Lifeloc Reports Second Quarter 2024 Results

Lifeloc Technologies (OTC PINK:LCTC) reported Q2 2024 financial results with net revenue of $2.387 million, a 5% increase from Q2 2023. However, the company posted a net loss of $(298) thousand, or $(0.12) per diluted share, compared to a net income of $55 thousand in Q2 2023. Gross margin declined to 41.6% from 45.7% year-over-year. R&D investment increased by 67% to $662 thousand, primarily for SpinDx development.

The company highlighted progress in its L-series devices, including the launch of LX9 units with smartphone pairing. Lifeloc is focusing on developing the SpinDx technology platform for rapid drug detection, with beta testing planned for later in 2024 and commercial launch projected for 2025. To support development, Lifeloc secured a $750,000 line of credit and raised $798,000 through a private placement of shares.

Lifeloc Technologies (OTC PINK:LCTC) ha riportato i risultati finanziari del secondo trimestre del 2024 con un fatturato netto di 2,387 milioni di dollari, un aumento del 5% rispetto al secondo trimestre del 2023. Tuttavia, l'azienda ha registrato una perdita netta di 298.000 dollari, ovvero $(0,12) per azione diluita, rispetto a un utile netto di 55.000 dollari nel secondo trimestre del 2023. Il margine lordo è diminuito al 41,6% rispetto al 45,7% dell'anno precedente. Gli investimenti in ricerca e sviluppo sono aumentati del 67% a 662.000 dollari, principalmente per lo sviluppo di SpinDx.

L'azienda ha evidenziato i progressi nei suoi dispositivi della serie L, inclusa la lancio delle unità LX9 con abbinamento a smartphone. Lifeloc si sta concentrando sullo sviluppo della piattaforma tecnologica SpinDx per la rapida rilevazione di sostanze stupefacenti, con test beta previsti per la fine del 2024 e lancio commerciale previsto per il 2025. Per sostenere lo sviluppo, Lifeloc ha ottenuto una linea di credito di 750.000 dollari e ha raccolto 798.000 dollari attraverso un collocamento privato di azioni.

Lifeloc Technologies (OTC PINK:LCTC) reportó los resultados financieros del segundo trimestre de 2024 con ingresos netos de 2,387 millones de dólares, un aumento del 5% en comparación con el segundo trimestre de 2023. Sin embargo, la compañía tuvo una pérdida neta de 298.000 dólares, o $(0,12) por acción diluida, en comparación con una ganancia neta de 55.000 dólares en el segundo trimestre de 2023. El margen bruto descendió al 41,6% desde el 45,7% del año anterior. La inversión en I+D creció un 67% hasta 662.000 dólares, principalmente para el desarrollo de SpinDx.

La empresa destacó avances en sus dispositivos de la serie L, incluida la lanzamiento de unidades LX9 con emparejamiento para smartphones. Lifeloc se está enfocando en desarrollar la plataforma tecnológica SpinDx para la detección rápida de drogas, con pruebas beta previstas para finales de 2024 y un lanzamiento comercial proyectado para 2025. Para apoyar el desarrollo, Lifeloc aseguró una línea de crédito de 750.000 dólares y recaudó 798.000 dólares a través de una colocación privada de acciones.

Lifeloc Technologies (OTC PINK:LCTC)는 2024년 2분기 재무 결과를 발표하며 순수익 238.7만 달러로 2023년 2분기 대비 5% 증가했다고 보고했습니다. 그러나 회사는 29만 8천 달러의 순손실을 기록했으며, 이는 희석주당 $(0.12)로, 2023년 2분기 5만 5천 달러의 순이익과 비교됩니다. 총 이익률은 지난해 45.7%에서 41.6%로 감소했습니다. 연구 및 개발 투자는 SpinDx 개발을 위해 67% 증가해 66.2만 달러에 달했습니다.

