Cannara Biotech Inc. Reports Q4 and Fiscal Year 2024 Results: Achieves Record Sales Growth and Operating Cash Flow, Solidifying Leadership in Canada's Cannabis Market

Cannara Biotech reported strong financial results for Q4 and FY2024, with record total revenues of $23.4M in Q4 (28% YoY increase) and $82.2M for FY2024 (43% YoY increase). The company achieved its 14th consecutive quarter of positive Adjusted EBITDA at $3.7M. Operating cash flow surged 81% YoY to $10.7M, while free cash flow reached $3.2M. The company captured 3.2% national market share and 11.9% in Québec, ranking 3rd in the province. Plans include activating two additional Valleyfield grow zones in FY2025, adding 50,000 square feet of canopy to reach an estimated annual cannabis production of 40,000 kg.

Cannara Biotech ha riportato risultati finanziari solidi per il quarto trimestre e l'anno fiscale 2024, con ricavi totali record di 23,4 milioni di dollari nel Q4 (aumento del 28% rispetto all'anno precedente) e 82,2 milioni di dollari per l'anno fiscale 2024 (aumento del 43% rispetto all'anno precedente). L'azienda ha raggiunto il 14esimo trimestre consecutivo di EBITDA rettificato positivo, pari a 3,7 milioni di dollari. Il flusso di cassa operativo è aumentato dell'81% rispetto all'anno precedente, raggiungendo i 10,7 milioni di dollari, mentre il flusso di cassa libero ha raggiunto i 3,2 milioni di dollari. L'azienda ha catturato il 3,2% della quota di mercato nazionale e l'11,9% in Québec, posizionandosi al 3° posto nella provincia. I piani includono l'attivazione di due ulteriori zone di coltivazione a Valleyfield nell'anno fiscale 2025, aggiungendo 50.000 piedi quadrati di superficie, per raggiungere una stima di produzione annuale di cannabis di 40.000 kg.

Cannara Biotech informó resultados financieros sólidos para el cuarto trimestre y el año fiscal 2024, con ingresos totales récord de $23.4 millones en el Q4 (un aumento del 28% interanual) y $82.2 millones para el año fiscal 2024 (un aumento del 43% interanual). La compañía logró su 14to trimestre consecutivo de EBITDA ajustado positivo, con $3.7 millones. El flujo de efectivo operativo aumentó un 81% interanual, alcanzando los $10.7 millones, mientras que el flujo de efectivo libre llegó a $3.2 millones. La empresa capturó el 3.2% de participación de mercado nacional y el 11.9% en Quebec, ocupando el tercer lugar en la provincia. Los planes incluyen activar dos zonas de cultivo adicionales en Valleyfield durante el año fiscal 2025, añadiendo 50,000 pies cuadrados de dosel para alcanzar una producción anual estimada de cannabis de 40,000 kg.

카나라 바이오텍은 2024년 4분기 및 회계연도에 대한 강력한 재무 결과를 보고했습니다. 4분기에 총 2,340만 달러의 기록적인 매출(전년 대비 28% 증가)과 2024년 회계연도에 대해 8,220만 달러(전년 대비 43% 증가)를 기록했습니다. 이 회사는 14번째 연속 분기로 조정된 EBITDA가 370만 달러의 긍정적인 결과를 달성했습니다. 운영 현금 흐름은 전년 대비 81% 증가하여 1,070만 달러에 달했으며, 자유 현금 흐름은 320만 달러에 도달했습니다. 이 회사는 전국 시장 점유율 3.2%와 퀘벡주에서 11.9%를 차지하며, 이 주에서 3위에 올랐습니다. 계획에는 2025 회계연도에 Valleyfield에서 추가 재배 지역 2개를 활성화하여 50,000 제곱피트의 캔피를 추가하고, 연간 40,000kg의 대마초 생산을 목표로 하고 있습니다.

