Latin Metals Vests 71% Ownership of Key Argentine Gold-Silver Exploration Assets with Potential for High-Grade Discoveries

Latin Metals (TSXV: LMS) (OTCQB: LMSQF) has secured 71% ownership of the Cerro Bayo and La Flora properties in Argentina's Santa Cruz Province, with an option to acquire 100% ownership. The properties, previously explored by Barrick Gold, show potential for high-grade gold-silver discoveries at depths of 150-200 meters within the Deseado Massif region. The project features a 6km-wide favorable structural zone with gold-silver mineralization. Drill permits are expected in Q4 2024, and the company is seeking a partner for comprehensive exploration activities in 2025. The properties are strategically located in Santa Cruz Province, which contributes 42% of Argentina's mineral exports and produced over 680,000 ounces of gold and 15.2 million ounces of silver in 2023.

Latin Metals (TSXV: LMS) (OTCQB: LMSQF) ha acquisito il 71% della proprietà Cerro Bayo e La Flora nella Provincia di Santa Cruz, Argentina, con l'opzione di acquisire la proprietà al 100%. Le proprietà, precedentemente esplorate da Barrick Gold, mostrano potenziale per scoperte ad alta grade di oro e argento a profondità di 150-200 metri nella regione del Massiccio Deseado. Il progetto presenta una zona strutturale favorevole larga 6 km con mineralizzazione di oro e argento. Si prevede che i permissi di perforazione siano disponibili nel quarto trimestre del 2024, e la società sta cercando un partner per attività di esplorazione esaustive nel 2025. Le proprietà sono strategicamente situate nella Provincia di Santa Cruz, che contribuisce al 42% delle esportazioni minerarie dell'Argentina e ha prodotto oltre 680.000 once d'oro e 15,2 milioni d'once d'argento nel 2023.

Latin Metals (TSXV: LMS) (OTCQB: LMSQF) ha asegurado el 71% de la propiedad Cerro Bayo y La Flora en la Provincia de Santa Cruz, Argentina, con la opción de adquirir el 100% de la propiedad. Las propiedades, que fueron exploradas previamente por Barrick Gold, muestran potencial para descubrimientos de alto grado de oro y plata a profundidades de 150-200 metros en la región del Macizo Deseado. El proyecto cuenta con una zona estructural favorable de 6 km de ancho con mineralización de oro y plata. Se esperan permisos de perforación para el cuarto trimestre de 2024, y la empresa está buscando un socio para actividades de exploración integral en 2025. Las propiedades están estratégicamente ubicadas en la Provincia de Santa Cruz, que contribuye con el 42% de las exportaciones minerales de Argentina y produjo más de 680,000 onzas de oro y 15.2 millones de onzas de plata en 2023.

라틴 메탈스 (TSXV: LMS) (OTCQB: LMSQF)는 아르헨티나 산타 크루즈 주의 세로 바요 및 라 플로라 자산의 71% 지분을 확보했으며, 100% 지분을 인수할 수 있는 옵션을 가지고 있습니다. 이 자산은 이전에 바라익 골드에 의해 탐사되었으며, 데세아도 마시프 지역에서 150~200미터 깊이의 고급 금-은 발견 가능성을 보여줍니다. 이 프로젝트는 금-은 광물이 형성된 6km 너비의 유리한 구조적 구역을 특징으로 합니다. 시추 허가는 2024년 4분기에 예상되며, 회사는 2025년 종합 탐사 활동을 위한 파트너를 찾고 있습니다. 이 자산은 산타 크루즈 주에 전략적으로 위치하고 있으며, 이는 아르헨티나 광물 수출의 42%를 차지하고 2023년에 680,000온스의 금과 1,520만 온스의 은을 생산했습니다.

Latin Metals (TSXV: LMS) (OTCQB: LMSQF) a sécurisé une participation de 71% dans les propriétés Cerro Bayo et La Flora dans la province de Santa Cruz en Argentine, avec une option pour acquérir 100 % de propriété. Les propriétés, auparavant explorées par Barrick Gold, montrent un potentiel pour des découvertes d'or et d'argent de haute teneur à des profondeurs de 150 à 200 mètres dans la région du Massif Deseado. Le projet présente une zone structurale favorable de 6 km de large avec minéralisation d'or et d'argent. Les permis de forage sont attendus au quatrième trimestre 2024, et l'entreprise cherche un partenaire pour des activités d'exploration complètes en 2025. Les propriétés sont stratégiquement situées dans la province de Santa Cruz, qui contribue à 42 % des exportations minérales de l'Argentine et a produit plus de 680 000 onces d'or et 15,2 millions d'onces d'argent en 2023.