회사는 스마트폰과 연결할 수 있는 LX9 기기 출시를 포함하여 L 시리즈 기기에서의 진행 상황을 강조했습니다. Lifeloc은 신속한 약물 탐지를 위한 SpinDx 기술 플랫폼 개발에 집중하고 있으며, 2024년 후반에 베타 테스트를 계획하고 있고 2025년에는 상업적 출시를 예상하고 있습니다. 개발을 지원하기 위해 Lifeloc은 75만 달러의 신용 한도를 확보했으며, 주식의 비공식 매입을 통해 79만 8천 달러를 모금했습니다.

Lifeloc Technologies (OTC PINK:LCTC) a annoncé les résultats financiers du 2ème trimestre 2024 avec un revenu net de 2,387 millions de dollars, ce qui représente une augmentation de 5 % par rapport au 2ème trimestre 2023. Cependant, la société a enregistré une perte nette de 298 000 dollars, soit $(0,12) par action diluée, comparé à un revenu net de 55 000 dollars au 2ème trimestre 2023. La marge brute a diminué à 41,6 % contre 45,7 % l'année précédente. Les investissements en R&D ont augmenté de 67 % pour atteindre 662 000 dollars, principalement pour le développement de SpinDx.

La société a souligné les progrès réalisés dans ses dispositifs de la série L, y compris le lancement d'unités LX9 avec appariement avec des smartphones. Lifeloc se concentre sur le développement de la plateforme technologique SpinDx pour la détection rapide de drogues, avec des tests bêta prévus pour fin 2024 et un lancement commercial prévu pour 2025. Pour soutenir le développement, Lifeloc a sécurisé une ligne de crédit de 750 000 dollars et a levé 798 000 dollars grâce à un placement privé d'actions.

Lifeloc Technologies (OTC PINK:LCTC) hat die Finanzzahlen für das 2. Quartal 2024 vorgelegt, mit Nettoeinnahmen von 2,387 Millionen Dollar, was einem Anstieg von 5 % im Vergleich zum 2. Quartal 2023 entspricht. Das Unternehmen verzeichnete jedoch einen Nettoverlust von 298.000 Dollar, oder $(0,12) pro verwässerter Aktie, im Vergleich zu einem Nettogewinn von 55.000 Dollar im 2. Quartal 2023. Die Bruttomarge sank von 45,7 % auf 41,6 % im Jahresvergleich. Die Investitionen in Forschung und Entwicklung stiegen um 67 % auf 662.000 Dollar, hauptsächlich für die Entwicklung von SpinDx.

Das Unternehmen hob die Fortschritte bei seinen L-Serie-Geräten hervor, darunter die Einführung der LX9-Einheiten mit Smartphone-Kopplung. Lifeloc konzentriert sich auf die Entwicklung der SpinDx-Technologieplattform zur schnellen Drogenidentifikation, mit geplanten Betatests für Ende 2024 und einem kommerziellen Launch, der für 2025 prognostiziert wird. Zur Unterstützung der Entwicklung sicherte sich Lifeloc eine Kreditlinie über 750.000 Dollar und sammelte 798.000 Dollar durch eine Privatplatzierung von Aktien.

- Net revenue increased by 5% year-over-year to $2.387 million in Q2 2024

- R&D investment rose 67% to $662 thousand, primarily for SpinDx development

- Launched LX9 units with smartphone pairing capability

- Secured $750,000 line of credit and raised $798,000 through private placement to support SpinDx development

- Reported net loss of $(298) thousand in Q2 2024, compared to net income of $55 thousand in Q2 2023

- Gross margin declined to 41.6% from 45.7% year-over-year

- Cash position decreased to $505 thousand at the end of Q2 2024

- Dilution of existing shareholders due to private placement of 210,000 new shares

WHEAT RIDGE, CO / ACCESSWIRE / August 8, 2024 / Lifeloc Technologies, Inc. (OTC PINK:LCTC), a global leader in the development and manufacturing of breath alcohol and drug testing devices, has announced financial results for the quarter ended June 30, 2024.

