Largo Announces Results of an Updated Life of Mine Plan and Pre-Feasibility Study for its Vanadium-Titanium Operation in Brazil: 67% Increase in Mineral Reserves, 64% Increase in Mineral Resources, 31-Year Mine Life with US$1.1 Billion NPV7% Estimate

Largo has announced significant updates to its vanadium-titanium operation in Brazil, including a 67% increase in Mineral Reserves and a 64% increase in Mineral Resources. The updated Life of Mine Plan extends operations to 31 years, with a post-tax NPV7% of $1.1 billion and post-tax life-of-mine cash flow of $3.8 billion. The project includes total Proven and Probable Reserves of 101.03 mt grading 0.56% V2O5, with planned production of 346.6 kt V2O5, 7,766.6 kt ilmenite concentrate, and 2,499 kt TiO2 pigment. The company plans phased expansions including a second kiln by 2027 and TiO2 pigment plant development reaching 100 ktpy by 2031.

Largo ha annunciato aggiornamenti significativi per la sua operazione di vanadio-titanio in Brasile, tra cui un aumento del 67% delle Riserve Minerarie e un aumento del 64% delle Risorse Minerarie. Il Piano di Vita della Miniera aggiornato estende le operazioni a 31 anni, con un NPV7% post-tasse di 1,1 miliardi di dollari e un flusso di cassa post-tasse per l'intera vita mineraria di 3,8 miliardi di dollari. Il progetto comprende Riserve Proved e Probabili totali di 101,03 milioni di tonnellate con una legge dello 0,56% di V2O5, con una produzione pianificata di 346,6 kt di V2O5, 7.766,6 kt di concentrato di ilmenite e 2.499 kt di pigmento TiO2. L'azienda prevede espansioni graduali, compreso un secondo forno entro il 2027 e lo sviluppo di una fabbrica di pigmenti TiO2 che raggiungerà 100 kt/anno entro il 2031.

Largo ha anunciado actualizaciones significativas en su operación de vanadio-titanio en Brasil, incluyendo un aumento del 67% en las Reservas Minerales y un aumento del 64% en los Recursos Minerales. El Plan de Vida de la Mina actualizado extiende las operaciones a 31 años, con un NPV7% post-impuestos de 1.1 mil millones de dólares y un flujo de caja total post-impuestos de 3.8 mil millones de dólares. El proyecto incluye Reservas Probadas y Probables totales de 101.03 mt con una ley del 0.56% de V2O5, con una producción prevista de 346.6 kt de V2O5, 7,766.6 kt de concentrado de ilmenita y 2,499 kt de pigmento TiO2. La empresa planea expansiones por fases, incluyendo un segundo horno para 2027 y el desarrollo de una planta de pigmento TiO2 que alcanzará 100 kt/año para 2031.

라고는 브라질의 탄탈륨-타이타늄 프로젝트에 대한 중대한 업데이트를 발표했습니다. 여기에는 광물 매장량 67% 증가와 광물 자원 64% 증가가 포함됩니다. 업데이트된 광산 수명 계획은 운영 기간을 31년으로 연장하며, 세후 NPV7%는 11억 달러, 생애비 세후 현금 흐름은 38억 달러입니다. 이 프로젝트는 0.56% V2O5 등급의 101.03 mt의 총 입증 및 추정 매장량을 포함하고 있으며, V2O5 346.6 kt, 일멘타이트 농축물 7,766.6 kt, TiO2 색소 2,499 kt 생산을 계획하고 있습니다. 회사는 2027년까지 두 번째 노를 포함한 단계적 확장을 계획하고 있으며, 2031년까지 연간 100 kt에 도달하는 TiO2 색소 공장 개발을 계획하고 있습니다.

Largo a annoncé des mises à jour significatives concernant son opération de vanadium-titane au Brésil, y compris une augmentation de 67 % des réserves minérales et une augmentation de 64 % des ressources minérales. Le plan de vie de la mine mis à jour prolonge les opérations sur 31 ans, avec une VAN7 % après impôts de 1,1 milliard de dollars et un flux de trésorerie total après impôts de 3,8 milliards de dollars. Le projet comprend des réserves prouvées et probables totalisant 101,03 millions de tonnes avec une teneur de 0,56 % V2O5, avec une production prévue de 346,6 kt de V2O5, 7 766,6 kt de concentré d'ilménite et 2 499 kt de pigment TiO2. L'entreprise prévoit des expansions par étapes, y compris un deuxième four d'ici 2027 et le développement d'une usine de pigment TiO2 atteignant 100 kt/an d'ici 2031.

