Snow Lake to Secure Stake in Game-Changing Uranium Enrichment Technology, Unlocking Access to $6 Billion Market

Snow Lake Resources (NASDAQ: LITM) announces a strategic investment to acquire a 19.99% stake in Global Uranium and Enrichment (ASX: GUE), which holds a 21.9% cornerstone position in Ubaryon Pty Ubaryon is developing next-generation uranium enrichment technology based on chemical separation of naturally occurring uranium isotopes.

The investment provides Snow Lake access to a potential $6 billion market in uranium enrichment. Currently, four non-U.S. companies control 62.7% of global commercial uranium enrichment capacity, with the U.S. having only one commercially operating plant with capacity. Nearly 67% of U.S. enriched uranium needs come from foreign suppliers.

Ubaryon's classified technology, which has received government approval for review by security-cleared experts, promises improved economics and environmental benefits compared to current centrifuge or laser-based methods. The company's operations are hosted at the Australian Nuclear Science and Technology Organization (ANSTO).

Snow Lake Resources (NASDAQ: LITM) annuncia un investimento strategico per acquisire una partecipazione del 19,99% in Global Uranium and Enrichment (ASX: GUE), che detiene una posizione fondamentale del 21,9% in Ubaryon Pty. Ubaryon sta sviluppando una tecnologia di arricchimento dell'uranio di nuova generazione basata sulla separazione chimica degli isotopi di uranio naturalmente presenti.

L'investimento offre a Snow Lake l'accesso a un potenziale mercato da 6 miliardi di dollari nell'arricchimento dell'uranio. Attualmente, quattro aziende non statunitensi controllano il 62,7% della capacità globale di arricchimento dell'uranio commerciale, mentre gli Stati Uniti hanno solo un impianto operativo commercialmente con capacità. Quasi il 67% delle esigenze di uranio arricchito degli Stati Uniti proviene da fornitori esteri.

La tecnologia classificata di Ubaryon, che ha ricevuto l'approvazione del governo per essere esaminata da esperti con autorizzazione di sicurezza, promette miglioramenti economici e benefici ambientali rispetto ai metodi attuali basati su centrifughe o laser. Le operazioni dell'azienda sono ospitate presso l'Australian Nuclear Science and Technology Organization (ANSTO).

Snow Lake Resources (NASDAQ: LITM) anuncia una inversión estratégica para adquirir una participación del 19.99% en Global Uranium and Enrichment (ASX: GUE), que posee una posición clave del 21.9% en Ubaryon Pty. Ubaryon está desarrollando una tecnología de enriquecimiento de uranio de nueva generación basada en la separación química de isótopos de uranio que ocurren naturalmente.

La inversión proporciona a Snow Lake acceso a un potencial mercado de 6 mil millones de dólares en enriquecimiento de uranio. Actualmente, cuatro empresas no estadounidenses controlan el 62.7% de la capacidad global de enriquecimiento comercial de uranio, mientras que EE. UU. solo tiene una planta en funcionamiento comercialmente con capacidad. Casi el 67% de las necesidades de uranio enriquecido de EE. UU. provienen de proveedores extranjeros.

La tecnología clasificada de Ubaryon, que ha recibido la aprobación del gobierno para ser revisada por expertos con autorización de seguridad, promete mejoras económicas y beneficios ambientales en comparación con los métodos actuales basados en centrifugadoras o láser. Las operaciones de la empresa se llevan a cabo en la Australian Nuclear Science and Technology Organization (ANSTO).

Snow Lake Resources (NASDAQ: LITM)는 Global Uranium and Enrichment (ASX: GUE)의 19.99% 지분을 인수하기 위한 전략적 투자를 발표했습니다. GUE는 Ubaryon Pty의 21.9%의 핵심 지분을 보유하고 있으며, Ubaryon은 자연 발생 우라늄 동위원소의 화학적 분리에 기반한 차세대 우라늄 농축 기술을 개발하고 있습니다.

이 투자는 Snow Lake에 우라늄 농축 분야에서 60억 달러 규모의 시장에 접근할 수 있는 기회를 제공합니다. 현재, 네 개의 비미국 기업이 전 세계 상업적 우라늄 농축 용량의 62.7%를 통제하고 있으며, 미국은 상업적으로 운영되는 하나의 공장만을 보유하고 있습니다. 미국의 농축 우라늄 수요의 거의 67%는 외국 공급업체에서 옵니다.