Second Quarter Financial Highlights

Lifeloc posted quarterly net revenue of

We believe our core alcohol detection product line-up is strong. The L-series LX9 and LT7 units have features and performance that have driven market penetration by meeting previously unaddressable market needs, such as wider temperature ranges and fast customization that incorporates local languages. Additionally, LX9 units capable of smart phone pairing began to ship in this quarter.

"We are excited to be able to offer and ship LX9 units with smart phone pairing to achieve better systems integration, which some customers have been seeking commented Dr. Wayne Willkomm, President and CEO. "This demonstrates again our commitment to innovation."

We expect that sales of our newer L-series devices will be incremental to FC-series devices rather than displacing FC sales. The L-series devices have been certified to meet the requirements of most modern registration standards, such as SAI's (Standards Australia International) latest AS 3547:2019 standards for Breath Alcohol Detectors. Our FC-series devices remain popular with many law enforcement and international organizations. Our Easycal® automated calibration station, the only automated calibration available for portable breath alcohol testers, builds valuable protection around our brand and contributes to market share gains by the workplace Phoenix® 6.0 BT and EV 30 devices.

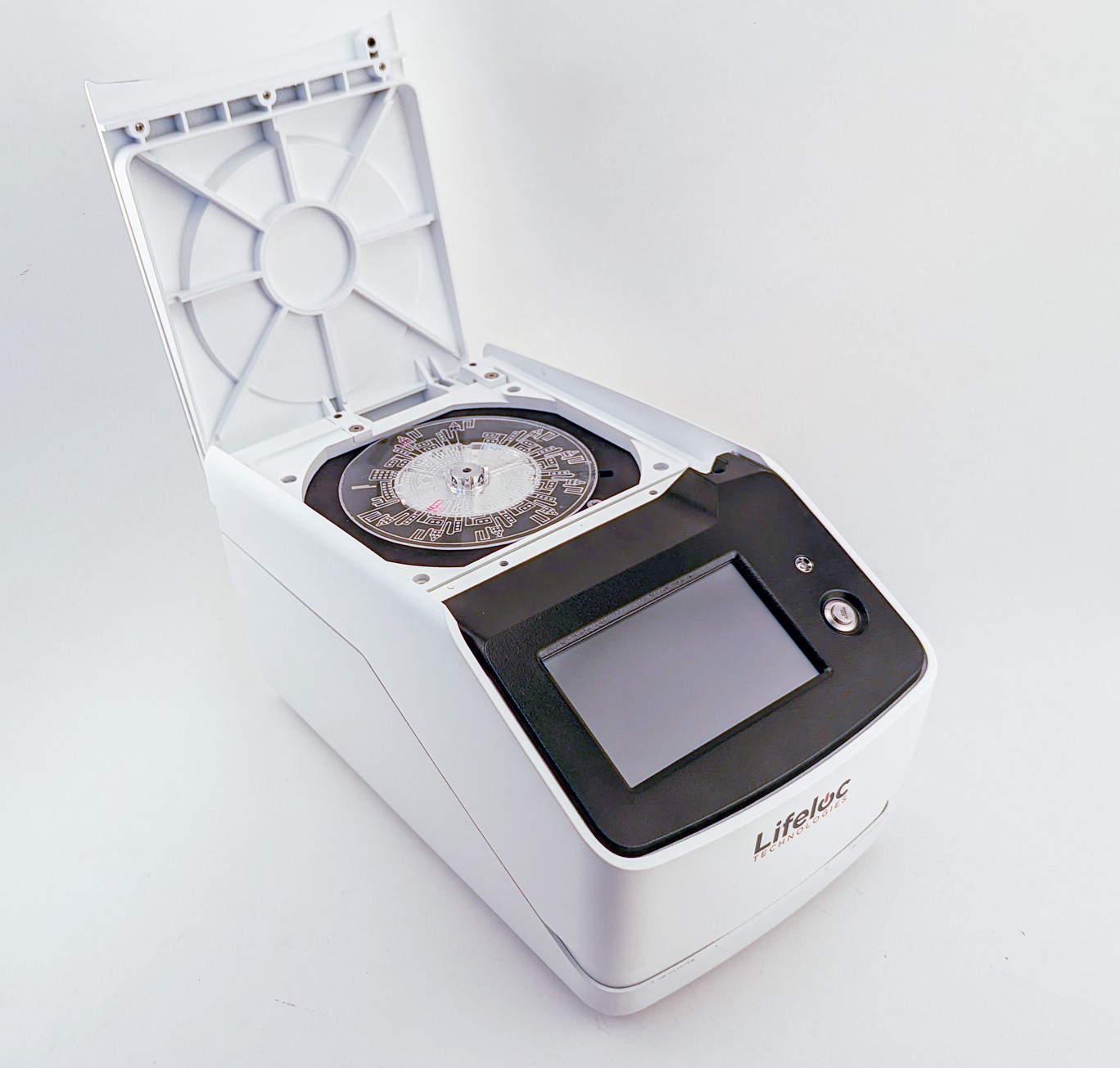

We believe our most important goal and best opportunity remains the convergence of the global need for rapid detection of drugs of abuse with Lifeloc's proven capability to build easy-to-use portable testing equipment. We are therefore focusing our research and development efforts on leveraging the SpinDx™ technology platform, sometimes referred to as "Lab on a Disk," to develop a series of devices and tests that can be used at roadside and in emergency rooms, forensic labs and workplace test sites to achieve a rapid and quantitative measure for a panel of drugs of abuse. The initial product release is projected to be a device with a disk that allows for detection of delta-9-THC (the major intoxicating component