Largo hat bedeutende Aktualisierungen zu seinem Vanadium-Titan Betriebs in Brasilien angekündigt, darunter eine 67%ige Erhöhung der Mineralreserven und eine 64%ige Erhöhung der Mineralressourcen. Der aktualisierte Lebenszyklusplan der Mine verlängert die Betriebsdauer auf 31 Jahre, mit einem post-tax NPV7% von 1,1 Milliarden Dollar und einem post-tax Cashflow über die Lebensdauer von 3,8 Milliarden Dollar. Das Projekt umfasst insgesamt nachgewiesene und wahrscheinliche Reserven von 101,03 mt mit einem Gehalt von 0,56% V2O5, mit geplanter Produktion von 346,6 kt V2O5, 7.766,6 kt Ilmenitkonzentrat und 2.499 kt TiO2-Pigment. Das Unternehmen plant schrittweise Erweiterungen, einschließlich eines zweiten Ofens bis 2027 und die Entwicklung einer TiO2-Pigmentanlage, die bis 2031 100 kt/Jahr erreichen soll.

- 67% increase in Mineral Reserves and 64% increase in Mineral Resources

- Extended mine life to 31 years (13 years longer than previous plan)

- Post-tax NPV7% of $1.1 billion and LOM cash flow of $3.8 billion

- Significant production capacity: 346.6 kt V2O5, 7,766.6 kt ilmenite, 2,499 kt TiO2

- 29% decrease in V2O5 head grade

- 15% decrease in V2O5 in magnetic concentrate

- 9% decrease in TiO2 head grade

- High CAPEX requirements: $575.4 million total, including $480.1 million for TiO2 pigment plant

Insights

The updated Life of Mine Plan reveals a substantial expansion of Largo's vanadium-titanium operation with significant economic implications. The 67% increase in Mineral Reserves and 64% increase in Mineral Resources translates to a 31-year mine life, extending operations to 2054. The project demonstrates robust economics with a

The planned sequential mining strategy across multiple pits (Campbell, NAN, SJO, NAO and GAN) ensures steady production, while proposed expansions in vanadium processing and ilmenite concentration capabilities position Largo to meet growing market demand. The addition of a

While head grades have decreased with the inclusion of new deposits, the expanded resource base and processing capabilities should support long-term production stability. The project's economics appear solid given current commodity price assumptions, though investors should monitor execution risks around planned facility expansions and capital expenditure requirements.

The strategic significance of this expansion cannot be overstated in the context of critical materials supply. The project will produce 346.6 kt of V2O5 equivalent and 7,766.6 kt of ilmenite concentrate over its life, positioning Largo as a major Western hemisphere supplier of these strategic materials.

The planned TiO2 pigment production capacity of 2,499 kt represents vertical integration into higher-value products. This is particularly relevant as global markets seek secure supply chains for titanium products used in aerospace and industrial applications. The phased approach to capacity expansion, reaching 100 ktpy of TiO2 pigment by 2031, appears well-aligned with market growth projections.

The decrease in head grades is offset by the significant increase in total resources, suggesting optimized long-term extraction potential. The project's 18.5% modified IRR indicates strong economic viability despite the substantial capital requirements.