Latin Metals (TSXV: LMS) (OTCQB: LMSQF) hat sich 71% der Cerro Bayo und La Flora Liegenschaften in der Provinz Santa Cruz, Argentinien, gesichert, mit der Option, 100% zu übernehmen. Die Liegenschaften, die zuvor von Barrick Gold erkundet wurden, zeigen Potenzial für hochgradige Gold- und Silberentdeckungen in Tiefen von 150-200 Metern im Deseado-Massiv. Das Projekt verfügt über eine 6 km breite förderliche Strukturzone mit Gold- und Silbermineralisierung. Bohrgenehmigungen werden im vierten Quartal 2024 erwartet, und das Unternehmen sucht einen Partner für umfassende Explorationsaktivitäten im Jahr 2025. Die Liegenschaften sind strategisch in der Provinz Santa Cruz gelegen, die 42% der Mineralexporte Argentiniens beiträgt und 2023 über 680.000 Unzen Gold und 15,2 Millionen Unzen Silber produziert hat.

- Option to acquire 100% ownership of the properties

- Strategic location in prolific mining region with established infrastructure

- Properties show potential for high-grade gold-silver discoveries

- Previous exploration work completed by Barrick Gold

- Drill permits expected in Q4 2024

- Additional investment required for 100% ownership

- Dependency on finding a partner for exploration activities

- Exploration stage project with no proven reserves

- 0.75% NSR royalty obligation

VANCOUVER, British Columbia, Nov. 06, 2024 (GLOBE NEWSWIRE) -- Latin Metals Inc. (“Latin Metals” or the “Company”) - (TSXV: LMS) (OTCQB: LMSQF), is pleased to announce it has successfully completed payment obligations to the underlying owner (the “Vendor”) to vest a