Cannara Biotech a rapporté de solides résultats financiers pour le quatrième trimestre et l'exercice 2024, avec des revenus totaux record de 23,4 millions de dollars au T4 (augmentation de 28 % par rapport à l'année précédente) et de 82,2 millions de dollars pour l'exercice 2024 (augmentation de 43 % par rapport à l'année précédente). L'entreprise a atteint son 14e trimestre consécutif d'EBITDA ajusté positif s'élevant à 3,7 millions de dollars. Le flux de trésorerie opérationnel a bondi de 81 % par rapport à l'année précédente pour atteindre 10,7 millions de dollars, tandis que le flux de trésorerie libre a atteint 3,2 millions de dollars. L'entreprise a capturé 3,2 % de part de marché national et 11,9 % au Québec, se classant 3e dans la province. Les projets incluent l'activation de deux zones de culture supplémentaires à Valleyfield pour l'exercice 2025, ajoutant 50 000 pieds carrés de canopée pour atteindre une production annuelle estimée de cannabis de 40 000 kg.

Cannara Biotech berichtete über starke Finanzergebnisse für das 4. Quartal und das Geschäftsjahr 2024 mit Rekordgesamtumsätzen von 23,4 Millionen Dollar im Q4 (28% Anstieg im Jahresvergleich) und 82,2 Millionen Dollar für das Geschäftsjahr 2024 (43% Anstieg im Jahresvergleich). Das Unternehmen erreichte sein 14. aufeinanderfolgendes Quartal mit positivem bereinigtem EBITDA von 3,7 Millionen Dollar. Der operative Cashflow schoss im Jahresvergleich um 81% auf 10,7 Millionen Dollar in die Höhe, während der freie Cashflow 3,2 Millionen Dollar erreichte. Das Unternehmen eroberte 3,2% nationalen Marktanteil und 11,9% in Québec und belegte den 3. Platz in der Provinz. Zu den Plänen gehört die Aktivierung von zwei weiteren Anbauzonen in Valleyfield im Geschäftsjahr 2025, was 50.000 Quadratfuß Blätterdach hinzufügen wird, um eine geschätzte jährliche Cannabisproduktion von 40.000 kg zu erreichen.

- Record revenue growth: Q4 revenue $23.4M (+28% YoY) and FY2024 revenue $82.2M (+43% YoY)

- Operating cash flow increased 81% YoY to $10.7M

- Free cash flow improved from -$4.0M to +$3.2M YoY

- Market share growth to 3.2% nationally and 11.9% in Québec

- 14th consecutive quarter of positive Adjusted EBITDA ($3.7M in Q4)

- Strong working capital position of $40.5M

- Operating income decreased from $11.9M in FY2023 to $10.1M in FY2024

- Net income declined from $6.9M in FY2023 to $6.4M in FY2024

- EPS decreased from $0.08 in FY2023 to $0.07 in FY2024

- Gross profit percentage before fair value adjustments declined to 34%

- Record Q4 and year-end total revenues of

$23.4 million and$82.2 million , representing a28% and43% increase compared to the same periods in 2023. - Robust growth in Q4 over Q3 2024, with total revenues increasing by

20% , operating income by42% , Adjusted EBITDA1 by33% , net income by184% and free cash flow1 by117% . - Delivered a fourteenth consecutive quarter of positive Adjusted EBITDA1 of

$3.7 million . - Operating cash flow surged

81% year-over-year to$10.7 million for fiscal 2024, while free cash flow1 reached$3.2 million , reflecting a$7.2 million improvement from the prior year. - Reached a national market share of

3.2% in Q4 20242, a39% increase from the prior year, with a leading11.9% market share in Québec, marking the Company as top 3rd in the province3. - Two Valleyfield grow zones planned for fiscal 2025, activating an additional 50,000 square feet of canopy, bringing its estimated total annual cannabis production to just under 40,000 kg.

- Annual General Meeting of shareholders scheduled for January 30, 2025, at 11:00 a.m. EST.

All financial results are reported in Canadian dollars, unless otherwise stated.