All amounts expressed are in

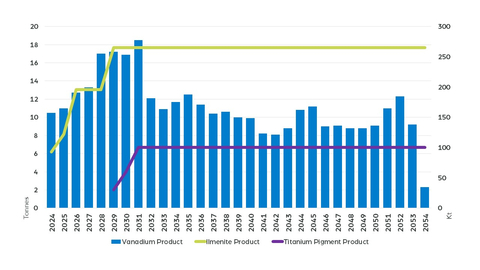

Figure 1: Proposed LOM Production Profile – Vanadium, Ilmenite Concentrate, Titanium Pigment (Graphic: Business Wire)

2024 Life of Mine Plan and Pre-Feasibility Study Highlights

- Large Scale Vanadium/Titanium Project – Increased Mine Life to 2054: Total operating mine life for the Project of 31 years, representing an increase of 13 years in mine life as compared to the parameters set forth in the Company’s 2021 technical report, titled An Updated Life of Mine Plan for Campbell Pit and Pre-Feasibility Study for GAN and NAN Deposits, dated December 16, 2021 (the “2021 Technical Report”)

-

Strong Economics Outlined over Project Life Including Additional TiO2 Pigment Production Upside Opportunity: Post-tax NPV

7% of$1.1 billion $3.8 billion $9.00 $222.05 $404 0.05$5.10 USD - Robust and Reliable Supply of Critical Materials through Outlined Operational Scenarios: Total LOM V2O5 equivalent production of 346.6 kt, ilmenite concentrate production of 7,766.6 kt and TiO2 pigment production opportunity of 2,499 kt

-

Supported by a Significant Increase in Mineral Reserves over 2021 Technical Report Results Following Inclusion of the Novo Amparo Oeste (“NAO”) and São Jose (“SJO”) Deposits: Total Proven and Probable Reserves of 101.03 mt grading

0.56% V2O5, yielding2.16% V2O5 in magnetic concentrate for 435.31 kt of contained V2O5 in magnetic concentrate and head grade of7.52% TiO2 for 6,890.99 kt of contained TiO2` in non-magnetic concentrate; representing a67% increase in total Mineral Reserves,16% increase in V2O5 contained metal,54% increase in TiO2 contained metal,29% decrease in V2O5 head grade,15% decrease in V2O5 in magnetic concentrate,9% decrease in TiO2 head grade -

Substantial Increase Mineral Resources over 2021 Technical Report – Upgrade of Measured and Indicated Resources from Campbell, Gulçari A Norte (“GAN”) and Novo Amparo Norte (“NAN”), and Indicated Resources from SJO, NAO Deposits: The total 2024 Measured and Indicated Resources of 104.78 mt grading

0.62% V2O5 and8.31% TiO2 for 653.54 kt of contained V2O5 in situ and 8707.50 kt of contained TiO2` in situ,64% increase in total Mineral Resources,29% increase in V2O5 contained metal,66% increase in TiO2 contained metal,22% decrease in V2O5 head grade,1% increase in TiO2 head grade - Future Growth Opportunities: The 2024 Technical Report outlines several additional studies in progress meant to improve future results of the Company, including new resource base and exploration potential of the Campbell Pit-Gulcari A South (“GAS”) connection, located approximately 800 meters from the Campbell Pit, the evaluation and exploration of precious group metals (“PGMs”) at the Project, the improvement of magnetite quality in its operations and the increase of the Company’s TiO2 grade in its flotation feed

Daniel Tellechea, Interim CEO and Director of Largo, stated: “The results of our 2024 Technical Report clearly showcase the long-term potential of the Maracás Menchen vanadium and titanium operation and reaffirm Largo’s position as a secure and reliable supplier of critical materials for the future in the

He continued: "In the long-term, we see growing demand for our products, particularly Largo’s high-quality vanadium, as industries and governments increasingly prioritize energy storage and the development of advanced technologies, particularly in the aerospace sector. Largo is well-positioned to meet this demand, with a significant resource base to support future production scenarios. Additional growth projects such as implementing a TiO2 pigment production in Camaçari, along with ongoing exploration at the Campbell-GAS connection and platinum-palladium exploration opportunities are expected to enhance overall results at the Company. These initiatives, combined with the outlined expansion scenarios, present a solid plan to strengthen Largo’s role as a key player in the vanadium and titanium markets, meeting the critical material needs of a transitioning global economy.”

Updated Vanadium/Titanium Project Overview and Timelines

The Company’s 2024 Technical Report outlines a comprehensive plan for the proposed development of its Project, highlighting key milestones across the 31-year project lifecycle. The proposed timeline for the Project is designed to seek ways to optimize the extraction of vanadium and titanium Resources, to ensure consistent production rates while progressively developing multiple pits. Contingent on securing the necessary financing and approvals, the potential strategic expansion of the Project’s various processing facilities aims to meet future production goals, particularly in enhancing TiO2 pigment production. Potential ramp-ups and expansions would align with the Company's long-term objectives to maximize Resource utilization and market presence with high-quality vanadium and titanium products.