of the cannabis plant) from a test subject's saliva, followed by a disk for a panel of other drugs. SpinDx has been demonstrated in our laboratory to effectively detect for delta-9-THC, cocaine, fentanyl, amphetamine methamphetamine, morphine, MDMA, and benzodiazepines. Testing has validated the SpinDx measurement technology against the definitive standard liquid chromatography-mass spectroscopy (LCMS) measurement utilizing human samples. The LCMS data have validated the SpinDx test results on real-world human saliva tests at a limit of detection of approximately 10 ng/ml. With our research and development work, we continue to improve our technology's robustness, speed, and convenience of operation. We plan to start of beta testing of our SpinDx saliva testing system utilizing the delta-9-THC disks later in 2024 using prototype readers as shown in the photograph below. Commercial launch of our first SpinDx application is projected to occur in 2025. Following initial commercialization, we expect more offerings from this technology platform to include expanded drug panels and samples collected from blood and breath. Following the release of our SpinDx saliva testing system, we expect to accelerate development of combining our LX9 breathalyzer with the THC SpinDx detection unit, to produce our roadside marijuana breathalyzer system.

"Our top priority is pushing the SpinDx product platform across the finish line," Dr. Willkomm said. "We anticipate continued high research and development expenses in this final push toward commercialization. With the rising demand for saliva drug testing, the initial release of SpinDx to the market becomes more urgent and valuable."

Research and development expenditures for SpinDx completion have consumed cash down to

About Lifeloc Technologies

Lifeloc Technologies, Inc. (OTC:LCTC) is a trusted U.S. manufacturer of evidential breath alcohol testers and related training and supplies for Workplace, Law Enforcement, Corrections and International customers. Lifeloc stock trades over-the-counter under the symbol LCTC. We are a fully reporting Company with our SEC filings available on our web site, www.lifeloc.com/investor.