MONTREAL, Nov. 25, 2024 (GLOBE NEWSWIRE) -- Cannara Biotech Inc. (“Cannara”, “the Company”, “us” or “we”) (TSXV: LOVE) (OTCQB: LOVFF) (FRA: 8CB0), a vertically integrated producer of premium-grade cannabis and derivative product offerings at affordable prices with two mega facilities based in Québec spanning over 1,650,000 sq. ft., today announced its fiscal fourth quarter 2024 financial and operating results for the three and twelve-month periods ended August 31, 2024. The full set of Consolidated Financial Statements for the year ended August 31, 2024, and the accompanying Management’s Discussion and Analysis can be accessed by visiting the Company’s website at investors.cannara.ca, or by accessing the Company’s SEDAR+ profile at www.sedarplus.ca. The Company’s latest investor presentation is available at www.cannara.ca/investors/investor-deck/.

“Fiscal 2024 was a transformative year for Cannara, showcasing the resilience of our business model and the strength of our execution strategy,” said Zohar Krivorot, President & CEO. “With a

“Cannara’s fiscal 2024 results demonstrate the financial strength and consistency that investors seek in today’s profit-focused marketplace,” added Nicholas Sosiak, Chief Financial Officer. “With Adjusted EBITDA of

_________________

1 Please refer to the Non-GAAP and Other Financial Measures section of this news release for corresponding definitions.

2 As reported by Hifyre data for the periods of June 2023 to August 2023 and June 2024 to August 2024.

3 Based on estimated sales data provided by Weed Crawler, for the period of June 2024 to August 2024.

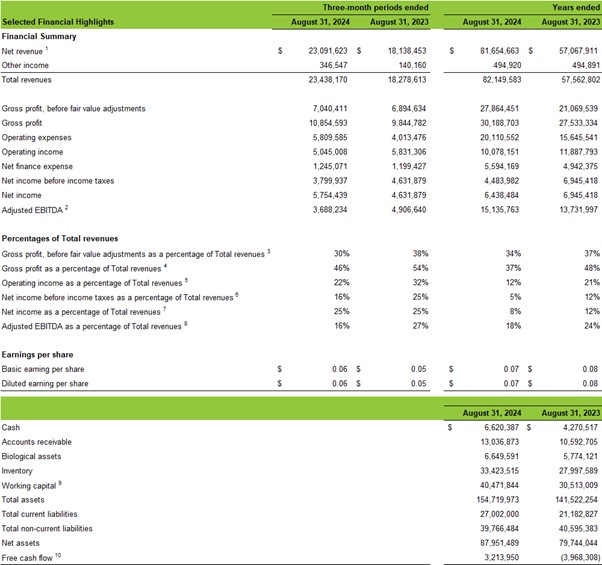

FISCAL 2024 FINANCIAL HIGHLIGHTS

- 2024 total revenues rose by

43% from$57.6 million in 2023 to$82.2 million . - Gross profit before fair value adjustments for 2024 was

$27.9 million , a32% increase compared to the twelve-month period of 2023. Gross profit percentage before fair value adjustments was34% while Gross profit after fair value adjustments was37% for 2024. - Operating income was

$10.1 million for 2024, compared to operating income of$11.9 million for 2023, reflecting increased marketing and administrative expenses to support the growth of the Company’s operations. - Adjusted EBITDA for 2024 amounted to

$15.1 million , a10% increase compared to the prior year. - 2024 net income was

$6.4 million , compared to$6.9 million in 2023, reflecting the impact of a larger fair value adjustment in 2023 as a result of activating 3 growing zones and increased marketing and administrative costs in 2024 as the Company continues to expand. - Earnings per share was

$0.07 for 2024 compared to$0.08 in 2023. - Posted positive operating cash flows of

$10.7 million in 2024 compared to$5.9 million in 2023, an81% increase over prior year. - Free cash flow improved to

$3.2 million compared to negative free cash flow of$4.0 million in 2023, representing a$7.2 million turnaround. - The Company has

$40.5 million in working capital4 as of August 31, 2024.