Outlined Project and Mining Development Phases:

- 2023 – 2032: Continued Mining at Campbell Pit: Mining operations will focus on the Campbell Pit, extracting vanadium-rich ore to meet the production target of 2.6 million tonnes per annum (“mtpa”) for the next nine years;

- 2032 – 2054: Sequential Mining from NAN, SJO, NAO, and GAN Pits: Following the Campbell Pit, mining would transition sequentially to the NAN, SJO, NAO, and GAN pits, ensuring a continuous feed of 3.4 mtpa to the vanadium and titanium processing plants.

Proposed Production Timeline:

-

Vanadium Processing

- 2027: The installation of a second kiln, designed for a 20-tonne-per-hour feed rate to increase the capacity of the vanadium operations

-

Ilmenite Concentration Plant:

- 2023: Production capacity of 100 kilotonnes per year (“ktpy”)

- 2025: Increased capacity to 122 ktpy

- 2026: Capacity reaches 196 ktpy

- 2029: Full ramp-up to 265 ktpy to meet the Company’s expected TiO2 pigment plant demand

-

TiO2 Pigment Plant:

-

2029: Construction in Camaçari,

Bahia begins, with an initial production capacity of 30 ktpy - 2030: Capacity increases to 60 ktpy

- 2031: Full production of 100 ktpy achieved

-

2029: Construction in Camaçari,

The outlined phased approach presents scenarios for maintaining stable production over the long term, supporting the Company’s growth objectives and its ambitions to remain a reliable and secure supplier in the vanadium and TiO2 markets. The proposed mining plan, along with potential expansions of processing capabilities—including the Ilmenite and TiO2 pigment plant—are expected to position the Company for sustained market leadership and resource optimization.

2024 Pre-Feasibility Study Summary

Production |

|||

LOM |

31 years |

||

Run-of-mine plant feed |

101.0 Mt |

||

LOM average strip ratio |

5 : 1 |

||

Metal production |

V2O5 equivalent

|

Ilmenite

|

TiO2

|

LOM |

343,600 |

7,766.6 |

2,490.0 |

Proven & Probable Reserves |

101.03 mt grading |

||

Cost |

|||

Ilmenite plant expansion CAPEX |

|

||

TiO2 pigment plant CAPEX |

|

||

Total sustaining CAPEX |

|

||

Total CAPEX |

|

||

Project Economicsi |

|||

Post-tax NPV |

|

||

Modified internal rate-of-return |

|

||

Post-tax LOM cash flow |

|

||

i Weighted average long-term forecast prices of |

|||

Significant Increase In Largo’s Mineral Resource and Reserves

The Company’s updated 2024 Mineral Resource and Reserve estimates demonstrate considerable advancements in exploration and development efforts at Largo over the last three years. Based on an extensive exploration program comprising 650 diamond drill holes, totaling over 114,000 meters (“m”) and incorporating more than 47,000 samples (45,814.24 m), the new geological models provide a strong foundation to support future production scenarios outlined in the 2024 Technical Report. This update includes newly reported Indicated and Inferred Resources at SJO and NAO, with additional Inferred Resources delineated at Jacaré (“JAC”), GAS, and Rio de Contas (“RIOCON”).

The Company has significantly increased both its Mineral Reserves and Resources through these exploration efforts, driven by a deeper understanding and improved interpretation of the ore bodies. While this additional knowledge has contributed to a substantial increase in the Company’s overall resource base, it has also led to a reduction in head grades, as the knowledge and understanding of more complex ore zones, including lower-grade pegmatite bodies, have been incorporated into the models. This is expected to enable the Company to optimize future mining and processing activities, balancing anticipated resource growth with long-term operational efficiency.