Forward Looking Statements

This press release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which involve substantial risks and uncertainties that may cause actual results to differ materially from those indicated by the forward-looking statements. All forward-looking statements expressed or implied in this press release, including statements about our strategies, performance, expectations about new and existing products, market demand, economic conditions, acceptance of new and existing products, technologies and opportunities, market size and growth, and return on investments in products and market, are based on information available to us on the date of this document, and we assume no obligation to update such forward-looking statements. Investors are strongly encouraged to review the section titled "Risk Factors" in our SEC filings.

Phoenix® and Easycal® are registered trademarks of Lifeloc Technologies, Inc.

SpinDx™ is a trademark of Sandia Corporation.

LIFELOC TECHNOLOGIES, INC.

Condensed Balance Sheets (Unaudited)

ASSETS

CURRENT ASSETS: |

|

|

|

| December 31, 2023 |

| ||

Cash and cash equivalents |

| $ | 504,642 |

|

| $ | 1,766,621 |

|

Accounts receivable, net |

|

| 831,501 |

|

|

| 812,126 |

|

Inventories, net |

|

| 2,962,071 |

|

|

| 3,024,834 |

|

Federal and state income taxes receivable |

|

| 40,280 |

|

|

| - |

|

Prepaid expenses and other |

|

| 176,928 |

|

|

| 105,967 |

|

Total current assets |

|

| 4,515,422 |

|

|

| 5,709,548 |

|

|

|

|

|

|

|

|

| |

PROPERTY AND EQUIPMENT, at cost: |

|

|

|

|

|

|

|

|

Land |

|

| 317,932 |

|

|

| 317,932 |

|

Building |

|

| 1,928,795 |

|

|

| 1,928,795 |

|

Real-time Alcohol Detection And Reporting equipment and software |

|

| 569,448 |

|

|

| 569,448 |

|

Production equipment, software and space modifications |

|

| 1,337,919 |

|

|

| 1,154,803 |

|

Training courses |

|

| 432,375 |

|

|

| 432,375 |

|

Office equipment, software and space modifications |

|

| 233,190 |

|

|

| 216,618 |

|

Sales and marketing equipment and space modifications |

|

| 226,356 |

|

|

| 226,356 |

|

Research and development equipment, software and space modifications |

|

| 544,933 |

|

|

| 480,684 |

|

Research and development equipment, software and space modifications not in service |

|

| 227,354 |

|

|

| - |

|

Less accumulated depreciation |

|

| (3,435,629 | ) |

|

| (3,326,837 | ) |

Total property and equipment, net |

|

| 2,382,673 |

|

|

| 2,000,174 |

|

|

|

|

|

|

|

|

| |

OTHER ASSETS: |

|

|

|

|

|

|

|

|

Patents, net |

|

| 82,422 |

|

|

| 64,439 |

|

Deposits and other |

|

| 34,790 |

|

|

| 111,157 |

|

Deferred taxes |

|

| 996,005 |

|

|

| 806,652 |

|

Total other assets |

|

| 1,113,217 |

|

|

| 982,248 |

|

|

|

|

|

|

|

|

|

|

Total assets |

| $ | 8,011,312 |

|

| $ | 8,691,970 |

|

|

|

|

|

|

|

|

| |

|

| |||||||

CURRENT LIABILITIES: |

|

|

|

|

|

|

|

|

Accounts payable |

| $ | 459,560 |

|

| $ | 402,231 |

|

Term loan payable, current portion |

|

| 52,386 |

|

|

| 51,588 |

|

Income taxes payable |

|

| - |

|

|

| 44,952 |

|

Customer deposits |

|

| 168,915 |

|

|

| 195,719 |

|

Accrued expenses |

|

| 288,415 |

|

|

| 329,311 |

|

Deferred revenue, current portion |

|

| 65,917 |

|

|

| 79,036 |

|

Reserve for warranty expense |

|

| 46,500 |

|

|

| 46,500 |

|

Total current liabilities |

|

| 1,081,693 |

|

|

| 1,149,337 |

|

|

|

|

|

|

|

|

| |

TERM LOAN PAYABLE, net of current portion and |

|

|

|

|

|

|

|

|

debt issuance costs |

|

| 1,144,876 |

|

|

| 1,170,243 |

|

|

|

|

|

|

|

|

| |

DEFERRED REVENUE, net of current portion |

|

| 5,712 |

|

|

| 11,565 |

|

Total liabilities |

|

| 2,232,281 |

|

|

| 2,331,145 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

COMMITMENTS AND CONTINGENCIES (Note 5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

