Lendway, Inc. Announces First Quarter 2024 Financial Results

Lendway announced its Q1 2024 financial results ending March 31, 2024. The company has transitioned into a specialty agricultural and finance firm, focusing on Bloomia B.V., a tulip growing enterprise, acquired in February 2024 for $53.4 million.

Q1 2024 net sales were $8 million, mainly from Bloomia. However, the company reported an operating loss of $1.5 million, compared to $628,000 in Q1 2023, and a net loss of $1.3 million, or $0.77 per share, up from $528,000 or $0.29 per share in Q1 2023. Despite the losses, adjusted EBITDA showed improvement at $1.7 million.

Bloomia's sales, benefiting from seasonality, contributed significantly to the results. Expenses, including $1.54 million acquisition-related costs and $1.36 million amortization expense, impacted profitability. Cash and equivalents stood at $5 million, down from $16.1 million at the end of December 2023.

- Q1 2024 net sales of $8 million, primarily from Bloomia.

- Adjusted EBITDA improved to $1.7 million in Q1 2024, compared to a negative $614,000 in Q1 2023.

- Gross profit of $1.89 million, or 23.6% of revenue.

- Bloomia's seasonal sales contributed positively.

- Tax benefit of 20.6% of pretax loss from continuing operations.

- Q1 2024 operating loss of $1.5 million, compared to $628,000 in Q1 2023.

- Net loss of $1.3 million, or $0.77 per share, up from $528,000 or $0.29 per share in Q1 2023.

- Significant expenses: $1.54 million in acquisition-related costs and $1.36 million in amortization expense.

- Interest expense of $225,000 compared to interest income of $103,000 in Q1 2023.

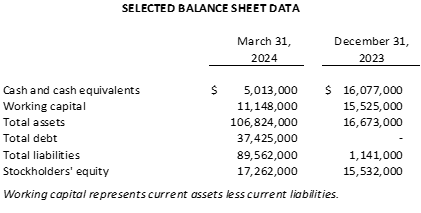

- Decrease in cash and equivalents to $5 million from $16.1 million as of December 31, 2023.

Insights

The first quarter financial results for Lendway, Inc. reveal a significant transformation following their acquisition of Bloomia B.V. Gross profit in Q1 2024 was

However, the net loss from continuing operations increased to

The significant drop in cash reserves from

Lendway’s strategic pivot to becoming a specialty agricultural and finance company with Bloomia B.V. at its core marks an intriguing shift. The revenue surge to

However, the increased SG&A expenses, accounting for

It's also worth noting the company's new lending business, which aims to leverage collateralized loans. Given its recent inception, its future performance could become another critical revenue stream. The success of this venture will largely depend on effective management and market conditions for non-bank lending.

The acquisition of Bloomia B.V. and its focus on hydroponically growing tulips represent a diversification into a high-margin, niche agricultural segment. Historically, the floriculture industry has stable demand peaks during key calendar events, such as Valentine's Day and Easter. Thus, Lendway's move strategically leverages these predictable patterns to boost revenue streams.

However, the initial costs, including

Investors should also consider the sustainability and scalability of hydroponic farming. It generally requires less land and water compared to traditional agriculture, which could be beneficial in the context of increasing environmental regulations and sustainability demands.

MINNEAPOLIS, MN / ACCESSWIRE / May 20, 2024 / Lendway, Inc. (Nasdaq: LDWY) ("Lendway" or the "Company") today announced financial results for the first quarter ("Q1") ended March 31, 2024.

Strategic Business Operations Update

The Company has strategically evolved into a specialty agricultural and finance company with an operational focus on its agricultural investments. These developments include:

- April 2023: The Company launched its lending business (the "Lending Business") through the hiring of Randy Uglem. The Company is seeking to build a scalable non-bank lending business to purchase existing loans or originate and fund new loans, all of which will be secured by collateral.

- August 2023: The Company completed the sale of certain assets and certain liabilities relating to the Company's legacy business of providing in-store advertising solutions to brands, retailers, shopper marketing agencies and brokerages (the "In-Store Marketing Business"). The operations of the In-Store Marketing Business are presented as discontinued operations.

- February 2024: The Company became a majority owner of Bloomia B.V. and its affiliated entities ("Bloomia").