Table 1: Maracás Menchen Project – Mineral Reserves Estimate (Effective Date – January 30th, 2024)

Category |

Tonnage

|

%Magnetics |

Head |

Magnetic Concentrate |

Metal Contained |

||||

%V2O5 |

%TiO2 |

Mag

|

%V2O5 |

%TiO2 |

V2O5 in Magnetic

|

TiO2 in Non-Magnetic

|

|||

Campbell Pit I |

|||||||||

Proven |

16.16 |

22.42 |

0.86 |

6.35 |

3.62 |

3.15 |

5.05 |

114.23 |

842.94 |

Probable |

5.47 |

18.75 |

0.76 |

5.60 |

1.03 |

3.23 |

4.60 |

33.14 |

259.09 |

Total Campbell

|

21.63 |

21.49 |

0.83 |

6.16 |

4.65 |

3.17 |

4.95 |

147.37 |

1,102.03 |

GAN II |

|||||||||

Proven |

12.96 |

18.44 |

0.45 |

7.66 |

2.39 |

1.80 |

2.93 |

43.94 |

922.31 |

Probable |

11.34 |

16.88 |

0.42 |

7.16 |

1.91 |

1.79 |

2.53 |

34.23 |

763.94 |

Total GAN

|

24.29 |

17.71 |

0.44 |

7.42 |

4.30 |

1.79 |

2.75 |

77.17 |

1,685.25 |

NAN III |

|||||||||

Proven |

19.55 |

21.02 |

0.58 |

8.25 |

4.11 |

2.05 |

3.33 |

84.22 |

1,474.91 |

Probable |

6.40 |

21.14 |

0.56 |

8.63 |

1.35 |

1.98 |

3.04 |

27.84 |

511.05 |

Total NAN

|

25.95 |

21.05 |

0.58 |

8.34 |

5.46 |

2.03 |

3.26 |

111.06 |

1,985.96 |

SJO IV |

|

|

|

|

|

|

|

|

|

Proven |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Probable |

22.41 |

18.12 |

0.44 |

7.48 |

4.06 |

1.76 |

2.99 |

71.32 |

1,555.47 |

Total SJO

|

22.41 |

18.12 |

0.44 |

7.48 |

4.06 |

1.76 |

2.99 |

71.32 |

1,555.47 |

NAO V |

|

|

|

|

|

|

|

|

|

Proven |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Probable |

6.74 |

24.98 |

0.53 |

9.17 |

1.68 |

1.69 |

3.33 |

28.39 |

562.27 |

Total NAO Reserve |

6.74 |

24.98 |

0.53 |

9.17 |

1.68 |

1.69 |

3.33 |

28.39 |

562.27 |

Total Maracás Menchen Mine Proven and Probable Reserves |

|||||||||

Proven |

48.67 |

20.80 |

0.64 |

7.46 |

10.12 |

2.38 |

3.85 |

241.39 |

3,240.16 |

Probable |

52.36 |

19.17 |

0.50 |

7.57 |

10.03 |

1.93 |

3.13 |

193.92 |

3,650.82 |

Total |

101.03 |

19.95 |

0.56 |

7.52 |

20.15 |

2.16 |

3.49 |

435.31 |

6,890.99 |

Notes: |

|||||||||

1. Mineral Reserves estimates were prepared under the CIM Standards. |

|||||||||

2. Mineral Reserves are the economic portion of the Measured and Indicated Mineral Resources. |

|||||||||

3. Mineral Reserves were estimated by Guilherme Gomides Ferreira, BSc. (MEng), MAIG, a GE21 associate, who meets the requirements of a “Qualified Person” as established by the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves (May 2014) (CIM Standards). |

|||||||||

4. Mineral Reserves are reported effective date January 30th, 2024. |

|||||||||

5. The reference point at which the Mineral Reserves are defined is the point where the ore is delivered from the open pit to the crushing plant. |

|||||||||

6. Vanadium product comes from magnetic concentrate, while TiO2 product comes from the non-magnetic portion. |

|||||||||

7. Mineral Reserves were estimated using the Geovia Whittle 4.3 software and following the geometric and economic parameters. |