Q4 2024 FINANCIAL HIGHLIGHTS

- Q4 2024 total revenues increased by

28% to$23.4 million compared to Q4 2023. - Gross profit before fair value adjustments for Q4 2024 was

$7.0 million , a2% increase compared to the same period in 2023. Gross profit percentage before fair value adjustments was30% and Gross profit after fair value adjustments was46% for Q4 2024. - Operating income was

$5.0 million for Q4 2024 compared to operating income of$5.8 million in Q4 2023, reflecting increased sales and marketing costs geared towards capturing more market share. - Delivered the Company’s 14th straight quarter of positive Adjusted EBITDA, totaling

$3.7 million for Q4 2024 or16% of net revenues. This compares to$4.9 million of Adjusted EBITDA generated in the same period of prior year. - Q4 2024 net income totaled

$5.8 million compared to$4.6 million in Q4 2023. - Earnings per share was

$0.06 and$0.05 for Q4 2024 and 2023. - Posted positive operating cash flows of

$3.2 million for Q4 2024 compared to$2.9 million in the same period of the prior year. - Free cash flow for Q4 2024 increased to

$2.7 million from$1.1 million in Q4 2023, a143% increase.

FISCAL 2024 OPERATIONAL HIGHLIGHTS & FISCAL 2025 OUTLOOK

Scaling Production to Meet Growing Consumer Demand

Cannara has seen strong consumer demand since launching its retail products, prompting expanded production at its Valleyfield Facility. In fiscal 2023, three new growing zones (25,000 sq. ft. each) were activated, with a 10th zone added in January 2024, bringing total cultivation to 250,000 sq. ft. (approximately 100,000 plants). For fiscal 2025, the Company aims to activate two more zones, adding 50,000 sq. ft. of active canopy, while its 24-zone facility allows scalable production in lockstep with demand. To promote demand for continued expansion, Cannara plans to maintain its investments in sales and marketing to boost market share and strengthen loyalty for its flagship brands—Tribal, Nugz, and Orchid CBD.

_________________

4 Please refer to the Non-GAAP and Other Financial Measures section of this news release for corresponding definitions.

FISCAL 2024 OPERATIONAL HIGHLIGHTS & FISCAL 2025 OUTLOOK

Innovating for Market Leadership

In fiscal 2024, Cannara achieved significant growth by refining its product portfolio and targeting high-growth categories such as dried flower, pre-rolls, infused pre-rolls, milled flower, and vapes. Highlights include Tribal’s #1 Live Resin Vape line in Canada (

For fiscal 2025, Cannara plans to launch over 20 new products in high volume categories, including innovative formats like all-in-one vape devices under Tribal and Nugz, and premium infused pre-rolls under Tribal. A rigorous pheno-hunting program underpins these developments, unlocking unique genetics tailored to brand fit, potency, structure, and market appeal. In April 2024, Cannara introduced three new genetics: Neon Sunshine and Bubble Up (Tribal) and Guava Jam (Nugz).

Expanding Market Share and Strengthening Leadership Across Canada

Cannara continues to strengthen its position in the Canadian cannabis market, achieving significant growth in national and provincial market share. Nationally, Cannara increased its market share by over

Additionally, Cannara entered Nova Scotia and Manitoba, introducing popular products like Tribal Cuban Linx pre-rolls, which transitioned from limited-time offerings to permanent SKUs. Manitoba saw the addition of 35 SKUs in May 2024, reinforcing Cannara’s market presence.

The expanding Canadian cannabis market, projected to reach US

Driving Profitability Through Strategic Efficiency

Cannara aims to build a strategic cannabis platform that generates growth in positive Adjusted EBITDA and operating cash flow by focusing on premium cannabis products at disruptive pricing, leveraging Québec’s low electricity and labor costs, and maintaining a lean operational model. The Company’s in-house pre-roll manufacturing, solventless hash lab, and BHO extraction lab provide a competitive edge through vertical integration and efficient raw material use. By developing high-demand SKUs with strong margins, Cannara has demonstrated its commitment to profitability. Year-to-date 2024 results show a

_________________

5 As reported by Hifyre data for the periods of June 2023 to August 2023 and June 2024 to August 2024.

6 Based on estimated sales data provided by Weed Crawler, for the period of June 2024 to August 2024.

7 Statista Market Insights, March 2024, US Dollars

CAPITAL TRANSACTIONS AND OTHER EVENTS

Capital Transactions

- Purchased 286,900 common shares during fiscal 2024, reducing outstanding shares and strengthening shareholder value.