Ubaryon의 기밀 기술은 보안 승인을 받은 전문가들에 의해 검토될 수 있도록 정부 승인을 받았으며, 현재의 원심분리기나 레이저 기반 방법에 비해 경제성과 환경적 이점을 개선할 것을 약속합니다. 회사의 운영은 호주 원자력 과학 및 기술 기구(ANSTO)에서 이루어집니다.

Snow Lake Resources (NASDAQ: LITM) annonce un investissement stratégique pour acquérir une participation de 19,99 % dans Global Uranium and Enrichment (ASX: GUE), qui détient une position clé de 21,9 % dans Ubaryon Pty. Ubaryon développe une technologie d'enrichissement de l'uranium de nouvelle génération basée sur la séparation chimique des isotopes d'uranium naturellement présents.

L'investissement permet à Snow Lake d'accéder à un potentiel marché de 6 milliards de dollars dans l'enrichissement de l'uranium. Actuellement, quatre entreprises non américaines contrôlent 62,7 % de la capacité mondiale d'enrichissement commercial de l'uranium, tandis que les États-Unis n'ont qu'une seule usine opérationnelle commercialement avec capacité. Près de 67 % des besoins en uranium enrichi des États-Unis proviennent de fournisseurs étrangers.

La technologie classifiée d'Ubaryon, qui a reçu l'approbation du gouvernement pour être examinée par des experts ayant une autorisation de sécurité, promet des avantages économiques et environnementaux améliorés par rapport aux méthodes actuelles basées sur des centrifugeuses ou des lasers. Les opérations de l'entreprise se déroulent au sein de l'Australian Nuclear Science and Technology Organization (ANSTO).

Snow Lake Resources (NASDAQ: LITM) gibt eine strategische Investition bekannt, um eine Beteiligung von 19,99% an Global Uranium and Enrichment (ASX: GUE) zu erwerben, das eine Schlüsselposition von 21,9% in Ubaryon Pty hält. Ubaryon entwickelt eine Technologie zur Urananreicherung der nächsten Generation, die auf der chemischen Trennung von natürlich vorkommenden Uranisotopen basiert.

Die Investition verschafft Snow Lake Zugang zu einem potenziellen 6-Milliarden-Dollar-Markt für Urananreicherung. Derzeit kontrollieren vier nicht-US-amerikanische Unternehmen 62,7% der globalen kommerziellen Urananreicherungskapazität, während die USA nur eine kommerziell betriebene Anlage mit Kapazität haben. Fast 67% des Bedarfs an angereichertem Uran in den USA stammen von ausländischen Lieferanten.

Die klassifizierte Technologie von Ubaryon, die die Genehmigung der Regierung zur Überprüfung durch sicherheitsüberprüfte Experten erhalten hat, verspricht verbesserte wirtschaftliche Bedingungen und Umweltvorteile im Vergleich zu den derzeitigen Zentrifugen- oder laserbasierten Methoden. Die Betriebsabläufe des Unternehmens finden in der Australian Nuclear Science and Technology Organization (ANSTO) statt.

- Strategic entry into $6 billion uranium enrichment market

- Access to next-generation enrichment technology with potential cost and environmental advantages

- Alignment with U.S. national security and energy independence objectives

- Early-mover advantage in addressing U.S. uranium enrichment capacity shortage

- Technology is still in development phase with no proven commercial success

- High regulatory barriers in nuclear industry could delay commercialization

- Minority stake position (19.99%) limits direct control over technology development

- Classified nature of technology may complicate development and partnerships

Insights

Snow Lake's strategic acquisition of a 19.99% stake in Global Uranium and Enrichment (GUE) represents a calculated move to penetrate the uranium enrichment sector—a critical bottleneck in the nuclear fuel supply chain. Through this investment, Snow Lake gains indirect exposure to Ubaryon's potentially disruptive chemical separation technology for uranium enrichment, positioning itself in a market projected to exceed

The timing aligns perfectly with growing U.S. national security concerns regarding uranium supply vulnerabilities. Currently, four non-U.S. companies control

What makes this investment particularly significant is the increasing demand for High-Assay Low-Enriched Uranium (HALEU) required by next-generation Small Modular Reactors. If successfully commercialized, Ubaryon's chemical-based enrichment technology could offer compelling advantages over current centrifuge methods (second generation) and even newer laser enrichment approaches (third generation).