Lendway acquired its interest in Bloomia (www.bloomia.com), for a purchase price of

Lendway's Q1 results include Bloomia's results from the acquisition date, February 22, 2024, through March 31, 2024. Bloomia's sales have historically experienced substantial seasonality, with the first and second calendar quarters being the strongest sales quarters and the first quarter benefiting from Valentine's Day, Easter season and the start of the Spring season. Q1 was also significantly impacted by

Overview

- Q1 2024 net sales were

$8.0 million . - Q1 2024 operating loss from continuing operations was

$1.5 million compared to$628,000 in Q1 2023. - Q1 2024 net loss from continuing operations was

$1.3 million , or$0.77 per basic share and diluted share, compared to$528,000 of net loss from continuing operations, or$0.29 per basic and diluted share in Q1 2023. - Q1 2024 adjusted EBITDA was

$1.7M compared to ($614,000) in Q1 2023.

Lendway CEO Randy Uglem, said: "the first quarter of 2024 included the addition of Bloomia to the Lendway family, which marked a pivotal moment in our evolution into a dynamic specialty ag and finance enterprise. I'm pleased with Bloomia's performance thus far and appreciate the efforts of the new team to integrate."

Q1 2024 Results

Revenue from continuing operations was

Gross profit in Q1 2024 was

Sales, general and administrative expenses in Q1 2024 were

Interest expense for Q1 2024 was

Income tax benefit for Q1 2024 was

As a result of the items above, the net loss for Q1 2024 was

Q1 2024 adjusted EBITDA from continuing operations was

The CEO of Bloomia owns

As of March 31, 2024, cash and cash equivalents totaled

About Lendway, Inc.

Lendway, Inc (Nasdaq:LDWY) is a specialty ag and finance company focused on making and managing its ag investments in the U.S. and internationally. The Company is the majority owner of Bloomia, one of the largest producers of fresh cut tulips in the United States. The Company fully owns and operates FarmlandCredit.com, a non-bank lending business that seeks to purchase existing loans and/or originate and fund new loans domestically. For additional information, contact (800) 874-4648, or visit our website at www.lendway.com. Investor inquiries can be submitted to info@lendway.com.

Cautionary Statement Regarding Forward-Looking Statements

Statements in this press release that are not statements of historical or current facts are considered forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended. The words "anticipate," "continue," "ensure," "expect," "plan," "remain," "seek," "will" and similar expressions identify forward-looking statements. Readers are cautioned not to place undue reliance on these or any forward-looking statements, which speak only as of the date of this press release. Statements made in this press release regarding, for instance, the short- and long-term benefits of the Bloomia acquisition, potential growth, allocations of capital resources among our businesses, and timing of future financial reporting, are forward-looking statements. These forward-looking statements are based on current information, which we have assessed and which by its nature is dynamic and subject to rapid and even abrupt changes. Factors that could cause our estimates and assumptions as to future performance, and our actual results, to differ materially include the following: (1) our ability to integrate and continue to successfully operate the newly acquired Bloomia business, (2) our ability to compete, (3) concentration of Bloomia's historical revenue among a small number of customers, (4) changes in interest rates, (5) ability to comply with the requirements of the Credit Agreement, (6) the limited history of our Lending Business, (7) the substantial risk of loss associated with lending generally, (8) market conditions that may restrict or delay appropriate or desirable opportunities, (9) our ability to develop and maintain necessary processes and controls relating to our businesses (10) reliance on one or a small number of employees in each of our businesses, (11) potential adverse classifications of our Company if we are unsuccessful in executing our business plans, (12) other economic, business, market, financial, competitive and/or regulatory factors affecting the Company's businesses generally; (13) our ability to attract and retain highly qualified managerial, operational and sales personnel; and (14) the availability of additional capital on desirable terms, if at all. Forward-looking statements involve known and unknown risks, uncertainties and other factors, including those set forth in our Annual Report on Form 10-K for the year ended December 31, 2023 and additional risks, identified in our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K filed with the SEC. Such forward-looking statements should be read in conjunction with Lendway's filings with the SEC. Lendway assumes no responsibility to update the forward-looking statements contained in this press release or the reasons why actual results would differ from those anticipated in any such forward-looking statement, other than as required by law.

Lendway, Inc.

CONDENSED AND CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(Unaudited)

| Three Months Ended | ||||||||

| March 31, | ||||||||

| 2024 | 2023 | |||||||

Revenue, net | $ | 8,033,000 | $ | - | ||||

Cost of goods sold | 6,139,000 | - | ||||||

Gross profit | 1,894,000 | - | ||||||

Sales, general and administrative | 3,388,000 | 628,000 | ||||||

Operating loss | (1,494,000 | ) | (628,000 | ) | ||||

Foreign exchange difference, net | (45,000 | ) | - | |||||

Interest expense (income), net | 225,000 | (103,000 | ) | |||||

Other expense, net | 9,000 | - | ||||||

Loss from continuing operations before income taxes | (1,683,000 | ) | (525,000 | ) | ||||