- Granted 625,000 stock options at

$1.20 , 124,000 stock options at$1.80 , and 715,000 RSUs to employees and board members. - Extended the terms of 2,435,000 stock options at

$1.80 and 750,000 stock options at$1.00 b y two years. - Subsequent to year-end, granted 525,000 stock options at

$1.00 , 115,000 stock options at$1.80 , and 625,000 RSUs with performance conditions to align incentives with long-term growth objectives and 90,000 RSUs without performance conditions to employees and board members subject to certain vesting conditions in accordance with the Company’s employee share option plan and RSU plan. - As of the date of this release, Cannara has 90,018,952 common shares, 5,166,600 stock options, and 2,219,183 RSUs issued and outstanding.

Other Events

- Completed the sale of a parcel of land at the Valleyfield site in April 2024, generating a

$2.0 million gain. Additional assets, including a building under construction, remain actively marketed for sale. - On August 16, 2024, Cannara announced KPMG LLP’s decision to resign as auditor on its own initiative upon the completion of the 2024 year-end audit. MNP LLP has been appointed as the successor auditor, pending shareholder approval at the 2025 Annual General Meeting.

ANNUAL GENERAL MEETING OF SHAREHOLDERS AND ANNUAL INFORMATION FORM

Cannara announced that its Annual General Meeting of shareholders scheduled for January 30, 2025, at 11:00 a.m. EST and will be held via live webcast online and teleconference. The Company also announced that its 2025 Annual Information Form and its Notice of Annual Meeting are now posted on Cannara’s website at www.cannara.ca and filed on SEDAR+ at www.sedarplus.ca.

Shareholders are encouraged to vote on the matters before the meeting by proxy and to join the meeting by webcast. Those who attend the meeting by teleconference are requested to read the notes to form of proxy and then to, complete, sign and mail the enclosed form of proxy in accordance with the instructions set out in the proxy and in the management proxy circular to be posted on Cannara’s website at www.cannara.ca and filed on SEDAR+ at www.sedarplus.ca.

Shareholders will be able to join the annual general meeting by clicking on the link below:

To join the meeting via teleconference, please dial 1-650-479-3208 and use meeting code 2636 952 9781 and passcode LOVE2025 (56832025 when dialing from a phone or video system). Shareholders accessing the Meeting via Teleconference will not be able to vote or speak at the Meeting. To vote or speak at the Meeting, Shareholders will need to join the webcast and utilize the chat function during the Meeting. A moderator will be present to allow Shareholders to vote or speak at the Meeting at the appropriate time.

SELECTED FINANCIAL HIGHLIGHTS

| 1 | Gross revenue included revenue from sale of goods, net of excise taxes, services revenues and lease revenues. |

| 2 | Adjusted EBITDA is a non-GAAP financial measure. |

| 3 | Gross profit before fair value adjustments as a percentage of Total revenues is a supplementary financial ratio. For more details see the Non-GAAP and Other Financial Measures section of this news release. |

| 4 | Gross profit as a percentage of Total revenues is a supplementary financial ratio. For more details see the Non-GAAP and Other Financial Measures section of this news release. |

| 5 | Operating income as a percentage of Total revenues is a supplementary financial ratio. For more details see the Non-GAAP and Other Financial Measures section of this news release. |

| 6 | Net income before income taxes as a percentage of Total revenues is a supplementary financial ratio. For more details see the Non-GAAP and Other Financial Measures section of this news release. |

| 7 | Net income as a percentage of Total revenues is a supplementary financial ratio. For more details see the Non-GAAP and Other Financial Measures section of this news release. |

| 8 | Adjusted EBITDA as a percentage of Total revenues is a non-GAAP financial ratio. For more details see the Non-GAAP and Other Financial Measures section of this news release. |

| 9 | Working capital is a non-GAAP financial measure. For more details see the Non-GAAP and Other Financial Measures section of this news release. |

| 10 | Free cash flow is a non-GAAP financial measure. For more details see the Non-GAAP and Other Financial Measures section of this news release. |