While the technology remains in development and requires substantial validation, this strategic positioning gives Snow Lake early mover advantage in a highly regulated sector with significant barriers to entry. The uranium enrichment segment represents one of the most concentrated and strategically important links in the nuclear fuel supply chain—any technological advancement could yield substantial returns and reshape market dynamics.

This investment by Snow Lake Resources presents a high-risk, high-reward opportunity for a micro-cap company with a market capitalization of just

The uranium enrichment market represents a critical chokepoint in the nuclear fuel cycle, characterized by extreme concentration, regulatory complexity, and high barriers to entry. Snow Lake's indirect stake in Ubaryon through GUE provides asymmetric upside potential—if Ubaryon's technology proves viable and attracts strategic partners, Snow Lake's 19.99% stake in GUE could appreciate significantly, potentially outweighing the company's current market value.

However, several risk factors warrant careful consideration. The technology remains pre-commercial and unproven at scale. Additionally, the uranium enrichment sector is highly regulated with national security implications that could complicate commercialization paths. The timeline to revenue generation, should the technology prove successful, likely extends several years.

What makes this investment strategically intelligent is the potential technology differentiation. While laser enrichment (third-generation) technologies have struggled with commercialization for decades, Ubaryon's approach using chemical separation could potentially offer a more viable path to market. This positions Snow Lake within an undervalued segment of the nuclear supply chain at a time when uranium prices have surged and nuclear energy is experiencing renewed policy support.

Winnipeg, Manitoba--(Newsfile Corp. - March 25, 2025) - Snow Lake Resources Ltd., d/b/a Snow Lake Energy (NASDAQ: LITM) ("Snow Lake"), a uranium exploration and development company, announces that Snow Lake's cornerstone investment in Global Uranium and Enrichment Limited (ASX: GUE) ("GUE"), and GUE's investment in Ubaryon Pty Ltd. ("Ubaryon"), will provide Snow Lake with early exposure to next generation uranium enrichment technology in a market projected to exceed US

Through its

Highlights

- U.S. National & Energy Security Objectives:

- The U.S. has only one commercially operating uranium enrichment plant, with limited capacity, resulting in reliance on foreign suppliers

- Next generation advanced nuclear reactors will require fuel enriched to even higher concentrations, increasing demand for uranium enrichment capacity

- Ubaryon Next-Generation Enrichment Technology: GUE, in which Snow Lake will hold a

19.99% interest, holds a cornerstone position in Ubaryon Pty Ltd, a private Australian company, developing an innovative uranium enrichment technology:[1]

100% ownership of an enrichment technology based on the chemical separation of naturally occurring uranium isotopes

- Currently running a structured process to find a potential strategic partner towards securing funding for ongoing development of its business

- Key motivation to secure a strategic partner is to enable future commercialization of the technology in one of the most highly regulated industries in the world

- Government approval received for appropriate security approved independent experts to review the details of the technology

CEO Remarks

"The Trump Administration is focusing on U.S. energy security, and in particular the vulnerabilities of the uranium supply chain," said Frank Wheatley, CEO of Snow Lake. "Given the United States is largely dependent on foreign countries for its supply of enriched uranium, the new administration is focusing its efforts on initiatives designed to expand domestic uranium enrichment capabilities and capacity. GUE's cornerstone investment in Ubaryon holds the potential to begin to address the lack of uranium enrichment capacity in the United States, and in particular, the production of high-assay low-enriched uranium required for the next generation of advanced nuclear reactors."

"We see this investment as more than financial - it's strategic. We believe Ubaryon has the potential to be a transformational technology in the global uranium enrichment space, and we're excited to position Snow Lake at the forefront of the coming nuclear energy renaissance."

He added: "We're not just investing in enrichment technology - we're investing in the future of clean energy security. This positions Snow Lake as an early mover in one of the most strategic and underdeveloped sectors of the nuclear supply chain."

Uranium Supply Chain[2]

The uranium-to-nuclear fuel supply chain is lengthy, complex and full of vulnerabilities from mine to nuclear reactor.