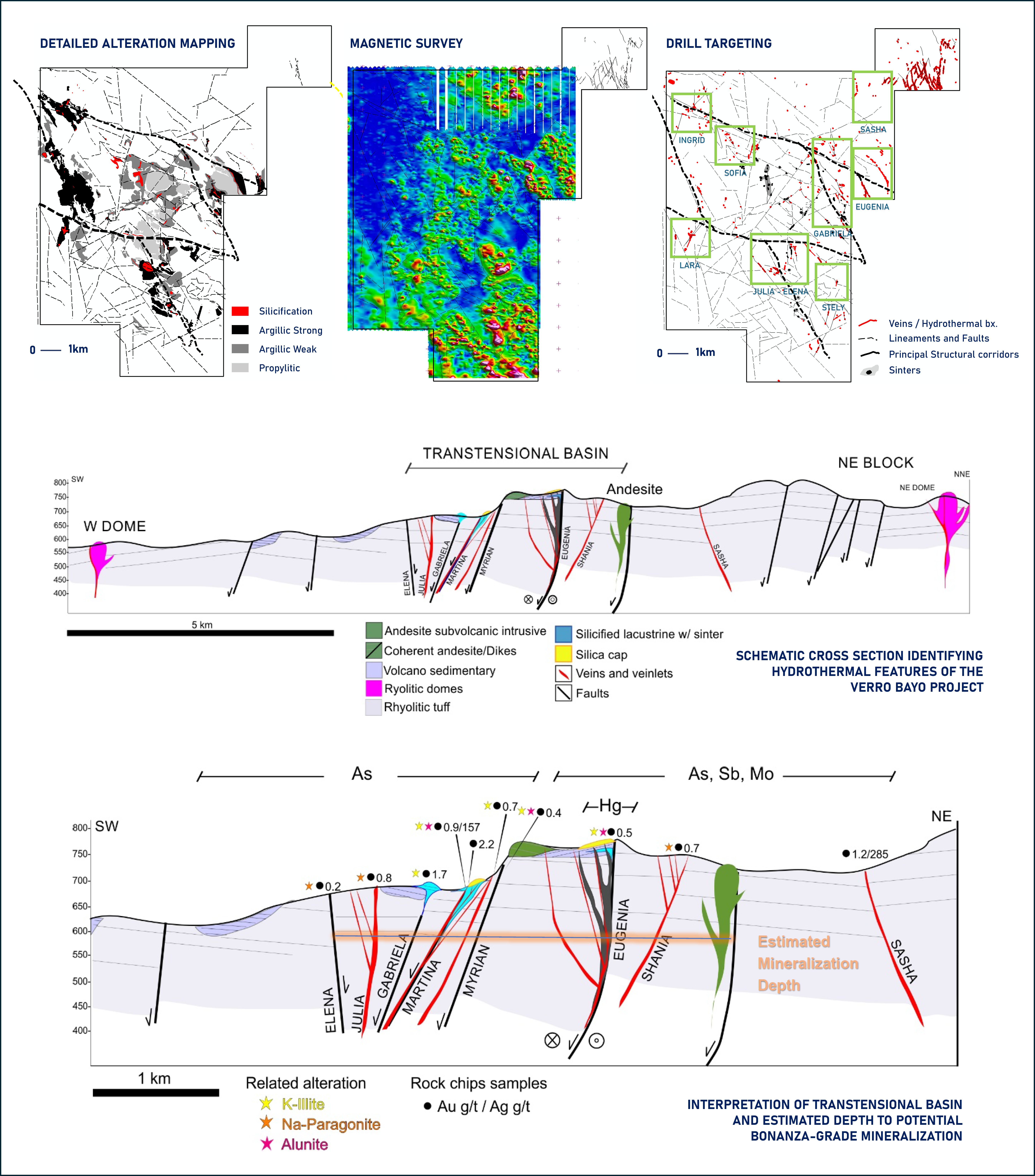

Exploration Potential at Cerro Bayo

The Cerro Bayo and La Flora properties, previously optioned out to Barrick Gold Corporation (NYSE: GOLD) (“Barrick”), have undergone extensive surface exploration and drill targeting (Figure 1). Located within the prolific Deseado Massif, a region known for high-grade gold-silver deposits, the properties exhibit evidence for the existence of low-sulfidation epithermal systems. The geological model indicates potential for gold-silver bonanza vein mineralization at accessible depths of 150 to 200 meters.

The district’s closest high-grade analog is Newmont’s Cerro Negro mine, located 70 kilometers north, where similar ore shoots are found below the palaeosurface, suggesting substantial potential for high-grade discoveries at Cerro Bayo.

A major west-northwest trending dextral structure is interpreted as a transtensional fault defining a favourable structural zone 6km wide, traversing the entire Cerro Bayo property.

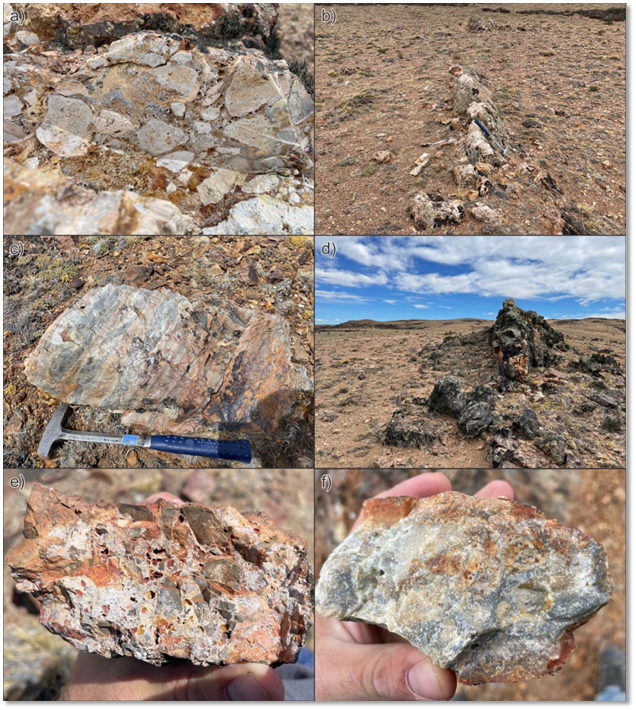

Gold and silver grades are related to As, Sb, Hg, and Mo pathfinder elements (Figure 1), indicating a shallow epithermal system. Silver-gold ratios vary from 10:1 to 200:1. Higher grade gold concentrates about 100m to 150m below palaeosurface. Although outcrop is sparse, various veins have been mapped and samples (Figure 2).

Drill Permit and Partnership Strategy

Latin Metals has been working towards a drill permit at Cerro Bayo and expects to conclude that process in Q4 2024. The Company is actively seeking an option partner to complete comprehensive exploration activities, including trenching, gradient array induced polarization (IP), CSAMT, and initial drill testing in 2025.

Cautionary Statement Regarding Adjacent Property

Readers are cautioned that the Cerro Negro mine discussed above is adjacent properties and that the Company has no interest in or right to acquire any interest in the deposit, and that mineral deposits on adjacent or similar properties, and any production therefore or economics with respect thereto, are not in any way indicative of mineral deposits on Latin Metals’ properties or the potential production from, or cost or economics of, any future mining of any of Latin Metals’ mineral properties.

Figure 1: Summary of key exploration completed by Barrick showing detailed alteration mapping, magnetic data, drill taregt areas, scematic cross sections and interpretation of transtensional basin and estimated depth to target mineralization.

