | 134.48 | 1.08 | 9.2 | 1.19 |

Incl | 89.0 | 95.0 | 6.0 | 5.89 | 11.40 | 17.9 | 11.62 | |

Incl | 100.0 | 101.0 | 1.0 | 0.98 | 6.23 | 84.6 | 7.25 | |

Incl | 106.0 | 115.0 | 9.0 | 8.83 | 2.13 | 4.0 | 2.18 | |

And | 173.0 | 194.0 | 21.0* | 20.61 | 3.38 | 9.8 | 3.50 | |

Incl | 188.0 | 194.0 | 6.0 | 5.89 | 10.94 | 28.5 | 11.28 | |

CC22-43 | 195° / -33° / 235m | 50.0 | 103.0 | 53.0* | 50.41 | 1.85 | 12.7 | 2.00 |

Incl | 95.0 | 103.0 | 8.0 | 7.61 | 8.77 | 53.7 | 9.42 | |

And | 117.0 | 149.0 | 32.0* | 30.43 | 0.43 | 4.7 | 0.48 | |

And | 207.0 | 209.0 | 2.0 | 1.90 | 3.79 | 3.4 | 3.83 | |

CC22-44 | 189° / -35° / | 102.0 | 146.0 | 44.0* | 41.35 | 0.64 | 7.3 | 0.72 |

Incl | 131.0 | 133.0 | 2.0 | 1.88 | 9.35 | 75.7 | 10.25 | |

And | 192.0 | 194.0 | 2.0 | 1.88 | 7.46 | 2.6 | 7.49 | |

And | 203.6 | 206.5 | 2.9 | 2.73 | 3.84 | 46.3 | 4.39 | |

CC22-45 | 160° / -27° / | 102.0 | 139.0 | 37.0* | 36.19 | 0.32 | 8.4 | 0.42 |

Incl | 125.0 | 126.0 | 1.0 | 0.98 | 3.59 | 22.9 | 3.86 | |

And | 154.0 | 159.6 | 5.6* | 5.50 | 0.57 | 5.0 | 0.63 | |

Incl | 159.1 | 159.6 | 0.5 | 0.46 | 3.28 | 35.9 | 3.71 | |

And | 186.0 | 192.0 | 6.0* | 5.87 | 0.44 | 1.8 | 0.46 | |

CC22-46 | 193° / -51° / | 47.0 | 87.0 | 40.0* | 32.36 | 1.29 | 32.2 | 1.68 |

And | 133.0 | 156.0 | 23.0* | 18.61 | 0.30 | 3.8 | 0.34 | |

And | 168.0 | 172.0 | 4.0* | 3.24 | 3.35 | 6.3 | 3.42 | |

And | 214.0 | 233.1 | 19.1 | 15.45 | 2.29 | 14.8 | 2.46 | |

And | 248.5 | 268.0 | 19.5 | 15.78 | 1.78 | 15.7 | 1.96 | |

And | 277.0 | 280.0 | 3.0 | 2.43 | 2.41 | 5.9 | 2.48 |

Asterisked (*) holes are "Shallower" intervals calculated using a lower limit of 0.20 g/t Au |

All Luminex sample assay results have been independently monitored through a quality control / quality assurance ("QA/QC") protocol which includes the insertion of blind standards, blanks as well as pulp and reject duplicate samples. Logging and sampling are completed at Luminex's core handling facility located at the Condor property. Drill core is diamond sawn on site and half drill-core samples are securely transported to ALS Laboratories' ("ALS") sample preparation facility in Quito, Ecuador. Sample pulps are sent to ALS's lab in Lima, Peru for analysis where gold content is determined by fire assay of a 50-gram charge with ICP finish. Silver and other elements are also determined by ICP methods. Over-limit samples assaying greater than 10 g/t gold and 100 g/t silver are re-analyzed by ALS using fire assay with a gravimetric finish. Luminex is not aware of any drilling, sampling, recovery or other factors that could materially affect the accuracy or reliability of the data referred to herein. ALS Laboratories is independent of Luminex.

Leo Hathaway, P. Geo, Senior Vice President Exploration of Luminex and the Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed, verified and approved the scientific and technical information concerning the Condor Project in this news release and has verified the data underlying that scientific and technical information.

Luminex Resources Corp. (TSXV:LR, OTCQX:LUMIF) is a Vancouver, Canada based precious and base metals exploration and development company focused on gold and copper projects in Ecuador. Luminex's inferred and indicated mineral resources are located at the Condor Gold-Copper project in Zamora-Chinchipe Province, southeast Ecuador. Luminex also holds a large and highly prospective land package in Ecuador, including the Pegasus and Orquideas projects, which are being co-developed with Anglo American and JOGMEC respectively.

Further details are available on the Company's website at https://luminexresources.com/.

To receive news releases please sign up at https://www.luminexresources.com/contact/contact-us/.

Follow us on: Twitter, Linkedin or Facebook.

LUMINEX RESOURCES CORP.

Signed: "Marshall Koval"

Marshall Koval, CEO and Director

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Certain statements and information herein, including all statements that are not historical facts, contain forward-looking statements and forward-looking information within the meaning of applicable securities laws. Such forward-looking statements or information include, but are not limited to, statements regarding future drilling and work programs at Condor. Often, but not always, forward-looking statements or information can be identified by the use of phrases or statements that certain actions, events or results "will" occur or be achieved.

With respect to forward-looking statements and information contained herein, the Company has made numerous assumptions including among other things, assumptions about general business and economic conditions, the prices of gold and copper, and anticipated costs and expenditures. The foregoing list of assumptions is not exhaustive.

Although management of the Company believes that the assumptions made and the expectations represented by such statements or information are reasonable, there can be no assurance that a forward-looking statement or information herein will prove to be accurate. Forward-looking statements and information by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause the Company's actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. These factors include, but are not limited to: risks associated with the business of the Company; business and economic conditions in the mining industry generally; the supply and demand for labour and other project inputs; changes in commodity prices; changes in interest and currency exchange rates; risks relating to inaccurate geological and engineering assumptions (including with respect to the tonnage, grade and recoverability of reserves and resources); risks relating to unanticipated operational difficulties (including failure of equipment or processes to operate in accordance with specifications or expectations, cost escalation, unavailability of materials and equipment, government action or delays in the receipt of government approvals, industrial disturbances or other job action, and unanticipated events related to health, safety and environmental matters); risks relating to adverse weather conditions; political risk and social unrest; changes in general economic conditions or conditions in the financial markets; changes in laws (including regulations respecting mining concessions); and other risk factors as detailed from time to time in the Company's continuous disclosure documents filed with Canadian securities administrators. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/luminex-extends-high-grade-gold-at-camp-deposit-results-include-15-4-metres-grading-5-25-gt-au-eq-301717181.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/luminex-extends-high-grade-gold-at-camp-deposit-results-include-15-4-metres-grading-5-25-gt-au-eq-301717181.html

SOURCE Luminex Resources Corp.