Income tax (benefit) expense | (347,000 | ) | 3,000 | |||||

Net loss from continuing operations | (1,336,000 | ) | (528,000 | ) | ||||

Income from discontinued operations, net of tax | 72,000 | 2,176,000 | ||||||

Net (loss) income including noncontrolling interest | (1,264,000 | ) | 1,648,000 | |||||

Less: Net (loss income attributable to noncontrolling interest | (223,000 | ) | - | |||||

Net (loss) income attributable to Lendway, Inc. | (1,041,000 | ) | 1,648,000 | |||||

Other comprehensive income (foreign currency translation) | 3,000 | - | ||||||

Comprehensive (loss) income attributable to Lendway, Inc. | $ | (1,044,000 | ) | $ | 1,648,000 | |||

Net (loss) income per basic and diluted share: | ||||||||

Continuing operations | $ | (0.77 | ) | $ | (0.29 | ) | ||

Discontinued operations | 0.04 | 1.21 | ||||||

Basic and diluted (loss) earnings per share | $ | (0.73 | ) | $ | 0.92 | |||

Shares used in calculation of net (loss) income per share: | ||||||||

Basic and diluted | 1,743,000 | 1,798,000 | ||||||

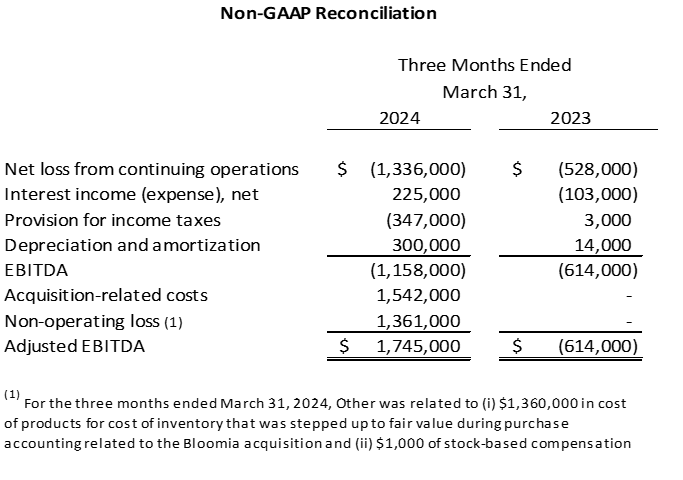

Non-GAAP Reconciliation

This press release includes adjusted EBITDA, which is a non-GAAP financial measure. Non-GAAP financial measures, which are not calculated or presented in accordance with U.S. generally accepted accounting principles ("GAAP"), have been provided as information supplemental and in addition to the financial measures presented in accordance with GAAP. Such non-GAAP financial measures are not substitutes for, or as an alternative to, and should be considered in conjunction with, respective GAAP financial measures. The non-GAAP financial measures presented may differ from similarly named measures used by other companies.

The following table reconciles net loss from continuing operations and adjusted EBITDA for the three months ended March 31, 2024 and 2023:

Included above are reconciliations of EBITDA and Adjusted EBITDA to net loss from continuing operations, the most directly comparable GAAP measure. We have included these non-GAAP performance measures as a comparable measure to eliminate the effects of non-recurring transactions that occurred during the three months ended March 31, 2024. We believe Adjusted EBITDA provides meaningful supplemental information about our operating performance as this measure excludes amounts from net loss from continuing operations that we do not consider part of our core operating results when assessing our performance. Items excluded from Adjusted EBITDA consist of acquisition-related costs and other costs such as the cost of inventory that was stepped up to fair value as a result of the purchase accounting related to our acquisition of a majority interest in Bloomia. Adjusted EBITDA does not reflect our cash expenditures, the cash requirements for the replacement of depreciated and amortized assets, or changes in or cash requirements for our working capital needs.

We believe these non-GAAP financial measures will be useful to permit investors to compare results with prior periods that did not include the one-time events and the resulting accounting charges. Management has used EBITDA and Adjusted EBITDA (a) to evaluate our historical and prospective financial performance and trends as well as our performance relative to competitors and peers; (b) to measure operational profitability on a consistent basis; (c) in presentations to the members of our Board of Directors; and (d) to evaluate compliance with covenants and restricted activities under the terms of our Credit Agreement and outstanding notes, as further described in the Notes to Consolidated Financial Statements included in Item 1 of Part I of the 10-K.

Contact:

Lendway, Inc.

Randy Uglem, CEO

(763) 392-6200

SOURCE: Lendway, Inc.

View the original press release on accesswire.com