Figure 2: a) channel sample of hydrothermal breccia on Sasha vein where rock ship samples return 1.2 g/t gold and 285 g/t silver. b) Ingrid northwest striking quart vein outcrop grading 2.1 g/t gold and 460 g/t silver. c) Euginia opaline silica replacement. d) northwest trending quartz vein. e) Gabriela crystalline quartz breccia with silicifies volcanosedimentary clasts grading 1.68 g/t gold and 27.4 g/t silver. f) Julia quartz vein with fine saccharoidal texture grading 0.7 g/t gold.

Value Proposition in Santa Cruz Province

Santa Cruz Province, known as Argentina’s premier mining region, represents a key area for gold and silver production, contributing approximately

The province’s precious metals production in 2023 reached notable levels, with over 680,000 ounces of gold and 15.2 million ounces of silver extracted, emphasizing its geological wealth. Since 1990, nearly 600 million ounces of silver and 20 million ounces of gold have been discovered within the region, reflecting a rich exploration history with demonstrable discovery record.

Santa Cruz’s mining sector supports approximately 9,000 jobs, accounting for

About Latin Metals

Latin Metals is a mineral exploration company acquiring a diversified portfolio of assets in South America. The Company operates with a Prospect Generator model focusing on the acquisition of prospective exploration properties at minimum cost, completing initial evaluation through cost-effective exploration to establish drill targets, and ultimately securing joint venture partners to fund drilling and advanced exploration. Shareholders gain exposure to the upside of a significant discovery without the dilution associated with funding the highest-risk drill-based exploration.

Stay up-to-date on Latin Metals developments by joining our online communities on X, Facebook, LinkedIn and Instagram.

Qualified Person

Keith J. Henderson, P.Geo., is the Company's qualified person as defined by NI 43-101 and has reviewed the scientific and technical information that forms the basis for portions of this news release. He has approved the disclosure herein. Mr. Henderson is not independent of the Company, as he is an employee of the Company and holds securities of the Company.

On Behalf of the Board of Directors of

LATIN METALS INC.

“Keith Henderson”

President & CEO

For further details on the Company readers are referred to the Company's web site (www.latin-metals.com) and its Canadian regulatory filings on SEDAR at www.sedar.com.

For further information, please contact:

Keith Henderson

Suite 890 - 999 West Hastings Street,

Vancouver, BC, V6C 2W2

Phone: 604-638-3456

E-mail: info@latin-metals.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and U.S. securities legislation, including the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, included herein including, without limitation, the anticipated content, commencement, timing and cost of exploration programs in respect of the Property and otherwise, anticipated exploration program results from exploration activities, and the Company's expectation that it will be able to enter into agreements to acquire interests in additional mineral properties, the discovery and delineation of mineral deposits/resources/reserves on the Properties, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Often, but not always, forward looking information can be identified by words such as "pro forma", "plans", "expects", "may", "should", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes", "potential" or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, market fundamentals will result in sustained precious and base metals demand and prices, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future development of the Company’s Argentine projects in a timely manner, the availability of financing on suitable terms for the development, construction and continued operation of the Company projects, and the Company’s ability to comply with environmental, health and safety laws.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking information. Such risks and other factors include, among others, operating and technical difficulties in connection with mineral exploration and development and mine development activities at the Properties, including the geological mapping, prospecting and sampling programs being proposed for the Properties (the "Programs"), actual results of exploration activities, including the Programs, estimation or realization of mineral reserves and mineral resources, the timing and amount of estimated future production, costs of production, capital expenditures, the costs and timing of the development of new deposits, the availability of a sufficient supply of water and other materials, requirements for additional capital, future prices of precious metals and copper, changes in general economic conditions, changes in the financial markets and in the demand and market price for commodities, possible variations in ore grade or recovery rates, possible failures of plants, equipment or processes to operate as anticipated, accidents, labour disputes and other risks of the mining industry, delays or the inability of the Company to obtain any necessary permits, consents or authorizations required, any current or future property acquisitions, financing or other planned activities, changes in laws, regulations and policies affecting mining operations, hedging practices, currency fluctuations, title disputes or claims limitations on insurance coverage and the timing and possible outcome of pending litigation, environmental issues and liabilities, risks related to joint venture operations, and risks related to the integration of acquisitions, as well as those factors discussed under the heading as well as those factors discussed under the heading “Risk Factors” in the Company’s annual management’s discussion and analysis and other filings of the Company with the Canadian Securities Authorities, copies of which can be found under the Company’s profile on the SEDAR+ website at www.sedarplus.ca.

Readers are cautioned not to place undue reliance on forward looking statements. Except as otherwise required by law, the Company undertakes no obligation to update any of the forward-looking information in this news release or incorporated by reference herein.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/f56a3f78-687b-48aa-b61f-e799da0815ff

https://www.globenewswire.com/NewsRoom/AttachmentNg/ce7af91a-53d3-4937-ac63-78750c059f27