LIFT quadruples the size of the Cali Property through staking

Rhea-AI Summary

Li-FT Power (TSXV: LIFT, OTCQX: LIFFF) announced a significant expansion of its Cali Project by staking an additional 9,681 hectares in the Little Nahanni Pegmatite District, Northwest Territories, Canada. The new claims host outcropping spodumene pegmatites, continuing the Cali dyke swarm. This expansion follows the Government of Canada’s approval of amendments to the Sahtú Land Use Plan. CEO Francis MacDonald emphasized the cost-effectiveness of staking for increasing land position and potential project size. Additionally, LIFT terminated a previous agreement with Infinity Stone Ventures Corp. for the Shorty West Lithium Claim and entered a new agreement to acquire it in exchange for 12,000 common shares, pending TSX Venture Exchange approval. Lastly, LIFT granted 7,544 Deferred Share Units (DSUs) to independent directors, valued at $2.65 per DSU, as part of its Share Incentive Plan.

Positive

- Acquired an additional 9,681 hectares at the Cali Project, increasing land position and potential project size.

- Newly staked claims contain outcropping spodumene pegmatites, continuing the known Cali dyke swarm.

- CEO emphasized staking as the most cost-effective method for land acquisition.

- Entered a new agreement to acquire the Shorty West Lithium Claim, pending TSX approval.

Negative

- Termination of previous Shorty West Lithium Claim agreement with Infinity Stone Ventures Corp.

News Market Reaction – LIFFF

On the day this news was published, LIFFF gained 10.65%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