NON-GAAP MEASURES AND OTHER FINANCIAL MEASURES

The Company reports its financial results in accordance with International Financial Reporting Standards (“IFRS”). Cannara uses a number of financial measures when assessing its results and measuring overall performance. Some of these financial measures are not calculated in accordance with IFRS. National Instrument 52-112 respecting Non-GAAP and Other Financial Measures Disclosure (“NI 52-112”) prescribes disclosure requirements that apply to the following types of measures used by the Company: (i) non-GAAP financial measures and (ii) non-GAAP and other supplementary financial ratios. In this news release, the following non-GAAP measures, non-GAAP and other supplementary financial ratios are used by the Company: adjusted EBITDA, free cash flow, working capital, segment gross profit before fair value adjustments as a percentage of segment total revenues, segment gross profit as a percentage of segment total revenues, segment operating income as a percentage of segment total revenues, gross profit as a percentage of total revenues and adjusted EBITDA as a percentage of total revenues. Additional details for these non-GAAP and other financial measures can be found in the section entitled “Non-GAAP and Other Financial Measures” of Cannara’s MD&A for the year ended August 31, 2024, which is posted on Cannara’s website at www.cannara.ca and filed on SEDAR+ at www.sedarplus.ca. Reconciliations of non-GAAP financial measures and non-GAAP and supplementary financial ratios to the most directly comparable IFRS measures are provided below. Management believes that these non-GAAP financial measures and non-GAAP and supplementary financial ratios provide useful information to investors regarding the Company’s financial condition and results of operations as they provide key metrics of its performance. These measures are not recognized under IFRS, do not have any standardized meanings prescribed under IFRS and may differ from similar computations as reported by other issuers, and accordingly may not be comparable. These measures should not be viewed as a substitute for the related financial information prepared in accordance with IFRS.

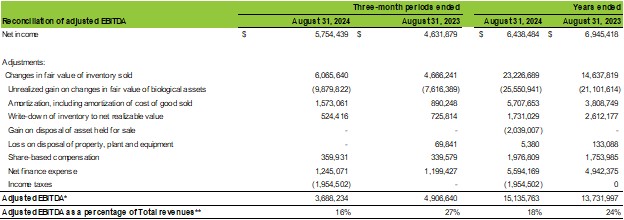

Reconciliation of Adjusted EBITDA

Adjusted EBITDA is a non-GAAP Measure and can be reconciled with net income, the most directly comparable IFRS financial measure, as detailed below.

Adjusted EBITDA as a percentage of total revenues is a non-GAAP financial ratio, determined as adjusted EBITDA divided by total revenues.

*Non-GAAP financial measure

**Non-GAAP financial ratio

NON-GAAP MEASURES AND OTHER FINANCIAL MEASURES

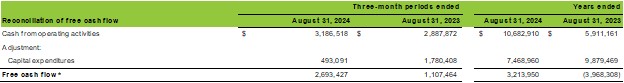

Reconciliation of free cash flow

Free cash flow is a non-GAAP measure and can be reconciled with Cash from operating activities, the most directly comparable IFRS financial measure, as detailed below.

*Non-GAAP financial measure

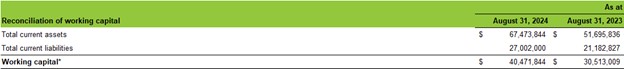

Reconciliation of working capital

Working capital is a non-GAAP Measure and can be reconciled with total current assets and total current liabilities, the most directly comparable IFRS financial measure, as detailed below.

