Latin Metals Expands Auquis Project Land Position

Rhea-AI Summary

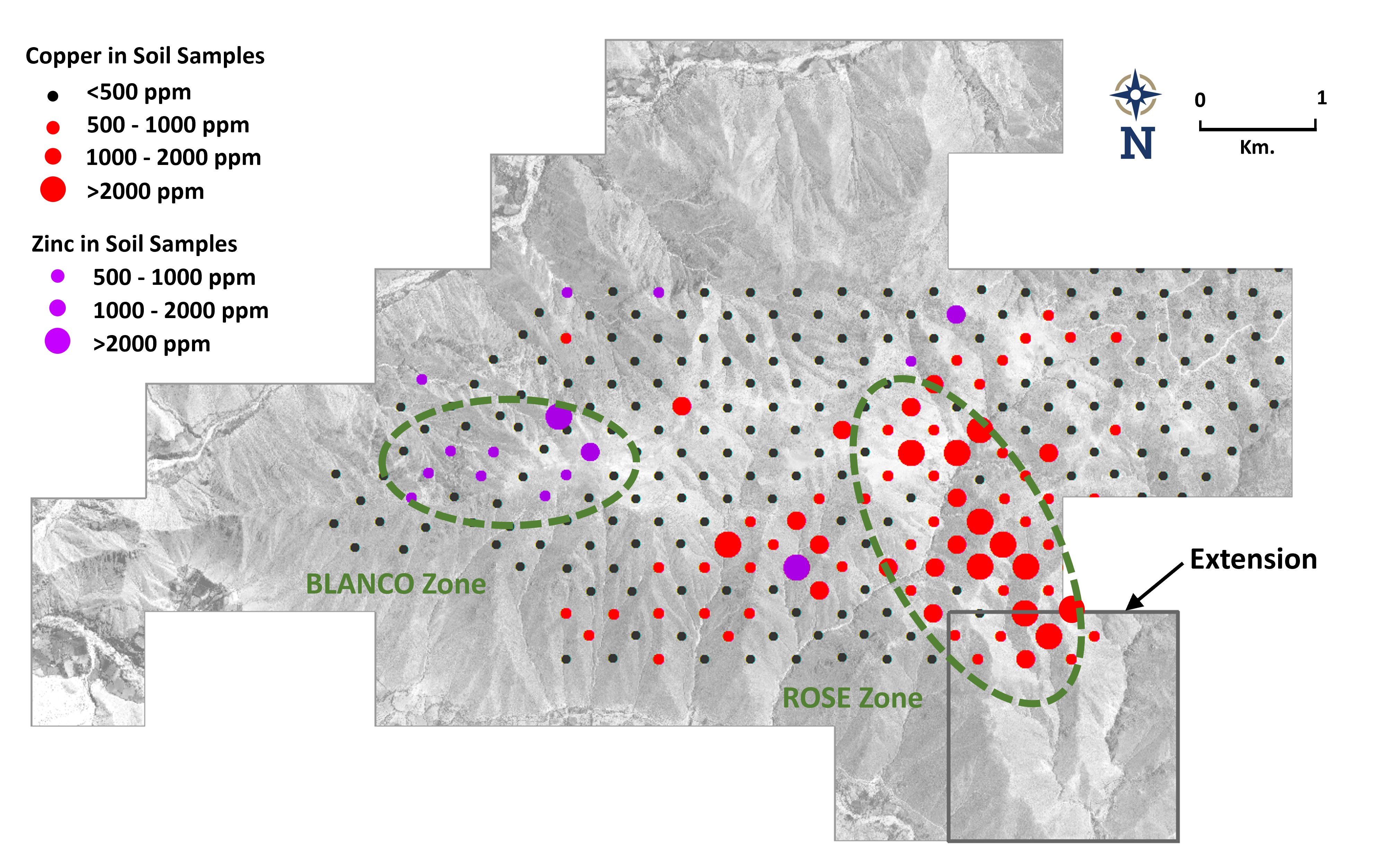

Latin Metals Inc. (TSXV: LMS) (OTCQB: LMSQF) has expanded its Auquis Project by staking an additional 400-hectare claim. The extension is located south of the Rose copper porphyry target area, potentially hosting an extension of the Rose porphyry system. The company plans future exploration at Auquis, including additional sampling at the Rose zone and the Blanco skarn target.

Latin Metals also announced two unsecured, non-interest-bearing loans from a trust controlled by a director: a USD 100,000 loan in July 2024 and another USD 100,000 loan in April 2024 (repaid in May 2024). The company intends to use the July 2024 loan proceeds for resource properties option payments and short-term corporate needs.