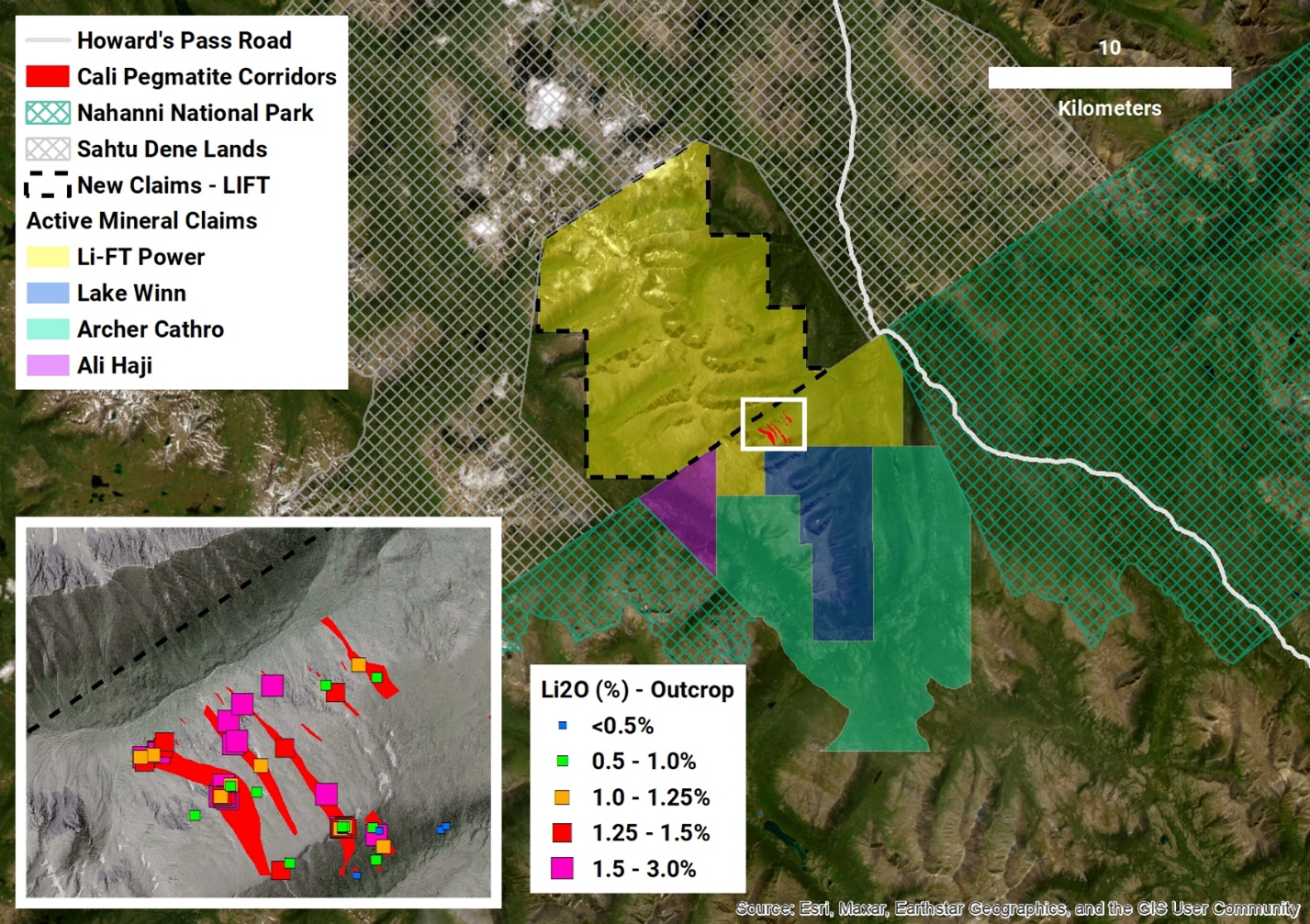

VANCOUVER, British Columbia, Sept. 03, 2024 (GLOBE NEWSWIRE) -- Li-FT Power Ltd. (“LIFT” or the “Company”) (TSXV: LIFT) (OTCQX: LIFFF) (Frankfurt: WS0) is pleased to report that the Company has increased its land position at the Cali Project by staking an additional 9,681 hectares of contiguous claims within the Little Nahanni Pegmatite District, Northwest Territories, Canada. The recently staked claims have outcropping spodumene pegmatites which are the continuation of Cali dyke swarm that LIFT has defined to date.

Lands to the northwest of LIFT’s current tenure became available following the Government of Canada’s approval of an amendment to the Sahtú Land Use Plan (the Nááts'ı̨hch’oh Amendments) in June of 2024. The amendment package allows new staking to be completed in the area and was previously approved by the Sahtú Secretariat Incorporated and Government of the Northwest Territories in 2019.