STOCKHOLDERS' EQUITY: |

|

|

|

|

|

|

|

|

Common stock, no par value; 50,000,000 shares authorized, 2,454,116 shares |

|

|

|

|

|

|

|

|

issued and outstanding as of June 30, 2024 and December 31, 2023 |

|

| 4,668,014 |

|

|

| 4,668,014 |

|

Retained earnings |

|

| 1,111,017 |

|

|

| 1,692,811 |

|

Total stockholders' equity |

|

| 5,779,031 |

|

|

| 6,360,825 |

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders' equity |

| $ | 8,011,312 |

|

| $ | 8,691,970 |

|

LIFELOC TECHNOLOGIES, INC.

Condensed Statements of Income (Loss) (Unaudited)

| Three Months Ended June 30, |

| ||||||

REVENUES: |

| 2024 |

|

| 2023 |

| ||

Product sales |

| $ | 2,370,433 |

|

| $ | 2,246,407 |

|

Royalties |

|

| 8,824 |

|

|

| 10,150 |

|

Rental income |

|

| 8,073 |

|

|

| 23,789 |

|

Total |

|

| 2,387,330 |

|

|

| 2,280,346 |

|

|

|

|

|

|

|

|

|

|

COST OF SALES |

|

| 1,393,734 |

|

|

| 1,237,902 |

|

|

|

|

|

|

|

|

| |

GROSS PROFIT |

|

| 993,596 |

|

|

| 1,042,444 |

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

Research and development |

|

| 662,276 |

|

|

| 395,781 |

|

Sales and marketing |

|

| 365,374 |

|

|

| 300,075 |

|

General and administrative |

|

| 363,008 |

|

|

| 284,116 |

|

Total |

|

| 1,390,658 |

|

|

| 979,972 |

|

|

|

|

|

|

|

|

| |

OPERATING INCOME (LOSS) |

|

| (397,062 | ) |

|

| 62,472 |

|

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSE): |

|

|

|

|

|

|

|

|

Interest income |

|

| 8,677 |

|

|

| 19,200 |

|

Interest expense |

|

| (10,057 | ) |

|

| (10,290 | ) |

Total |

|

| (1,380 | ) |

|

| 8,910 |

|

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS) BEFORE BENEFIT FROM (PROVISION FOR) TAXES |

|

| (398,442 | ) |

|

| 71,382 |

|

|

|

|

|

|

|

|

|

|

BENEFIT FROM (PROVISION FOR) FEDERAL AND STATE INCOME TAXES |

|

| 100,454 |

|

|

| (16,237 | ) |

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS) |

| $ | (297,988 | ) |

| $ | 55,145 |

|

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS) PER SHARE, BASIC |

| $ | (0.12 | ) |

| $ | 0.02 |

|

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS) PER SHARE, DILUTED |

| $ | (0.12 | ) |

| $ | 0.02 |

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE SHARES, BASIC |

|

| 2,454,116 |

|

|

| 2,454,116 |

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE SHARES, DILUTED |

|

| 2,454,116 |

|

|

| 2,454,116 |

|

LIFELOC TECHNOLOGIES, INC.