|||||||||

8. Geometric and economic parameters include: |

|||||||||

• Mine Recovery of |

|||||||||

• V2O5 selling price (standard purity > |

|||||||||

• TiO2 pigment selling price (purity > |

|||||||||

• Mining costs of |

|||||||||

• Vanadium processing costs of |

|||||||||

• Ilmenite concentrate costs |

|||||||||

• TiO2 pigment costs of |

|||||||||

• General and Administrative (G&A) costs of |

|||||||||

9. Exchange rate: |

|||||||||

10. Specific values for each Deposit: |

|||||||||

I. Campbell Pit: Pit slope angles ranging from 37.5° to 64°. V2O5 concentrate recovery of |

|||||||||

II. GAN: Pit slope angles ranging from 40° to 64. V2O5 concentrate recovery of |

|||||||||

III. NAN: Pit slope angles ranging from 40° to 68°. V2O5 concentrate recovery of |

|||||||||

IV. SJO: Pit slope angles ranging from 40° to 56°. V2O5 concentrate recovery of |

|||||||||

V. NAO: Pit slope angles ranging from 40° to 68°. V2O5 concentrate recovery of |

|||||||||

Source: GE21, 2024. |

|||||||||

Table 2: Maracás Menchen Project – Non-Magnetic Reserves in Ponds (Effective Date – January 30th, 2024)

Pond |

Classification |

Mass (kt) |

Grade TiO2 (%) |

Metal Content (kt) |

BNM 02 |

Probable |

1,131.77 |

10.69 |

120.99 |

BNM 03 |

Probable |

1,051.72 |

11.87 |

124.84 |

BNM 04 |

Probable |

3,034.94 |

10.03 |

304.42 |

Total in Ponds Reserves |

Probable |

5,218.43 |

10.54 |

550.25 |

Notes: |

||||

1. Stock of “Non-Magnetic concentrate” available in the tailing’s ponds. |

||||

2. Effective Date–January 30th, 2024. |

||||

3. Mineral Reserves in ponds were estimated based on monthly processing and validated with topographic surveys (primitive data and current data) and reconciliation data. |

||||

4. Recovery is |

||||

Source: GE21, 2024. |

||||

Table 3: Mineral Resource of Maracás Menchen Project (Effective Date – January 30th, 2024)