*Non-GAAP financial measure

CONTACT

| Nicholas Sosiak, CPA, CA Chief Financial Officer nick@cannara.ca | Zohar Krivorot President & Chief Executive Officer zohar@cannara.ca |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

ABOUT CANNARA

Cannara Biotech Inc. (TSXV: LOVE) (OTCQB: LOVFF) (FRA: 8CB0), is a vertically integrated producer of affordable premium-grade cannabis and cannabis-derivative products for the Canadian markets. Cannara owns two mega facilities based in Québec spanning over 1,650,000 sq. ft., providing the Company with 100,000 kg of potential annualized cultivation output. Leveraging Québec’s low electricity costs, Cannara’s facilities produce premium-grade cannabis products at an affordable price. For more information, please visit cannara.ca.

CAUTIONARY STATEMENT REGARDING “FORWARD-LOOKING” INFORMATION

This news release may contain “forward-looking information” within the meaning of Canadian securities legislation (“forward-looking statements”). These forward-looking statements are made as of the date of this MD&A and the Company does not intend, and does not assume any obligation, to update these forward-looking statements, except as required under applicable securities legislation. Forward-looking statements relate to future events or future performance and reflect Company management’s expectations or beliefs regarding future events and include, but are not limited to, the Company and its operations, its projections or estimates about its future business operations, its planned expansion activities, anticipated product offerings, the adequacy of its financial resources, the ability to adhere to financial and other covenants under lending agreements, future economic performance, and the Company’s ability to become a leader in the field of cannabis cultivation, production, and sales.

In certain cases, forward-looking statements can be identified by the use of words such as “plans,” “expects” or “does not expect,” “is expected,” “budget,” “scheduled,” “estimates,” “forecasts,” “intends,” “anticipates” or “does not anticipate,” or “believes,” or variations of such words and phrases or statements that certain actions, events or results “may,” “could,” “would,” “might” or “will be taken,” “occur” or “be achieved” or the negative of these terms or comparable terminology. In this document, certain forward-looking statements are identified by words including “may,” “future,” “expected,” “intends” and “estimates.” By their very nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

Forward-looking information is based upon a number of assumptions and is subject to a number of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those that are disclosed in, or implied by, such forward-looking information. These risks and uncertainties include, but are not limited to, the risk factors which are discussed in greater detail under “Risk Factors” in the Company’s AIF available on SEDAR+ at www.sedarplus.ca and under the “Investor Area” section of our website at https://www.cannara.ca/en/investor-area.

Other risks not presently known to the Company or that the Company believes are not significant could also cause actual results to differ materially from those expressed in its forward-looking statements. Although the forward-looking information contained herein is based upon what we believe are reasonable assumptions, readers are cautioned against placing undue reliance on this information since actual results may vary from the forward-looking information. Certain assumptions were made in preparing the forward-looking information concerning the availability of capital resources, business performance, market conditions, as well as customer demand. Consequently, all of the forward-looking information contained herein is qualified by the foregoing cautionary statements, and there can be no guarantee that the results or developments that we anticipate will be realized or, even if substantially realized, that they will have the expected consequences or effects on our business, financial condition or results of operation. Unless otherwise noted or the context otherwise indicates, the forward-looking information contained herein is provided as of the date hereof, and we do not undertake to update or amend such forward-looking information whether as a result of new information, future events or otherwise, except as may be required by applicable law.

A Media Snippet accompanying this announcement is available by clicking on this link.

Figures accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/3f77c62c-8b07-45a8-a032-f68ffbe910c9

https://www.globenewswire.com/NewsRoom/AttachmentNg/6d3a1a37-df5b-4f6a-86fd-f3f3325d2579

https://www.globenewswire.com/NewsRoom/AttachmentNg/7f178e3c-4f26-4d6e-be80-26163a53c130

https://www.globenewswire.com/NewsRoom/AttachmentNg/210dfde3-4532-4497-902a-d67722be0887

FAQ

What was Cannara Biotech's (LOVFF) revenue growth in Q4 2024?

What was Cannara Biotech's (LOVFF) market share in Quebec for Q4 2024?

How much free cash flow did Cannara Biotech (LOVFF) generate in fiscal 2024?