Condensed Statements of Income (Loss) (Unaudited)

|

| Six Months Ended June 30, |

| |||||

REVENUES: |

| 2024 |

|

| 2023 |

| ||

Product sales |

| $ | 4,504,867 |

|

| $ | 4,379,766 |

|

Royalties |

|

| 19,760 |

|

|

| 18,356 |

|

Rental income |

|

| 16,146 |

|

|

| 46,778 |

|

Total |

|

| 4,540,773 |

|

|

| 4,444,900 |

|

|

|

|

|

|

|

|

|

|

COST OF SALES |

|

| 2,711,870 |

|

|

| 2,467,029 |

|

|

|

|

|

|

|

|

|

|

GROSS PROFIT |

|

| 1,828,903 |

|

|

| 1,977,871 |

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

Research and development |

|

| 1,217,875 |

|

|

| 792,547 |

|

Sales and marketing |

|

| 710,383 |

|

|

| 587,958 |

|

General and administrative |

|

| 677,934 |

|

|

| 603,131 |

|

Total |

|

| 2,606,192 |

|

|

| 1,983,636 |

|

|

|

|

|

|

|

|

| |

OPERATING (LOSS) |

|

| (777,289 | ) |

|

| (5,765 | ) |

|

|

|

|

|

|

|

| |

OTHER INCOME (EXPENSE): |

|

|

|

|

|

|

|

|

Interest income |

|

| 26,349 |

|

|

| 29,000 |

|

Interest expense |

|

| (20,207 | ) |

|

| (20,825 | ) |

Total |

|

| 6,142 |

|

|

| 8,175 |

|

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS) BEFORE BENEFIT FROM (PROVISION FOR) TAXES |

|

| (771,147 | ) |

|

| 2,410 |

|

|

|

|

|

|

|

|

|

|

BENEFIT FROM (PROVISION FOR) FEDERAL AND STATE INCOME TAXES |

|

| 189,353 |

|

|

| (1,053 | ) |

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS) |

| $ | (581,794 | ) |

| $ | 1,357 |

|

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS) PER SHARE, BASIC |

| $ | (0.24 | ) |

| $ | - |

|

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS) PER SHARE, DILUTED |

| $ | (0.24 | ) |

| $ | - |

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE SHARES, BASIC |

|

| 2,454,116 |

|

|

| 2,454,116 |

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE SHARES, DILUTED |

|

| 2,454,116 |

|

|

| 2,454,116 |

|

LIFELOC TECHNOLOGIES, INC.

Condensed Statements of Stockholders' Equity (Unaudited)

|

| Three Months Ended June 30, |

|

| Six Months Ended June 30, |

| ||||||||||

|

| 2024 |

|

| 2023 |

|

| 2024 |

|

| 2023 |

| ||||

Total stockholders' equity, beginning balances |

| $ | 6,077,019 |

|

| $ | 6,101,423 |

|

| $ | 6,360,825 |

|

| $ | 6,155,211 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock (no shares issued during periods): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beginning balances |

|

| 4,668,014 |

|

|

| 4,668,014 |

|

|

| 4,668,014 |

|

|

| 4,668,014 |

|

Ending balances |

|

| 4,668,014 |

|

|

| 4,668,014 |

|

|

| 4,668,014 |

|

|

| 4,668,014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retained earnings: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beginning balances |

|

| 1,409,005 |

|

|

| 1,433,409 |

|

|

| 1,692,811 |

|

|

| 1,487,197 |

|

Net income (loss) |

|

| (297,988 | ) |

|

| 55,145 |

|

|

| (581,794 | ) |

|

| 1,357 |

|

Ending balances |

|

| 1,111,017 |

|

|

| 1,488,554 |

|

|

| 1,111,017 |

|

|

| 1,488,554 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total stockholders' equity, ending balances |

| $ | 5,779,031 |

|

| $ | 6,156,568 |

|

| $ | 5,779,031 |

|

| $ | 6,156,568 |

|

LIFELOC TECHNOLOGIES, INC.