Target |

Classification |

Mass |

Head |

Magnetic Concentrate |

Material Content |

||||

V2O5 |

TiO2 |

DT |

V2O5 |

TiO2 |

V2O5 |

TiO2 |

|||

(Mt) |

(%) |

(kt) |

|||||||

Campbell Pit + GAN |

Measured |

30.28 |

0.71 |

7.64 |

22.21 |

2.40 |

3.48 |

215.73 |

2,313.22 |

Indicated |

21.09 |

0.54 |

7.28 |

18.51 |

2.14 |

2.73 |

114.50 |

1,536.38 |

|

Measured + Indicated |

51.37 |

0.64 |

7.49 |

20.69 |

2.30 |

3.17 |

330.23 |

3,849.60 |

|

Inferred |

29.94 |

0.54 |

7.46 |

18.52 |

2.00 |

2.31 |

162.2 |

2,232.6 |

|

SJO |

Indicated |

17.92 |

0.58 |

8.77 |

22.78 |

1.90 |

2.86 |

104.4 |

1,571.6 |

Measured + Indicated |

17.92 |

0.58 |

8.77 |

22.78 |

1.90 |

2.86 |

104.39 |

1,571.57 |

|

Inferred |

15.19 |

0.52 |

7.43 |

19.02 |

1.89 |

2.53 |

78.9 |

1,127.9 |

|

NAO |

Indicated |

7.13 |

0.58 |

10.06 |

27.29 |

1.72 |

3.06 |

41.4 |

717.2 |

Measured + Indicated |

7.13 |

0.58 |

10.06 |

27.29 |

1.72 |

3.06 |

41.38 |

717.16 |

|

Inferred |

4.09 |

0.59 |

8.61 |

23.34 |

1.83 |

3.03 |

24.0 |

351.8 |

|

NAN |

Measured |

19.44 |

0.64 |

9.02 |

22.88 |

2.14 |

2.83 |

123.7 |

1,753.6 |

Indicated |

8.93 |

0.60 |

9.14 |

21.90 |

2.14 |

2.63 |

53.9 |

815.6 |

|

Measured + Indicated |

28.37 |

0.63 |

9.06 |

22.57 |

2.14 |

2.77 |

177.54 |

2,569.17 |

|

Inferred |

6.88 |

0.66 |

9.16 |

22.69 |

2.28 |

2.68 |

45.7 |

630.0 |

|

GAS |

Inferred |

11.30 |

0.58 |

8.48 |

18.36 |

2.31 |

2.22 |

66.0 |

958.7 |

JAC |

Inferred |

21.16 |

0.47 |

7.78 |

18.57 |

1.74 |

4.65 |

98.9 |

1,645.3 |

RIOCON |

Inferred |

13.27 |

0.41 |

7.23 |

16.15 |

1.63 |

3.86 |

55.0 |

959.3 |

Total |

Measured |

49.72 |

0.68 |

8.18 |

22.47 |

2.30 |

3.22 |

339.39 |

4,066.84 |

Indicated |

55.06 |

0.57 |

8.43 |

21.58 |

2.01 |

2.80 |

314.15 |

4,640.66 |

|

Measured + Indicated |

104.78 |

0.62 |

8.31 |

22.01 |

2.15 |

3.00 |

653.54 |

8,707.50 |

|

Inferred |

101.82 |

0.52 |

7.76 |

18.75 |

1.93 |

3.08 |

530.79 |

7,905.60 |

|

Notes: |

|||||||||

1. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

|||||||||

2. Mineral Resources were estimated by Fábio Xavier, BSc. (Geo), MAIG, a GE21 Associate, who meets the requirements of a “Qualified Person” as established by the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves (May 2014) (CIM Standards). |

|||||||||

3. The Mineral Resource estimates were prepared under the CIM Standards and the CIM Guidelines, using geostatistical, economic, and mining parameters appropriate to the deposits. |

|||||||||

4. Presented Mineral Resources are inclusive of Mineral Reserves. All figures have been rounded to the relative accuracy of the estimates. Summed amounts may not add due to rounding. |

|||||||||

5. The Mineral Resource is reported on an effective date of January 30th, 2024. |

|||||||||

6. A cut-off grade of |

|||||||||

7. A cut-off grade of |

|||||||||

8. Geometric and economic parameters include: |

|||||||||

• Mine Recovery of |

|||||||||

• V2O5 selling price of |

|||||||||

• TiO2 pigment selling price of |

|||||||||

• Mining costs of |

|||||||||

• Vanadium processing costs of |

|||||||||

• Ilmenite concentrate costs |

|||||||||

• TiO2 pigment costs of |

|||||||||

• General and Administrative (G&A) costs of |

|||||||||

9. Exchange rate: |

|||||||||

10. Specific values for each Deposit: |

|||||||||

• Campbell Pit + GAN: Pit slope angles ranging from 37.5° to 64°. V2O5 concentrate recovery of |

|||||||||

• NAN: Pit slope angles ranging from 40° to 68°. V2O5 concentrate recovery of |

|||||||||

• SJO: Pit slope angles ranging from 40° to 56°. V2O5 concentrate recovery of |

|||||||||

• NAO: Pit slope angles ranging from 40° to 68°. V2O5 concentrate recovery of |

|||||||||

Source: GE21, 2024. |

|||||||||

Table 4: Non-Magnetic Ponds Resource Estimate (Effective Date – January 30th, 2024)

Pond |

Classification |

Mass (kt) |

Grade TiO2 (%) |

Metal content (kt) |

BNM 02 |

Indicated |

1,131.77 |

10.69 |

120.99 |

BNM 03 |

Indicated |

1,051.72 |

11.87 |

124.84 |

BNM 04 |

Indicated |

3,034.94 |

10.03 |

304.42 |

Total in Ponds Resources |

Indicated |

5,218.43 |

10.54 |

550.25 |

Notes: |

||||

1. Stock of “Non-Magnetic concentrate” available in the tailing’s ponds. |

||||

2. Effective Date–January 30th, 2024. |

||||

3. Mineral Resources in ponds were estimated based on monthly processing and validated with topographic surveys (primitive data and current data) and reconciliation data. |

||||

4. Recovery is |

||||

Source: GE21, 2024. |

||||

Future Growth Opportunities at the Project

The Company is actively advancing several long-term growth initiatives, designed to enhance resource potential and production capabilities at the Project. These initiatives will focus on both expanding the Company's resource base and leveraging new technologies to optimize future operations.

