CesiumAstro Secures $65M in Oversubscribed Funding Round

CesiumAstro, a leading space communications technology company, announced the closing of a $65 million Series B+ funding round. The round was led by Trousdale Ventures, with participation from the Development Bank of Japan and Quanta Computer, Inc. Other investors included Kleiner Perkins, Lavrock Ventures, L3Harris Technologies (NYSE: LHX), InMotion Ventures, Matter Venture Partners, MESH Ventures, and Assembly Ventures.

The funds will be used to accelerate research and development, expand manufacturing capabilities, support global expansion, and enhance talent acquisition. CesiumAstro aims to leverage this funding to solidify its position within the space and defense industries and to advance its innovative space communications technologies, such as the Vireo multi-beam Ka-band active phased array payload and Skylark SATCOM terminal.

Since its founding in 2017, CesiumAstro has raised $156 million in equity capital. The company’s team of over 200 professionals and its in-house capabilities in rapid prototyping, testing, and manufacturing are pivotal to its success.

- $65 million Series B+ funding round closed, led by Trousdale Ventures.

- Participation from industry leaders including L3Harris Technologies (NYSE: LHX).

- Funding to accelerate R&D, expand manufacturing, and support global expansion.

- $156 million raised in equity capital since 2017.

- Strong team of over 200 engineers, scientists, and business professionals.

- None.

Insights

The successful closing of a $65 million Series B+ funding round is an important event for CesiumAstro, showing solid support from both existing and new investors. This capital influx will allow the company to accelerate R&D, expand manufacturing capabilities, boost global expansion and enhance talent acquisition. These investments are likely to contribute to sustainable long-term growth, as they are focused on core business areas that drive innovation and competitiveness.

From a financial perspective, the involvement of notable investors such as Kleiner Perkins and L3Harris Technologies adds credibility and indicates a strong belief in the company's future prospects. This could attract more interest from other institutional investors in the future, improving the company's financial stability and market valuation.

However, it’s important to monitor how effectively CesiumAstro utilizes this new capital and manages growth. Overexpansion and poor capital allocation can lead to operational inefficiencies and financial strain. Investors should keep an eye on quarterly financial reports for signs of prudent financial management and adherence to strategic goals.

CesiumAstro’s focus on space communications technology positions them in a niche but rapidly growing market. Their products like the Vireo multi-beam Ka-band active phased array payload and the Skylark SATCOM terminal are pivotal innovations that address increasing demands for versatile and reliable communication systems in space and defense sectors.

The investment will likely speed up the development and deployment of these technologies, keeping CesiumAstro at the forefront of the industry. This can lead to lucrative contracts with government agencies and private enterprises, who are in dire need of advanced space-borne communication solutions. Additionally, the company’s provider-agnostic approach enhances flexibility and market reach, making its offerings attractive to a broader client base.

Nevertheless, success in the tech industry hinges on constant innovation and staying ahead of competitors. CesiumAstro must continue to invest in cutting-edge research to maintain its competitive edge and meet the evolving needs of the market.

The backing from high-profile investors and partners, including Trousdale Ventures and the Development Bank of Japan, highlights a strong market confidence in CesiumAstro's potential. Moreover, CesiumAstro's plans for global expansion and the emphasis on both space and non-space industries could significantly broaden its market reach.

The space communication market is expected to grow substantially due to increasing satellite deployments and demand for advanced communication networks. CesiumAstro is well-positioned to capitalize on this trend. Their integrated approach, combining hardware capabilities and software-defined solutions, can cater to a wide range of applications, enhancing their market penetration.

However, market dynamics can shift rapidly and competition in the space technology sector is fierce. Continuous adaptation to market needs and proactive engagement with diverse stakeholders will be key to maintaining and enhancing their market position. Investors should consider the market growth rate and the company’s ability to capture market share when evaluating long-term prospects.

-

CesiumAstro closes

$65 million Japan and Quanta Computer, Inc. - Participating investors include Kleiner Perkins, Lavrock Ventures, L3Harris Technologies, InMotion Ventures (JLR’s investment arm), Matter Venture Partners, MESH Ventures, and Assembly Ventures

- Funding accelerates R&D, expands manufacturing, and supports global expansion and talent acquisition.