Positive

- Expansion of Auquis Project by 400 hectares, potentially extending the Rose porphyry system

- Planned future exploration at Auquis, including additional sampling at Rose zone and Blanco skarn target

- Secured USD 100,000 loan to fund resource properties option payments and short-term corporate needs

Negative

- Reliance on related party loans for short-term financing needs

News Market Reaction

On the day this news was published, LMSQF gained 8.97%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

VANCOUVER, British Columbia, Aug. 30, 2024 (GLOBE NEWSWIRE) -- Latin Metals Inc. (“Latin Metals” or the “Company”) - (TSXV: LMS) (OTCQB: LMSQF) announces the acquisition by staking of an additional 400-hectare claim (the “Extension”), contiguous with its

Future exploration at Auquis is planned to include additional sampling at the Rose zone as well as additional work at the Blanco skarn target where skarn mineralization includes anomalous rock samples up

Figure 1: Location of the Auquis Project Extension relative to the existing Project and the Rose Zone

The Company also announces that it has entered into a loan agreement with a trust controlled by a director of the Company (the “Lender”) pursuant to which the Lender has agreed to provide an unsecured and non-interest-bearing loan to the Company in the aggregate principal amount of up to USD 100,000 (the “July 2024 Loan”) repayable by the Company on demand. The Company intends to use the proceeds of the July 2024 Loan to fund its resource properties option payment requirements and to meet its short-term corporate and working capital needs. The Company also announces that on April 28, 2024, it received an unsecured and non-interest-bearing loan (the “April 2024 Loan”; together with the July 2024 Loan, the “Loans”) in the principal amount of USD 100,000 from the Lender. The April 2024 Loan was repaid in May 2024. Neither of the Loans are convertible into or repayable in securities of the Company, and no bonus is payable to the Lender in connection with the Loans.

As the Lender is a trust controlled by a director of the Company, each of the Loans constitute a related party transaction pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The Company is relying on Sections 5.5(a) and 5.7(1)(a) of MI 61-101 for exemptions from the formal valuation and minority shareholder approval requirements, respectively, of MI 61-101, as, at the time the loan agreements for the respective Loans were entered into by the Company with the Lender, neither the fair market value of the subject matter of, nor the fair market value of either of the Loans exceeded

About Latin Metals

Latin Metals is a mineral exploration company acquiring a diversified portfolio of assets in South America. The Company operates with a Prospect Generator model focusing on the acquisition of prospective exploration properties at minimum cost, completing initial evaluation through cost-effective exploration to establish drill targets, and ultimately securing joint venture partners to fund drilling and advanced exploration. Shareholders gain exposure to the upside of a significant discovery without the dilution associated with funding the highest-risk drill-based exploration. For more information, please get in touch with Latin Metals Investor Relations at 604-638-3456 or via email at info@latin-metals.com.

Stay up to date on Latin Metals developments by joining our online communities through LinkedIn, Facebook, X and Instagram.

QA/QC

The work program at Auquis was designed and supervised by Eduardo Leon, the Company's Exploration Manager. He is responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel at the project rigorously collect and track samples which are then security sealed and shipped to the ALS laboratory in Lima. Samples used for the results described herein are prepared and analyzed by multi-element analysis using an inductively coupled mass spectrometer in compliance with industry standards.

Soil samples were extracted from prospecting pits measuring 40cm x 40cm, where the uppermost A horizon was removed to collect the underlying B horizon. A total of 1.5 to 2.0 kg of B Horizon material was collected at each sampling site, before the sampling pit was reclaimed. A total of 10 samples were added to the previous grid of 200m north-south and 400m east-west orientation.

Qualified Person

Keith J. Henderson, P.Geo., is the Company's qualified person as defined by NI 43-101 and has reviewed the scientific and technical information that forms the basis for portions of this news release. He has approved the disclosure herein. Mr. Henderson is not independent of the Company, as he is an employee of the Company and holds securities of the Company.

On Behalf of the Board of Directors of

LATIN METALS INC.

“Keith Henderson”

President & CEO

For further details on the Company readers are referred to the Company’s web site (www.latin-metals.com) and its Canadian regulatory filings on SEDAR+ at www.sedarplus.ca.

For further information, please contact:

Keith Henderson

Suite 890

999 West Hastings Street

Vancouver, BC, V6C 2W2

Phone: 604-638-3456

E-mail: info@latin-metals.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable Canadian and U.S. securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding the anticipated content, commencement and timing of exploration programs in respect of the Project, anticipated exploration program results from exploration activities, and the Company's expectation that it will be able to enter into agreements to acquire interests in additional mineral properties, the discovery and delineation of mineral deposits/resources/reserves on the Project, statements regarding the Loans and the use of proceeds from the July 2024 Loan, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: “believes”, “expects”, “anticipates”, “intends”, “estimates”, “plans”, “may”, “should”, “would”, “will”, “potential”, “scheduled” or variations of such words and phrases and similar expressions, which, by their nature, refer to future events or results that may, could, would, might or will occur or be taken or achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking information. Such risks and other factors include, among others, requirements for additional capital, actual results of exploration activities, including on the Company’s projects, the estimation or realization of mineral reserves and mineral resources, future prices of copper, changes in general economic conditions, changes in the financial markets and in the demand and market price for commodities, lack of investor interest in future financings, accidents, labour disputes and other risks of the mining industry, delays in obtaining governmental approvals (including TSX Venture Exchange acceptance), permits or financing or in the completion of development or construction activities, risks relating to epidemics or pandemics, including the impact of epidemics or pandemics on the Company’s business, financial condition and results of operations, changes in laws, regulations and policies affecting mining operations, title disputes, the timing and possible outcome of any pending litigation, environmental issues and liabilities, as well as the risk factors described in the Company’s annual and quarterly management’s discussion and analysis and in other filings made by the Company with Canadian securities regulatory authorities under the Company’s profile at www.sedarplus.ca.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company does not undertake any obligation to update any of the forward-looking statements in this news release or incorporated by reference herein, except as otherwise required by law.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/5b66425b-80e8-4f1a-bbc2-021068c3f228