Condensed Statements of Cash Flows (Unaudited)

|

|

| Six Months Ended June 30, |

| |||||

CASH FLOWS FROM OPERATING ACTIVITIES: |

| 2024 |

|

| 2023 |

| |||

Net income (loss) |

| $ | (581,794 | ) |

| $ | 1,357 |

| |

Adjustments to reconcile net income (loss) to net cash |

|

|

|

|

|

|

|

| |

(used in) operating activities- |

|

|

|

|

|

|

|

| |

Depreciation and amortization |

|

| 114,619 |

|

|

| 132,088 |

| |

Provision for doubtful accounts, net change |

|

| (3,175 | ) |

|

| - |

| |

Provision for inventory obsolescence, net change |

|

| (35,000 | ) |

|

| - |

| |

Deferred taxes |

|

| (189,353 | ) |

|

| 1,053 |

| |

Changes in operating assets and liabilities- |

|

|

|

|

|

|

|

| |

Accounts receivable |

|

| (16,200 | ) |

|

| (134,751 | ) | |

Inventories |

|

| 97,763 |

|

|

| (171,601 | ) | |

Employee retention credit and income taxes receivable |

|

| (40,280 | ) |

|

| 107,575 |

| |

Prepaid expenses and other |

|

| (70,961 | ) |

|

| (149,575 | ) | |

Deposits and other |

|

| 76,367 |

|

|

| - |

| |

Accounts payable |

|

| 57,329 |

|

|

| (84,118 | ) | |

Income taxes payable |

|

| (44,952 | ) |

|

| - |

| |

Customer deposits |

|

| (26,804 | ) |

|

| (26,064 | ) | |

Accrued expenses |

|

| (40,896 | ) |

|

| (54,002 | ) | |

Deferred revenue |

|

| (18,972 | ) |

|

| (18,955 | ) | |

Net cash (used in) |

|

|

|

|

|

|

|

| |

operating activities |

|

| (722,309 | ) |

|

| (396,993 | ) | |

|

|

|

|

|

|

|

|

| |

CASH FLOWS USED IN INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

| |

Purchases of property and equipment |

|

| (263,937 | ) |

|

| (14,811 | ) | |

Purchases of research and development equipment, software |

|

|

|

|

|

|

|

| |

and space modifications not in service |

|

| (227,354 | ) |

|

| - |

| |

Patent filing costs |

|

| (21,708 | ) |

|

| (1,404 | ) | |

Net cash used in investing activities |

|

| (512,999 | ) |

|

| (16,215 | ) | |

|

|

|

|

|

|

|

| ||

CASH FLOWS USED IN FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

| |

Principal payments made on term loan payable |

|

| (26,671 | ) |

|

| (26,047 | ) | |

Net cash used in financing |

|

|

|

|

|

|

|

| |

activities |

|

| (26,671 | ) |

|

| (26,047 | ) | |

|

|

|

|

|

|

|

|

| |

NET (DECREASE) IN CASH |

|

| (1,261,979 | ) |

|

| (439,255 | ) | |

|

|

|

|

|

|

|

|

| |

CASH, BEGINNING OF PERIOD |

|

| 1,766,621 |

|

|

| 2,352,754 |

| |

|

|

|

|

|

|

|

|

| |

CASH, END OF PERIOD |

| $ | 504,642 |

|

| $ | 1,913,499 |

| |

|

|

|

|

|

|

|

|

| |

SUPPLEMENTAL INFORMATION: |

|

|

|

|

|

|

|

| |

Cash paid for interest |

| $ | 18,105 |

|

| $ | 18,673 |

| |

|

|

|

|

|

|

|

|

| |

Cash paid for income tax |

| $ | 40,280 |

|

| $ | - |

| |

|

|

|

|

|

|

|

|

| |

CONTACT:

Amy Evans

Lifeloc Technologies, Inc.

http://www.lifeloc.com

(303) 431-9500

SOURCE: Lifeloc Technologies, Inc.

View the original press release on accesswire.com