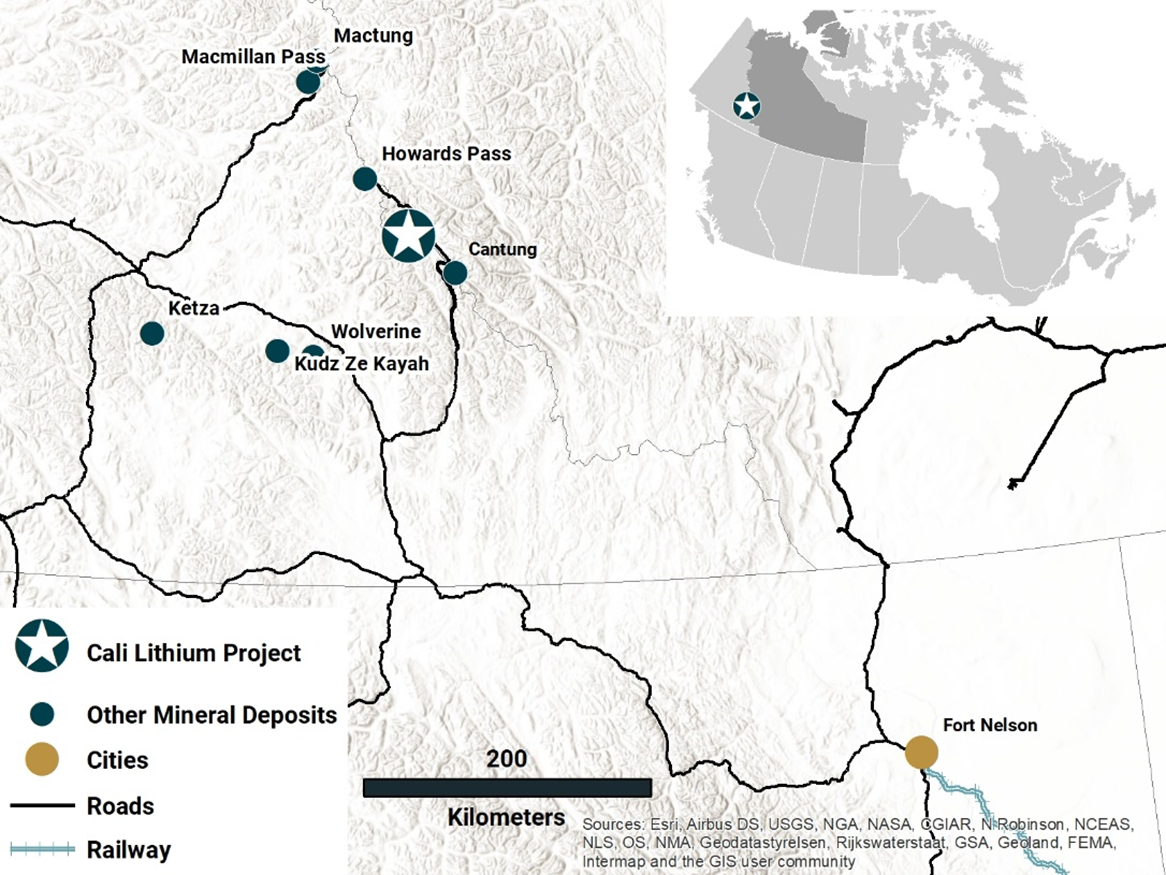

Figure 1 – Location of LIFT’s Cali Lithium Project (CLP). The CLP is located in the Mackenzie Mountains along the Northwest Territories-Yukon border. The area is accessible by road and is located ~850 kilometers from rail in Fort Nelson, British Columbia.

Figure 2 – Location of the newly staked claims to the northwest of LIFT’s existing outcropping lithium pegmatites on the Cali Project.

Francis MacDonald, CEO of LIFT comments, “Acquiring new areas through staking is the most cost-effective way to increase a company’s land position. The newly staked ground has outcropping spodumene deposits that are continuations of our existing deposits and increases the overall size potential of the Cali Project”.

LIFT Provides Update on Acquisition of Shorty West Lithium Claim

LIFT announces that at the request of Infinity Stone Ventures Corp., it has terminated the mineral property purchase agreement dated July 17, 2024 regarding the Shorty West Lithium mineral claim (the “Claim”). In connection with the termination, beneficial ownership of the Claim, which is adjacent to the Company’s Yellowknife Lithium Project, was transferred to an arm’s length private entity. The Company has now entered into a mineral property purchase agreement dated August [16] 2024 with that entity to acquire the Claim in consideration of the issuance 12,000 common shares, which is the same consideration which was offered to Infinity Stone. The shares, once issued, will be subject to applicable resale restrictions under Canadian securities laws. The completion of the acquisition is subject to the approval of the TSX Venture Exchange. No finder’s fees are payable in connection with the acquisition.

LIFT Announces Issuance of DSUs

The Company announces that it has granted 7,544 deferred share units (“DSUs”) to certain independent directors of the Company in lieu of interim director fees previously paid in cash, at a fair market value of

Qualified Person

The disclosure in this news release of scientific and technical information regarding LIFT’s mineral properties has been reviewed and approved by Ron Voordouw, Ph.D., P.Geo., Partner, Director Geoscience, Equity Exploration Consultants Ltd., and a Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101) and member in good standing with the Northwest Territories and Nunavut Association of Professional Engineers and Geoscientists (NAPEG) (Geologist Registration number: L5245).

About LIFT

LIFT is a mineral exploration company engaged in the acquisition, exploration, and development of lithium pegmatite projects located in Canada. The Company’s flagship project is the Yellowknife Lithium Project located in Northwest Territories, Canada. LIFT also holds three early-stage exploration properties in Quebec, Canada with excellent potential for the discovery of buried lithium pegmatites, as well as the Cali Project in Northwest Territories within the Little Nahanni Pegmatite Group.

For further information, please contact:

| Francis MacDonald Chief Executive Officer Tel: + 1.604.609.6185 Email: info@li-ft.com Website: www.li-ft.com | Daniel Gordon Investor Relations Tel: +1.604.609.6185 Email: investors@li-ft.com |

Cautionary Statement Regarding Forward-Looking Information

Certain statements included in this press release constitute forward-looking information or statements (collectively, “forward-looking statements”), including those identified by the expressions “anticipate”, “believe”, “plan”, “estimate”, “expect”, “intend”, “may”, “should” and similar expressions to the extent they relate to the Company or its management. The forward-looking statements are not historical facts but reflect current expectations regarding future results or events. This press release contains forward looking statements. These forward-looking statements and information reflect management's current beliefs and are based on assumptions made by and information currently available to the company with respect to the matter described in this new release.

Forward-looking statements involve risks and uncertainties, which are based on current expectations as of the date of this release and subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Additional information about these assumptions and risks and uncertainties is contained under "Risk Factors and Uncertainties" in the Company's latest annual information form filed on March 27, 2024, which is available under the Company's SEDAR+ profile at www.sedarplus.ca, and in other filings that the Company has made and may make with applicable securities authorities in the future. Forward-looking statements contained herein are made only as to the date of this press release and we undertake no obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law. We caution investors not to place considerable reliance on the forward-looking statements contained in this press release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/3bede764-9946-44b6-809e-8080267d00b8

https://www.globenewswire.com/NewsRoom/AttachmentNg/8ea181b6-2589-4940-abac-912beb3e3df5