-

Additional Exploration and the Campbell-GAS Deposit Connection: The Company is undertaking an exploration program to confirm mineralization between the Campbell Pit and the GAS deposit. Previous drilling at the GAS target identified 11.3 mt of Inferred Resources, grading

0.58% V2O5 and8.48% TiO2, with concentrate grades of2.31% V2O5 and2.22% TiO2. The relatively short distance of approximately 800 m between the Campbell Pit and the GAS deposit presents a strong opportunity to enhance the Company’s resource base by connecting these deposits. If successful, this would increase the overall ROM material close to the Company’s existing processing facilities as compared to other more northerly deposits. - PGM Opportunities: At the end of 2023, the Company resumed studies to further explore the existence of PGMs within its non-magnetic tailings ponds. Auger samples from the non-magnetic tailings ponds revealed promising results, with notable platinum and palladium grades, including 3.0 meters grading 0.410 g/t Pt and 0.209 g/t Pd. This follows historical data from past exploration efforts at the Company, which also demonstrated significant PGM mineralization (see press release dated March 5, 2024). By further reviewing and analyzing historical drill data, the Company aims to develop a comprehensive PGM resource model that could further enhance the potential of future mining operations and provide a potential new revenue opportunities alongside its vanadium and ilmenite operations. PGMs are highly valuable due to their applications in catalytic converters and the automotive industry, presenting a major growth opportunity if these studies yield positive results.

Technical Report Consultants

GE21 is a specialized and independent mineral consulting firm based on a multi-disciplinary technical team, which offers services covering most project development stages in the mining sector. The senior staff and Board of Directors have extensive technical and operational experience, based on collaboration with relevant companies in the fields of exploration and mineral consulting in

Technical Report and Qualified Persons

A Technical Report prepared in accordance with NI 43-101 for the Project will be filed on SEDAR+ (www.sedarplus.com) on or before December 12, 2024. Readers are encouraged to read the Technical Report in its entirety, including all qualifications, assumptions and exclusions that relate to the Mineral Reserve and Mineral Resource declaration. The 2024 Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context. The Mineral Reserve and Mineral Resource statements for the Project included in this press release were prepared under the supervision of Porfírio Cabaleiro Rodriguez, Mining Engineer, BSc (Mine Eng), FAIG, GE21 director. Mr. Rodriguez is a “qualified persons” as defined in NI 43-101 and have reviewed and approved disclosure of the scientific and technical information and data in this press release that relate to the mineral operations which are the subject of the 2024 Technical Report.

About Largo

Largo is a globally recognized vanadium company known for its high-quality VPURE® and VPURE+® products, sourced from its Maracás Menchen Mine in

Largo’s common shares trade on the Nasdaq Stock Market and on the Toronto Stock Exchange under the symbol "LGO". For more information on the Company, please visit www.largoinc.com.

Cautionary Statement Regarding Forward-looking Information:

This press release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian and

Forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. All information contained in this news release, other than statements of current and historical fact, is forward looking information. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Largo to be materially different from those expressed or implied by such forward-looking statements, including but not limited: to those risks described in the annual information form of Largo and in its public documents filed on www.sedarplus.ca and available on www.sec.gov from time to time. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made. Although management of Largo has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Largo does not undertake to update any forward-looking statements, except in accordance with applicable securities laws. Readers should also review the risks and uncertainties sections of Largo’s annual and interim MD&A which also apply.

Trademarks are owned by Largo Inc.

Information Concerning Estimates of Mineral Reserves and Measured, Indicated and Inferred Resources

This press release has been prepared in accordance with the requirements of the securities laws in effect in

View source version on businesswire.com: https://www.businesswire.com/news/home/20241028307463/en/

For further information, please contact:

Investor Relations

Alex Guthrie

Director, Investor Relations

+1.416.861.9778

aguthrie@largoinc.com

Source: Largo Inc.