Enrichment: Yellow cake is the feedstock for the uranium enrichment part of the uranium supply chain. Four companies dominate this stage in the nuclear fuel cycle: Rosatom in Russia, CNNC in China, Orano in France and the Urenco Group (British – German-Dutch). Collectively, they control

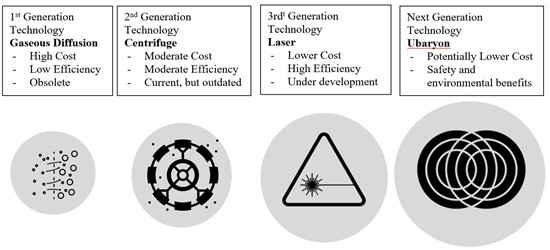

Enrichment Technology: First generation enrichment technology, now obsolete, was gaseous diffusion. Second generation technology, currently used in the majority of global enrichment plants is a centrifuge. Laser enrichment technology, which is currently under development by a number of companies, holds the promise of higher efficiency and lower cost, and is considered third generation technology.

Next-generation technology, currently being developed by Ubaryon, offers potentially lower cost and environmental and safety benefits. A schematic of the four generations of uranium enrichment technology is set out in Figure 1.

United States - Uranium Enrichment

Four non-U.S. companies control

Snow Lake's investment strategy directly aligns with U.S. national security and energy independence objectives.

Figure 1 – Generations of Uranium Enrichment Technology⁴

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9547/245979_slimage.jpg

Ubaryon Pty Ltd - Next-Generation Uranium Enrichment Technology

GUE's holds a cornerstone investment (

Snow Lake believes that as Ubaryon advances the development and commercializing of its enrichment technology, it holds the potential to begin to address the lack of uranium enrichment capacity in the U.S.

About Global Uranium and Enrichment Limited

Global Uranium and Enrichment Limited (GUE) is an Australian public listed company providing unique exposure to not only uranium exploration and development, but to the uranium enrichment space. Amid a nuclear energy renaissance, GUE is developing a portfolio of advanced, high grade uranium assets in prolific uranium districts in the United States and Canada, and has established a cornerstone position in Ubaryon Pty Ltd, an Australian uranium enrichment technology company.

For more information on GUE, please refer to their website[6].

Snow Lake Resources Ltd.

Snow Lake Resources Ltd., d/b/a Snow Lake Energy, is a Canadian mineral exploration company listed on (NASDAQ: LITM), with a global portfolio of clean energy mineral projects comprised of three uranium projects and two hard rock lithium projects. The Engo Valley Uranium Project is an exploration stage project located in the Skeleton Coast of Namibia, the Black Lake Uranium Project is an exploration stage project located in the Athabasca Basin, Saskatchewan, and the Buffalo Uranium Project is an exploration stage project in Wyoming, United States. The Shatford Lake Project is an exploration stage project located adjacent to the Tanco lithium, cesium and tantalum mine in Southern Manitoba, and the Snow Lake Lithium™ Project is an exploration stage project located in the Snow Lake region of Northern Manitoba. Learn more at www.snowlakeenergy.com.

Forward-Looking Statements: This press release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the "safe harbor" provisions under the Private Securities Litigation Reform Act of 1995 that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements, including without limitation statements with regard to Snow Lake Resources Ltd. We base these forward-looking statements on our expectations and projections about future events, which we derive from the information currently available to us. Forward-looking statements contained in this press release may be identified by the use of words such as "anticipate," "believe," "contemplate," "could," "estimate," "expect," "intend," "seek," "may," "might," "plan," "potential," "predict," "project," "target," "aim," "should," "will," "would," or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements are based on Snow Lake Resources Ltd.'s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. Some of these risks and uncertainties are described more fully in the section titled "Risk Factors" in our registration statements and annual reports filed with the Securities and Exchange Commission. Forward-looking statements contained in this announcement are made as of this date, and Snow Lake Resources Ltd. undertakes no duty to update such information except as required under applicable law.

Contact and Information

Frank Wheatley, CEO

Investor Relations

Investors:

ir@snowlakelithium.com

Website:

www.snowlakeenergy.com

Follow us on Social Media

Twitter:

www.twitter.com/SnowLakeEnergy

[1] https://wcsecure.weblink.com.au/pdf/GUE/02912046.pdf

[2] Centre for Strategic & International Studies - February 5, 2025

[3] Centre for Strategic & International Studies - February 5, 2025.

[4] https://globaluranium.com.au

[5] https://www.ubaryon.com

[6] https://globaluranium.com.au

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/245979