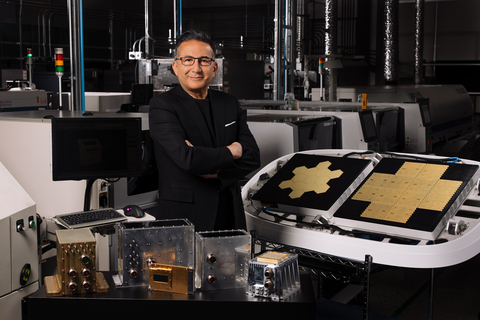

CesiumAstro's Founder and CEO, Shey Sabripour, pictured in the company's

Industry Leaders Back Groundbreaking Technology

This investment validates CesiumAstro’s innovative approach to space communications technology, as exemplified by their industry-leading Vireo multi-beam Ka-band active phased array payload and provider-agnostic Skylark SATCOM terminal, which are disrupting the space communications landscape.

“This raise fuels our commitment to expanding our software-defined communication solutions for the next era of connectivity,” said Shey Sabripour, Founder and CEO of CesiumAstro. “We extend our deepest gratitude to our investors for their support in solidifying CesiumAstro’s leadership within the space and defense industries.”

Trousdale Ventures Leads Funding Round, Voice Confidence in CesiumAstro’s Vision

“We are thrilled to lead CesiumAstro’s Series B+ round,” said Phillip Sarofim, Founding Partner and CEO of Trousdale Ventures. “Their innovative technologies are game changers. We have unwavering confidence in Shey’s leadership and CesiumAstro’s team and believe this investment will propel their mission to deliver scalable space tech for a range of applications.”

Funding Boosts Growth and Global Expansion

With

DBJ Backs CesiumAstro’s Mission to Transform Space Communications

“CesiumAstro's full-mission payloads for space and air have huge potential to enable the next generation of connectivity solutions,” noted Masao Masuda, Managing Executive Officer at Development Bank of

A Team Built for Success

CesiumAstro’s more than 200 engineers, scientists, and business professionals, combined with its in-house rapid prototyping, testing, and manufacturing capabilities, positions them for continued success. The Company boasts a robust portfolio spanning development, production, and deployment of high-reliability space communication systems.

“In a world where connectivity and national security are increasingly entwined, CesiumAstro emerges with a unique combination of team, capability, and ambition jointly built to power a new era harnessed by reliable, high-powered connectivity,” remarked CesiumAstro Board Member and Airbus Ventures Managing Partner, Thomas d’Halluin. “This latest round of investment signifies the collective force that Shey and the team have unlocked to accelerate an impressive roadmap in a moment that will be defined by the agility and strength of dual-use frontier technologies—with secure connectivity being an essentially relevant global priority.”

Legal Representation

Optimal Counsel LLP served as legal advisor to CesiumAstro.

About CesiumAstro

Headquartered in

About Trousdale Ventures

Trousdale Ventures is a privately held investment firm led by Founding Partner and CEO Phillip Sarofim. Its portfolio of groundbreaking companies improves quality of life by fueling advances in space and mobility, climate tech, and technology-driven health and wellness. Trousdale Ventures seeks to overcome barriers in the fields of health, productivity, and sustainability by democratizing wellness and accelerating innovation. For more information, visit www.trousdale.vc.

About Development Bank of

Development Bank of Japan Inc. (DBJ) is a Japanese financial institution which is owned by the Government of

About Quanta Computer, Inc.

Quanta Computer is a Fortune Global 500 Company and an industry leader in global notebook ODM and cloud computing solutions. Quanta provides innovative products with superior technology in information and communications, consumer electronics, cloud computing, smart automobile solutions, smart healthcare, and AIoT, etc. Founded in 1988 and listed on the TWSE since 1999, Quanta Computer is headquartered in

View source version on businesswire.com: https://www.businesswire.com/news/home/20240618783414/en/

Aimée Ahiers, media@cesiumastro.com

Source: CesiumAstro Inc.